An entrepreneur looking at Haiti sees a paradox. On one hand, the country faces profound challenges: political instability, economic hardship, and vulnerability to natural disasters. On the other, these same challenges create one of the most compelling market opportunities in the Western Hemisphere for decentralized energy.

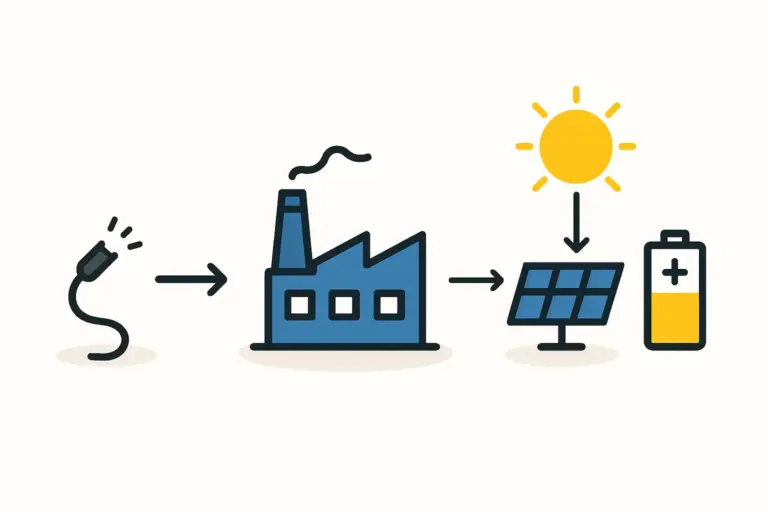

With an unreliable national grid that reaches less than half the population, the demand for independent power solutions is not just a commercial interest—it is a fundamental need. Such an environment requires more than a standard business plan; it demands a sophisticated risk mitigation framework. For any serious investor, understanding and addressing these risks is the first step toward building a successful and impactful solar module manufacturing enterprise. This article outlines a structured framework for navigating the complexities of the Haitian market, one that transforms potential obstacles into manageable operational variables.

Understanding the Haitian Context: A Duality of Risk and Opportunity

Before deploying capital, investors must clearly understand the operating landscape. Haiti’s business environment is defined by key factors that are simultaneously risks and the very sources of market demand.

-

The Energy Deficit as a Market Driver: The severe energy crisis is the primary driver for a solar manufacturing venture. With only 45% of the population having access to electricity and a notoriously unreliable national grid, businesses, hospitals, schools, and households are in urgent need of stable power. Solar PV provides a direct, cost-effective solution. This deficit ensures long-term, sustainable demand for locally produced modules.

-

Economic Vulnerabilities: High unemployment (estimated above 40%) and widespread poverty mean that standard retail models may prove less effective. However, a local manufacturing facility creates skilled jobs and can partner with international NGOs and development banks that are heavily invested in the country. Projects backed by these organizations often have secure financing.

-

Political and Institutional Fragility: Chronic political instability and weak governance are significant concerns for any investor. This reality demands a strategy that insulates the operation as much as possible from political turbulence by focusing on strong local partnerships and clear, enforceable legal agreements.

Success in Haiti depends not on ignoring these realities, but on designing the venture with them in mind from the outset. Any comprehensive solar module manufacturing business plan must include a dedicated chapter on risk management specific to the Haitian context.

A Structured Framework for Risk Mitigation

A proactive risk management approach identifies potential threats and lays out specific strategies to neutralize or minimize their impact. The framework can be broken down into four critical areas.

1. Political and Institutional Risks

Political instability can disrupt supply chains, affect legal agreements, and create security challenges.

Mitigation Strategies:

-

Forge Strong Local Partnerships: Partnering with a reputable, well-established local business or institution can provide invaluable operational support and insight. A local partner can help navigate bureaucracy, understand cultural nuances, and maintain business continuity during periods of civil unrest.

-

Secure Political Risk Insurance (PRI): Work with development finance institutions (DFIs) or multilateral agencies that offer PRI. This can protect the investment against risks such as expropriation, political violence, and currency inconvertibility.

-

Phased Investment and Clear Milestones: Structure the investment in phases linked to clear, achievable milestones. This approach limits initial capital exposure and allows for adjustments as the political situation evolves. A full turnkey solar manufacturing line can be implemented in stages, starting with a smaller capacity and expanding as the market proves stable.

2. Economic and Financial Risks

Currency volatility and limited consumer purchasing power are primary financial concerns.

Mitigation Strategies:

-

USD-Denominated Contracts: Whenever possible, structure contracts with commercial clients, NGOs, and international organizations in U.S. Dollars. This protects revenue streams from the volatility of the Haitian Gourde.

-

Focus on B2B and Institutional Clients: Target businesses, hospitals, schools, and agricultural operations that rely on expensive diesel generators. For these clients, solar offers a clear and rapid return on investment, making them stable, bankable customers.

-

Explore Microfinance and PAYGO Models: For the residential market, partner with microfinance institutions or implement Pay-As-You-Go (PAYGO) systems. This removes the barrier of high upfront costs for households and aligns payments with their income patterns.

3. Operational and Logistical Risks

A successful factory depends on a skilled workforce, reliable infrastructure, and a secure supply chain—all of which present significant challenges in Haiti.

Mitigation Strategies:

-

Invest Heavily in Workforce Training: The shortage of skilled technical workers is a major obstacle. The business plan must include a comprehensive training program, potentially developed with a technical partner. This investment not only ensures quality but also builds strong community loyalty and goodwill.

-

Strategic Site Selection: Physical site selection must prioritize security and logistics. Choose a location within a secure industrial park or a zone with reliable private security. While proximity to the port in Port-au-Prince is important, it’s worth considering a location with easier access and less congestion to avoid logistical bottlenecks.

-

Build Supply Chain Redundancy: Relying on a single source for raw materials or a single shipping route is risky. Establish relationships with multiple suppliers and logistics providers. Maintain a larger-than-usual inventory of critical components on-site to buffer against shipping delays caused by port congestion or civil unrest.

4. Natural Disaster and Environmental Risks

Haiti’s location in the Caribbean makes it highly susceptible to hurricanes and earthquakes.

Mitigation Strategies:

-

Adherence to Strict Building Codes: Construct the factory to withstand seismic activity and hurricane-force winds. This higher upfront construction cost is a critical form of insurance against catastrophic loss.

-

Comprehensive Insurance Coverage: Secure comprehensive insurance policies that specifically cover natural disasters prevalent in the region. This is non-negotiable for protecting the asset base.

-

Decentralized Product Application: The product itself helps mitigate risk for the country. By manufacturing modules for decentralized solar installations, the business helps build a more resilient national energy infrastructure that is less vulnerable to centralized grid failure during a natural disaster.

Frequently Asked Questions (FAQ)

Q1: Is Haiti a genuinely viable market for a solar manufacturing facility given the risks?

A: Yes, with a robust strategy. The immense, unmet demand for reliable electricity creates a powerful, long-term market. The key is not to underestimate the risks but to address them systematically within the business plan. The high operating costs of diesel generators make solar a financially compelling alternative for a large segment of the commercial market.

Q2: What is the single biggest operational challenge for a new factory?

A: Beyond security, the most significant challenge is developing a skilled technical workforce. A new venture cannot assume a plug-and-play labor pool exists. A foundational part of the investment must be a dedicated, in-house training academy to build skills from the ground up, ensuring operational excellence and quality control.

Q3: How can a foreign investor build trust in the local community?

A: Trust is built through tangible commitments. Prioritizing local hiring, investing in comprehensive employee training and development, and partnering with local businesses for services and supplies are essential. Operating with transparency and demonstrating a long-term commitment to the community—rather than a purely extractive approach—is critical for sustainable success.

Q4: What is a realistic initial investment for a small to medium-sized plant?

A: The cost of a solar panel factory varies based on capacity and automation levels. For an entry-level, semi-automated line with an annual capacity of 20-50 MW, investors should anticipate an initial capital expenditure for machinery, training, and setup in the range of several million U.S. Dollars. This figure does not include the cost of the building and land.

Conclusion: Transforming Calculated Risk into Strategic Advantage

Investing in solar module manufacturing in Haiti is not an endeavor for the risk-averse. It is an opportunity for the strategic investor who can see past the headlines to the fundamental market need. The country’s challenges are significant, but they are not insurmountable.

By implementing a structured risk mitigation framework that addresses political, economic, operational, and environmental factors, an investor can build a resilient and profitable enterprise. Success in Haiti hinges on thorough planning, strong local partnerships, and a long-term commitment. With the right approach, a solar manufacturing facility can do more than generate returns; it can become a cornerstone of the country’s economic and energy future.