An investor reviews a financial projection for a new solar module factory. The numbers look promising, charting a path to profitability. However, a significant portion of the initial capital goes to import duties on machinery, while projected profits are reduced by standard corporate taxes.

Now, imagine those two major costs simply disappearing. This isn’t a hypothetical exercise—it’s the reality for businesses operating within a Special Economic Zone (SEZ), a framework that can fundamentally alter the financial viability of a manufacturing enterprise.

For entrepreneurs and established companies considering the solar panel production market, understanding government incentives is a critical step in strategic planning. Jamaica, through its Special Economic Zone Authority (JSEZA), offers a compelling package designed to attract this type of high-value, export-oriented manufacturing. This article analyzes the fiscal and operational benefits available under Jamaica’s SEZ framework and offers a clear guide for investors evaluating the setup of a solar module production line.

The Foundation: Jamaica’s Special Economic Zone Act

Established under the Special Economic Zone Act of 2016, Jamaica’s SEZ regime is a strategic initiative to stimulate economic growth, create employment, and position the country as a major logistics and manufacturing hub in the Americas. The JSEZA is the regulatory body responsible for overseeing the application process, development, and operation of these zones.

For a solar module manufacturer, the primary appeal is the potential for designation as an “SEZ Developer” or “SEZ Occupant.” This status unlocks a suite of powerful incentives designed to significantly lower both initial investment and ongoing operational costs. The core philosophy is simple: by removing tax and customs burdens, the government enables businesses to compete more effectively on the global stage. In return, these enterprises are expected to generate local employment and contribute to the national economy.

Core Fiscal Incentives: A Game-Changer for Financial Projections

The financial benefits offered within a Jamaican SEZ are substantial and can dramatically improve a solar factory’s return on investment. The primary incentives are focused on taxation and customs duties.

The 0% Corporate Profit Tax

Perhaps the most significant benefit is a 0% corporate profit tax rate in perpetuity. Unlike tax holidays in some jurisdictions that expire after a set number of years, the SEZ incentive provides a permanent exemption from profit tax as long as the company maintains its status. This allows manufacturers to reinvest a much larger portion of their earnings into expansion, research and development, or improving operational efficiency. For a capital-intensive business like solar module manufacturing, this accelerated capital accumulation can be a decisive competitive advantage.

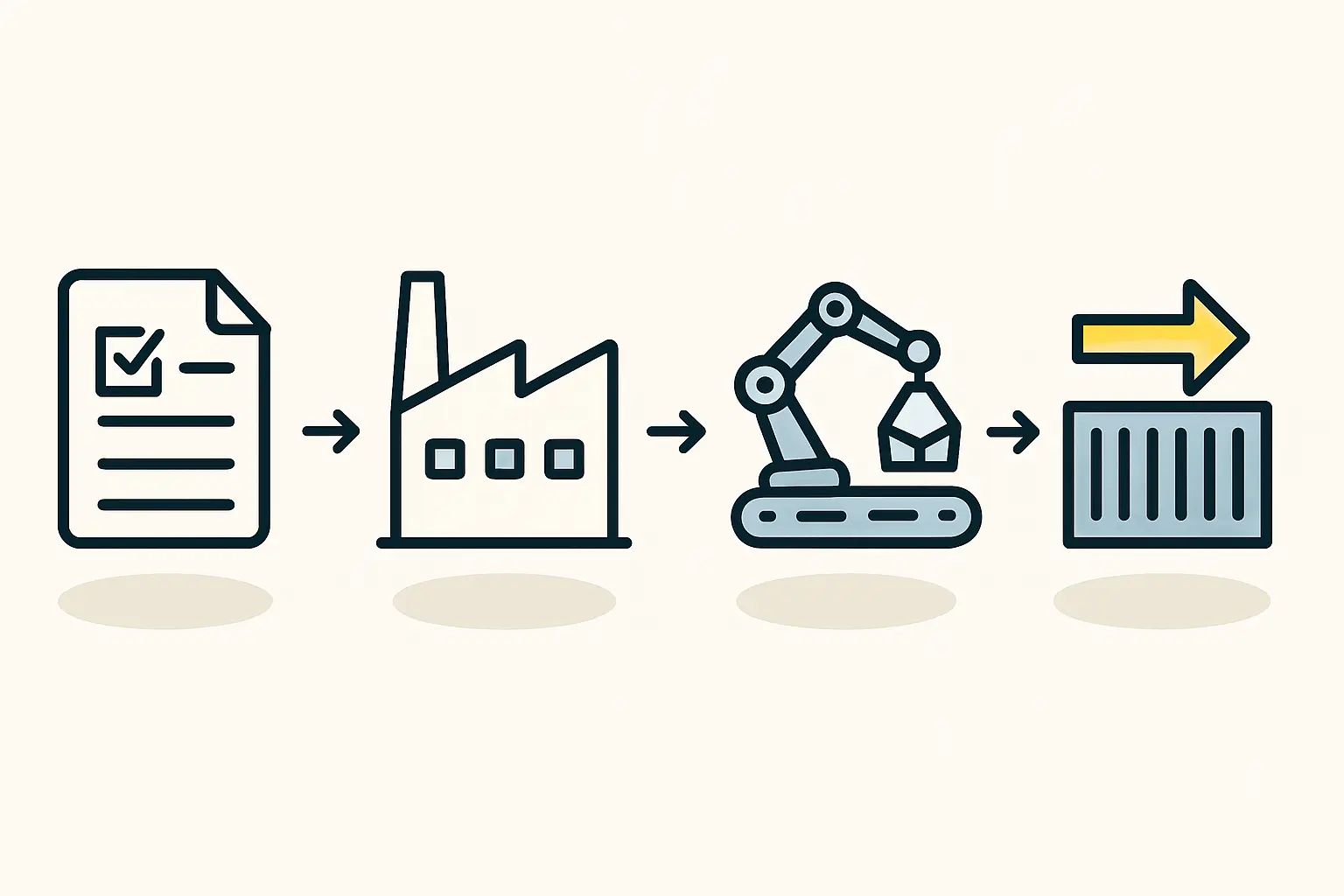

Exemption from Customs Duties

A new solar module production line requires importing specialized equipment, from cell stringers and laminators to testing simulators. Outside an SEZ, these capital goods would typically be subject to significant customs duties, potentially adding 15-20% to the initial machinery investment.

Within a Jamaican SEZ, however, developers and occupants are granted a complete exemption from the Customs Act. This means all capital equipment, raw materials (such as solar cells, EVA film, and glass), and factory construction materials can be imported duty-free. This single benefit can reduce the initial setup cost of a 50 MW factory by several hundred thousand, or even millions, of dollars.

Waiver of GCT and Other Taxes

In addition to profit tax and customs duties, SEZ entities are exempt from the General Consumption Tax (GCT), Jamaica’s version of a Value-Added Tax (VAT). This exemption applies to all goods and services sourced within the zone, further reducing operational overhead. Other levies, such as asset taxes, are also waived, creating a highly favorable fiscal environment that simplifies financial management and improves cash flow.

Operational and Logistical Advantages

While the fiscal incentives are the main draw, the operational benefits of locating within an SEZ are also a critical consideration.

Streamlined Bureaucracy

The JSEZA acts as a “one-stop shop” for approvals and permits, reducing the administrative friction often associated with setting up a new industrial operation. This includes expedited customs clearance for both imports and exports, a crucial factor for a manufacturing business reliant on global supply chains and serving international markets.

Strategic Location

Jamaica’s geographic position provides a logistical advantage for serving markets across North, Central, and South America. Zones like the Kingston Free Zone provide direct access to world-class port facilities, enabling efficient export of finished solar modules to customers throughout the hemisphere.

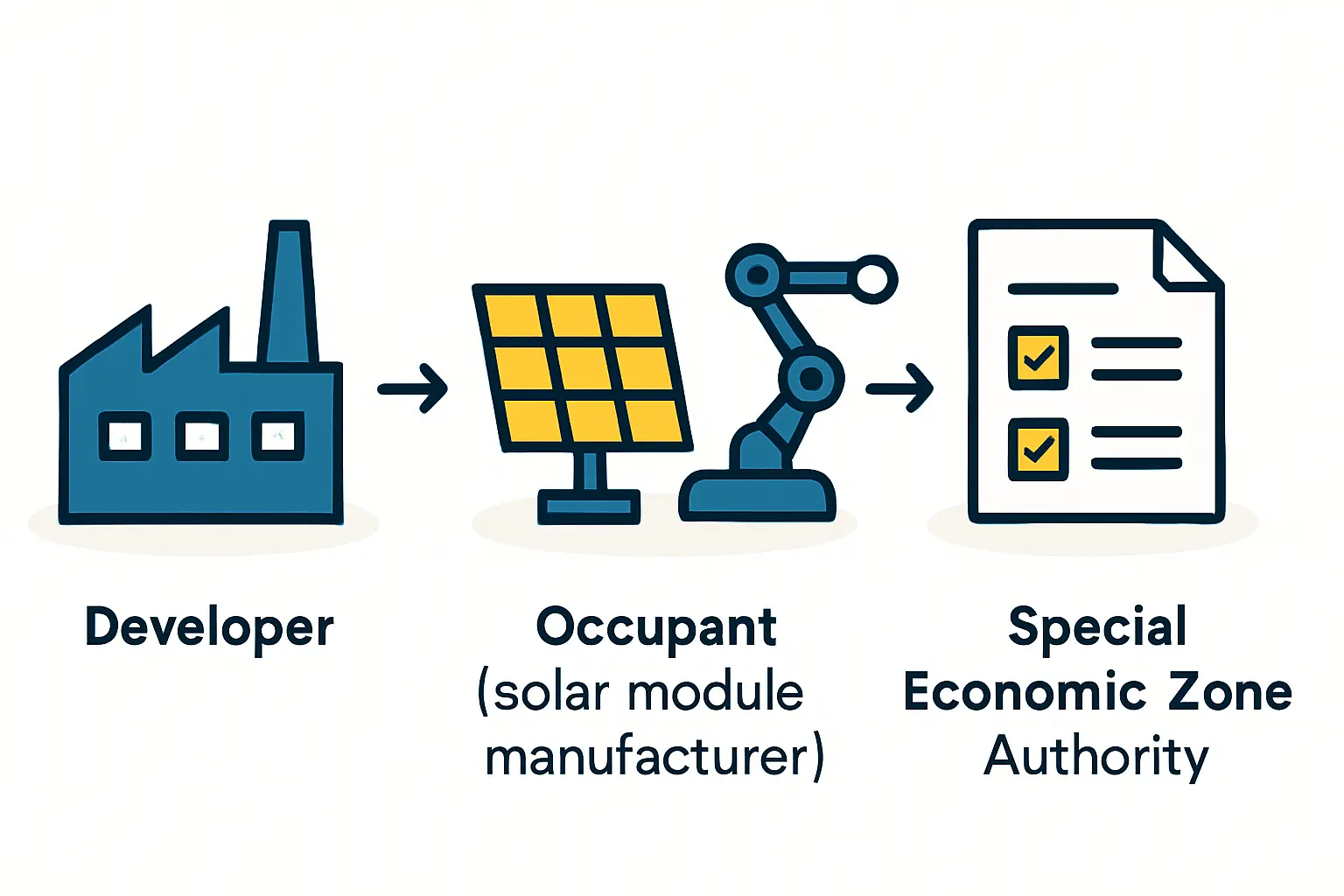

The Application Process: Key Requirements for Investors

Gaining SEZ status is not automatic. The JSEZA evaluates applications based on criteria designed to ensure that approved projects align with Jamaica’s economic development goals. An aspiring solar module manufacturer must present a compelling case that typically involves:

-

A Robust Business Plan: The application must be supported by a comprehensive business plan detailing financial projections, market analysis, operational plans, and employment forecasts. This document is the cornerstone of the evaluation.

-

Focus on Export: The SEZ regime is designed for export-oriented businesses. The business plan must demonstrate that a substantial majority of the solar modules produced will be sold outside Jamaica.

-

Value-Added Activity: The project must involve genuine manufacturing and assembly, not simply repackaging or minor finishing. The process of turning solar cells, glass, and other components into a finished, certified solar panel is a clear example of a qualifying value-added activity.

-

Employment Generation: One of the JSEZA’s primary mandates is job creation. The business plan must outline realistic projections for local employment, from skilled technicians and engineers to administrative and logistics staff.

Based on experience from J.v.G. turnkey projects, having a well-structured and detailed plan is the single most important factor in a successful application for such incentives.

Frequently Asked Questions (FAQ)

What is the primary difference between Jamaica’s old Free Zone regime and the new SEZ framework?

The SEZ framework, established in 2016, is more comprehensive and compliant with World Trade Organization (WTO) standards. It moves beyond just export-focused activities to encourage a wider range of industries and value-added services, offering a more modern and flexible regulatory environment than the older Free Zone system.

Are there any minimum investment requirements to qualify for SEZ status?

While the SEZ Act does not specify a rigid minimum investment figure, the JSEZA assesses the scale, scope, and economic impact of the proposed project. A plan for a commercially viable solar module production line, which inherently requires significant capital investment, would generally meet the implicit threshold of substance that regulators seek.

Can a foreign-owned company operate within a Jamaican SEZ?

Yes, the Jamaican SEZ framework is designed to attract foreign direct investment. Foreign investors can hold 100% ownership of a company established within an SEZ, and the process is structured to be accessible to international businesses.

Are there restrictions on selling solar modules to the local Jamaican market?

While the primary focus of SEZ entities must be on exports, the regulations do allow for a certain percentage of sales into the domestic market. However, these sales would typically be subject to the standard customs duties and taxes that were waived on import, ensuring a level playing field with non-SEZ domestic producers.

Conclusion: A Strategic Consideration for Market Entry

For any company or investor evaluating a move into solar module manufacturing, government incentives are a powerful lever for success. Jamaica’s Special Economic Zone framework offers one of the most attractive fiscal packages in the region, with the potential to eliminate major cost centers like corporate tax and customs duties.

This transforms a factory’s financial model, allowing for faster capital recovery, greater price competitiveness in export markets, and increased capacity for reinvestment. Accessing these benefits, however, requires meticulous planning and a compelling business case. By thoroughly investigating these incentives, investors can unlock a significant strategic advantage in the competitive global solar market.