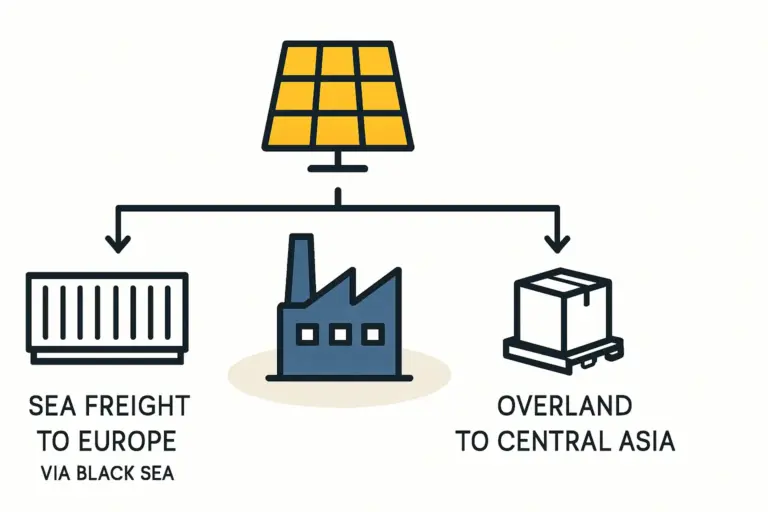

An investor identifies a promising location for a new solar module factory in one of Georgia’s Free Industrial Zones. The site offers attractive tax incentives, a capable workforce, and excellent logistics for exporting to Europe and Central Asia. The business plan is solid, the financial projections are positive, and market demand is clear.

Yet a critical factor is often assessed too late in the process: the stability and cost of the electricity supply—the lifeblood of a 24/7 manufacturing facility.

For any energy-intensive industry like solar panel manufacturing, simply assuming the electrical grid can meet operational demands is a costly oversight. This article examines the realities of Georgia’s electricity infrastructure, offering a crucial layer of due diligence for any entrepreneur considering the country for an industrial venture. Understanding the nuances of the Georgian grid is not just a technical detail; it is a fundamental component of risk management and strategic planning.

The Structure of Georgia’s Electrical Grid

Evaluating the opportunities and challenges begins with understanding Georgia’s power system. The national grid is managed by the Georgian State Electrosystem (GSE), which oversees the transmission network and dispatch. Unlike in many highly regulated markets, Georgia’s electricity market for industrial consumers is largely deregulated.

Instead of paying a standardized tariff, large users negotiate bilateral contracts directly with power generation companies or suppliers. This structure offers a significant advantage, allowing for competitive pricing based on consumption volume and contract length. However, it also places the responsibility of securing a stable and fairly priced supply directly on the investor.

A key characteristic of Georgia’s energy profile is its status as a net electricity importer, particularly during the colder winter months when heating demand rises and hydropower output decreases. The country supplements its domestic generation with imports from Russia, Azerbaijan, and Turkey, creating a dependency on regional energy markets and geopolitical stability.

Analyzing Power Generation and Potential Risks

The backbone of Georgia’s domestic electricity production is the Enguri Hydropower Plant (HPP). While it is a formidable source of clean energy, its location presents a unique geopolitical risk. The dam is located in the disputed territory of Abkhazia, though it is operated by the Georgian state. This arrangement has remained stable, but it represents a non-commercial risk factor that any serious assessment must consider.

Reliability and Seasonal Fluctuations

While the Georgian grid is generally stable for commercial and residential use, industrial operations have far more stringent requirements. A modern solar module factory relies on an uninterrupted power supply. Even minor fluctuations can disrupt sensitive machinery like laminators and cell stringers, leading to production losses and material waste.

Large-scale blackouts, like the one in 2021, are a stark reminder of the grid’s vulnerability. These events are infrequent but can halt production for hours or even days. The primary cause of grid instability is often linked to the combination of high winter demand, reliance on imports, and the seasonal variability of hydropower, the country’s main domestic energy source. Investors must plan for this contingency as part of their initial factory setup and operational strategy.

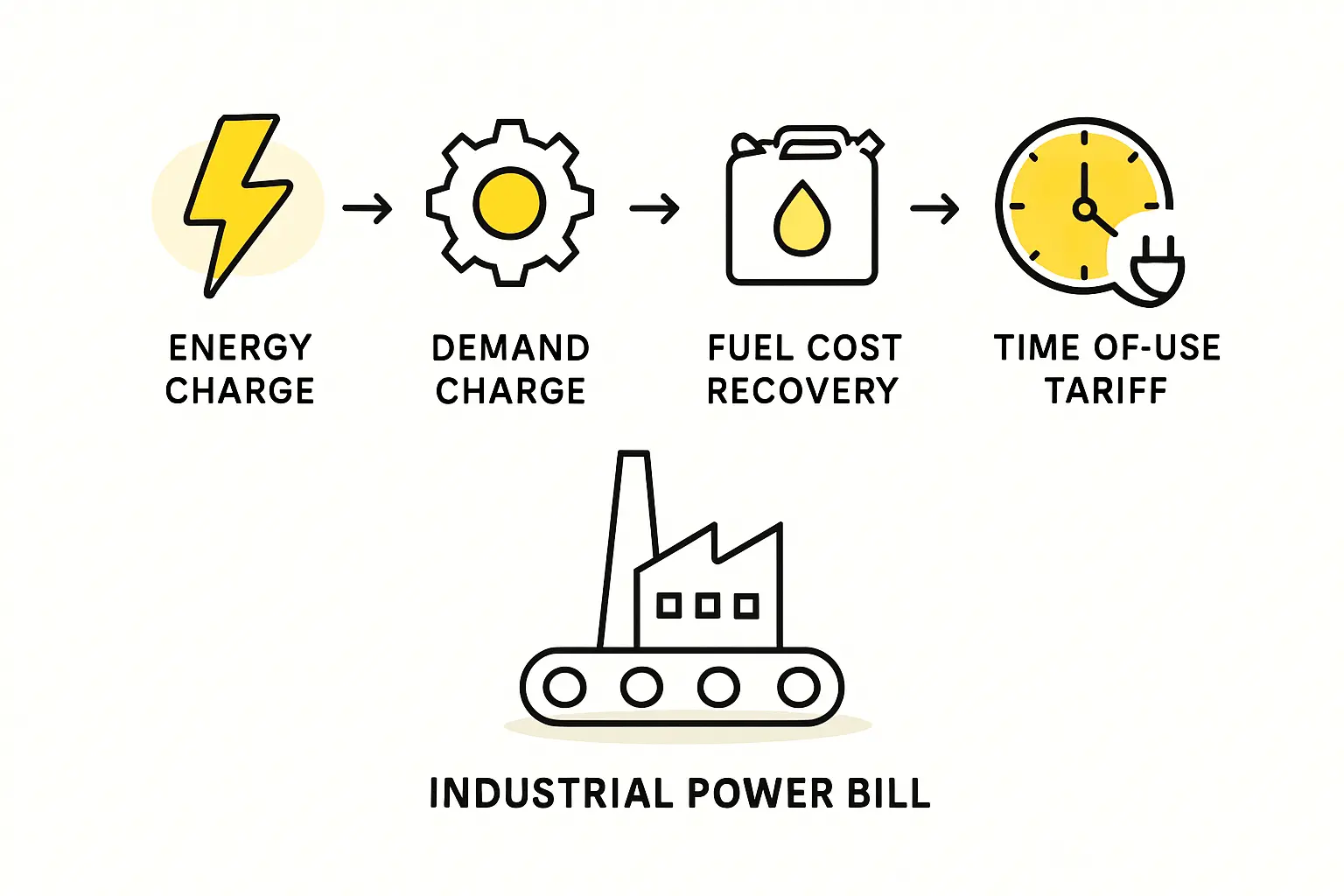

Industrial Power Costs and Free Industrial Zones (FIZs)

The deregulated market structure allows industrial users to secure electricity at competitive rates, typically ranging from US$0.06 to US$0.08 per kilowatt-hour (kWh). This is significantly lower than in many European countries and represents a major competitive advantage for energy-intensive manufacturing.

Georgia has established Free Industrial Zones in cities like Poti and Kutaisi to attract foreign investment with tax exemptions and streamlined business registration. While these benefits are compelling, the infrastructure within these zones may not always be as robust as in established industrial areas. Due diligence must include a thorough technical audit of the local substation’s capacity and the reliability of the last-mile connection to the proposed factory site. An attractive tax incentive is quickly negated if the power supply is insufficient or unstable.

A Framework for Electrical Due Diligence

For any business professional planning a manufacturing operation in Georgia, a systematic approach to evaluating the electricity supply is essential. Based on experience from J.v.G. turnkey projects, the following steps are recommended:

-

Site-Specific Grid Assessment: Do not rely on national averages. Engage with GSE and local distribution companies to assess the specific connection point for your chosen location. This includes verifying available capacity, historical reliability data for that specific feeder line, and any planned upgrades.

-

Negotiate a Long-Term Power Purchase Agreement (PPA): A bilateral contract is an opportunity to secure price stability. The terms should include clear provisions on supply guarantees, tariffs for different times of day, and penalties for non-delivery. This is a critical step in controlling your solar factory investment costs.

-

Plan for Backup Power: Given the potential for grid instability, incorporating a backup power strategy is not an option but a necessity. This could range from diesel generators for critical systems to a more sophisticated uninterruptible power supply (UPS) or even a small-scale, on-site solar plant with battery storage. This initial investment protects against far greater losses from production downtime.

-

Understand the Connection Process: The administrative process for securing a high-voltage connection for a new industrial facility can be bureaucratic and time-consuming. Factoring these timelines into the overall project plan is critical to avoid delays in commissioning the factory.

Frequently Asked Questions (FAQ)

What does a ‘deregulated’ electricity market mean for a factory owner?

A deregulated market means the government does not set a single, fixed price for electricity. Instead, buyers (like a factory) and sellers (power plants) can negotiate prices and terms directly. This creates competition and can lead to lower costs for large consumers with strong negotiating power.

How does the seasonality of hydropower affect supply and cost?

Hydropower output is highest in the spring and summer when snowmelt and rainfall are abundant. In the winter, river flows decrease, reducing generation. This seasonality means Georgia often has a surplus of cheap electricity in the summer but must import more expensive power in the winter. A well-negotiated PPA can help smooth out these price fluctuations over the year.

Are there hidden costs associated with connecting a new factory to the grid?

Yes, potential costs can include paying for the construction or upgrade of a local substation, the physical transmission line to the factory site, and various administrative and permitting fees. These costs are typically the responsibility of the investor and must be budgeted for within the initial capital expenditure for setting up a solar factory.

Can a new factory build its own solar plant for self-consumption in Georgia?

Yes, Georgia’s regulations support self-generation, and this is an increasingly viable strategy. A rooftop or ground-mounted solar PV system can offset a significant portion of a factory’s electricity consumption, hedge against rising grid prices, and improve the facility’s carbon footprint. It can also be paired with battery storage to provide a degree of backup power.

Conclusion: Balancing Opportunity with Preparation

Georgia presents a compelling case for entrepreneurs looking to establish a solar module manufacturing presence. Its strategic location, favorable business environment, and competitively priced electricity are significant advantages. However, these opportunities are balanced by tangible risks related to grid stability, import dependency, and bureaucratic processes.

A successful venture is built not on overlooking these challenges, but on understanding and preparing for them. Thorough and professional due diligence of the electrical infrastructure is a non-negotiable step in the planning process. By transforming this potential weakness into a well-managed part of the business plan, an investor can harness Georgia’s full potential and build a resilient and profitable manufacturing operation.