Iraq, a nation historically defined by its vast oil reserves, is emerging as a serious contender in the renewable energy sector. With some of the world’s highest solar irradiation levels and vast tracts of available land, its potential for solar power generation is immense.

For international entrepreneurs and investors, this presents a significant opportunity. However, entering any new market, especially one with a complex history, requires a clear grasp of the legal framework.

The cornerstone of Iraq’s effort to attract foreign capital is its National Investment Law No. 13 of 2006. This legislation is more than a document—it’s a clear signal of the government’s intent to diversify the economy and build a sustainable energy future.

For any professional considering a solar module factory, this law provides the essential framework for investment, offering protections and incentives designed to mitigate risk and encourage long-term commitment. This guide breaks down the law’s key provisions and the practical considerations for leveraging it successfully.

Why Consider Iraq for Solar Module Manufacturing?

The Iraqi government has set an ambitious target of generating 7.5 GW of power from renewable sources by 2030. This strategic pivot away from oil dependency is driven by both economic and environmental necessity.

Establishing local solar module manufacturing is a critical part of this vision, aimed at creating jobs, increasing energy independence, and building a domestic industrial base. For investors, this top-level commitment translates into a favorable environment. The government actively seeks foreign expertise and technology to help achieve these national goals, making the solar manufacturing sector a strategic priority.

Understanding Iraq’s National Investment Law No. 13 (2006)

Enacted to create a stable and predictable environment, Law No. 13 is the primary legal framework governing foreign investment in Iraq. Its fundamental principle is non-discrimination, meaning foreign investors are granted the same rights and privileges as their Iraqi counterparts. This ensures a level playing field and is a critical confidence-builder for anyone bringing capital and technology into the country.

The law also established the National Investment Commission (NIC) and Provincial Investment Commissions (PICs) to oversee and facilitate investment projects. These commissions act as the primary interface between the investor and the state.

Key Benefits for Foreign Solar Investors

The legislation offers several powerful incentives designed to attract the kind of long-term industrial projects vital for the solar sector. Understanding these benefits is the first step in assessing a project’s financial viability. A comprehensive solar factory setup plan must incorporate these legal advantages from the outset.

Tax and Customs Exemptions

One of the most significant financial incentives is a comprehensive tax holiday. Investment projects licensed by the NIC are exempt from all taxes and fees for ten years from the start of commercial operation. This period can be extended to fifteen years if the project is a joint venture with a majority Iraqi stake.

Imported assets required for the project—such as manufacturing machinery and production materials—are also exempt from customs duties. This substantially reduces initial capital expenditure and improves the project’s return on investment.

Land Allocation and Ownership

The law also addresses one of the most practical challenges in establishing a factory: securing land. It allows investors to lease land for the term of the investment project, up to 50 years, with the possibility of renewal. This provides the long-term security needed for industrial development. The NIC and PICs are responsible for facilitating land allocation for licensed projects.

Repatriation of Capital and Profits

A primary concern for any foreign investor is the ability to move capital freely. The Investment Law explicitly guarantees the right of foreign investors to repatriate their capital and the profits generated from their projects, including the salaries and wages of non-Iraqi employees. This provision ensures that returns can be transferred out of the country in a convertible currency without undue restriction—a standard feature of a secure investment climate.

Guarantees Against Nationalization

To further bolster investor confidence, the law provides explicit protection against the nationalization or expropriation of an investment project. Any such action is permitted only for a public purpose and must be accompanied by fair and immediate compensation. This guarantee is fundamental to protecting an investor’s assets over the long term.

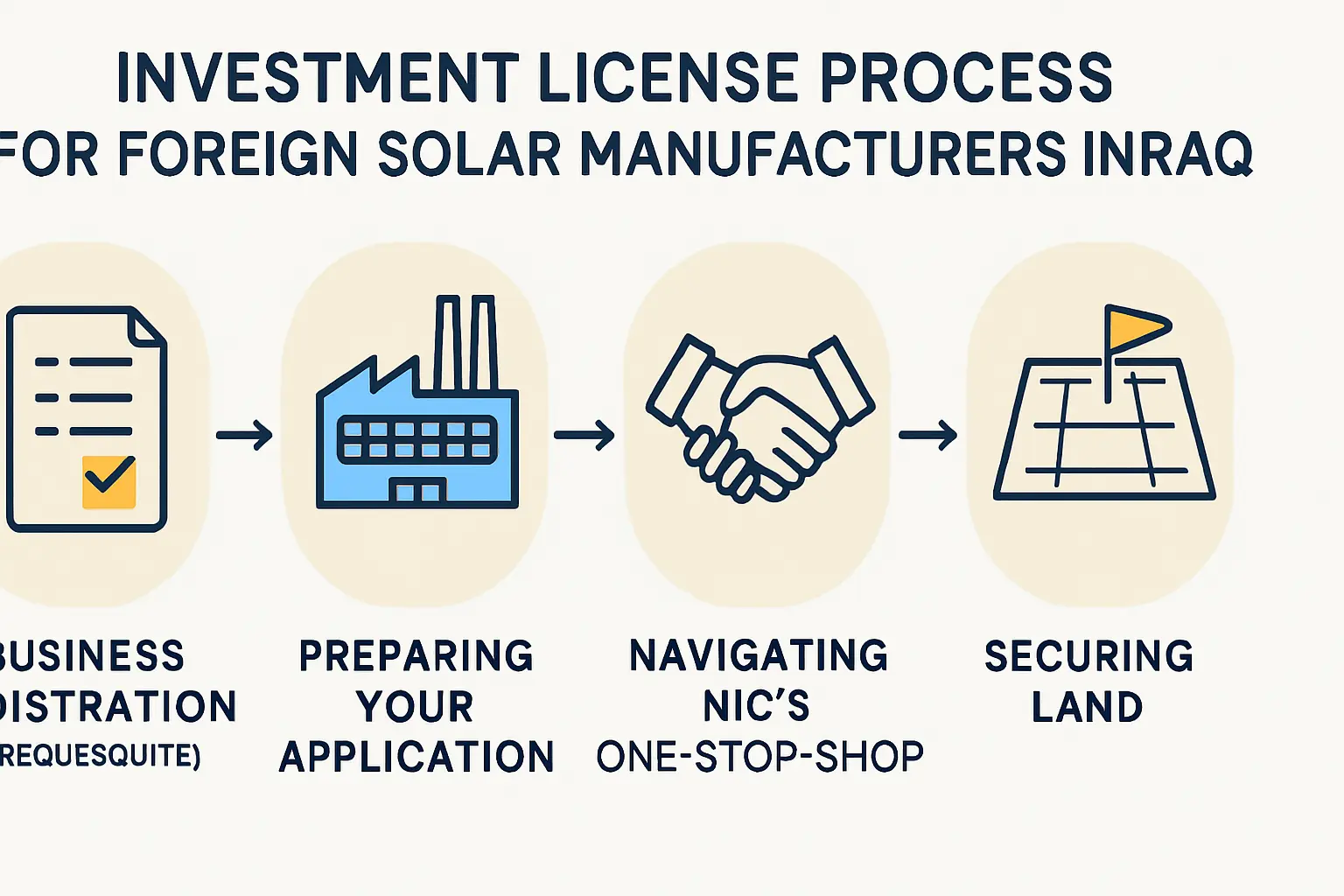

The Practical Steps: Engaging with Investment Commissions

The gateway to accessing these benefits is through the National Investment Commission (NIC) in Baghdad or the Provincial Investment Commissions (PICs) in the provinces. These bodies are tasked with:

- Receiving and evaluating investment applications.

- Issuing investment licenses.

- Allocating land for projects.

- Assisting investors in obtaining necessary approvals from other government ministries.

The process typically involves submitting a detailed project proposal that outlines the technical scope, financial projections, and expected economic impact, such as job creation. Experience with turnkey projects in emerging markets shows that a well-defined business plan is critical for navigating this stage successfully.

Navigating Potential Challenges

While the Investment Law provides a robust framework, prospective investors must be aware of practical challenges. A realistic approach, backed by thorough due diligence, is essential.

Bureaucratic Delays

As in many developing economies, administrative processes can be slow. Securing all necessary permits and approvals may require persistence and patience. This is where a clear understanding of the investment costs becomes crucial, as timelines can affect budget projections.

The Importance of Local Partners

Engaging a reliable local partner is not just a recommendation; it is often a strategic necessity. A partner with a strong reputation and an established network can provide invaluable assistance in navigating bureaucracy, understanding local business culture, and managing on-the-ground logistics.

Security and Regional Stability

The security situation in Iraq has improved significantly but can vary by region. Investors must conduct a thorough risk assessment for their chosen location and implement appropriate security measures. Working with established local entities can help mitigate these risks.

Frequently Asked Questions (FAQ)

-

Is my investment safe from government seizure in Iraq?

Yes. Article 12 of National Investment Law No. 13 explicitly guarantees that investment projects will not be nationalized or expropriated, except in cases of public benefit and with fair compensation. -

Can I transfer my profits out of the country?

Yes. The law guarantees foreign investors the right to repatriate their capital and profits from the investment project in a convertible currency. -

Do I need an Iraqi partner to invest?

While the law permits 100% foreign ownership of projects, having a strong and trustworthy Iraqi partner is highly advisable for practical reasons. They can help navigate local regulations, business practices, and administrative hurdles. -

How long does the tax exemption last for a solar manufacturing project?

The standard exemption from taxes and fees is ten years. This can be extended to fifteen years if the project has a significant Iraqi shareholding.

A Strategic Path Forward

Iraq’s National Investment Law No. 13 (2006) offers a compelling set of incentives for entrepreneurs looking to establish solar module manufacturing facilities. The combination of tax holidays, customs exemptions, and investment protections creates a strong foundation for a profitable venture.

Success, however, depends on more than the legal framework. It requires meticulous planning, comprehensive due diligence, and a deep understanding of the local context. For investors without prior experience in the photovoltaic industry, a turnkey solution can provide the necessary technical expertise and project management support to bridge the gap. By combining the powerful incentives of Iraqi law with proven technical and operational know-how, investors can position themselves to capitalize on one of the most promising emerging solar markets in the world.