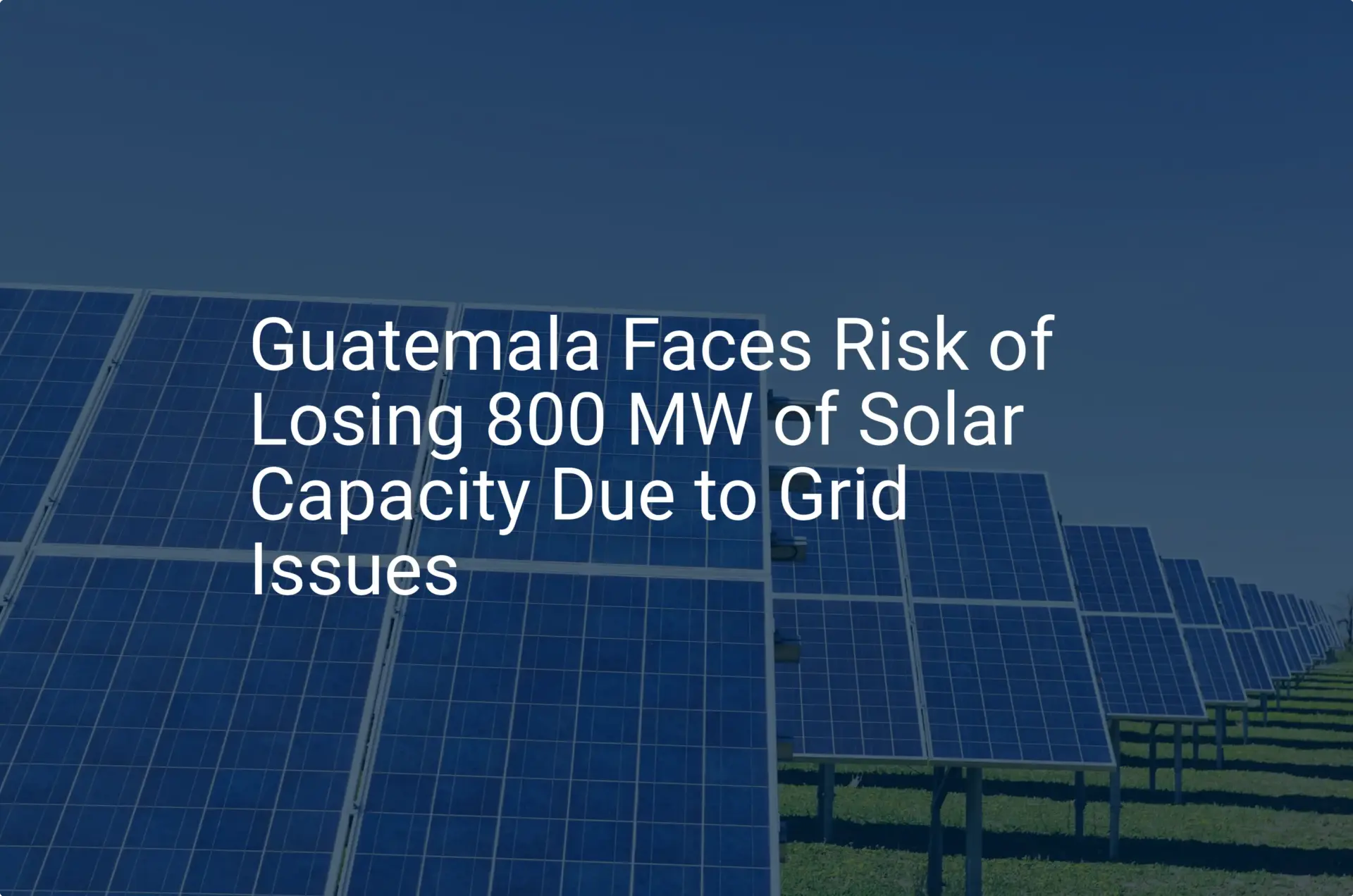

Entrepreneurs exploring new markets often weigh a critical question: Is the potential reward worth the administrative effort?

For those considering a solar module factory in Central America, Guatemala presents a compelling case. The country’s “Law of Incentives for the Development of Renewable Energy Projects” (Decree 52-2003) offers significant financial advantages, though the path to securing them can seem complex.

This guide walks through the application process, designed for professionals who see the market opportunity but need a structured understanding of the steps involved—from initial documentation to final approval.

Understanding Decree 52-2003: The Foundation for Your Investment

Decree 52-2003 is the cornerstone of Guatemala’s policy for attracting investment in the renewable energy sector. Its primary purpose is to reduce the financial barriers for companies building the country’s sustainable energy infrastructure.

For entrepreneurs planning to manufacture solar modules or related components, the decree offers three key benefits:

- Exemption from Customs Duties: All machinery, equipment, materials, and spare parts imported for the plant’s construction and operation are exempt from customs duties (DAI) and charges.

- Value Added Tax (VAT) Exemption: A full VAT exemption is granted on the same imported goods.

- Income Tax (ISR) Exemption: The company receives a full income tax exemption for ten years.

These incentives are not limited to energy generation projects; they also extend to companies that manufacture equipment and components for renewable energy systems. Experience from J.v.G. turnkey projects in emerging markets shows that leveraging such government incentives can fundamentally improve a project’s financial viability and significantly shorten its return on investment.

The Application Process: A Step-by-Step Walkthrough

Navigating the application is a methodical process that involves several government bodies, each with a specific role in vetting and approving the project.

Step 1: Company Registration and Legal Prerequisites

Before an application can be submitted, the investing entity must be legally established in Guatemala. This involves standard corporate registration procedures to form a Guatemalan company (Sociedad Anónima), with key requirements that include:

- Formalizing articles of incorporation with a local notary.

- Registering the company with the Mercantile Registry (Registro Mercantil).

- Obtaining a tax identification number (NIT) from the Superintendency of Tax Administration (SAT).

Establishing this legal foundation is the essential first step for all subsequent applications.

Step 2: Preparing the Comprehensive Project Proposal

The application centers on a detailed project proposal submitted to the Ministry of Energy and Mines (MEM). This document must demonstrate the project’s technical, economic, and environmental soundness. It should be built upon a robust business plan that outlines everything from factory layout to initial investment costs.

Key components of the proposal include:

- Technical Feasibility Study: Details on the proposed manufacturing process, machinery specifications, production capacity, and quality control protocols.

- Financial Projections: A comprehensive financial model showing investment requirements, operational costs, revenue forecasts, and profitability analysis over the incentive period and beyond.

- Business Plan: A strategic document outlining market analysis, employment projections, and the project’s contribution to the local economy.

- Preliminary Environmental Assessment: An initial study identifying potential environmental impacts and proposed mitigation measures.

Step 3: Submission to the Ministry of Energy and Mines (MEM)

The complete project proposal is formally submitted to the MEM, the primary authority that administers Decree 52-2003. The Ministry’s technical and financial departments will conduct a thorough review to ensure the project aligns with the law’s objectives. This evaluation stage typically takes 90 to 120 days, depending on the project’s complexity and the completeness of the documentation.

Step 4: Inter-Agency Coordination and Approvals

Following a positive preliminary review, the MEM coordinates with other government agencies to secure their approvals. This phase of specialized oversight is critical:

- Ministry of Environment and Natural Resources (MARN): Reviews the environmental impact assessment and issues the necessary environmental permits.

- Superintendency of Tax Administration (SAT): Analyzes the financial aspects and formally approves the tax exemptions.

- Ministry of Economy: May be consulted to assess the project’s broader economic impact.

Navigating this stage successfully requires clear communication and diligent follow-up. Engaging local legal counsel with experience in this process is highly advisable for managing inter-agency communications effectively.

Common Challenges and How to Prepare for Them

While the process is well-defined, applicants often encounter challenges. Proactive preparation can mitigate most potential delays.

Documentation Delays

The most frequent cause of setbacks is incomplete or incorrectly prepared documentation. A minor omission in the financial projections or a missing technical specification can send the application back to the start.

To prepare, create a meticulous checklist of all required documents. Before submission, have the entire package reviewed by a local consultant or legal expert who understands the MEM’s specific requirements.

Navigating Bureaucracy

For entrepreneurs accustomed to different administrative cultures, government processes in Guatemala can sometimes seem opaque.

The best approach is consistent, professional follow-up. One J.v.G. client in the region noted that regular contact with their designated case officer at the MEM was key to keeping the application moving. Establishing a respectful, persistent line of communication is essential.

Meeting Technical Requirements

The project must be technically viable and credible, as the MEM will scrutinize the proposed technology and operational plan.

Preparation is key. Detailed planning for setting up a solar module factory is critical here. The technical specifications of your machinery, your proposed production workflow, and your quality assurance measures must all be clearly articulated and defensible.

Frequently Asked Questions (FAQ)

What is the typical duration of the entire incentive application process?

From company registration to final approval, a realistic timeline is 8 to 14 months, assuming all documentation is correctly prepared and submitted.

Are the incentives applicable to foreign-owned companies?

Yes. A company legally incorporated in Guatemala is eligible for the incentives, regardless of its shareholders’ nationality.

Do the incentives cover raw material imports after the factory is operational?

The decree primarily covers importing machinery and equipment for the initial setup and operation. While other interpretations may exist, it is prudent to assume that ongoing imports of raw materials (like solar cells or EVA film) will not be covered under the same exemptions and should be planned for accordingly.

What happens after the 10-year income tax incentive period expires?

After the 10-year term, the company becomes subject to the standard corporate income tax rates applicable in Guatemala.

Is there a minimum investment size to qualify for these incentives?

The law does not specify a minimum investment threshold. However, the project must be large enough to be considered a serious industrial undertaking. Projects with investment levels typical for a 20–50 MW capacity factory are regularly reviewed.

The Strategic Advantage of Securing Incentives

Securing these incentives offers more than just tax savings; it creates a powerful strategic advantage by significantly de-risking the investment. The improved cash flow during the first decade of operation allows for faster reinvestment, debt repayment, and market expansion. Furthermore, official government endorsement can enhance the project’s credibility with local financial institutions and partners. Understanding these benefits is a vital part of navigating local regulations when planning an international manufacturing venture.

Next Steps in Your Planning Journey

Securing Guatemala’s renewable energy incentives is an achievable goal for any well-prepared investor. The process demands diligence, technical clarity, and an understanding of local administrative procedures.

The logical next step is to commission a detailed feasibility study tailored to your specific project vision. This study will serve as the foundation for the technical and financial proposal required by the Ministry of Energy and Mines. For entrepreneurs seeking a structured approach, the pvknowhow.com e-course provides detailed modules on financial modeling and regulatory compliance to support this critical planning phase.