An entrepreneur studying Europe’s energy landscape might easily overlook Croatia. Yet a closer analysis reveals a significant opportunity. By the end of 2022, Croatia had only 139 MW of installed solar capacity—a modest figure for a country with abundant sunshine.

The nation’s energy strategy, however, targets an ambitious 1.5 GW by 2030. This gap between current capacity and future goals creates a compelling entry point for local manufacturing, particularly for an investor aiming to serve the broader regional market.

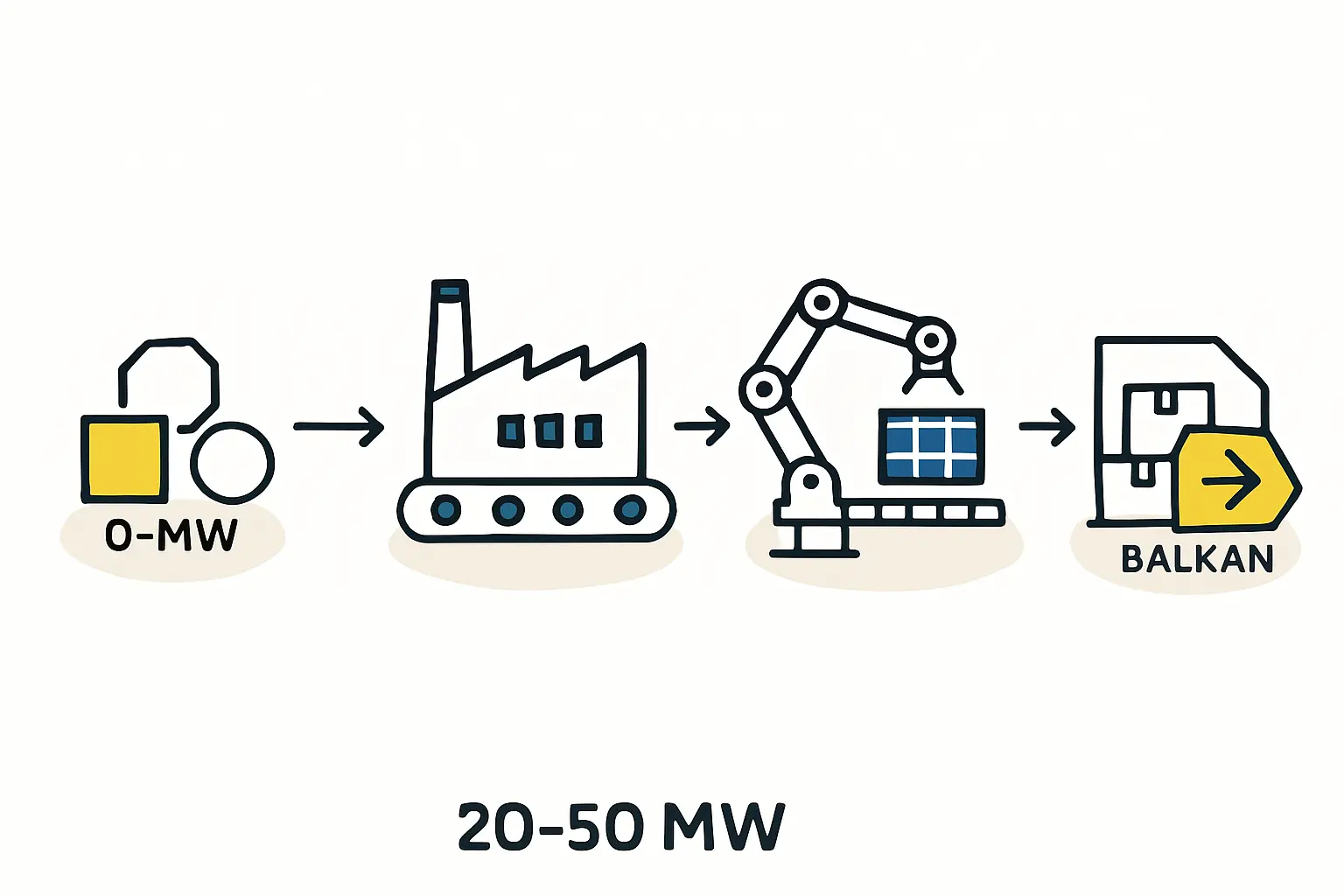

This article examines the feasibility of a specific, manageable market entry strategy: establishing a small-scale 20–50 MW solar module assembly line in Croatia. We will explore the strategic advantages of the location, the required investment and operational footprint, and the potential for supplying the wider Balkan region.

The Strategic Advantage of Croatia for Solar Manufacturing

The success of any manufacturing venture hinges on its location. For a new solar module assembly operation, Croatia offers an attractive base, combining European Union membership with strategic geography and growing market demand.

A Gateway to Two Markets: EU and the Balkans

As an EU member, a factory in Croatia gains frictionless access to the European Single Market—a significant advantage for future expansion. More immediately, its location provides direct, low-cost logistical access to neighboring non-EU markets like Bosnia and Herzegovina, Serbia, and Montenegro.

These countries are also experiencing rising demand for renewable energy but often lack local production facilities. A Croatian manufacturer would be perfectly positioned to serve this regional demand, offering shorter lead times and lower transportation costs than suppliers from Asia.

Leveraging the “Made in Europe” Label

In a market often dominated by price-sensitive imports, a “Made in Europe” label carries substantial weight. It signifies adherence to stringent quality, environmental, and labor standards—a key differentiator for commercial and governmental clients.

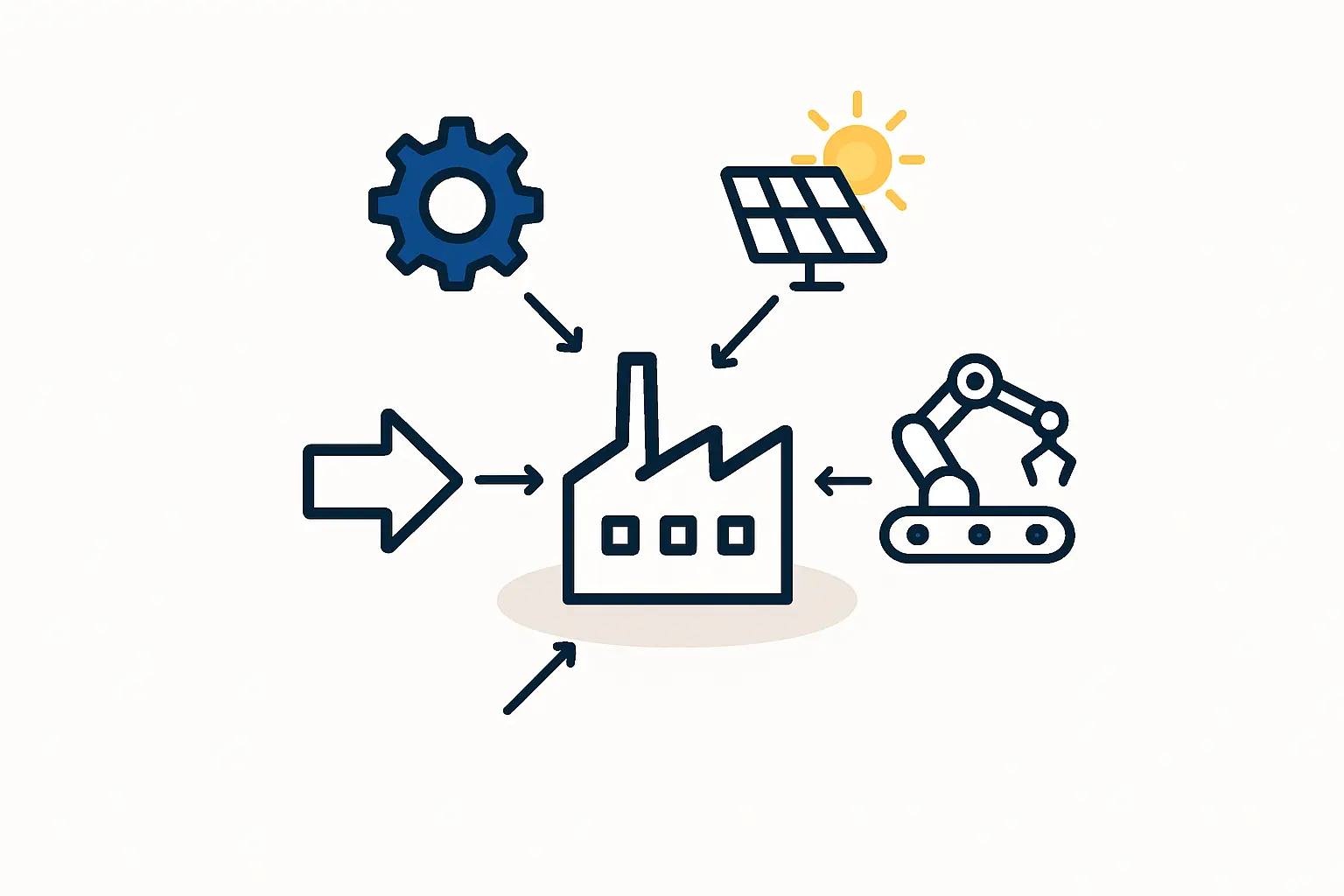

Furthermore, discussions within the EU about potential tariffs on imported solar modules could make local production increasingly cost-competitive. A Croatian facility would be insulated from such trade policies, providing a stable and predictable supply chain for regional customers.

Established Logistical Infrastructure

Croatia’s well-developed infrastructure, including the major Adriatic port of Rijeka, simplifies the import of essential raw materials like solar cells, glass, and aluminum frames. This logistical network reduces supply chain complexity and helps ensure consistent production timelines.

Deconstructing the 20-50 MW “Starter Factory” Model

For an entrepreneur new to the solar industry, a phased approach is often the most prudent strategy. Instead of committing to a large, high-capacity factory, starting with a 20–50 MW assembly line lowers the initial investment and reduces risk. It also provides the opportunity to scale operations as the market matures, making it a common path for those learning how to start a solar panel factory from the ground up.

What Does a 20-50 MW Line Entail?

A small-scale facility focuses on assembling solar modules rather than the capital-intensive manufacturing of solar cells, significantly lowering the barrier to entry. Drawing on experience from numerous J.v.G. turnkey projects, the requirements are well-defined:

-

Investment: The total investment needed to start a solar panel manufacturing plant of this scale typically ranges from €2 million to €5 million. This covers machinery, installation, training, and initial working capital.

-

Building Footprint: A suitable facility requires approximately 1,500 to 2,500 square meters of industrial space to accommodate the assembly line, warehousing for raw materials, and finished goods storage.

-

Labor Force: A semi-automated line of this capacity can be operated efficiently with a team of 25 to 40 employees, including technicians, operators, and administrative staff.

This “starter factory” model is a manageable first step, allowing a business to establish its brand, build relationships with regional distributors and installers, and refine its operational processes before committing to further expansion.

Analyzing the Market Opportunity: Filling the Regional Supply Gap

The primary business case for a Croatian assembly line rests on the substantial and growing demand for solar panels within the region.

Croatia’s Domestic Demand

Croatia aims to increase its solar capacity more than tenfold by 2030, a goal that underpins the domestic market opportunity. A 50 MW factory running at full capacity could supply approximately 3.5% of this projected annual growth. This scale positions a local producer to create an immediate market presence by offering reliability, technical support, and faster delivery than international competitors.

Supplying Neighboring Non-EU Markets

The opportunity extends well beyond Croatia’s borders. Neighboring countries in the Western Balkans are also rapidly developing their renewable energy sectors. A Croatian manufacturer can become a regional hub, exporting modules without the logistical complexities and long shipping times associated with sourcing from East Asia. This proximity is a powerful advantage for building a loyal customer base among the region’s engineering, procurement, and construction (EPC) companies.

Common Questions for Entrepreneurs Entering This Market

For professionals exploring this venture, several practical questions naturally arise.

-

Is a technical background necessary to start this type of business?

No, it is not a prerequisite. Many successful factory owners come from non-technical business backgrounds. The key is to partner with experienced engineering consultants and turnkey providers to manage the technical aspects. An entrepreneur’s focus should be on business strategy, finance, and market development. -

How long does it take to set up a 20-50 MW line?

With a structured project plan and experienced partners, a timeline of 9 to 12 months from the final investment decision to the first certified module coming off the line is realistic. -

What are the biggest risks?

The primary risks include securing a consistent supply chain for raw materials, achieving necessary product certifications (like IEC), and penetrating a market accustomed to established international brands. A detailed business plan is essential for mitigating these risks. -

Why not start with a larger, 200 MW factory?

A larger factory requires a significantly higher capital outlay and assumes a large, stable offtake agreement is already in place. The 20-50 MW model is a de-risked approach that allows a business to prove its model, build market share, and generate cash flow before undertaking a major expansion. -

How crucial is a detailed business plan?

It is absolutely fundamental. A comprehensive solar panel manufacturing business plan is the project’s roadmap, essential for securing financing and guiding critical decisions on machinery selection, facility layout, hiring, and go-to-market strategy.

The Path Forward: From Concept to Production

This analysis confirms that establishing a 20–50 MW solar module assembly line in Croatia is a viable and strategically sound venture. It leverages the country’s unique geographical position, taps into a clear and growing regional demand, and allows for a phased, lower-risk market entry.

For an entrepreneur, the journey from initial concept to a fully operational factory begins with diligent planning. The next steps involve a detailed market analysis, a robust financial model, and a thorough business plan. Structured resources, like the educational materials and courses provided by pvknowhow.com, can guide entrepreneurs through each stage of this complex but rewarding process.