For any entrepreneur exploring Libya’s solar energy sector, the path forward can seem divided. On one side is immense potential, with some of the highest solar irradiation levels in the world. On the other is a complex and often misunderstood legal landscape for foreign investment.

This uncertainty often acts as a barrier for professionals considering entry into this promising market. Yet, the perception of complexity frequently overshadows a legal framework designed specifically to attract foreign capital into strategic industries.

This article offers a clear, structured overview of Libya’s foreign investment laws, with a specific focus on establishing a solar module manufacturing facility. It outlines the core regulations, ownership structures, and practical steps involved, turning legal ambiguity into a clear business roadmap.

Understanding Libya’s Commitment to Foreign Direct Investment (FDI)

For decades, Libya’s economy has been dominated by its hydrocarbon sector. Recognizing the strategic imperative to diversify, the government has made renewable energy—particularly solar—central to its economic vision. To facilitate this transition, it has established a legal framework to attract and protect foreign investment.

The cornerstone of this framework is Law No. 9 of 2010 Concerning the Promotion of Investment, which governs all foreign direct investment (FDI) and is administered by the General Authority for Investment Promotion and Privatization Affairs (GAIPPA). For any potential investor in solar manufacturing, understanding this law is the most critical first step, as it signals a clear intent to welcome and secure international business in sectors vital to national development.

Key Provisions of Law No. 9 (2010) for Solar Manufacturers

Law No. 9 (2010) is more than a set of rules; it’s a package of guarantees and incentives designed to reduce risk and encourage long-term commitment from foreign enterprises. For those looking to invest in the solar manufacturing sector, several provisions are particularly relevant.

Ownership Structures and Percentages

A primary concern for any international investor is the degree of control they can exercise over their enterprise. Under Libyan law, foreign investors have several options for establishing a business presence, but for a manufacturing operation, the most suitable structure is typically a Joint Stock Company (JSC).

The most significant provision in Law No. 9 allows for up to 100% foreign ownership of a project. This point is critical, as it dispels the common misconception that a local partner is always required. While forming a joint venture with a Libyan partner can offer strategic advantages in navigating local markets and administrative processes, it is not a legal necessity for establishing a solar factory. This provision gives investors maximum control over their operations, technology, and governance.

Capital Requirements and Transfers

The law facilitates the entry of foreign capital and, just as importantly, ensures its eventual exit. Investors are guaranteed the right to repatriate profits, allowing them to transfer net profits and dividends generated by the project abroad in a convertible currency.

Investors can also transfer capital, meaning they can re-export the invested capital in the event of project liquidation or sale.

Additionally, foreign personnel employed by the project are permitted to transfer their salaries and benefits outside of Libya. These guarantees are designed to directly address fundamental investor concerns about financial mobility and return on investment.

Incentives and Guarantees for Investors

To make investing in priority sectors like renewable energy more attractive, the law offers a range of fiscal incentives. A solar manufacturing project approved by GAIPPA can benefit from several advantages.

First, an exemption from customs duties means all machinery, equipment, and raw materials required for the factory are exempt from import taxes and customs fees.

Second, the project is exempt from corporate income tax for five years, an exemption that can be extended under certain conditions.

Third, the law grants foreign-owned projects the right to lease the real estate necessary for their operations through land use rights.

Furthermore, the law provides strong guarantees against non-commercial risks, including the assurance that a project will not be nationalized or expropriated.

The Practical Steps to Establishing a Solar Manufacturing Company

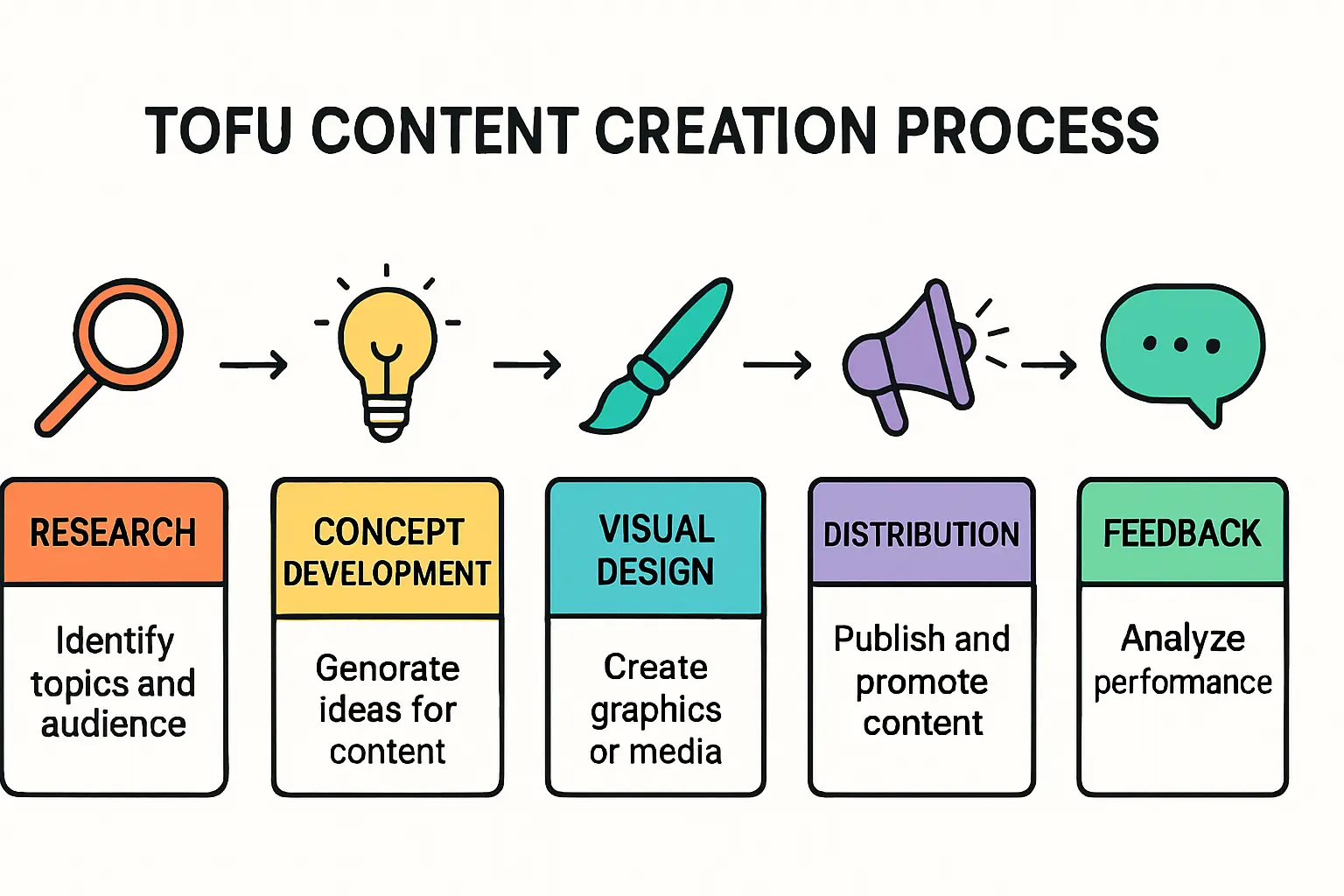

With an understanding of the law, the next phase is application. The process for establishing a foreign-owned company in Libya is structured and managed primarily through GAIPPA, which acts as a ‘one-stop shop’ to streamline the procedure.

Step 1: Initial Approval from GAIPPA

The process begins with submitting an application for an investment license to GAIPPA. This application must be supported by comprehensive documentation, particularly a detailed feasibility study. The study is more than a formality; it must demonstrate the project’s technical, economic, and financial viability. A solid business plan is essential here, as it forms the basis for the entire approval process.

Step 2: Company Registration

Once GAIPPA grants the investment license, the next step is the company’s legal formation. This includes drafting and notarizing the company’s Articles of Association, registering the company in the Commercial Registry, and obtaining a commercial license from the Ministry of Economy. These steps formalize the company’s existence and its right to operate in Libya.

Step 3: Securing Land and Operational Permits

With the company legally established, the focus shifts to the physical setup. This involves finalizing the lease for the factory site and securing all necessary operational permits. This stage brings up key considerations for the factory’s location and building requirements, such as access to infrastructure, logistics, and a suitable workforce. Depending on the project’s specifics, environmental and industrial permits will also be required before construction and operations can begin.

Navigating Potential Challenges and Local Nuances

While the legal framework is favorable, investors must be prepared for the practical realities of operating in a developing market. A realistic approach is essential for long-term success.

Bureaucratic Delays and Administrative Hurdles

Like in many emerging economies, administrative processes in Libya can be slow, requiring both patience and persistence. Experience from J.v.G. turnkey projects shows that partnering with reputable local legal counsel or a knowledgeable consultant can significantly expedite these processes and help avoid common pitfalls. Such local experts understand the unwritten rules and can navigate the bureaucracy more effectively.

Evolving Regulatory Landscape

While Law No. 9 provides a stable foundation, specific decrees and implementation procedures can evolve. Investors must stay informed of any changes that might affect their operations, particularly those concerning tax, labor, or import regulations.

Security and Political Stability

Investors must conduct a thorough risk assessment as part of their due diligence. This is standard practice for any significant investment, particularly in regions undergoing political and economic transition. A comprehensive evaluation, often part of the project’s feasibility study, should account for the security environment and its potential impact on logistics, supply chains, and personnel.

Frequently Asked Questions (FAQ) for Investors

Can I own 100% of a solar factory in Libya?

Yes. Under Law No. 9 of 2010, foreign investors are permitted 100% ownership in priority sectors, which includes renewable energy manufacturing.

How are my profits treated for tax purposes?

Approved investment projects are granted a five-year exemption from corporate income tax. After this period, standard corporate tax rates apply.

Is it difficult to repatriate profits?

No. The law explicitly guarantees the right of foreign investors to transfer net profits and dividends abroad in a convertible currency through official banking channels.

What is the minimum investment required?

The law does not stipulate a fixed minimum capital investment. The required investment is determined by the scale and scope of the project as outlined in the feasibility study submitted to and approved by GAIPPA.

Do I need a Libyan partner?

A local Libyan partner is not a legal requirement for 100% foreign-owned investment projects. However, a strategic partnership can be highly beneficial for market entry, navigating local networks, and managing administrative processes.

Conclusion: A Structured Path to Investment

Libya presents a substantial opportunity for entrepreneurs looking to enter the solar manufacturing industry. The country’s legal framework, centered on Law No. 9 of 2010, is designed to be attractive and secure for foreign investors. It offers full ownership, significant tax incentives, and legal guarantees against major risks.

While practical challenges exist, they are not insurmountable. With thorough preparation, professional guidance, and a clear understanding of the regulatory process, the path to establishing a solar factory is manageable. For the discerning investor, the legal framework is not a barrier but a structured pathway to harnessing one of the world’s most promising solar energy markets.