An investor might assume that a country known for massive infrastructure projects offers uniform excellence in utility services across its industrial zones. When establishing a solar manufacturing plant, however, this assumption can lead to significant operational and financial challenges.

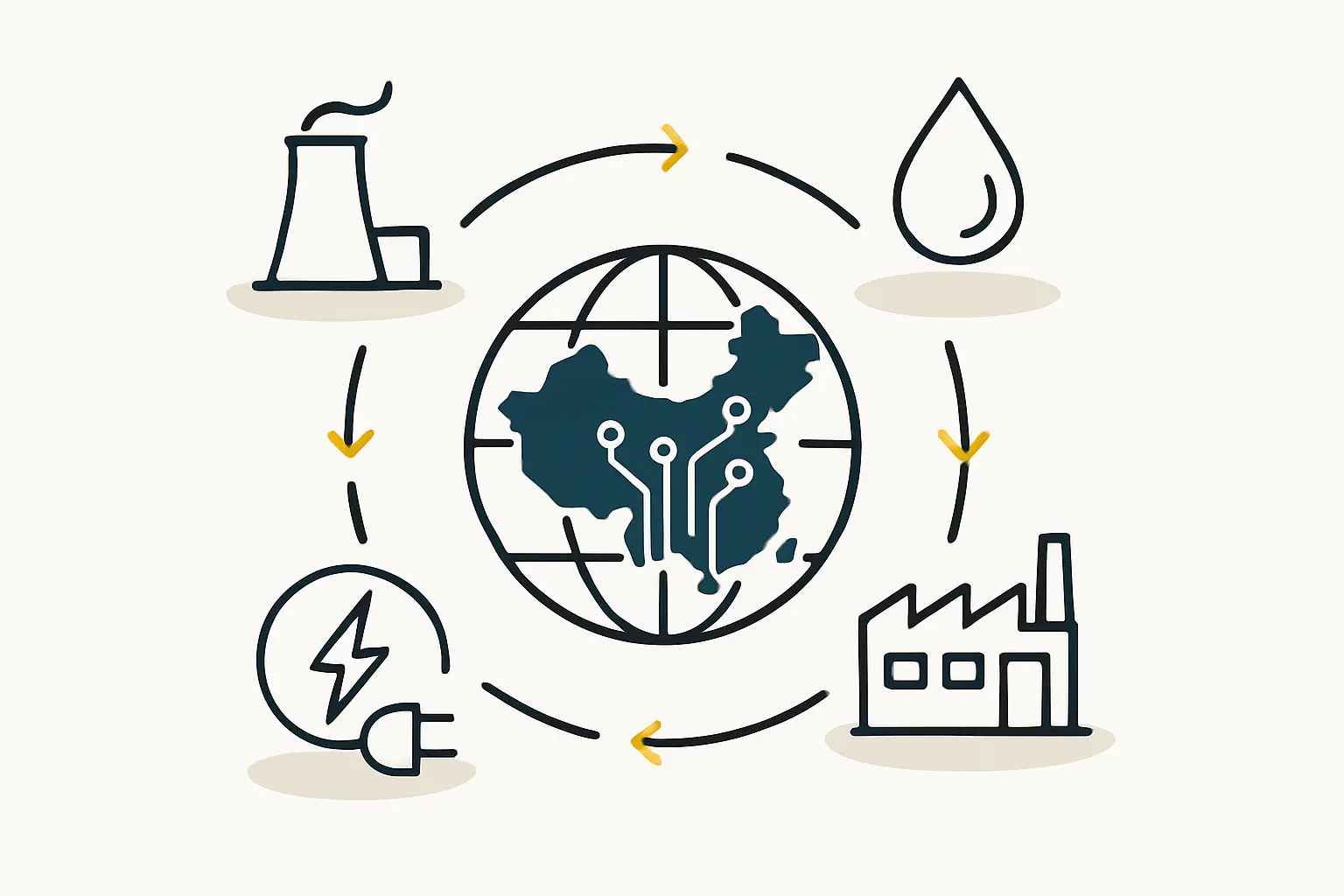

The reality is far more nuanced: a factory in one province might enjoy uninterrupted, low-cost power, while a similar facility just a few hundred kilometers away could face seasonal power rationing that brings production to a halt for days.

Meticulously assessing local utility and energy infrastructure is not just a preliminary check; it is a foundational step that directly influences a project’s profitability, risk profile, and long-term viability. This guide provides a framework for evaluating the critical infrastructure of electricity, water, and logistics for any prospective solar factory in China.

Table of Contents

The Electrical Grid: Beyond Availability

China operates the world’s largest and most extensive power grid. While national investment ensures broad coverage, the quality, reliability, and cost of electricity can vary significantly between regions, provinces, and even specific industrial parks. For a power-intensive operation like solar module manufacturing, these variations are critically important.

Reliability and the Risk of Rationing

The primary concern for any manufacturer is the stability of the power supply. Unexpected outages can damage sensitive equipment and ruin entire batches of products. In China, a unique challenge is government-mandated power rationing, which can occur for several reasons:

- Peak Demand: During extreme weather, such as summer heatwaves that increase air conditioning use, demand can outstrip supply, leading authorities to curtail power for industrial users. The 2022 heatwave in Sichuan province, a major industrial hub, forced many factories to shut down for over a week.

- Energy Policy: To meet national carbon emissions targets or manage coal supplies, local governments may implement planned power cuts for heavy industry.

- Grid Constraints: In some regions, particularly those rich in renewable energy like wind and solar, the grid infrastructure may not be sufficient to transmit all the power generated—a phenomenon known as curtailment.

A thorough due diligence process must include an investigation into the history of power rationing in a specific industrial zone over the past several years.

Understanding Electricity Costs

Industrial electricity prices in China are state-regulated but vary by province and consumption patterns, typically ranging from 0.6 to 0.8 RMB per kilowatt-hour (kWh) for industrial users. The final cost, however, is often determined by a tiered pricing system:

- Peak Hours: Higher prices during times of high demand (e.g., daytime).

- Off-Peak Hours: Lower prices during periods of low demand (e.g., late night).

A strategic production schedule can leverage these price differences to significantly reduce operational costs. When evaluating a site, it is essential to get the specific tariff structure from the local power bureau rather than relying on national averages. This detailed financial modeling is a core component of planning a turnkey solar manufacturing line.

Water Supply: A Resource Not to Be Overlooked

The solar panel manufacturing process requires a consistent supply of water, primarily for cleaning solar cells and glass before lamination. While the quantities needed are not as vast as in other heavy industries, the quality and reliability of the supply are paramount.

Availability and Regional Scarcity

China’s water resources are unevenly distributed. The North China Plain, a major industrial region, faces significant water scarcity. In these areas, industrial water use may be restricted, or costs can be substantially higher. Investors must verify the long-term water allocation guarantees for their chosen industrial park.

Water Quality and Treatment

Water supplied by the municipality will almost certainly require further purification to meet the stringent standards for module manufacturing. Impurities in the water used for cleaning can leave residues that compromise cell efficiency and module longevity.

Equally important is wastewater management. China has strict environmental regulations governing the discharge of industrial wastewater. A prospective factory must have a clear plan and the necessary facilities for treating its effluent before release. This includes planning for the physical space and capital investment required for a water treatment facility—a key consideration in the overall solar factory layout.

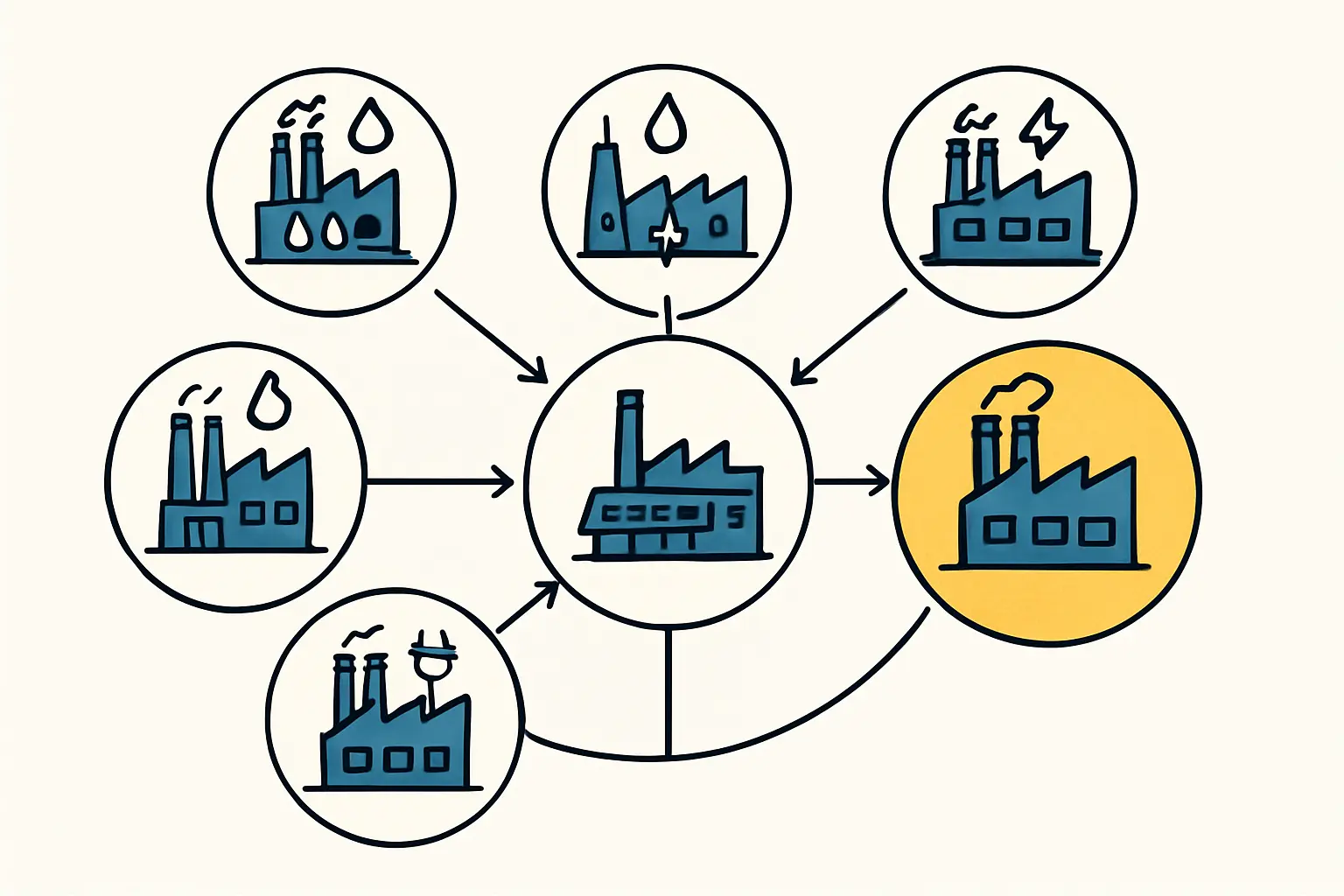

Evaluating Industrial Zones: A Holistic Approach

The selection of an industrial zone is where all utility assessments converge. A well-managed zone will provide clear, reliable data on its infrastructure capacity and a track record of stable service.

Key Assessment Criteria

When comparing potential locations, key criteria include:

- Dedicated Power Substations: The presence of a dedicated substation, which often indicates a more stable and reliable power supply for industrial tenants.

- Dual-Circuit Power Lines: The availability of a secondary power line to provide critical redundancy and minimize the impact of faults on the primary line.

- Water and Gas Capacity: Confirmation that the mains for water and any required natural gas have sufficient capacity for planned production volumes and future expansions.

- Logistical Infrastructure: The quality of road access for heavy trucks, proximity to major highways, and distance to the nearest seaport or rail hub for shipping finished modules.

- Communications: Access to a reliable, high-speed fiber optic network for modern manufacturing operations, data management, and global communication.

Based on experience from J.v.G. turnkey projects, engaging with the management committee of the industrial park is crucial. They can provide historical data on utility performance and details about any planned infrastructure upgrades.

Frequently Asked Questions (FAQ)

Q: What is the single biggest utility-related risk for a solar factory in China?

A: The most significant and often underestimated risk is unscheduled or prolonged power rationing. While price fluctuations can be managed, a complete production shutdown directly impacts revenue and contract fulfillment. A historical analysis of the local grid’s stability is non-negotiable.

Q: Are utility costs in China generally competitive for solar manufacturing?

A: Yes, on a global scale, China’s industrial utility costs are competitive. The advantage, however, lies in careful site selection. Choosing a province with favorable electricity tariffs and a stable grid can create a significant cost advantage over competitors in other regions.

Q: How important is wastewater treatment planning from the beginning?

A: It is absolutely crucial. Environmental regulations in China are strictly enforced, and failing to plan for an adequate wastewater treatment system can lead to significant fines, operational suspensions, and reputational damage. The investment must be factored into the initial business plan.

Q: Can a foreign investor assess this infrastructure alone?

A: While possible, it is highly challenging without local expertise. Navigating discussions with local power bureaus, water authorities, and industrial park management requires local knowledge and language skills. Partnering with a consultant or a turnkey provider experienced in the region is standard practice to mitigate risks.

Conclusion:

Ultimately, the success of a solar manufacturing venture in China is built on a foundation of reliable and cost-effective utilities. Moving beyond national statistics to conduct rigorous, on-the-ground due diligence for each potential site is an essential investment of time and resources. This detailed assessment ensures the chosen location can support a resilient, efficient, and profitable manufacturing operation for years to come.