Entrepreneurs exploring renewable energy will see significant potential in Eswatini’s growing commitment to solar power. Navigating the legal and administrative landscape of a foreign country, however, can seem formidable. Questions about where to start, which authorities to contact, and what documentation is required often create barriers to entry.

This guide breaks down the registration and licensing process for a foreign-owned solar manufacturing business in Eswatini. A key governmental body oversees the process, making it more accessible than many investors might assume. Understanding these procedures helps entrepreneurs confidently lay the legal groundwork for their new venture.

Understanding the Regulatory Framework: The Role of EIPA

The first and most important point of contact for any foreign investor is the Eswatini Investment Promotion Authority (EIPA). EIPA functions as a ‘one-stop shop’ designed to streamline the investment process. Its mandate is to guide investors through every necessary procedure, from initial inquiries to full operational licensing.

Working with EIPA from the outset provides a central channel for communication and coordination with various government ministries. This support significantly reduces the complexity of establishing a business, allowing investors to focus on their core operational planning.

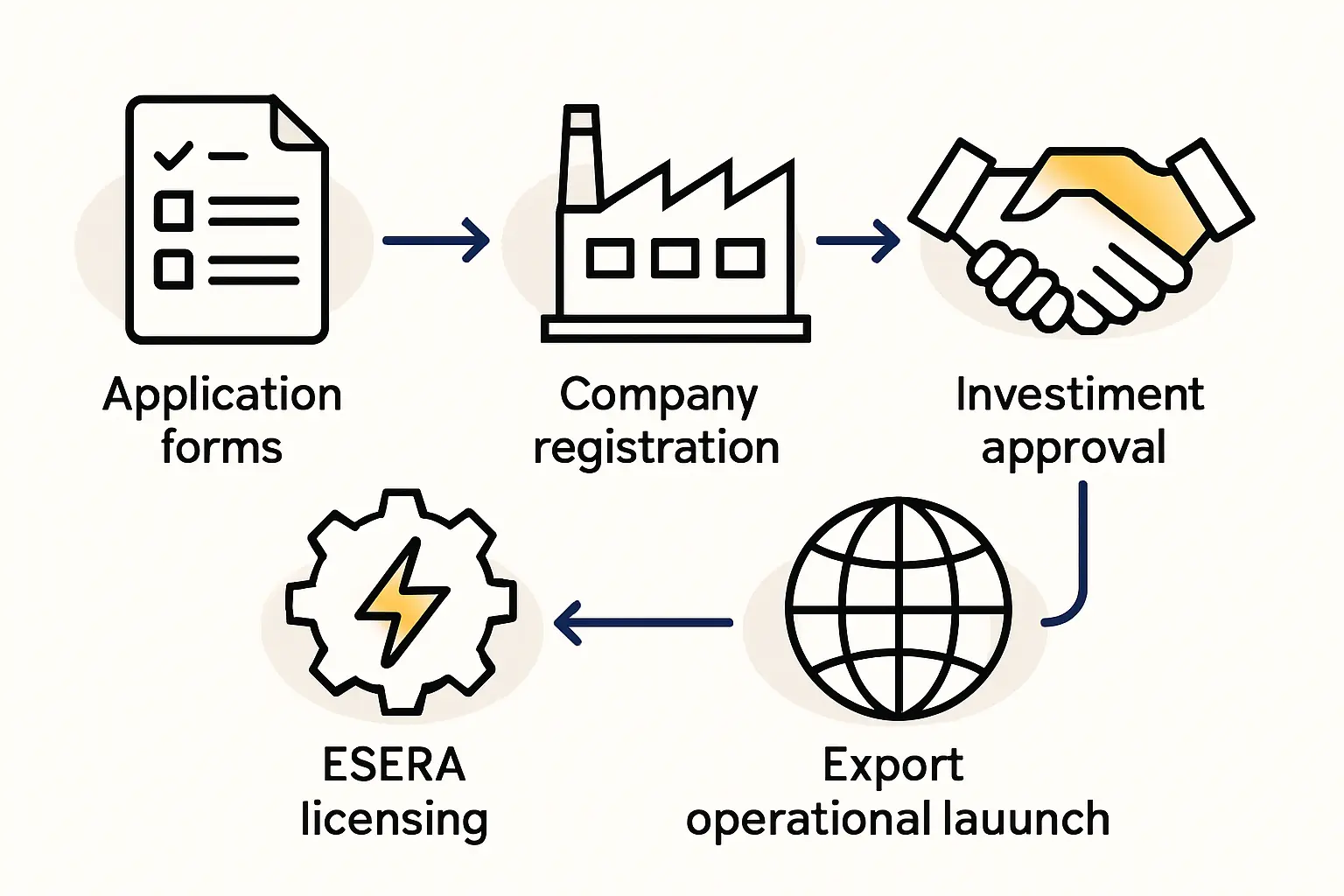

The Core Registration Process: A Step-by-Step Breakdown

Establishing a legal entity for a solar factory involves a series of official registrations. While EIPA provides guidance, understanding the individual steps is crucial for effective project management.

Step 1: Company Name Reservation and Registration

The first legal step is to register the company with the office of the Registrar of Companies.

-

Name Reservation: Before full registration, the proposed company name must be submitted for approval to ensure it is unique and compliant with local regulations.

-

Company Incorporation: Once the name is approved, the investor must submit a complete application for incorporation. This typically requires the following documents:

- Memorandum and Articles of Association, which outline the company’s purpose, structure, and operational rules.

- Form C: Statement of Nominal Capital.

- A notice of the company’s registered physical address in Eswatini.

- A list of company directors, along with their consent to serve.

Upon successful review, the Registrar of Companies issues a Certificate of Incorporation, which formally establishes the company as a legal entity.

Step 2: Securing a Trading License

Once the company is legally incorporated, the next critical step is to obtain a Trading License from the Ministry of Commerce, Industry and Trade. This license authorizes the company to conduct its specific business activities—in this case, solar module manufacturing.

The application for a Trading License requires the Certificate of Incorporation and a detailed business plan. Crucially, the license is tied to a specific physical location. This means that before it can be granted, the proposed factory premises must pass inspections by several authorities:

- The Health Inspectorate (Ministry of Health)

- The Fire and Emergency Services

- The relevant City Council or Municipal Authority

EIPA often helps coordinate these inspections to ensure an efficient process. This requirement underscores the importance of identifying and securing a suitable building early on. For further guidance on this topic, a detailed analysis of how to find and prepare a suitable factory building for solar module production is available.

Essential Post-Registration Compliance

Once the company is registered and holds a trading license, several additional steps are necessary to become fully operational and compliant with Eswatini law.

Tax Registration with the ERS

All new businesses must register with the Eswatini Revenue Service (ERS). This is a fundamental requirement for operating legally, not an optional step. The primary registrations include:

- Corporate Income Tax: For the company’s profits.

- Value Added Tax (VAT): If the company’s projected turnover exceeds the threshold.

- Pay As You Earn (PAYE): An income tax withholding system for all employees.

Employee and Social Security Registration

Companies are legally required to register their employees with the Eswatini National Provident Fund (ENPF). This is the national social security scheme, to which both employers and employees must contribute.

Work Permits for Expatriate Staff

For a foreign-owned enterprise, bringing in key technical or managerial staff from abroad is often necessary. Each expatriate employee must have a valid work permit, issued by the Ministry of Home Affairs.

The application requires a justification for hiring a non-resident, proving that the individual possesses skills not readily available in the local workforce. Experience from J.v.G. Technology GmbH turnkey projects suggests identifying these key positions early and beginning the application process well in advance to prevent project delays.

Key Considerations for a Solar Manufacturing Plant

While the above steps apply to most businesses, a manufacturing plant has specific requirements. The business plan submitted to EIPA and the Ministry of Commerce should be robust and detailed, covering not just financial projections but also technical aspects.

The plan should include an overview of the planned production capacity, the types of solar modules to be manufactured, and the key machinery involved. A well-structured business plan demonstrates project viability and a clear understanding of the industry, which can expedite approvals. Platforms like pvknowhow.com offer structured resources, including e-courses, to help entrepreneurs develop the kind of comprehensive business plan that investment authorities require.

Frequently Asked Questions (FAQ)

-

How long does the entire registration process typically take?

While EIPA works to fast-track applications, the full process—from company registration to obtaining all licenses and permits—can take several weeks to a few months. The final timeline depends heavily on the completeness and accuracy of the submitted documents. -

Is a local partner required for a foreign investor in Eswatini?

No, Eswatini law permits 100% foreign ownership of a business, so a local partner is not legally required. -

What is the minimum investment capital required?

There is no official minimum investment amount. However, investors must demonstrate to EIPA that they have sufficient capital to fund their proposed business plan. Proof of funding is a standard part of the due diligence process. -

Can EIPA assist with finding a suitable location for the factory?

Yes, EIPA can assist in identifying available industrial land or factory buildings that meet an investor’s requirements. They serve as a primary resource for site selection.

Next Steps in Your Planning

Successfully navigating the registration process lays the legal foundation for your solar manufacturing enterprise. It is the first major milestone in turning a business concept into an operational reality.

With the legal entity in place, the next phase focuses on financial and operational planning. A comprehensive understanding of capital expenditure is essential. For a detailed breakdown of costs, from machinery to facility setup, explore the guide on investment requirements for starting a 20–50 MW solar factory.