Alright, let’s get straight to it. Algeria is on a truly exciting journey, aiming to tap into its massive solar potential – we’re talking an ambitious 15 GW of renewable energy by 2035. This is flinging the doors wide open for solar manufacturers ready to get local production up and running. But, like any venture worth its salt, real success means getting your head around how things actually work on the ground in Algeria. We’re going to dig into the essentials: the labor market, what the training infrastructure looks like, and the nitty-gritty of supply chain capabilities. Consider this your essential briefing to help you map out your investment. The opportunities are definitely shining bright. However, successfully figuring out workforce skills, getting training aligned, and sourcing your components will take clever, strategic thinking. So, let’s unpack it all.

Table of Contents

Algeria’s Solar Energy Revolution: Setting the Stage for Manufacturing

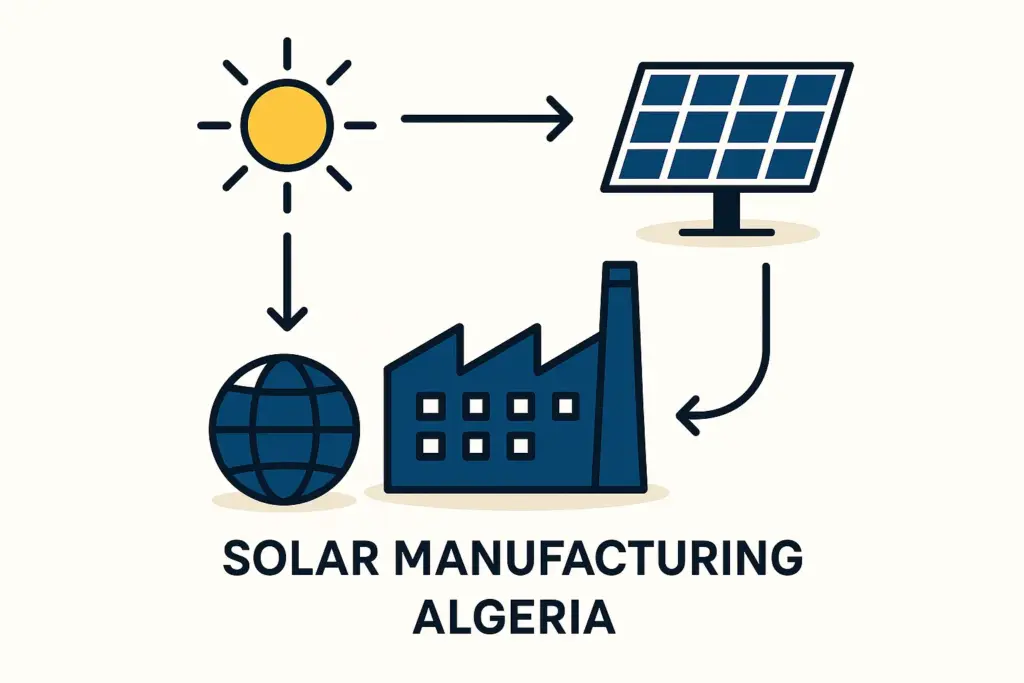

Blessed with sunshine that most countries can only dream of, Algeria is making a serious pivot towards renewable energy, and solar power is front and center in its national energy game plan. This isn’t just about switching to cleaner electricity; it’s a much bigger picture. We’re looking at a vision to supercharge industrial development, create a wave of new jobs, and really bolster the nation’s energy independence.

A. Government Vision and Targets

So, what’s the official word from the top? Well, they’ve laid out some seriously ambitious goals. That headline figure – targeting 15 gigawatts (GW) of renewable energy capacity by 2035 – is a big one, and you can bet a hefty slice of that pie is earmarked for solar photovoltaic (PV) installations. This isn’t just talk; this long-term vision is being backed by various programs and tenders, all designed to pull in investment and get projects moving, and moving fast.

B. Current Solar Capacity and Key Projects

Where does Algeria stand right now, you ask? As of late 2023, the installed solar capacity was hovering around 437 megawatts (MW). Now, to close that gap and hit the 2035 target, the country has kicked off some pretty major initiatives. The “Solar 1,000 MW” scheme is a real cornerstone, aiming to give capacity a quick and significant boost through large-scale solar farms. And if that wasn’t enough, a 2023 tender for 15 solar farms, each ranging from a hefty 80 MW to 220 MW, really shouts about the ongoing momentum in this sector. These projects are a clear signal: there’s a growing hunger for locally produced solar components.

C. The Strategic Push for Local Solar Manufacturing

It’s clear that Algeria gets the economic and strategic wins here, and that’s why they’re actively cheering on the growth of a local solar manufacturing industry. Why this big push? It’s all about cutting down reliance on imports, creating those all-important quality jobs, encouraging technology to flow into the country, and building a strong, dependable domestic supply chain. We’re already seeing positive signs, like discussions with international heavy-hitters such as LONGi, to set up local PV module manufacturing lines. This is a strong indicator of the government’s genuine commitment to nurturing these local production capabilities. In fact, current local assembly capacity for solar modules is already around 500 MW, and the word on the street is that we can expect that to climb to 600-700 MW by the end of 2025.

The Algerian Labor Market: Powering Solar Manufacturing

Let’s be honest, any successful manufacturing venture leans heavily on its people – a skilled and adaptable workforce is non-negotiable. If you’re seriously considering Algeria for your solar manufacturing base, getting to know the ins and outs of the local labor market isn’t just important, it’s absolutely essential.

A. Availability of General and Technical Workforce

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

First, the good news: Algeria has a relatively young and growing population, which means there’s a substantial pool of general labor. Reports, like those from trade.gov, give us a sense that “qualified, cost-effective labor” is available. However, and this is a key “however,” when we zoom in on specialized sectors like solar PV manufacturing, the real challenge often pops up when you’re looking for folks with very specific technical know-how.

B. Assessing Specific Skillsets for Solar Panel & Component Manufacturing

Making solar panels and their components isn’t exactly like assembling flat-pack furniture; it demands a diverse mix of skills. We’re talking about engineers who are wizards at process optimization and quality control, technicians who are comfortable wrangling sophisticated machinery, and assembly line workers who can perform precise, consistent tasks day in, day out.

- Current Strengths: The great thing is, Algeria isn’t starting from a blank slate. It already has a foundation of engineering and technical skills, largely thanks to its established industrial base and its long history in the energy sector.

- Critical Gaps: Now, while that general technical aptitude might be there, finding specific experience in PV manufacturing processes – things like delicate cell handling, lamination, tabbing and stringing, junction box assembly, and those super-important quality assurance protocols unique to solar – well, that’s likely to be more limited. Some market analyses actually point to a “lack of skilled labor” specifically for these advanced manufacturing roles. This is a different story from general labor availability and really hammers home the need for targeted upskilling.

C. Wage Competitiveness and Labor Environment

One of the factors that can make Algeria attractive for manufacturers is its competitive labor costs, especially when you compare them to many developed nations. Of course, it’s absolutely crucial to get a thorough understanding of local labor laws, employment regulations, and what typical wage expectations look like for different skill levels. This isn’t just red tape; it’s vital for accurate financial planning and making sure you’re playing by the rules.

D. Regional Labor Hotspots and Considerations

It’s also worth keeping in mind that labor availability and where those skills are concentrated can vary quite a bit across Algeria’s different regions. You might find that industrial zones or areas with a history of manufacturing activity offer a more readily available technical workforce. And, naturally, being close to universities and vocational training centers can be a significant advantage.

Bridging the Skills Gap: Training and Workforce Development for the Solar Industry

To really get the engines roaring in a growing solar manufacturing sector, strong training and workforce development programs aren’t just a nice-to-have; they’re absolutely essential. The good news is, Algeria has recognized this and is starting to put some serious muscle into addressing it.

A. Overview of Existing Vocational and Technical Training Infrastructure

Algeria already has a network of vocational training centers and technical institutes in place. What’s really encouraging is seeing their focus increasingly shift towards weaving renewable energy technologies into their curriculum.

B. Current Solar-Specific Training Programs

Several initiatives are already up and running, aiming to build up those solar-specific skills:

- The Centre de Développement des Energies Renouvelables (CDER) has been pretty active in rolling out training programs that cover things like PV system sizing, installation, and maintenance.

- We’re also seeing some interesting partnerships emerge, like the one between TotalEnergies and DEMJ (Direction de l’Enseignement et de la Main d’Œuvre Jeunesse). They’ve launched courses such as “Hydro and Solar PV.”

- International cooperation is playing a part too, with organizations like TİKA (Turkish Cooperation and Coordination Agency) throwing their support behind renewable energy training. All these efforts are positive signs, pointing towards building a skilled workforce.

However, it’s really important to take a closer look and see how much these programs are specifically geared towards manufacturing roles, as opposed to, say, installation and maintenance. There’s a difference!

C. Identifying Critical Training Needs for Solar Component Manufacturing

When we’re talking about solar manufacturing, the training needs go quite a bit deeper than just basic PV knowledge. We need to be thinking about:

- How to operate and maintain all that automated manufacturing equipment.

- Cleanroom protocols – super important when you’re handling sensitive components like solar cells.

- Quality control techniques that are specific to PV module production (like EL testing and sun simulation – these are key!).

- Managing the intricate dance of supply chain and logistics for all your manufacturing inputs.

- And, of course, health and safety standards within a manufacturing environment.

D. Opportunities for Public-Private Partnerships in Skilling the Workforce

Here’s where things get really exciting: there’s a fantastic opportunity for solar manufacturers like yourselves to team up with local educational institutions and government agencies. Imagine co-developing training programs that are perfectly tailored to what the industry actually needs. This kind of partnership can ensure that the curriculum hits the nail on the head, providing a steady pipeline of skilled workers ready to step into manufacturing roles. This approach could even echo successful models like the European Solar Academy, adapting them to fit snugly within the Algerian context.

Untangling the Algerian Solar Supply Chain: Capabilities for Manufacturers

A resilient and cost-effective supply chain – it’s the absolute backbone of competitive solar manufacturing. So, it’s vital to get a clear picture of what’s locally available in terms of components and raw materials, and also to understand the country’s logistical muscle.

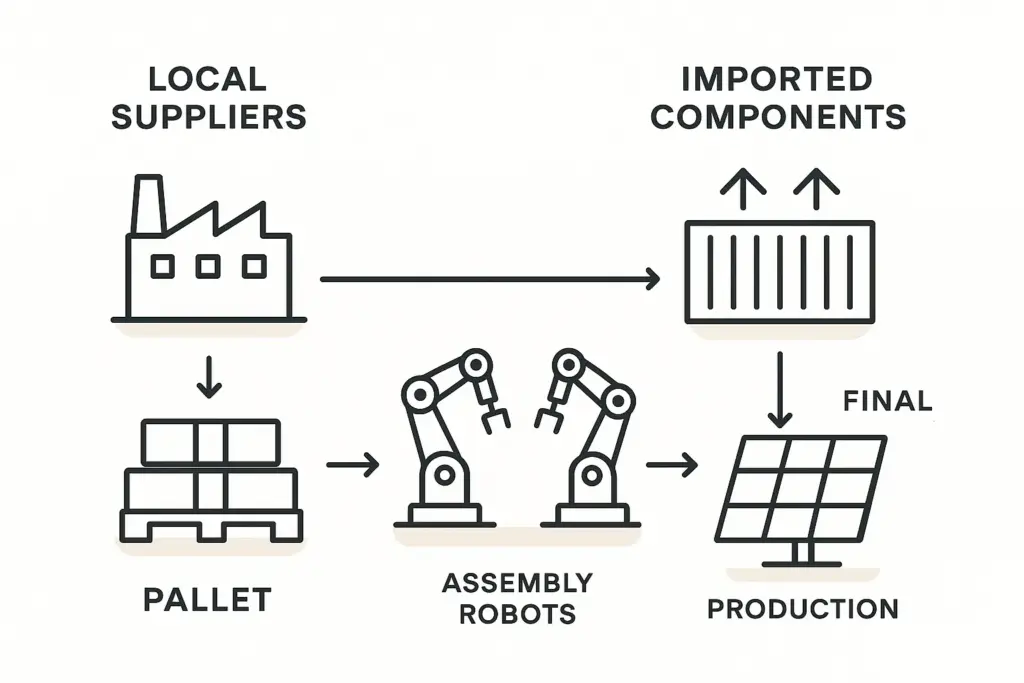

A. Current State of Local Manufacturing for Solar Components

Algeria’s solar supply chain has definitely been on an upward curve over the past decade, with an ever-increasing focus on doing more locally.

- PV Module Assembly: As we touched on earlier, Algeria has existing module assembly capacity. Right now, this primarily relies on imported solar cells and other specialized materials. The big goal here is to ramp up this capacity and, ideally, deepen the value chain over time – more “Made in Algeria” from start to finish.

- Inverters and BoS (Balance of System) Components: Now, while some basic BoS components, like mounting structures or certain cables, might have some local sourcing potential, the more sophisticated bits and pieces, like inverters, are largely imported. You can bet there’s a strategic interest in developing local production for these items too.

- Raw Materials for Manufacturing: This is a big one. The local availability of key raw materials for PV manufacturing (we’re talking high-purity glass, EVA encapsulant, backsheets, aluminum frames, and of course, silicon wafers and solar cells if you’re not producing them in-house) is a critical point to really dig into. Currently, Algeria relies pretty heavily on imports for most of these specialized raw materials and upstream components like cells and wafers.

B. Logistics and Infrastructure: Ports, Transport, and Industrial Zones

Algeria has established ports and a transportation network that’s continuously improving. And let’s not forget its historical strengths in logistics and civil engineering, particularly from the oil and gas sector – these can certainly be leveraged for the solar industry. You might also find that designated industrial zones offer better infrastructure and logistical support, which can be a real boon for manufacturing setups.

C. The Role of Imports: Key Components and Materials Sourced Externally

Despite all the noble efforts to localize, let’s be realistic: manufacturers will likely need to import a significant chunk of specialized components (like those high-efficiency solar cells and advanced inverters) and specific raw materials. Getting a firm grasp on import regulations, customs procedures, and those all-important lead times is absolutely essential. No surprises wanted here!

D. Government Initiatives and Incentives to Bolster the Local Supply Chain

The Algerian government is clearly keen to attract investment into the local supply chain – that much is crystal clear. Those discussions with international companies like LONGi about setting up local production lines? They’re aimed squarely at bringing in valuable technology transfer and building up domestic capabilities. It’s highly probable that incentives will be on the table for companies that contribute to local value addition.

E. Identifying Strengths, Weaknesses, and Gaps for a Resilient Manufacturing Supply Chain

Okay, let’s break it down, warts and all:

- Strengths: There’s a growing domestic market, solid government backing for localization, existing module assembly experience (which is a great starting point!), and good potential for BoS component manufacturing.

- Weaknesses: A heavy reliance on imports for those critical raw materials and advanced components (cells, wafers, specialized polymers, high-quality glass) is a key challenge right now. Plus, there’s limited upstream manufacturing (think polysilicon, ingots, and wafers).

- Gaps: There’s a clear need – and therefore opportunity – for greater investment in upstream manufacturing and the development of a robust ecosystem of local suppliers for those specialized materials.

Operational Intelligence: Navigating Investment and Setup

Successfully setting up a solar manufacturing facility in Algeria isn’t just about having a great product; it means careful planning and a really solid understanding of the local operational environment. Let’s touch on some key areas you’ll want to have on your radar.

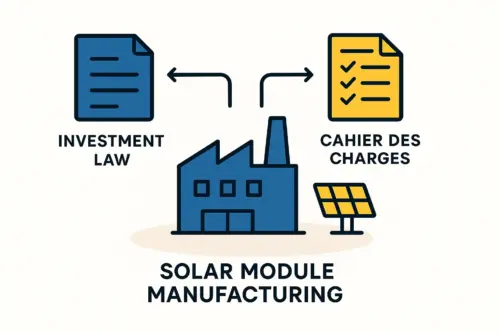

A. Regulatory Framework for Foreign Investors in Manufacturing

If you’re an investor, this is homework you can’t skip: thoroughly research Algeria’s investment laws. You’ll need to get your head around regulations concerning foreign ownership, how profits can be repatriated (an important one!), and any sector-specific requirements for renewable energy manufacturing. Bringing local legal and business consultants on board early? Highly advisable. They can be worth their weight in gold.

B. Key Incentives for Solar Manufacturing Ventures

The Algerian government, keen to see this sector flourish, may well offer various incentives to attract investment in solar manufacturing. What could these look like? We’re potentially talking tax breaks, exemptions from customs duties for imported machinery and raw materials (a big help to your bottom line), access to land in those specialized industrial zones, and perhaps even a bit of preferential treatment in public tenders if your goods are locally produced.

C. Potential Challenges and Mitigation Strategies

It’s always wise to go in with your eyes open to potential hurdles. Manufacturers might face challenges such as:

- Bureaucracy and Regulatory Delays: Let’s be frank, navigating administrative processes can sometimes feel like wading through treacle. Being proactive, ensuring your documentation is squeaky clean, and building strong local partnerships can help smooth out these potential bumps in the road.

- Access to Finance: Securing local or international financing will require a really robust business plan and a good understanding of the financial landscape. Start these conversations early.

- Grid Integration for Offtake (if selling locally): While this is primarily a concern for power producers, if you’re a manufacturer supplying large local projects, it’s good to be aware of grid capacity and stability. It can impact your customers, and therefore, you.

- Developing a Skilled Workforce: As we’ve emphasized throughout, investing in training and skills development isn’t just an option; it’s pretty much crucial for long-term success.

Conclusion: Capitalizing on Algeria’s Solar Manufacturing Potential

So, what’s the final word? Algeria presents a genuinely compelling, though yes, admittedly complex, opportunity for solar manufacturers. The nation’s strong commitment to solar energy, coupled with a growing domestic market and that strategic push for local industrialization, really does create a favorable wind for investment.

The real key to unlocking all this potential lies in doing your homework thoroughly – meticulous due diligence is your friend here – and engaging in smart, strategic planning. Understanding the nuances of the labor market, actively participating in workforce development (maybe even leading the charge!), and skillfully navigating the evolving supply chain are all critical pieces of this exciting puzzle. Yes, challenges related to specialized skills and the current reliance on imports for certain components do exist. But, and this is important, these challenges also represent golden opportunities for pioneering companies to step in, innovate, and contribute to building a truly robust local solar ecosystem.

For entrepreneurs and companies who are ready to invest the time to really understand these dynamics, and perhaps even partner to build local capabilities from the ground up, Algeria offers a chance to be part of something big – a truly significant energy transition and industrial development story. With experienced guidance and a clear-eyed strategy, manufacturers can definitely tap into this promising North African market. And hey, we’re here to help you explore that journey.

Want to learn more or need expert help? Visit our free e-course or explore our services. Or, if you’re ready to dive deeper, our Premium Business Plan E-Course offers personalized guidance to get your venture off the ground. Let’s make your solar journey smooth and successful.

Frequently Asked Questions (FAQs)

Let’s tackle some common questions that might be bubbling up:

Q1: What are the most critical skills gaps for solar manufacturing in Algeria?

A1: That’s a really pertinent question. While you’ll find general technical labor is often available, the more specialized skills tied directly to advanced PV manufacturing processes often need dedicated development. We’re thinking about things like the delicate handling of solar cells, operating sophisticated automated production lines, specific quality control methods for PV modules (like electroluminescence testing – it’s a must!), and hands-on experience with specialized materials such as EVA and backsheets. Targeted training programs, ideally designed with industry input, are going to be absolutely essential to bridge these gaps effectively.

Q2: How reliable is the local supply of raw materials for solar panel manufacturing in Algeria?

A2: This is a super important consideration for anyone planning to manufacture. Currently, Algeria relies quite heavily on imports for most of the specialized raw materials that are crucial for making solar panels. This list includes things like high-purity silicon, solar cells (unless, of course, they’re part of your integrated manufacturing plan), specialized glass, EVA encapsulant, and backsheets. While more basic materials like aluminum for frames might be easier to source locally, a comprehensive sourcing strategy will definitely need to include managing international supply chains for these key inputs. It’s all about planning.

Q3: Are there specific government incentives for setting up solar manufacturing plants in Algeria?

A3: Yes, absolutely. The Algerian government is actively encouraging local manufacturing and is quite likely to offer various incentives to sweeten the deal. These could take the form of tax concessions, exemptions on customs duties for imported machinery and raw materials (which can make a big difference!), providing land in designated industrial zones, and potentially even support through public procurement policies that favor locally made goods. As always, the best bet is to get detailed, up-to-the-minute information directly from the relevant Algerian investment promotion agencies – they’ll have the latest.

Q4: What is the biggest challenge for foreign solar manufacturers entering Algeria?

A4: From what we often see and hear, navigating the regulatory and administrative environment can be a significant hurdle. This involves really getting to grips with investment laws, successfully obtaining all the necessary permits, and sometimes dealing with bureaucratic processes that can take time. Alongside this, developing a skilled workforce that’s perfectly tailored to your specific manufacturing needs, and establishing a reliable supply chain for those specialized components, are key operational challenges. These require careful planning and, quite often, strong local partnerships to navigate successfully.

Q5: What support can PVknowhow.com offer for establishing a solar factory in Algeria?

A5: We’re so glad you asked! At PVknowhow.com, we bring over two decades of real, hands-on experience to the table, offering end-to-end solutions for anyone looking to establish solar module production lines. This isn’t just about us providing turnkey production equipment (though we do that very well!); we also dive deep into crucial business planning (including financial modeling and market analysis, which you can explore through our Premium E-Course with personal mentoring). We offer technical consulting, and provide practical guidance on factory layout, process engineering, and that all-important technology transfer. Our genuine goal is to empower entrepreneurs and companies just like yours to confidently navigate the complexities of setting up and successfully operating a solar factory in exciting, high-potential markets like Algeria. We’d genuinely love to have a chat about how we can support your venture!