An entrepreneur’s vision for a new solar module factory often begins with a solid business plan and a secured location. Yet a significant logistical challenge lies between this vision and reality: transporting specialized, heavy manufacturing equipment from Europe or Asia to the factory floor in Bangladesh.

This final step in the supply chain involves navigating complex customs procedures, documentation, and local logistics. While the process may seem daunting, it is a structured procedure that can be managed efficiently with the right knowledge and preparation.

For investors new to the industrial sector in Bangladesh, understanding this process is key to avoiding costly delays and keeping a project on schedule and within budget. Here, we outline the key steps, regulatory requirements, and practical considerations for importing solar panel production machinery into the country.

Table of Contents

Understanding the Regulatory Landscape: Key Authorities and Incentives

The primary governing body for all import activities in Bangladesh is the National Board of Revenue (NBR). The NBR’s customs wing is responsible for assessing and collecting duties, enforcing import regulations, and clearing goods for entry.

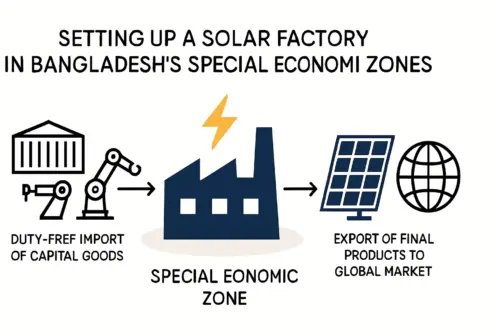

For entrepreneurs in the renewable energy sector, the regulatory environment in Bangladesh offers a significant opportunity. The government actively encourages investment in green technology through fiscal incentives, and a key instrument in this policy is the Statutory Regulatory Order (SRO).

Specifically, SRO No. 128-Ain/2021/144-Customs (and its subsequent updates) provides substantial relief for new industrial enterprises. Under this provision, capital machinery imported for setting up a new factory, including a solar module production line, is generally exempt from:

- Customs Duty (CD)

- Regulatory Duty (RD)

- Supplementary Duty (SD)

This exemption can significantly reduce the initial capital outlay. However, other taxes like Value Added Tax (VAT) and Advance Income Tax (AIT) may still apply, though often at reduced rates for capital machinery.

Eligibility for these benefits depends on the correct classification of the imported goods using the Harmonized System (HS) code. An incorrect code can lead to the full tariff being applied, creating unforeseen expenses that can threaten a project’s viability.

Sourcing Your Equipment: Key Considerations for Bangladeshi Projects

Most high-performance solar manufacturing equipment is sourced from leading industrial nations in Europe, such as Germany, and Asia, particularly China. The choice of supplier affects not only technology and quality but also the logistics of the import process.

Shipping heavy machinery from a European port like Hamburg to Chittagong Port in Bangladesh typically takes four to six weeks by sea freight—a critical factor in the overall project schedule. During this time, meticulous coordination between the equipment supplier, the freight forwarder, and the receiving party in Bangladesh is essential to ensure all documentation is prepared correctly and sent ahead of the vessel’s arrival.

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

The Core Import Process: A Step-by-Step Breakdown

The import process follows a sequence of well-defined stages. While a turnkey solutions provider often manages this entire journey, understanding these steps is crucial for any project owner.

Pre-Shipment Preparations: Before any equipment is shipped, the importing company in Bangladesh must hold a valid Import Registration Certificate (IRC). For high-value transactions, securing finance and opening a Letter of Credit (L/C) with a bank is standard.

Documentation Assembly: The supplier provides a set of critical documents, including the Commercial Invoice, Packing List, and Certificate of Origin. These must align perfectly with the terms of the L/C.

Shipping and Arrival: The equipment is shipped to a designated port in Bangladesh, most commonly Chittagong (Chattogram) Port. The shipping line issues a Bill of Lading (B/L), which serves as the title to the goods.

Engaging a C&F Agent: Upon the vessel’s arrival, the importer engages a licensed Clearing and Forwarding (C&F) agent. This local expert is indispensable for navigating the customs bureaucracy.

Customs Clearance and Assessment: The C&F agent prepares and submits the Bill of Entry—the primary declaration document—to customs. Officials then appraise the shipment, which often involves a physical inspection to verify the goods against the declaration and assess applicable duties and taxes.

Final Release and Inland Logistics: Once duties are paid and all formalities are complete, customs issues a release order. The machinery is then loaded onto trucks for the final leg of its journey to the factory site.

Required Documentation: Your Checklist for a Smooth Clearance

Accuracy and consistency across all documents are paramount, as even minor discrepancies can lead to significant delays. The essential documents include:

- Bill of Entry: The formal declaration submitted to customs.

- Commercial Invoice: Details the transaction between the buyer and seller.

- Packing List: Itemizes the contents of the shipment.

- Bill of Lading (B/L) or Air Waybill (AWB): The transport contract.

- Letter of Credit (L/C): The financing instrument.

- Certificate of Origin (COO): Verifies the country of manufacture.

- Import Registration Certificate (IRC): The importer’s license.

- VAT Registration Certificate: Proof of tax registration.

- Proforma Invoice: The initial quote from the supplier.

- Insurance Certificate: Covers the goods during transit.

Common Challenges and How to Mitigate Them

Several challenges can arise during the import process. Proactive planning is the key to mitigating them.

Challenge 1: Port Congestion and Demurrage

Chittagong Port is one of the busiest in the region and can experience significant congestion. If cargo is not cleared within the allotted free time (typically seven days), the port authority will levy demurrage charges, which can accumulate rapidly.

Mitigation: Work with a highly experienced and proactive C&F agent. Ensure all documentation is flawless and submitted in advance to ensure a swift clearance process. Build a buffer of at least two weeks into your project timeline to account for potential delays.

Challenge 2: Incorrect HS Code Classification

As mentioned, using the wrong HS code is a costly error. It can lead to the loss of tax exemptions and result in disputes with customs authorities that take weeks or even months to resolve.

Mitigation: The classification of complex machinery should be confirmed by experts. A turnkey solutions partner typically handles this, as their teams have extensive experience classifying machinery for different customs regimes. The HS code should be verified with the supplier and the C&F agent before the shipment is finalized.

Challenge 3: Inland Transportation Hurdles

The journey from port to factory can be as challenging as the ocean voyage. Roads may be narrow, bridges may have weight limits, and local infrastructure may not be designed to handle oversized or heavy industrial equipment.

Mitigation: A thorough route survey must be conducted well before the shipment arrives. This involves physically assessing the entire route to identify potential obstacles and plan for necessary measures, such as temporary road reinforcements or specialized transport vehicles.

The Advantage of a Turnkey Partner

For entrepreneurs without a background in international logistics or industrial project management, these challenges can be overwhelming. This is where a turnkey equipment and solutions partner becomes invaluable.

Experienced providers, such as J.v.G. Technology GmbH, handle the entire logistics chain as part of their service. This includes verifying HS codes, preparing all documentation, coordinating with shipping lines, and managing the C&F agent to ensure a smooth customs clearance process. This integrated approach de-risks the project for the investor, transforming a complex logistical puzzle into a managed, predictable stage of the factory setup.

This end-to-end project management is a core component explored in resources like the pvknowhow.com free e-learning course, which is designed to guide new investors through such complexities.

Frequently Asked Questions (FAQ)

Q: How long does customs clearance typically take in Bangladesh?

A: If all documents are correct and there are no disputes, the process can take between 7 and 20 days. However, delays from physical inspections, valuation disputes, or documentation errors can extend this period significantly.

Q: What are the main import duties for solar manufacturing machinery?

A: Under current SROs, capital machinery for new industries is largely exempt from customs duty, regulatory duty, and supplementary duty. However, VAT and AIT may still apply. It is essential to consult the latest NBR regulations, as these policies can be updated.

Q: Is it mandatory to hire a local C&F agent?

A: While not legally mandatory, it is practically essential. Licensed C&F agents have the authorization, expertise, and local relationships needed to manage complex clearance procedures efficiently.

Q: Which port is best for importing heavy machinery into Bangladesh?

A: Chittagong (Chattogram) Port is the country’s primary seaport and handles the vast majority of containerized and project cargo. Mongla Port is another option, though it is generally smaller and has different logistical considerations.

Q: Can I import used or reconditioned machinery?

A: Importing used machinery is possible but faces a much stricter set of regulations, including pre-shipment inspections and limitations on the age of the equipment. Furthermore, used machinery may not be eligible for the same tax exemptions as new capital machinery. A bankable solar panel manufacturing business plan almost always specifies new, warrantied equipment to ensure quality, efficiency, and eligibility for incentives.

Planning for a Successful Import

Importing solar manufacturing equipment into Bangladesh is a manageable process when approached with diligence and professional support. While the government’s favorable policies for new industries provide a strong financial incentive, realizing these benefits depends entirely on meticulous execution.

By understanding the key steps, preparing flawless documentation, and engaging experienced local partners like a C&F agent, entrepreneurs can successfully navigate the complexities of customs and logistics. Careful planning ensures that the sophisticated machinery at the heart of the new factory arrives safely, on time, and ready for installation—turning the vision of a productive solar module facility into a tangible reality.