Imagine your new solar module factory in China has just completed its first successful year. The financial statements show a healthy profit—a testament to careful planning and execution. But those profits are held within the Chinese financial system.

For any international investor, this raises a critical question: how do you transfer these earnings from the local entity back to the parent company abroad?

This process, known as profit repatriation, is a fundamental part of international business. In China, it operates within a highly regulated government framework. While this framework might seem complex to entrepreneurs new to the country, with a clear understanding of the rules and proper strategic planning, the process is both manageable and predictable.

This guide outlines the primary methods for repatriating profits from a foreign-owned enterprise in China, explaining the steps and considerations necessary for building a financially sound international operation.

Table of Contents

Understanding the Regulatory Landscape: Capital Controls and SAFE

Unlike many Western economies with free-flowing capital, China maintains a system of capital controls. This means the government regulates the flow of money into and out of the country. Its primary objective is to maintain financial stability and manage the nation’s foreign exchange reserves.

The key regulatory body overseeing these transactions is the State Administration of Foreign Exchange (SAFE). Any significant cross-border transfer, whether it’s an initial investment coming into China or profits going out, must follow SAFE’s procedures.

For a foreign investor, this means repatriating profits isn’t as simple as initiating a bank wire. It’s a formal process requiring specific documentation and approvals to prove the legitimacy of the funds being transferred.

The Foundation: Your Legal Entity in China

The ability to repatriate profits is directly tied to the legal structure of your business in China. For the vast majority of international investors, the most common and effective structure is the Wholly Foreign-Owned Enterprise (WFOE).

A WFOE is a limited liability company in China that is 100% owned by a foreign investor or parent company. This structure provides the greatest control over operations, intellectual property, and, most importantly, financial management. It serves as the legal vehicle for earning and ultimately repatriating profits. Understanding how to form a WFOE is therefore an essential first step when setting up a solar module factory.

Primary Methods for Profit Repatriation

There are several established channels for transferring funds from a Chinese WFOE to its foreign parent. The most appropriate method depends on the company’s financial strategy, tax planning, and the nature of its inter-company relationship.

1. Dividend Distribution: The Standard Path

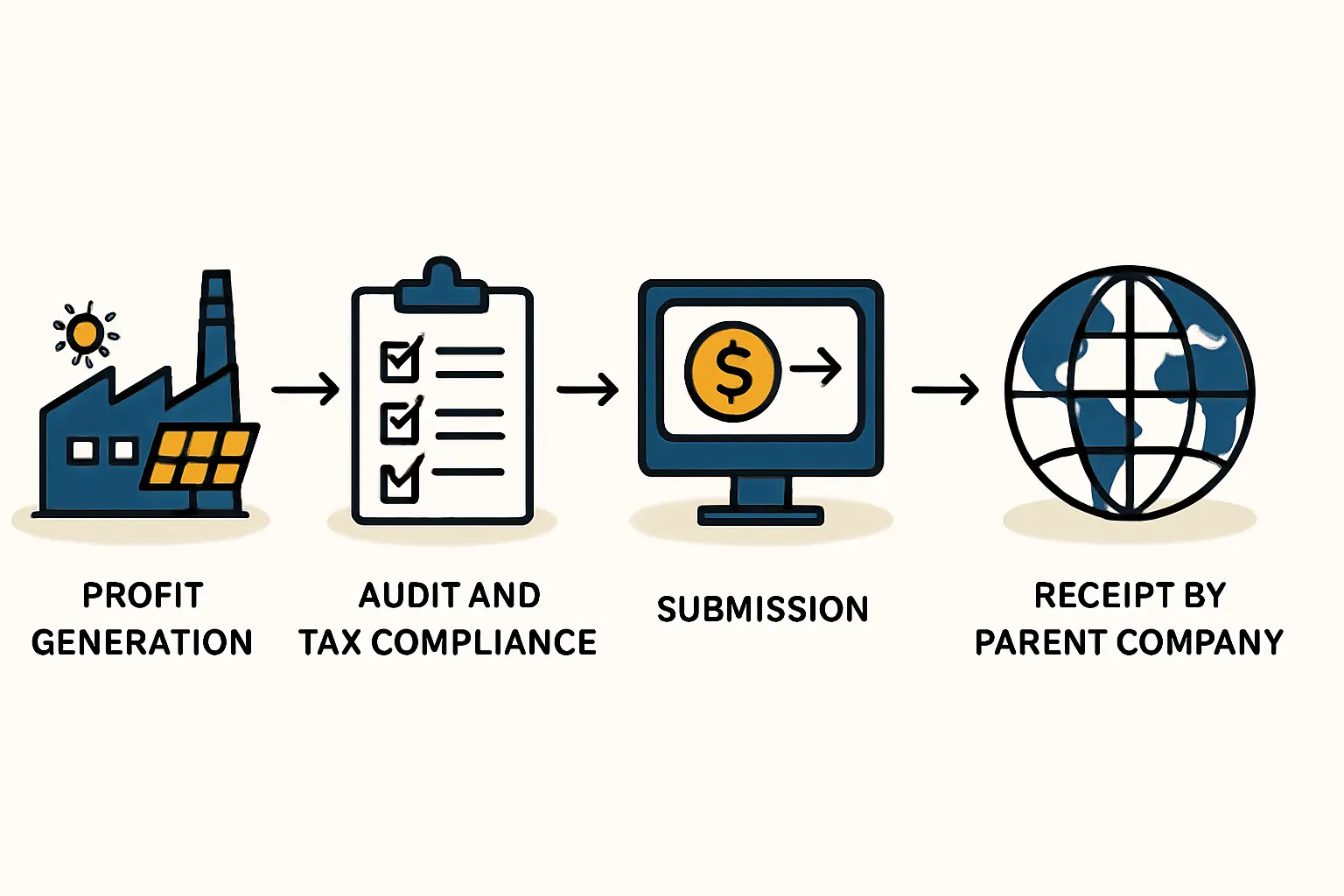

The most direct and common way to repatriate profits is by distributing dividends, which are considered a return on the parent company’s initial investment. This process can only begin after the financial year is complete and certain conditions are met.

The procedure involves these key steps:

- Annual Audit: The WFOE must complete its annual statutory audit with a certified public accounting firm in China. This audit verifies the company’s financial performance and confirms its official net profit.

- Tax Clearance: All applicable Chinese taxes, primarily the Corporate Income Tax (CIT), must be fully paid. The standard CIT rate is 25%, though preferential rates may apply in certain high-tech sectors or special economic zones.

- Allocation to Statutory Reserves: Chinese law requires companies to allocate at least 10% of their after-tax profits to a statutory reserve fund until this fund reaches 50% of the company’s registered capital. These funds cannot be distributed as dividends.

- Board Resolution: The WFOE’s board must pass a formal resolution declaring the dividend amount to be distributed to the foreign shareholder.

- Withholding Tax Payment: A withholding tax is levied on dividends sent abroad. The standard rate is 10%, but this can be reduced if a Double Taxation Agreement (DTA) exists between China and the parent company’s home country.

- Bank Application: With all the required documentation in hand—including the audit report, tax receipts, and board resolution—the WFOE submits an application to its bank to process the foreign exchange and execute the transfer.

Although highly structured, this is the most transparent and legally sound method for repatriating profits.

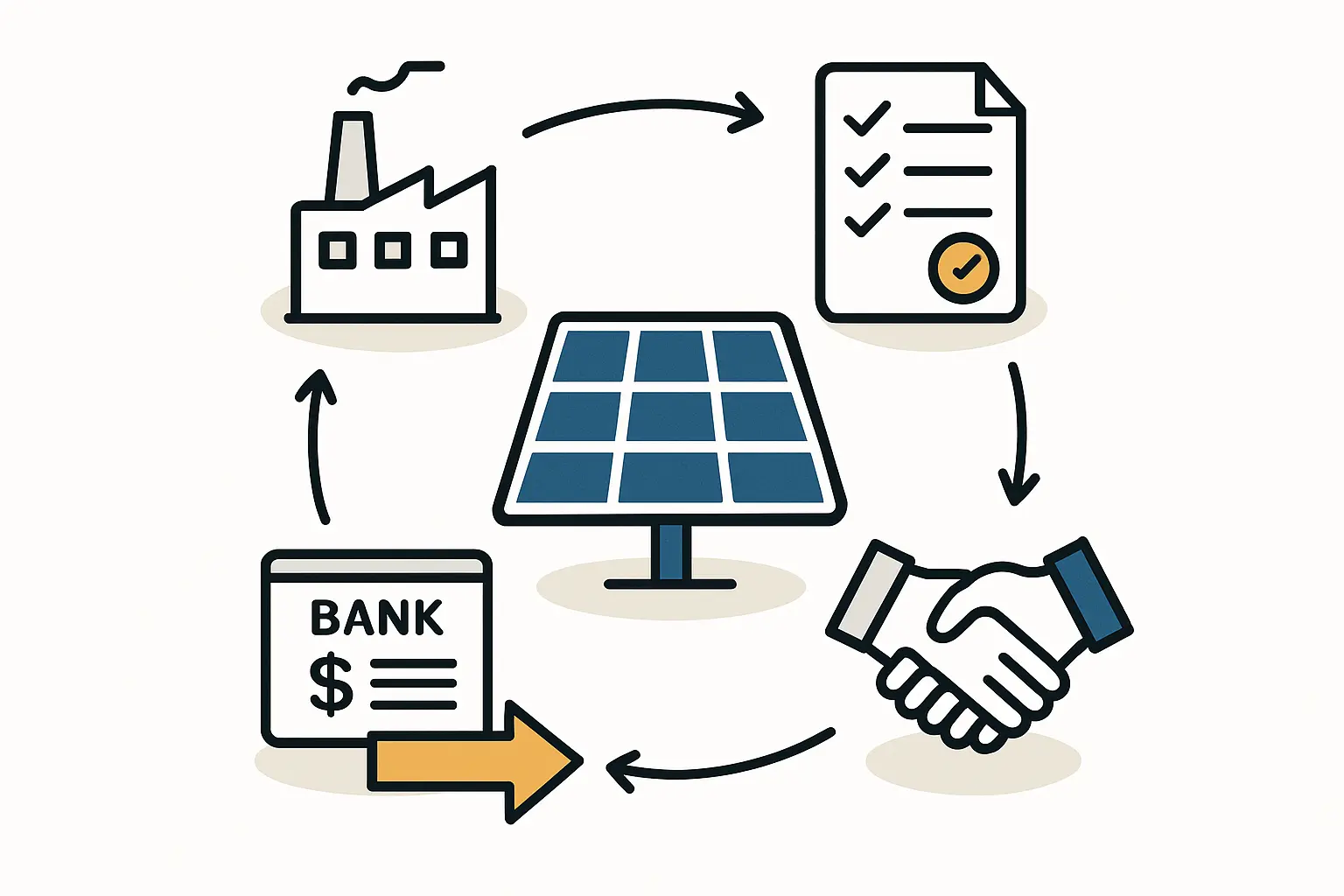

2. Service Fees and Royalties: A Strategic Alternative

Another effective strategy involves the WFOE paying its foreign parent for legitimate services or the use of intellectual property. This approach requires a formal agreement between the two entities.

Management or Service Fees: If the parent company provides ongoing support—such as strategic management, technical guidance, or marketing services—it can charge the WFOE a fee. This is treated as a business expense for the WFOE, which can be advantageous for tax purposes.

Royalty Payments: If the WFOE uses technology, patents, or a brand name owned by the parent company, it can pay royalties for the license to use this intellectual property. This is particularly relevant in manufacturing.

These payments must be for genuine, demonstrable services or licenses and priced at a fair “arm’s length” market rate. The associated inter-company agreements must be registered with the relevant authorities. While these payments are also subject to taxes in China, they offer a more flexible way to repatriate funds throughout the year, rather than waiting for the annual dividend distribution.

Based on our experience with J.v.G. turnkey projects, clients who establish clear inter-company service agreements from the outset find the repatriation process more flexible and predictable than those who rely solely on annual dividends.

Strategic Planning for Successful Repatriation

Effective profit repatriation isn’t an afterthought; it’s a core component of comprehensive financial planning for any solar enterprise. Success hinges on foresight and meticulous execution.

- Impeccable Record-Keeping: Chinese authorities require extensive documentation. Maintaining clean, accurate, and compliant financial records is non-negotiable. Any discrepancies can lead to significant delays.

- Proactive Tax Planning: Understand the tax implications in both China and your home country. Structuring your investment to leverage any applicable Double Taxation Agreements can yield significant savings on withholding taxes.

- Engage Local Expertise: Navigating SAFE regulations and the Chinese banking system requires local knowledge. Working with a reputable accounting firm and legal counsel in China is a crucial investment to ensure compliance and efficiency.

Frequently Asked Questions (FAQ)

Q: How often can a WFOE repatriate profits?

A: Dividends can typically be distributed only once per year, after the annual audit is finalized. Service fees and royalty payments can often be made more regularly (e.g., quarterly or semi-annually), as outlined in the inter-company agreement.

Q: Is there a limit on the amount of profit that can be repatriated?

A: For dividends, the amount is limited to the accumulated distributable profits confirmed by the annual audit. For service fees and royalties, payments must be justifiable and align with market rates for the services or licenses provided. While there is no arbitrary cap, all transfers must be substantiated.

Q: What are the main taxes involved in repatriation?

A: The two key taxes are the Corporate Income Tax (CIT) paid on profits within China and the Withholding Tax paid on funds (dividends, royalties, etc.) being transferred out of China.

Q: What are the risks of attempting to bypass the official process?

A: Attempting to move money out of China through unofficial channels is illegal and carries severe penalties, including substantial fines, the freezing of assets, and the potential blacklisting of the company and its directors from doing business in the country. Adherence to the formal process is the only secure path.

Conclusion: A Matter of Process, Not Prohibition

Repatriating profits from a solar factory in China is a procedural challenge, not a fundamental barrier. The Chinese government has established a clear, albeit rigorous, system for foreign investors to realize the returns on their investments.

Success lies in understanding this system, incorporating repatriation strategies into the initial business plan, and maintaining meticulous compliance. By treating profit repatriation as an integral part of your financial operations from day one, you ensure the rewards of your successful venture can be fully realized.