Entering the solar module manufacturing industry requires significant capital investment. The financial viability of such a project often hinges not just on market demand but also on the fiscal environment where the factory operates.

Government-led incentive programs can fundamentally alter the business case, transforming a high-risk venture into a highly strategic opportunity. In West Africa, Liberia is actively positioning itself as a destination for this kind of investment through its Special Economic Zone framework.

This guide breaks down the specific incentives available within Liberia’s SEZs and outlines the practical steps a new solar manufacturer must take to secure them. It is written for business professionals exploring the sector who need a clear understanding of the financial and procedural landscape.

Understanding the Role of Special Economic Zones in Liberia

A Special Economic Zone (SEZ) is a geographically designated area within a country where business and trade laws differ from the rest of the nation. The primary goal is to attract foreign direct investment, boost manufacturing, and create employment by offering significant financial and regulatory advantages.

In Liberia, the legal foundation for these zones is the Special Economic Zone Act of 2017. The National Investment Commission (NIC) manages their implementation and serves as the primary point of contact for investors. The Buchanan Special Economic Zone (BSEZ), located at the Port of Buchanan, is the country’s flagship SEZ, offering integrated logistics and infrastructure tailored for manufacturing and export.

For an investor planning a solar module assembly line, operating within an SEZ like Buchanan provides a purpose-built environment designed to reduce costs and streamline operations from day one.

Core Fiscal Incentives for Solar Module Manufacturers

The incentives offered within a Liberian SEZ are substantial and target the key costs of a new manufacturing facility. These benefits, codified in law, are designed to enhance profitability during the critical early years of operation.

Corporate Income Tax Holiday

Perhaps the most significant incentive is a complete exemption from corporate income tax for a defined period. For qualifying manufacturing projects, this holiday can extend for up to 10 years, and in some cases longer, depending on the scale of the investment and the number of jobs created.

This allows a new enterprise to reinvest profits directly into expansion, technology upgrades, or market development. It’s a crucial advantage when competing in the global solar market.

Exemption from Customs Duties and Import Taxes

A solar module factory relies on a global supply chain for its core components and machinery. The SEZ framework provides a 100% exemption from customs duties and import taxes on capital goods, raw materials, and intermediate goods.

This exemption applies directly to:

Production Machinery: All manufacturing equipment for solar panels, from stringers and laminators to testing simulators, can be imported duty-free. This considerably lowers the initial setup cost.

Raw Materials: Key inputs such as solar cells, tempered glass, EVA encapsulant, backsheets, and aluminum frames are also covered, reducing the per-module production cost.

This benefit effectively removes a major financial barrier, enabling investment in higher-quality, more efficient equipment from the outset.

Exemption from Goods and Services Tax (GST)

Goods produced within the SEZ are exempt from the standard Goods and Services Tax (GST). This creates a distinct price advantage, particularly for modules intended for export markets. It also simplifies the business’s tax administration, reducing the compliance burden.

Based on experience from J.v.G. turnkey projects, these combined fiscal incentives can significantly improve a solar factory’s internal rate of return (IRR), often shortening the payback period by several years.

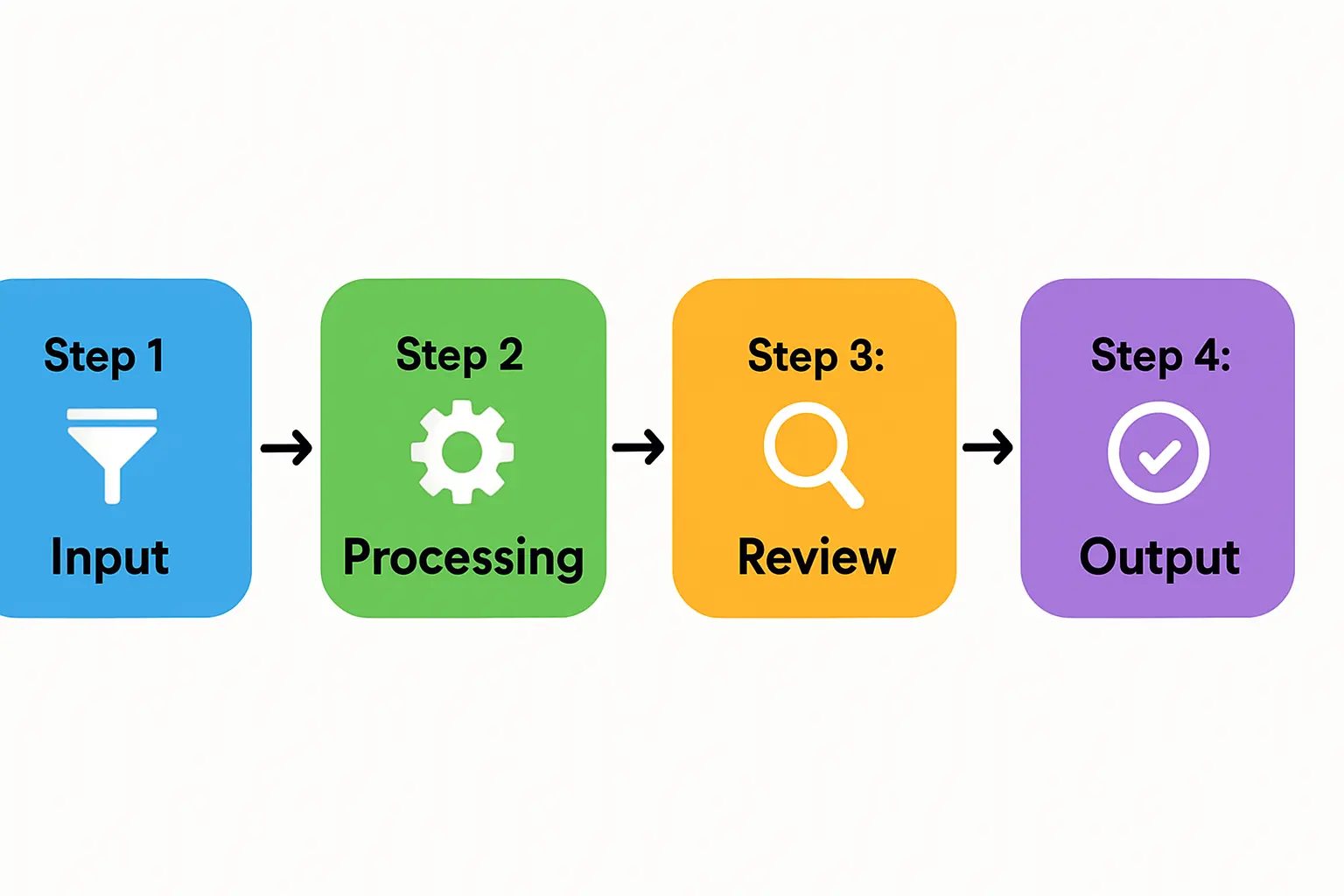

Navigating the Application Process: A Step-by-Step Guide

Securing SEZ status is a structured process managed by the National Investment Commission (NIC). While thorough, the process is designed to be transparent for serious investors.

Step 1: Initial Engagement with the National Investment Commission (NIC)

The process begins with the submission of a letter of intent or a detailed project proposal to the NIC. This document should clearly outline the project’s scope, including proposed production capacity, target markets, job creation estimates, and a summary of the solar factory business plan. This initial step allows the NIC to gauge the project’s alignment with Liberia’s economic development objectives.

Step 2: Formal Application and Due Diligence

Following a positive initial review, the investor submits a formal application. The NIC then conducts a due diligence process, which involves a technical and financial assessment of the project. This assessment verifies the investor’s background, the feasibility of the business model, and the project’s potential economic impact.

Step 3: Obtaining the SEZ Enterprise License

Upon successful completion of due diligence, the NIC Board of Commissioners grants an SEZ Enterprise License. This official document authorizes the company to operate within the SEZ and access all associated incentives.

Step 4: Registration with the Liberia Revenue Authority (LRA)

With the SEZ license in hand, the final administrative step is to register the enterprise with the Liberia Revenue Authority (LRA). This formalizes the tax and customs exemptions, ensuring that all relevant government agencies recognize the company’s special status.

Common Challenges and Considerations

While the incentive framework is attractive, prospective investors should be aware of certain practical realities.

-

Local Employment and Training: Creating local jobs is a key expectation of the Liberian government. The business plan should include a clear strategy for hiring and training a Liberian workforce.

-

Bureaucratic Timelines: While the process is structured, it is not instantaneous. Investors should budget several months for the application and approval cycle.

-

Infrastructure Outside the SEZ: Liberia is a developing nation. While the SEZ itself is designed to have reliable infrastructure, logistical planning for the transport of goods and personnel outside the zone requires careful consideration. This is particularly relevant in regions with unstable grid infrastructure, where a solar factory’s output can have a significant local impact.

Frequently Asked Questions (FAQ)

What is the minimum investment required to qualify for SEZ incentives in Liberia?

While not always explicitly defined, projects with a planned investment of over USD 1 million are typically given serious consideration, especially in strategic sectors like renewable energy manufacturing.

Are these incentives only for foreign investors?

No, the SEZ incentives are available to both foreign and domestic investors who meet the eligibility criteria.

How long does the entire application and approval process typically take?

A realistic timeline is four to six months from initial submission to final registration with the LRA, assuming all documentation is in order.

Can a solar factory in the SEZ sell modules to the domestic Liberian market?

Generally, SEZ enterprises are export-oriented. However, regulations may permit a certain percentage of sales to the domestic market, though these sales would likely be subject to standard customs duties and GST.

What happens after the tax holiday period expires?

Once the incentive period ends, the company transitions to the standard fiscal regime and becomes subject to the prevailing corporate income tax rates in Liberia.

Next Steps in Your Planning Journey

Liberia’s Special Economic Zone framework presents a compelling financial case for establishing a solar module manufacturing facility. The combination of tax holidays and duty exemptions directly lowers the primary cost barriers, creating a favorable environment for long-term success.

Your logical next step in evaluating this opportunity is to develop a detailed financial model. A comprehensive understanding of the investment required to start a solar panel factory is essential for creating a business plan that will meet the National Investment Commission’s due diligence requirements.

For entrepreneurs seeking a structured approach to this complex process, the pvknowhow.com platform offers educational resources that cover the entire journey, from initial concept and feasibility analysis to full-scale production and operations.