For entrepreneurs exploring new frontiers in solar panel manufacturing, the ideal location balances production costs, market access, and a supportive regulatory environment. While established hubs in Asia and Europe are familiar choices, strategic alternatives can offer unique competitive advantages. One such often-overlooked location is the Republic of Belarus, which offers a compelling framework for high-tech manufacturing investment.

Its position as a logistical bridge between the Eurasian Economic Union (EAEU) and the European Union, combined with a suite of government-backed incentives, creates a significant opportunity. Understanding this landscape is essential for capitalizing on a location that actively supports industrial growth. This guide outlines the Special Economic Zones (SEZs) and investment programs available in Belarus for solar production ventures.

Table of Contents

Why Belarus? A Strategic Overview for Solar Investors

Choosing a country for a new manufacturing facility is a critical strategic decision. Beyond a simple cost analysis, factors like market proximity, workforce quality, and government stability play a decisive role. The case for establishing a facility in Belarus rests on three core pillars.

First, its geographical position is central to its appeal. As a member of the EAEU, goods made in Belarus have tariff-free access to a market of over 180 million consumers across Russia, Kazakhstan, Armenia, and Kyrgyzstan. Its proximity to the Polish and Lithuanian borders also provides a direct logistical corridor to the vast European market.

Second, the country has a highly skilled and cost-effective workforce. With a strong legacy in engineering, physics, and technical education, Belarus offers a pool of qualified technicians and process engineers essential for operating a modern solar module factory. This human capital is a critical asset, particularly for investors without a pre-existing technical team.

Finally, the government maintains a consistent policy of attracting foreign direct investment (FDI) through a stable, preferential legal framework. This commitment is an active strategy, formalized in law and carried out by dedicated administrative bodies.

Understanding Belarus’s Special Economic Zones (SEZs)

Central to Belarus’s investment strategy is its network of six Special Economic Zones. An SEZ is a designated geographical area where businesses operate under a preferential tax and customs regime, designed to stimulate export-oriented and high-tech production. For a company setting up a solar module factory, becoming an SEZ resident unlocks the most significant financial and administrative benefits.

The six SEZs are strategically located across the country:

- Brest

- Gomel-Raton

- Grodnoinvest

- Minsk

- Mogilev

- Vitebsk

A legal entity is granted resident status once it registers within an SEZ and meets the required investment criteria. The core benefits for residents typically include:

- Exemption from Corporate Profit Tax: Resident companies are exempt from the standard profit tax (currently 18%) on the sale of goods or services for the first five years after declaring their first profit. Following this period, a reduced rate of 50% of the standard tax applies.

- Customs and VAT Benefits: The import of manufacturing equipment, raw materials, and components for an investment project is exempt from customs duties and Value Added Tax (VAT). This exemption significantly reduces a solar manufacturer’s initial capital outlay for a turnkey solar module production line.

- Real Estate Tax Exemption: Land and buildings located within the SEZ are exempt from real estate and land taxes for the entire duration of the project.

- Simplified Administration: SEZ administrations act as a one-stop shop, assisting investors with registration, permits, and other bureaucratic procedures to streamline the setup process.

These incentives directly address the primary cost centers of a manufacturing startup, enabling a faster path to profitability and reinvestment.

Key Investment Incentives Beyond the SEZs

While the SEZs offer a comprehensive package, Belarus provides additional support for investment, particularly for large-scale or strategically important projects.

The Law on Investment is the key legislation protecting foreign investors. It guarantees fundamental rights, including the protection of property from expropriation, the unrestricted transfer of profits and other revenues abroad after taxes are paid, and dispute resolution through international arbitration.

For projects with an investment value exceeding approximately €5 million, investors can enter into an Investment Agreement directly with the Republic of Belarus. This allows for a bespoke incentive package. Such an agreement can provide additional benefits and stability clauses that grandfather the agreed-upon conditions for the project’s duration, protecting it even if national legislation changes.

A notable example of a specialized zone is the Great Stone Industrial Park near Minsk. This joint Belarusian-Chinese project serves as a hub for high-tech and innovative businesses and offers an even more preferential regime than standard SEZs, including tax exemptions for up to 10 years.

Eligibility and the Application Process: A Step-by-Step Guide

Gaining resident status in an SEZ is a structured, transparent process. While requirements may vary slightly between zones, the general pathway is consistent.

Eligibility Criteria:

- The investor must register a new legal entity (e.g., a Limited Liability Company) in the Republic of Belarus.

- The project must involve an investment of at least €1 million. Residency can also be granted for investments of at least €500,000, provided the business plan demonstrates the project will be exclusively export-oriented or focused on import-substituting technologies.

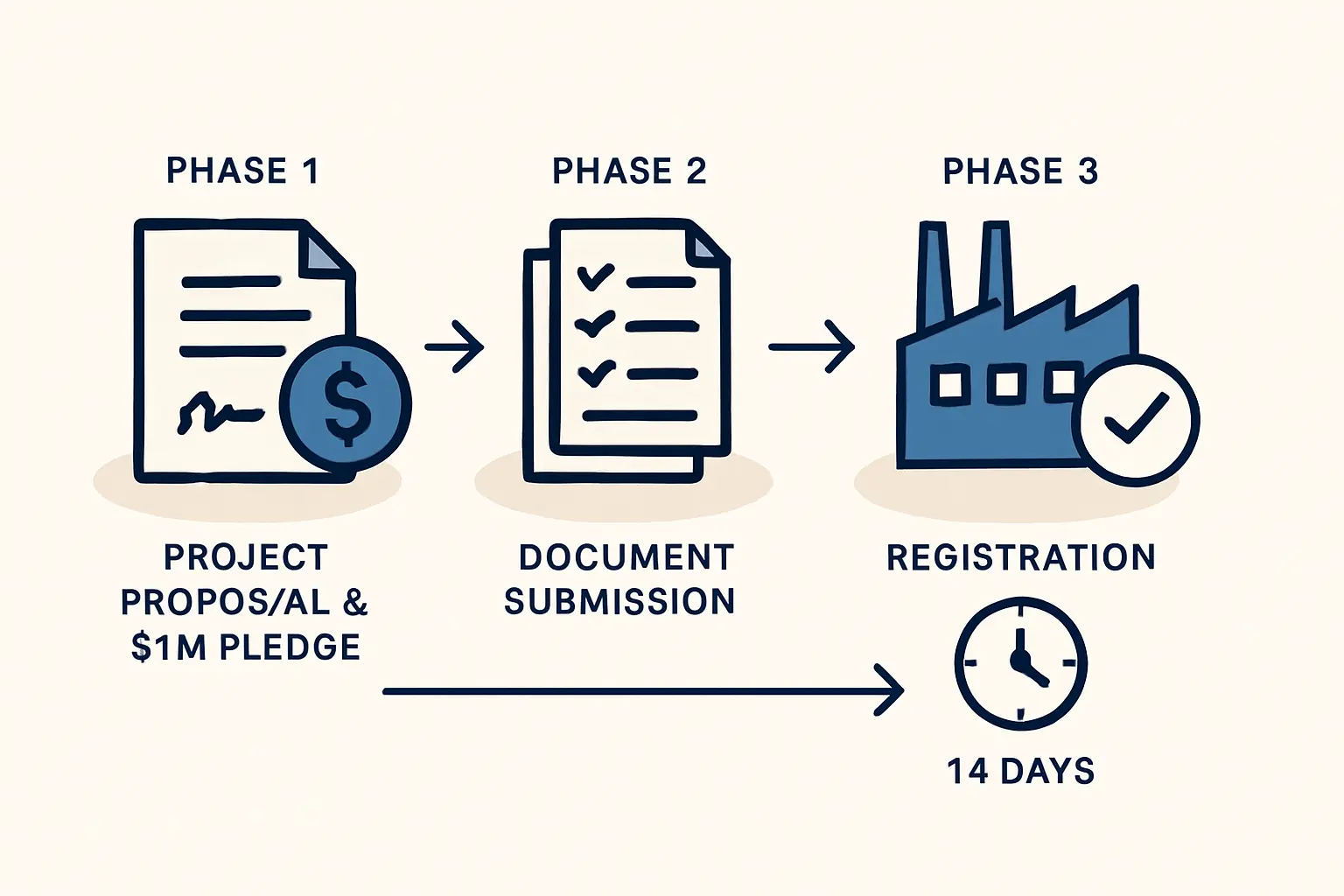

The Application Process:

- Project Conception and Business Plan: The first and most critical step is developing a detailed business plan. This document must outline the project’s scope, technology, production volume, financial forecasts, market analysis, and job creation potential. A clear plan for aspects like solar factory layout planning is essential for credibility.

- SEZ Administration Consultation: The investor presents the draft business plan to the administration of the chosen SEZ. The administration offers feedback and guidance to help align the project with the zone’s requirements.

- Legal Entity Registration: Once the plan is refined, the investor formally registers a legal entity in Belarus.

- Formal Application Submission: The complete application package, including the business plan and registration documents, is submitted to the SEZ administration.

- Review and Agreement: The administration reviews the project. Upon approval, the investor and the SEZ administration sign an agreement that formalizes the terms of operation, locking in the rights and obligations of the resident company.

Based on experience from J.v.G. turnkey projects, having a thoroughly researched and professionally prepared business plan is the single most important factor in a successful application.

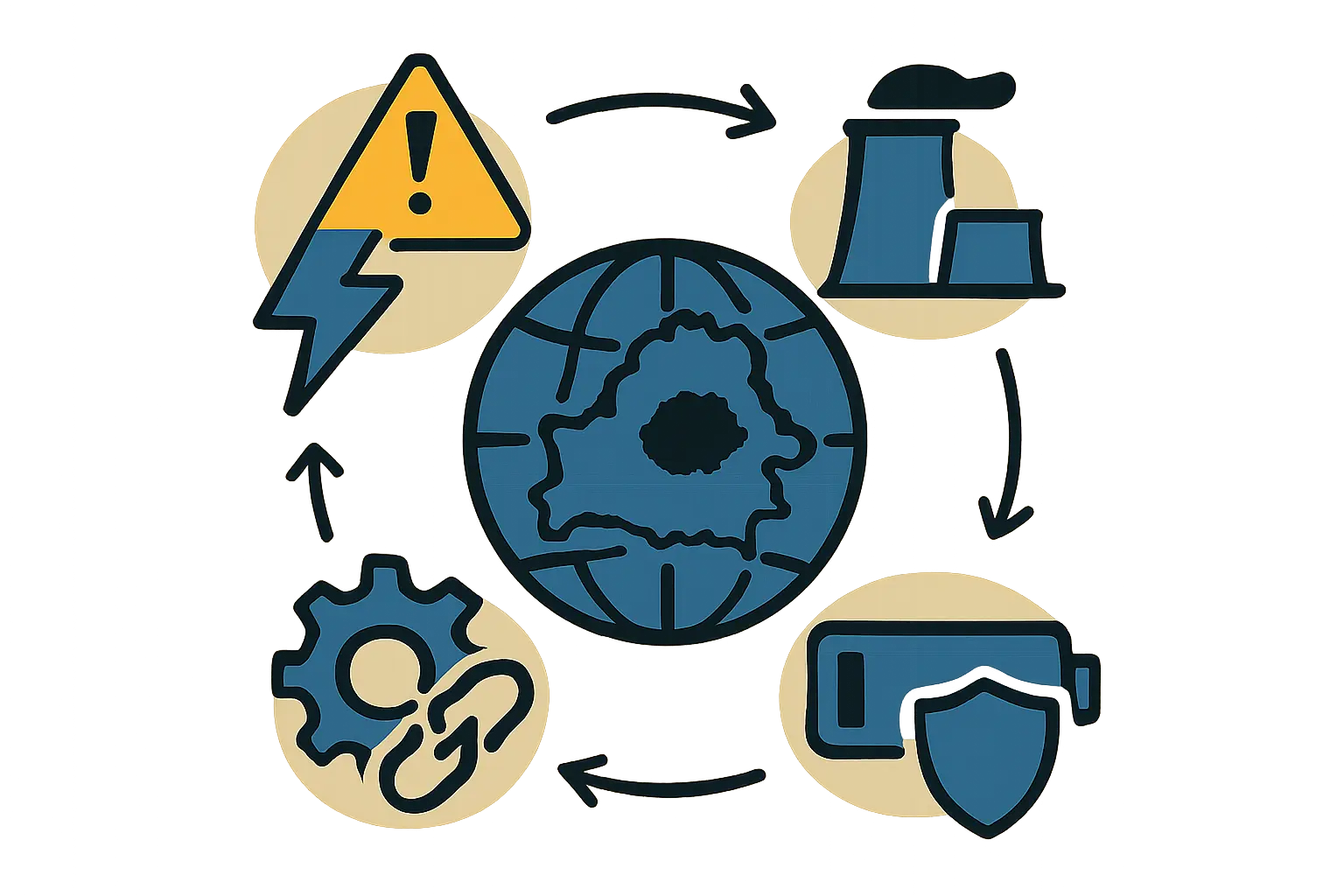

Practical Considerations for Solar Manufacturing in Belarus

Beyond the legal and financial frameworks, a successful venture depends on operational realities.

- Logistics and Supply Chain: Investors must plan for both the import of specialized raw materials (e.g., solar cells, EVA film, glass) and the export of finished modules. The developed rail and road infrastructure connecting Belarus to Russian ports and European logistics hubs is a significant advantage.

- Quality and Certification: To compete in European or other international markets, modules must adhere to strict solar panel quality standards such as IEC 61215 and IEC 61730. The factory’s quality management system must be designed to meet these from day one.

- Energy and Utilities: While the grid is generally stable, securing reliable, high-capacity power connections is a key part of factory site selection and planning. SEZs typically offer pre-prepared industrial sites with utility access.

Frequently Asked Questions (FAQ)

Q: What is the typical minimum investment to qualify for an SEZ in Belarus?

A: The standard requirement is an investment equivalent to at least €1 million. However, a lower threshold of €500,000 may be considered for projects focused on export or import substitution technologies.

Q: How long do the tax benefits for SEZ residents last?

A: The benefits are tied to the operational period of the SEZ itself, which is currently set to run until 2050 in most cases. Key benefits like the profit tax exemption have specific durations (e.g., 5 years from the first profit), after which a reduced rate applies.

Q: Can I repatriate 100% of my profits from Belarus?

A: Yes. The Law on Investment guarantees foreign investors the right to the unrestricted transfer of profits and other income received from their investment out of the country after paying the applicable taxes and fees.

Q: What happens if the laws in Belarus change after I have invested?

A: Investment agreements, particularly for larger projects, often include a stabilization or grandfather clause. This ensures that the legal and tax conditions in place when the agreement was signed remain applicable to the investor for a specified period, protecting the project from adverse legislative changes.

Q: Does pvknowhow.com assist with setting up factories in locations like Belarus?

A: pvknowhow.com provides the educational foundation and structured guidance to help entrepreneurs plan such a project. The parent company, J.v.G. Technology GmbH, has over two decades of experience in setting up turnkey solar production lines globally, including navigating the specific requirements of various investment jurisdictions.

Conclusion and Next Steps

For the discerning entrepreneur, Belarus offers a structured, incentive-rich, and strategically located environment for establishing a solar module manufacturing facility. The combination of SEZ benefits, tariff-free access to the EAEU market, and proximity to Europe creates a compelling business case.

Success in such a venture is not automatic; it requires meticulous planning, a deep understanding of the regulatory landscape, and a robust technical and financial plan. The next logical step is to conduct in-depth due diligence on a specific SEZ and begin outlining a comprehensive business plan for your solar factory. By leveraging the available government support, investors can build a competitive and sustainable manufacturing operation.