Target Market Analysis: The C&I Sector as the Primary Driver for Lebanese Solar Module Demand

Imagine a market where electricity demand is constant, yet the public grid provides power for only one or two hours a day. For businesses in Lebanon, this isn’t a hypothetical scenario—it’s a daily reality. This profound energy deficit has created an unprecedented opportunity for alternative power, with solar photovoltaics emerging as the only viable solution. Between 2021 and early 2023, the country’s installed solar capacity surged from 100 MW to nearly 1,000 MW—a tenfold increase driven by urgent necessity.

For an entrepreneur considering entry into the solar industry, understanding this dynamic is crucial. The most pressing demand comes not from individual households but from the commercial and industrial (C&I) sector, where the cost of inaction is far greater than the cost of investment. Here, we’ll examine why Lebanon’s C&I clients represent the primary target market for a new solar module manufacturer and how to build a strategy to serve them effectively.

The Engine of Demand: Lebanon’s Severe Energy Crisis

Grasping the scale of the opportunity begins with understanding the problem. The near-collapse of Lebanon’s state-owned electricity provider, Electricité du Liban (EDL), has forced the entire country to rely on a network of private diesel generators—an alternative that is both financially and logistically unsustainable.

The solar boom is being fueled by several core challenges:

-

Extreme Grid Unreliability: With the public grid virtually non-operational, businesses cannot function without a private power source.

-

Volatile Diesel Costs: The price of diesel fuel is high and subject to global market fluctuations, making it impossible for businesses to forecast operational expenses.

-

Operational Disruption: A constant dependency on generator maintenance, fuel delivery, and repairs introduces significant risk and inefficiency into business operations.

For a factory, a hospital, or a large retailer, consistent power is not a luxury; it is a prerequisite for survival. This has created a powerful incentive to seek a long-term, cost-stable energy solution. Solar PV offers precisely that: a fixed upfront investment that provides predictable, low-cost electricity for over 25 years, effectively insulating a business from fuel price volatility.

Identifying the Premier Customer: The Commercial and Industrial Sector

While the energy crisis affects everyone, the C&I sector is the most motivated and capable segment to invest in large-scale solar solutions. This group includes factories, hospitals, universities, hotels, and large commercial centers.

Their motivation comes down to three key factors:

-

Critical Power Needs: Unlike a small residence, an industrial production line or a hospital’s critical equipment cannot tolerate power interruptions. The need for continuous, reliable energy is non-negotiable.

-

Financial Capacity: These entities typically have the capital or access to financing required for the significant investment of a commercial-scale solar system (50 kW to over 1 MW).

-

Clear Financial Payback: The return on investment is remarkably clear. With the high cost of running diesel generators, the payback period for a solar installation in Lebanon is often as short as two to four years. After this period, the electricity generated is virtually free, leading to substantial long-term savings and a competitive advantage.

This makes the C&I sector the ideal customer for a local solar module manufacturer. They order high volumes of panels, need professional installation, and prioritize long-term reliability over the lowest possible price.

A Focused Strategy for Local Solar Module Manufacturing

An aspiring entrepreneur might wonder, ‘Why manufacture locally when panels can be imported?’ The answer lies in creating a strategic advantage tailored to the specific needs of the C&I market. Importing modules involves logistical challenges, customs delays, and currency risks. A local facility can offer reliability, faster delivery, and products specifically designed for the market.

This focus is a critical part of any plan to start a solar panel manufacturing business. The business model should be built around serving the sophisticated needs of C&I clients, not the residential market.

Producing the Right Product

C&I clients require high-performance modules. A manufacturer should focus production on panels utilizing modern cell technologies like M10 or G12. These larger cells create more powerful and efficient modules, reducing the number of panels needed for a given installation and lowering the overall balance-of-system costs for the end customer. Producing small, low-wattage panels suitable for residential use would fail to address the core demand.

Structuring the Go-to-Market Approach

Direct sales to end-users are often inefficient. The most effective route to market is through strong relationships with the Engineering, Procurement, and Construction (EPC) companies and professional solar installers who serve the C&I sector. These partners become the primary sales channel.

By providing them with a reliable, locally available supply of high-quality modules, a manufacturer becomes an essential part of their value chain. This strategy minimizes sales and marketing overhead while building a loyal customer base. This partnership relies on a solar panel manufacturing process optimized to deliver consistent quality that professional installers can trust.

Understanding the Investment

Setting up a production line requires a clear understanding of the necessary capital. The initial cost of a solar panel manufacturing plant depends on the desired capacity and level of automation. However, the high demand and favorable market dynamics in Lebanon make a strong case for this investment. The right set of solar panel manufacturing machines is critical to producing the high-efficiency modules that the C&I market demands.

Experience from J.v.G. Technology GmbH with turnkey projects in emerging markets shows that a well-planned facility can become operational in under a year, positioning a new entrant to capitalize on the existing wave of demand.

Frequently Asked Questions

Why is the C&I sector a better target than the residential market?

The C&I sector offers a more concentrated and profitable customer base. C&I projects are larger, requiring hundreds or thousands of modules at a time, which streamlines sales and production. Furthermore, these clients are driven by clear financial calculations like ROI and operational cost savings, making demand more stable and predictable.

What are the main advantages of local manufacturing in Lebanon?

Local manufacturing offers several key advantages: mitigating supply chain risks associated with imports, avoiding currency fluctuation exposure on large orders, reducing shipping times, and potentially benefiting from government incentives. It also helps a manufacturer build a brand trusted within the local market.

Is this market opportunity unique to Lebanon?

While the specifics are unique, the general dynamic is not. Many emerging markets, from Nigeria to parts of Southeast Asia, face similar challenges with grid instability and high alternative energy costs. The principle of targeting the C&I sector, where the economic pain is greatest, can be applied in any region with similar underlying conditions.

Next Steps for Market Entry

The Lebanese solar market presents a compelling, demand-driven opportunity for entrepreneurs ready to enter the module manufacturing space. The path to success lies not in serving everyone, but in strategically targeting the commercial and industrial sector with a high-quality, locally produced product. By focusing on the specific needs of businesses crippled by the energy crisis, a new manufacturer can build a robust and profitable enterprise.

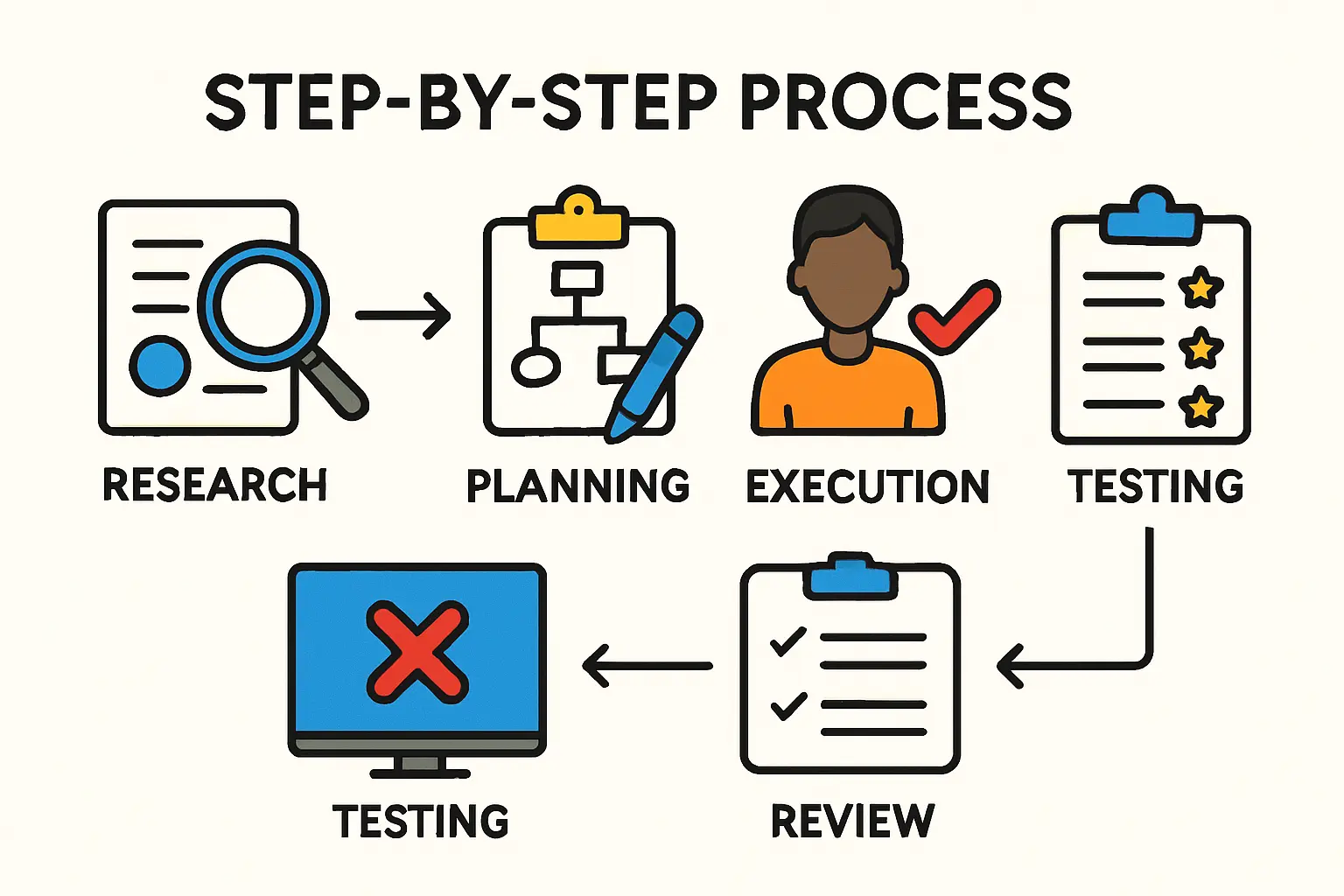

For those considering this path, the next step involves detailed financial modeling and technical planning. A structured approach is essential to navigate the complexities of factory setup, from equipment selection to process optimization.