For entrepreneurs entering the solar manufacturing sector, the initial financial outlay can be formidable. Acquiring machinery, setting up a facility, and training a workforce all demand a significant capital investment.

In strategic locations like Benin, however, the government has introduced powerful incentives to ease these burdens and attract this very kind of forward-looking investment. Understanding these support mechanisms isn’t just an advantage—it’s a critical part of a successful business plan.

This guide offers a clear overview of the financial and administrative support available to investors establishing solar panel manufacturing operations in Benin. We will detail the specific benefits of the nation’s Investment Code and the specialized advantages of operating within the Glo-Djigbé Industrial Zone (GDIZ).

Table of Contents

The Strategic Framework: Why Benin Welcomes Solar Investment

Benin’s government is actively transforming its economy, shifting from traditional sectors toward industrialization and sustainable energy. This national ambition is laid out in the country’s Development Plan and implemented by agencies like the Investment and Export Promotion Agency (APIEx).

The goal is to create a stable, predictable, and highly attractive environment for private investment. For solar manufacturers, this support builds a foundation of security, reducing both financial risk and bureaucratic hurdles. The establishment of the Glo-Djigbé Industrial Zone (GDIZ) is a tangible result of this commitment, offering world-class infrastructure and a streamlined regulatory process for industrial projects.

Decoding Benin’s Investment Code: Key Financial Benefits

The Investment Code of the Republic of Benin provides a structured framework of incentives for qualifying projects. These are designed to significantly reduce the initial and ongoing costs of establishing a factory.

For investors planning a solar manufacturing venture, these concessions can dramatically improve a project’s financial projections. The incentives fall into two main phases: the setup phase and the operational phase.

Tax Exemptions During the Investment & Setup Phase

During the crucial period of building and equipping the factory, the Investment Code offers substantial relief from taxes and duties, directly lowering the capital required to get a project off the ground. Key exemptions include:

-

Exemption from Customs Duties: Import taxes are waived on all equipment, machinery, and materials needed to set up the production line. This is a major cost-saving measure, particularly for specialized turnkey solar production lines sourced internationally.

-

Value-Added Tax (VAT) Exemption: The purchase of goods and services within Benin for the project is also exempt from VAT, further reducing setup costs.

Tax Reductions During the Operational Phase

Once the factory is operational, the benefits shift toward improving profitability and cash flow. A key incentive is a significant reduction in corporate income tax (CIT). The scale of this reduction is directly tied to the size of the investment and the number of local jobs created, rewarding investors for contributing to the local economy.

The structure is tiered:

-

For investments up to 500 million CFA francs: A 50% reduction in CIT.

-

For investments exceeding 3 billion CFA francs: A 65% reduction in CIT for the first five years.

These long-term tax benefits create a stable financial environment, allowing businesses to reinvest profits and achieve sustainable growth.

The GDIZ Advantage: A One-Stop Shop for Industrial Investors

For many new investors, the Glo-Djigbé Industrial Zone (GDIZ), located near the capital city of Cotonou, represents the most efficient path to market. This Special Economic Zone (SEZ) provides benefits that go well beyond the standard Investment Code.

Operating within GDIZ gives investors access to:

-

A Single Point of Contact: The zone’s administration handles all necessary permits and approvals, eliminating the need for investors to navigate multiple government ministries. This one-stop-shop service drastically reduces administrative delays.

-

Reliable Infrastructure: GDIZ guarantees access to stable electricity, water, and logistics infrastructure—a critical factor for ensuring consistent production quality and output.

-

Preferential Tax Regime: Companies within GDIZ benefit from a complete exemption from corporate income tax for a defined period, followed by a highly preferential flat rate. They are also exempt from all customs duties and VAT on imported inputs for production.

Navigating the Application Process

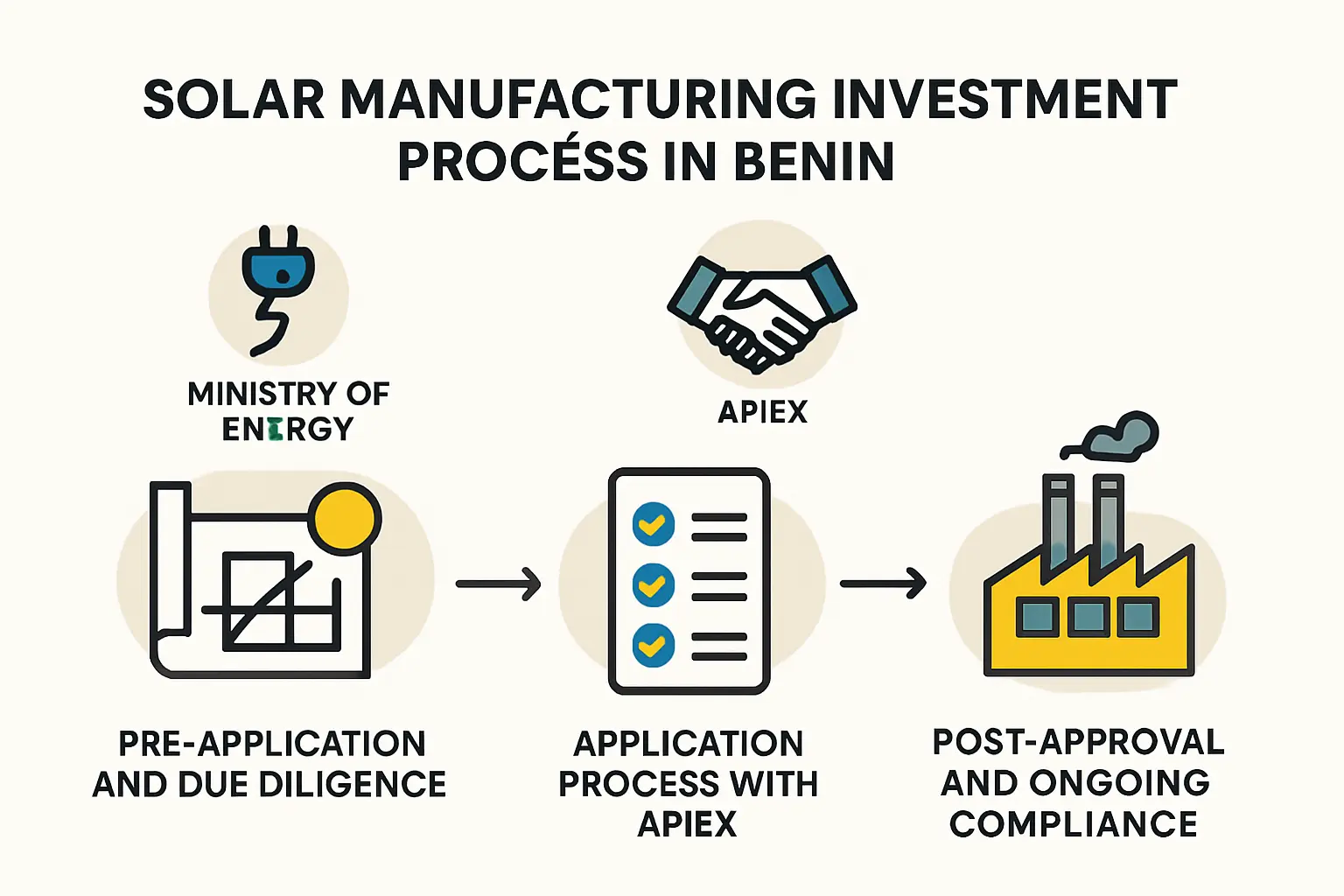

The Benin government, through its central agency APIEx, has streamlined the process for securing these incentives with steps designed for transparency and efficiency.

-

Project Submission: The process begins with submitting a detailed investment file to APIEx. This file must include a comprehensive solar business plan, technical specifications, and financial forecasts.

-

Evaluation: APIEx evaluates the project’s eligibility based on criteria in the Investment Code, such as investment amount, job creation potential, and alignment with national development goals.

-

Approval: Following a successful evaluation, an approval certificate is granted. This document formally outlines the specific incentives and exemptions the project qualifies for.

Experience from J.v.G. turnkey projects in emerging markets shows that a well-prepared, professional investment proposal is key to navigating this stage successfully.

Next Steps for Exploration

The government of Benin has established one of the most compelling incentive structures in West Africa for investors in the solar manufacturing sector. By significantly de-risking the initial investment and improving long-term profitability, these policies create a clear and strategic pathway for entrepreneurs.

For those ready to move from concept to detailed planning, understanding the complete process is the logical next step. A structured roadmap—from initial feasibility studies to final commissioning—provides the clarity required to confidently launch your solar factory and bring your vision to life.

Frequently Asked Questions (FAQ)

-

What is the minimum investment required to qualify for these incentives?

While the benefits are tiered, projects with investments as low as 50 million CFA francs (approximately €75,000) can qualify for certain regimes under the Investment Code, making it accessible even to smaller-scale operations. -

Are these incentives available to both local and foreign investors?

Yes, the Investment Code and GDIZ benefits are designed to attract both domestic and international capital. The legal framework ensures equal treatment and protection for all investors. -

How long does the approval process typically take?

APIEx aims to provide a response within 30 days of receiving a complete application file, reflecting the government’s commitment to facilitating investment. -

Do these benefits apply to a smaller operation, such as a 20 MW semi-automated production line?

Absolutely. A 20 MW semi-automated production line represents a significant investment that would comfortably qualify for substantial benefits under the Investment Code, including customs duty exemptions on imported machinery and significant corporate tax reductions during operation. -

Is there support for securing financing?

The government and APIEx actively work to facilitate relationships between investors and local and international financial institutions. The approval certificate itself can serve as a strong document when seeking credit.