An entrepreneur on a factory floor in Kingston looks out at the intense Caribbean sun and considers a fundamental question: With some of the highest electricity costs in the region and a national commitment to renewable energy, why are nearly all of Jamaica’s solar panels imported? The opportunity seems immense, but that raises an even more challenging question: How does one finance a multi-million-dollar solar module factory from the ground up?

This is a common challenge for innovators and business leaders across the Caribbean. While the vision is clear, the path to securing capital is often opaque. This article outlines the financing landscape for solar manufacturing in Jamaica—exploring the roles of development banks, private equity firms, and international climate finance institutions—to help entrepreneurs and investors navigate this complex environment.

The Strategic Case for Solar Manufacturing in Jamaica

Before approaching any potential financier, understanding the compelling national and regional arguments for local solar production is crucial. A strong proposal is built on more than financial projections; it must align with broader economic and policy goals.

Jamaica’s National Energy Policy and Vision 2030 framework explicitly target a significant increase in renewable energy generation, aiming for 50% by 2030. This government-level commitment creates stable, long-term demand for solar panels and signals to investors that the sector has official backing.

Local manufacturing can also:

- Reduce reliance on imports: This strengthens the national economy and insulates it from global supply chain volatility and currency fluctuations.

- Create skilled jobs: A modern manufacturing facility requires engineers, technicians, and operations managers, contributing to local workforce development.

- Generate export revenue: A Jamaican factory can serve as a hub for the wider CARICOM market, which shares similar energy challenges and goals.

Framing a project within this strategic context transforms it from a simple business venture into a contribution to national development—a perspective that resonates strongly with development banks and institutional investors.

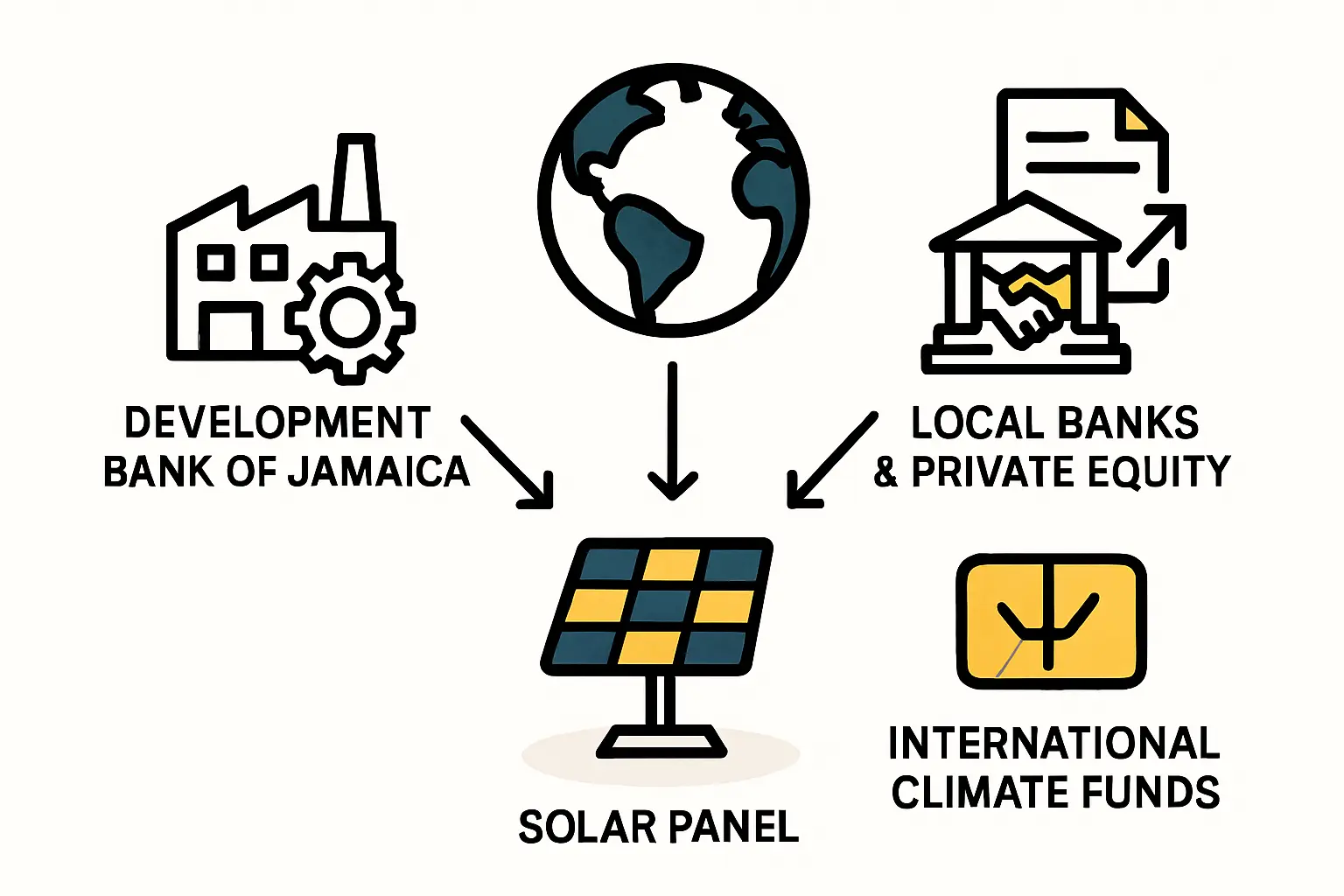

Navigating Public Sector Financing: The Development Bank of Jamaica (DBJ)

For many industrial projects in Jamaica, the Development Bank of Jamaica (DBJ) plays a critical role in the financing strategy. While not always a direct lender for large-scale industrial setups, the DBJ acts as a vital catalyst, particularly for the small and medium-sized enterprises (SMEs) that form the backbone of the economy.

Key DBJ Programs and Mechanisms

Understanding the DBJ’s mandate is the first step. Its focus is on fostering economic growth by making it easier for viable businesses to access capital through commercial lenders. One of its most powerful tools is the Partial Credit Guarantee.

Instead of providing the full loan amount, the DBJ can guarantee a significant portion of a loan (often up to 80%) made by a commercial bank. This de-risks the project for the bank, making it far more likely to approve financing for a new manufacturing venture that may lack a long operational history. This mechanism is central to the National Five-Year MSME & Entrepreneurship Policy.

Programs like ‘Boosting Innovation, Growth and Entrepreneurship Ecosystems’ (BIGEE) also support innovative projects that align with national development priorities—a category that clearly includes solar manufacturing.

Preparing a Proposal for DBJ-backed Financing

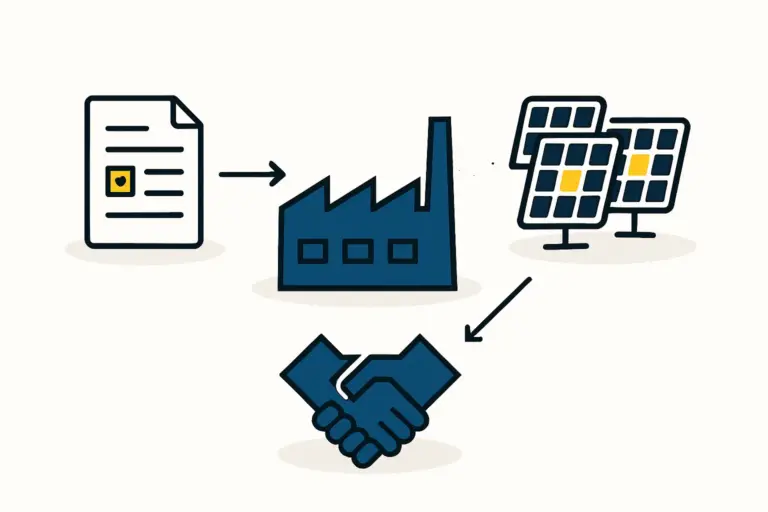

To access DBJ support, whether directly or via a guarantee, a project must be exceptionally well-documented. Lenders will scrutinize the venture’s viability, management team, and market potential.

The foundational document is a comprehensive business plan that must go beyond simple numbers to clearly articulate the project’s technical feasibility, operational strategy, and projected economic impact, such as job creation and foreign exchange savings.

Tapping into Private Capital: Equity and Venture Funds

While development banks help de-risk debt financing, private equity (PE) offers another avenue: direct investment in exchange for an ownership stake. Jamaica has a mature private capital market with several prominent firms actively seeking investment opportunities.

Major Players in the Jamaican Market

Firms like Sygnus Capital, Proven Investments, and Mayberry Investments are established players in the Caribbean private equity landscape. Unlike a bank that simply lends money, a PE firm becomes a partner in the business, providing capital and strategic oversight to grow the company’s value over time.

What Private Equity Investors Look For

Private equity investors are highly selective. They typically look for businesses that are already generating revenue and have a proven management team. However, a ‘greenfield’ project like a new solar factory can attract interest if the proposal is compelling.

Key criteria include:

- A Clear Path to Profitability: Detailed financial models showing a strong and realistic return on investment.

- A Scalable Model: The ability to grow production and expand into new markets (e.g., CARICOM).

- Technical & Managerial Expertise: The founding team must demonstrate deep industry knowledge or have credible technical partners, assuring investors of their capacity to manage the setup and operation of a complex turnkey production line.

- Significant Founder Investment: PE firms expect founders to have significant personal capital invested, demonstrating their commitment and shared risk.

Securing International Climate Finance

For larger, more ambitious projects, international climate finance institutions represent a third pillar of potential funding. These multilateral banks and funds are mandated to finance projects that contribute to climate change mitigation and adaptation in developing regions.

Key Institutions for the Caribbean

The primary institutions active in the region include:

- Green Climate Fund (GCF): The world’s largest dedicated climate fund, supporting transformative projects.

- Caribbean Development Bank (CDB): A regional financial institution with a strong focus on sustainable energy and climate resilience.

- Inter-American Development Bank (IDB): A major source of development financing for Latin America and the Caribbean.

Understanding Their Mandate and Requirements

Accessing this type of capital is a complex, long-term process. These institutions finance large-scale projects, often through public-private partnerships, and require exhaustive due diligence. A proposal must demonstrate significant, measurable environmental benefits, such as greenhouse gas emissions reduction. While challenging to secure, this funding can enable projects of a scale that would be difficult to finance through local sources alone.

Structuring a Realistic Financing Strategy

A single source is unlikely to provide 100% of the capital for a new solar manufacturing plant. A more realistic approach involves ‘capital stacking’—layering different types of financing. Before approaching any source, a founder must have a precise understanding of the project’s total investment requirements, from building works and machinery to operational working capital.

A typical structure might look like this:

- Founder Equity (20-30%): The entrepreneur and initial partners provide seed capital for feasibility studies, business planning, and initial deposits.

- Commercial Bank Loan (40-60%): A senior debt facility from a local commercial bank, critically supported by a DBJ partial credit guarantee.

- Equity Investment (10-30%): A private equity firm or a group of private investors provide capital for growth in exchange for a minority stake.

Frequently Asked Questions (FAQ)

Can a new company without a track record get financing for a factory?

It’s challenging but certainly possible. Success depends on a highly credible and detailed business plan, strong collateral, a competent management team, and experienced technical partners. The DBJ’s credit guarantee scheme is specifically designed to bridge this gap for promising new ventures.

How much personal capital is typically required to start?

There’s no universal percentage, but financiers expect founders to have significant personal capital at risk, often referred to as ‘skin in the game.’ This typically ranges from 20% to 30% of the total project cost.

Is it better to seek debt (loans) or equity (investment)?

Each has distinct advantages. Debt financing allows founders to retain full ownership but comes with fixed repayment obligations. Equity financing dilutes ownership but brings in strategic partners and capital that isn’t tied to a fixed repayment schedule. Many successful industrial projects use a carefully balanced combination of both.

How long does the financing process for a manufacturing project take?

Patience is essential. For a combination of bank debt and private equity, the process can take anywhere from 6 to 18 months from the initial pitch to the disbursement of funds. Securing capital from international development institutions can take significantly longer, often over two years.

Conclusion: Preparation is the Key to Success

Financing a solar panel manufacturing facility in Jamaica is a complex undertaking, but one that is achievable with the right strategy. The landscape offers a blend of public sector support designed to foster industrial growth, a dynamic private equity market seeking strong returns, and international institutions focused on climate impact.

Success does not hinge on finding a single ‘yes,’ but on building a credible, multi-layered financial structure. This begins not with meetings, but with meticulous preparation: a bankable business plan, a validated technical design, and a clear understanding of how the project contributes to Jamaica’s prosperous and sustainable future.