For many international entrepreneurs, Liberia represents a frontier of opportunity. With strong demand for local production and access to regional West African markets, the potential for establishing a successful manufacturing operation is significant.

Yet, the prospect of navigating a foreign legal system can seem daunting. This perceived complexity often obscures a well-structured framework designed to attract and protect foreign investment. This guide provides a clear overview of the regulatory landscape for foreign direct investment (FDI) in Liberia’s manufacturing sector. It outlines the essential legal requirements, from company registration to tax compliance, clarifying the path to establishing a compliant and successful enterprise.

Understanding the Legal Foundation for Foreign Investment

The cornerstone of Liberia’s approach to foreign investment is the Investment Act of 2010. This legislation is designed to create a predictable and transparent environment for both foreign and domestic investors. Its central principle is non-discrimination, meaning foreign investors are, by law, afforded the same rights and protections as Liberian citizens in most business activities.

The primary government body responsible for implementing this act is the National Investment Commission (NIC). The NIC serves as the main point of contact for investors, facilitating the investment process, providing information, and administering the valuable incentives available to qualifying enterprises. For any serious investor, the NIC is the first and most important institutional relationship to build.

Key Steps to Establishing a Foreign-Owned Company

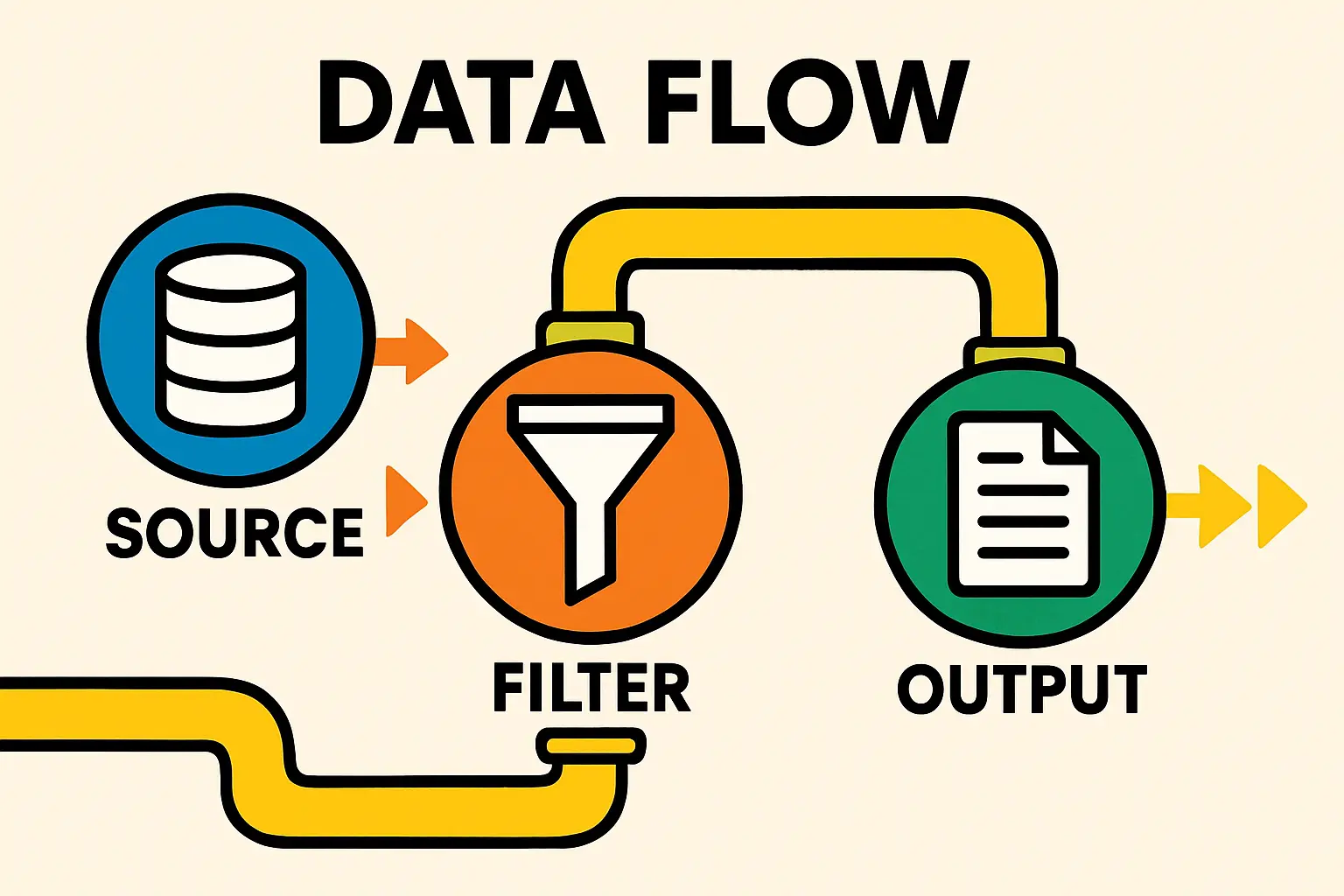

Establishing a manufacturing entity in Liberia follows a sequential process managed by distinct government agencies. While it requires careful documentation, the path is well-defined.

Step 1: Business Registration with the Liberia Business Registry (LBR)

The first official step is to legally form the company. The Liberia Business Registry (LBR) handles this step, centralizing the registration process.

The typical procedure involves:

-

Name Reservation: Ensuring the proposed company name is unique and available.

-

Submission of Articles of Incorporation: This foundational document defines the company’s purpose, share structure, board of directors, and operational rules. It is advisable to retain competent legal counsel to draft these articles, ensuring they comply with the Liberia Business Corporation Act.

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

-

Registration and Issuance of Certificate: Once the documents are approved, the LBR issues a Business Registration Certificate, which officially recognizes the company as a legal entity in Liberia.

Step 2: Obtaining an Investment Permit from the NIC

With the company legally formed, the next step is to secure an Investment Permit from the National Investment Commission. This is not merely a formality; it is the gateway to accessing the fiscal incentives that can significantly impact a project’s financial viability.

The application requires a detailed business plan, proof of financing, and the company’s registration documents. The NIC reviews the proposal to ensure it aligns with Liberia’s economic development goals. For manufacturing projects, this process is generally straightforward, provided the business case is sound.

Step 3: Tax Registration with the Liberia Revenue Authority (LRA)

Every legally operating business in Liberia must be registered with the Liberia Revenue Authority (LRA). Upon registration, the LRA issues a Taxpayer Identification Number (TIN), a number essential for all financial transactions, including opening a corporate bank account, clearing goods through customs, and filing taxes.

Key taxes for a manufacturing concern include:

-

Corporate Income Tax: Levied on the company’s profits.

-

Goods and Services Tax (GST): Applicable to the sale of finished products within Liberia.

-

Customs Duties: Applied to imported raw materials and equipment, though significant exemptions are available through NIC incentives.

Ownership Structures and Sector-Specific Considerations

Liberia’s investment law is notably open, permitting 100% foreign ownership in most sectors, including large-scale manufacturing. This is a significant advantage for investors who wish to retain full control over their operations.

However, the law does set aside a small list of business activities exclusively for Liberian citizens. These are generally small-scale, service-oriented enterprises such as small-scale retail, local transportation, and block making. This restriction does not apply to capital-intensive manufacturing operations, which fall well outside this scope. This distinction is critical when evaluating market entry strategies for sectors like renewable energy.

The Role of Incentives in Attracting Manufacturing FDI

To encourage investment in value-adding industries, the Investment Act of 2010 provides a range of powerful incentives. For a manufacturing startup, these can dramatically reduce initial capital expenditure and improve cash flow during the crucial early years.

Incentives are granted by the NIC and may include:

-

Tax deductions on profits for up to five years.

-

Exemption from import duties on capital equipment, machinery, and raw materials needed for production.

-

Loss carry-forward provisions to offset future tax liabilities.

Securing these incentives hinges on a meticulously prepared business plan and application. A common oversight is failing to properly document the value and purpose of imported machinery, leading to delays at customs. Providing detailed engineering specifications and a clear project timeline upfront is key to preventing such issues.

Compliance and Ongoing Obligations

Once operational, a foreign-owned company must adhere to ongoing compliance obligations. These standard business practices include:

-

Annual Business Registration Renewal: Maintaining good standing with the LBR.

-

Regular Tax Filings: Submitting tax returns to the LRA in a timely manner.

-

Maintaining Proper Financial Records: Adhering to local accounting standards.

Failing to meet these obligations can result in penalties and complicate future operations, such as importing new equipment or repatriating profits.

Frequently Asked Questions (FAQ)

What is the minimum investment required for FDI in Liberia?

The Investment Act of 2010 specifies minimum capital requirements for foreign investors to be eligible for NIC incentives. For foreign-owned enterprises, this is typically set at US$500,000, while for joint ventures with Liberian partners, the threshold is lower.

Can a foreign company own land in Liberia?

No, the Liberian constitution restricts land ownership to Liberian citizens. However, foreign investors can acquire land through long-term leases, which can extend up to 99 years. These leases are legally secure and provide the stability needed for long-term manufacturing investments.

How long does the business registration process typically take?

With all documentation in order, the process at the Liberia Business Registry can be completed within a few weeks. The NIC permit and LRA registration may take several additional weeks. A realistic expectation for completing all initial registrations is two to three months.

Are there restrictions on repatriating profits?

The Investment Act guarantees the right of foreign investors to repatriate profits, dividends, and capital after satisfying their tax obligations. The process is managed through the commercial banking system and requires proper documentation.

Conclusion: Building a Foundation for Success

Liberia offers a structured and legally secure framework for foreign investors willing to engage with its processes. The country’s laws are designed to encourage, rather than hinder, the establishment of manufacturing enterprises that contribute to economic growth. Success hinges not on finding loopholes, but on diligent preparation, transparent documentation, and a clear understanding of the legal pathway.

With this legal framework understood, the next step is to explore the physical and logistical requirements. Learn more in our practical guide to establishing a manufacturing facility in Liberia.