An entrepreneur planning to establish a solar module factory in the Americas often faces a critical financial challenge before the first panel is even produced: import tariffs.

The essential components for solar manufacturing—photovoltaic cells, specialized glass, aluminum frames, and encapsulants—are typically sourced globally. The cumulative cost of customs duties on these materials can significantly inflate the initial investment and strain a new venture’s financial viability.

This is where a strategic understanding of regional trade incentives becomes a competitive advantage. Guatemala’s Free Trade and Industry Zone, known as ZOLIC (Zona Libre de Industria y Comercio Santo Tomás de Castilla), offers a compelling solution. For companies entering the solar sector, ZOLIC provides a framework to eliminate these import taxes, streamline logistics, and establish a powerful operational hub for serving markets across North and South America.

This guide provides a detailed analysis of the business case for leveraging ZOLIC for solar component imports and manufacturing.

What is ZOLIC and Its Relevance for Solar Manufacturing?

A Free Trade Zone (FTZ) is a designated geographical area where goods can be imported, handled, manufactured, and re-exported without being subject to the usual customs duties. Essentially, goods within the zone are treated as if they are not yet in the country’s domestic market.

Established in 1973, ZOLIC is strategically located at Santo Tomás de Castilla on Guatemala’s Atlantic coast. This location was chosen specifically to facilitate international trade by providing direct access to major maritime shipping lanes connecting the Americas, Europe, and Asia.

For a new solar module manufacturer, the implications are profound. This allows a business to establish a production facility that combines the benefits of a Central American labor force with the financial advantages of an offshore jurisdiction, creating a duty-free environment for its entire production line.

The Financial Advantages: A Breakdown of ZOLIC’s Tax Incentives

The primary appeal of ZOLIC for any import-dependent manufacturing operation lies in its extensive fiscal benefits, governed by Decrees 22-73 and 65-89. These incentives are designed to attract foreign investment and can dramatically improve a solar factory’s financial model.

The key exemptions include:

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

-

100% Exemption from Customs Duties: All raw materials, machinery, and equipment required for the solar module assembly process can be imported into ZOLIC without incurring import tariffs or related charges. This applies directly to high-value components like solar cells, tempered glass, EVA/POE films, backsheets, and aluminum frames.

-

100% Exemption from Income Tax: New industrial operations established within ZOLIC are granted a full exemption from corporate income tax for 10 years. This allows a new venture to reinvest profits directly into growth, scaling operations, or improving technology during its critical early stages.

-

Exemption from Value Added Tax (VAT): All commercial transactions, purchases, and sales conducted within the boundaries of the ZOLIC zone are exempt from VAT. This reduces the operational cost burden on everything from local service procurement to inter-company transactions within the zone.

-

Exemption from Stamp Tax: Legal and commercial documents related to the business’s operations within the zone are exempt from stamp taxes, further reducing administrative overhead.

Together, these exemptions have a direct and substantial impact on a project’s financial projections. The savings on duties for machinery and initial raw material stocks can lower the required upfront capital, a critical factor when assessing overall solar factory investment costs.

Operational and Logistical Benefits for a Solar Factory

Beyond the significant tax incentives, ZOLIC provides a robust logistical framework that simplifies the complexities of a global supply chain. The zone’s physical integration with one of Guatemala’s principal ports is its greatest operational asset.

Proximity to the Port of Santo Tomás de Castilla minimizes inland transportation costs, delays, and security risks associated with moving containerized goods over long distances. This creates a seamless flow for a solar manufacturing operation:

-

Import: Containers of raw materials (e.g., solar cells from Asia, glass from regional suppliers) arrive at the port and move directly into the ZOLIC facility without customs clearance delays or charges.

-

Manufacture: The components are assembled into finished solar modules within the factory.

-

Export: The finished modules are packaged, containerized, and moved back to the port for export to markets in North America, South America, or the Caribbean, again without incurring export duties.

This integrated system is fundamental to an effective supply chain strategy for solar manufacturing, as it reduces lead times and logistics costs. Furthermore, Guatemala’s road network provides efficient land-based access to neighboring markets like Mexico, El Salvador, and Honduras, offering a dual sea-and-land distribution advantage.

Establishing an Operation in ZOLIC: Key Procedural Steps

While the benefits are clear, establishing a company as a qualified ZOLIC user requires a structured approach. The process is manageable, particularly for investors with a clear business plan.

The general steps are as follows:

-

Qualify as a ZOLIC User: A business must apply to become an authorized user, typically under the “Industrial User” category for manufacturing. This involves demonstrating that the primary activity will be transforming raw materials into a new product for export.

-

Prepare and Submit the Application: The application requires comprehensive documentation, including the company’s legal formation, a detailed business plan, financial projections, and an overview of the planned investment, job creation, and production processes.

-

Secure a Facility: The business must lease or acquire land or an existing building within the designated ZOLIC area to house its operations. This is where planning for a turnkey solar module production line takes shape, from factory layout to equipment installation.

Based on J.v.G. Technology GmbH’s experience with clients entering new markets, this initial application phase is a critical step. Detailed professional planning at this stage can prevent significant delays down the line.

Potential Challenges and Considerations

As with any business opportunity, entrepreneurs considering ZOLIC should conduct thorough due diligence. Potential considerations include:

-

Bureaucratic Navigation: While the process is well-defined, navigating administrative and legal requirements in a new country can be complex. Working with local legal and business consultants is highly advisable.

-

Regulatory Compliance: Operating within an FTZ comes with strict compliance and reporting rules. A company must maintain meticulous records of all goods entering, processed in, and leaving the zone.

-

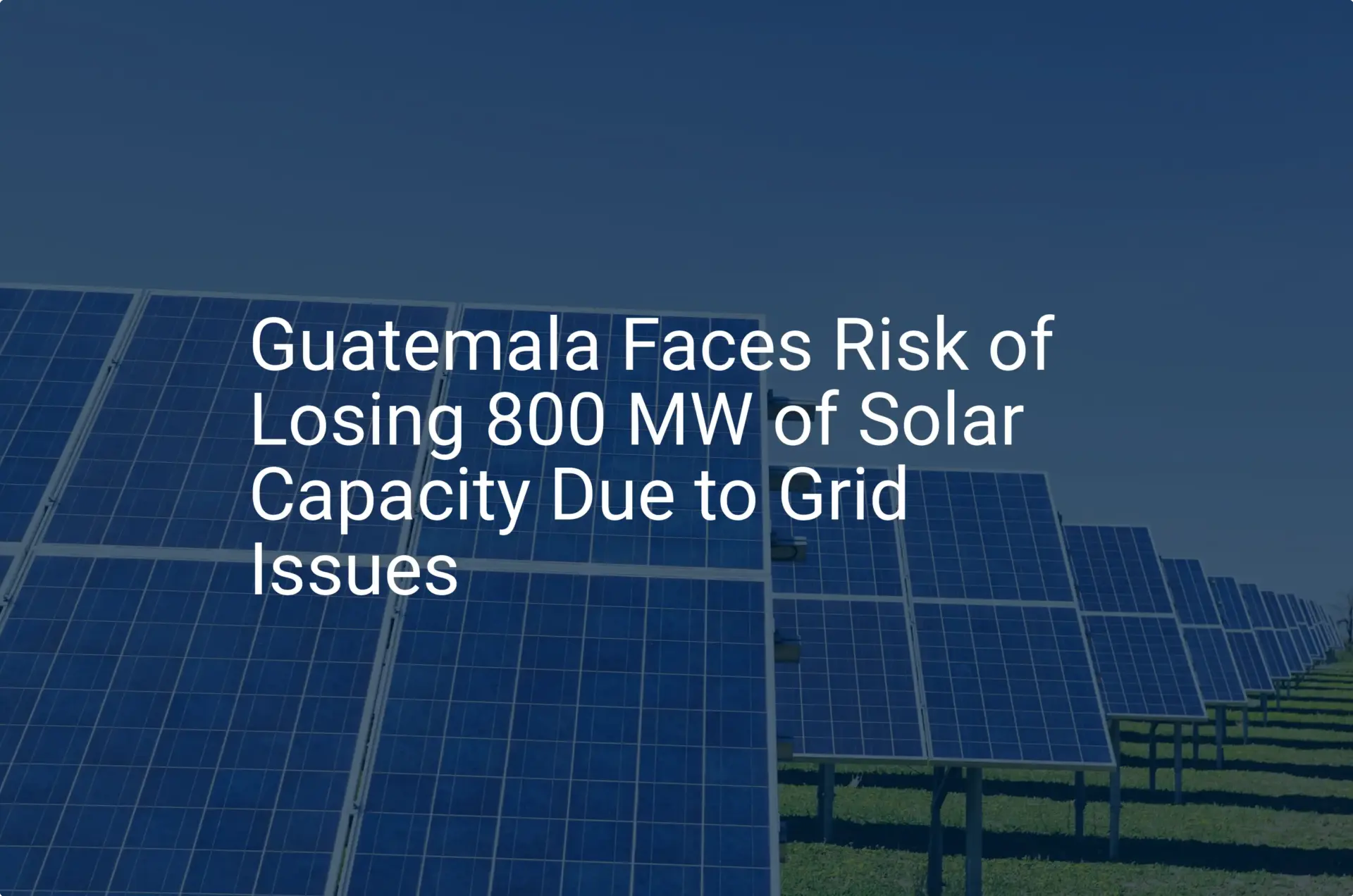

Regional Stability: Investors should assess the broader political and economic climate of the region as part of their risk management strategy.

These factors underscore the importance of preparation. The considerable advantages of ZOLIC are best realized by companies that approach the setup process with a clear strategy and expert guidance.

Frequently Asked Questions (FAQ)

Is ZOLIC only suitable for large corporations?

No. ZOLIC is designed to accommodate businesses of various sizes. The framework is equally applicable to a small-to-medium enterprise (SME) establishing a 50 MW production line as it is to a large-scale industrial project.

Can modules manufactured in ZOLIC be sold within Guatemala?

Primarily, goods produced in an FTZ are intended for export. Selling into the Guatemalan domestic market is possible but requires the products to be formally “imported” from the zone. This means they become subject to all standard customs duties and taxes, which negates the primary tax benefit for those specific units.

What types of solar components are covered by the duty exemption?

The exemption is comprehensive. It covers all tangible goods required for the manufacturing process, including solar cells, glass, EVA and POE encapsulants, backsheets, aluminum frames, junction boxes, ribbons, and even the capital machinery used for assembly and testing.

How long does the setup process typically take?

The timeline can vary depending on the complexity of the project. After the business plan is finalized, the application and approval process with ZOLIC authorities can take several months. Concurrently, factory construction or retrofitting can begin. A well-managed project can often move from initial application to the start of production in under a year.