An investor considering Malta for a new solar module factory sees clear advantages: high solar irradiation, strategic access to European and North African markets, and strong government support. But a critical question arises long before any business plan is drafted: is the local workforce capable of running such a sophisticated operation? For a small island nation, the answer is more encouraging than one might expect, provided a strategic approach to recruitment and training is adopted.

This article assesses Malta’s technical labor pool, examining the availability of skilled personnel, highlighting key industries with transferable skills, and outlining practical strategies for building a competent team for a solar production line.

Understanding Malta’s Evolving Industrial Landscape

Malta’s economy is undergoing a significant transformation. While traditionally known for tourism and gaming, a strategic push from government bodies like Malta Enterprise has fostered a shift towards high-value, knowledge-based industries. This pivot has direct implications for any investor looking to establish a manufacturing presence.

The country has cultivated a robust ecosystem in sectors such as pharmaceuticals, microelectronics, and aviation maintenance. These industries demand precision, strict adherence to quality control, and a technically proficient workforce—all qualities directly applicable to solar module production.

At the same time, a strong national focus on STEM (Science, Technology, Engineering, and Mathematics) education is expanding the talent pipeline. Institutions like the University of Malta and the Malta College of Arts, Science and Technology (MCAST) are producing a steady stream of engineers and technicians equipped with modern industrial skills. This educational infrastructure provides a solid foundation for building a specialized workforce.

Sourcing Key Personnel: Where to Find Talent

Identifying the right talent requires looking beyond direct solar experience to focus on foundational skills and adaptability. The Maltese labor market, though competitive, offers distinct pockets of expertise.

The Engineering Pool: Universities and Existing Industries

For critical roles like process engineers, quality control managers, and production supervisors, the most promising candidates come from two primary sources:

-

Recent Graduates: Engineering programs at the University of Malta provide graduates with strong theoretical knowledge in electrical, mechanical, and industrial engineering. While they may lack specific photovoltaic (PV) experience, they are an adaptable talent pool that can be shaped to the unique requirements of a solar production line.

-

Experienced Professionals from Adjacent Sectors: Engineers currently working in Malta’s pharmaceutical or electronics manufacturing sectors have invaluable transferable skills. Their experience with automated production lines, cleanroom environments, quality assurance systems (like ISO 9001), and process optimization is directly relevant. An engineer who has managed a precision assembly line for medical devices can quickly adapt to overseeing a solar stringer or laminator.

Technicians and Operators: A Competitive Market

The market for skilled technicians and line operators is more competitive. Malta’s low unemployment rate, which stood at approximately 2.9% in 2023, means skilled labor is in high demand. A significant number of foreign workers—constituting around 30% of the labor pool—supplements the nation’s workforce, filling gaps across various sectors.

For these roles, it’s practical to look for candidates with experience in:

-

Maintenance: Technicians from other manufacturing plants will have experience with the pneumatic, hydraulic, and electrical systems common in industrial machinery.

-

Assembly: Workers from the electronics industry are accustomed to handling delicate components and following precise assembly procedures.

-

Quality Inspection: Personnel with a background in visual inspection and quality control can be readily trained for tasks like post-lamination checks and electroluminescence (EL) testing.

Investors must be prepared to offer competitive compensation and a positive work environment to attract and retain these skilled professionals.

Bridging the Skills Gap: Training and Development Strategies

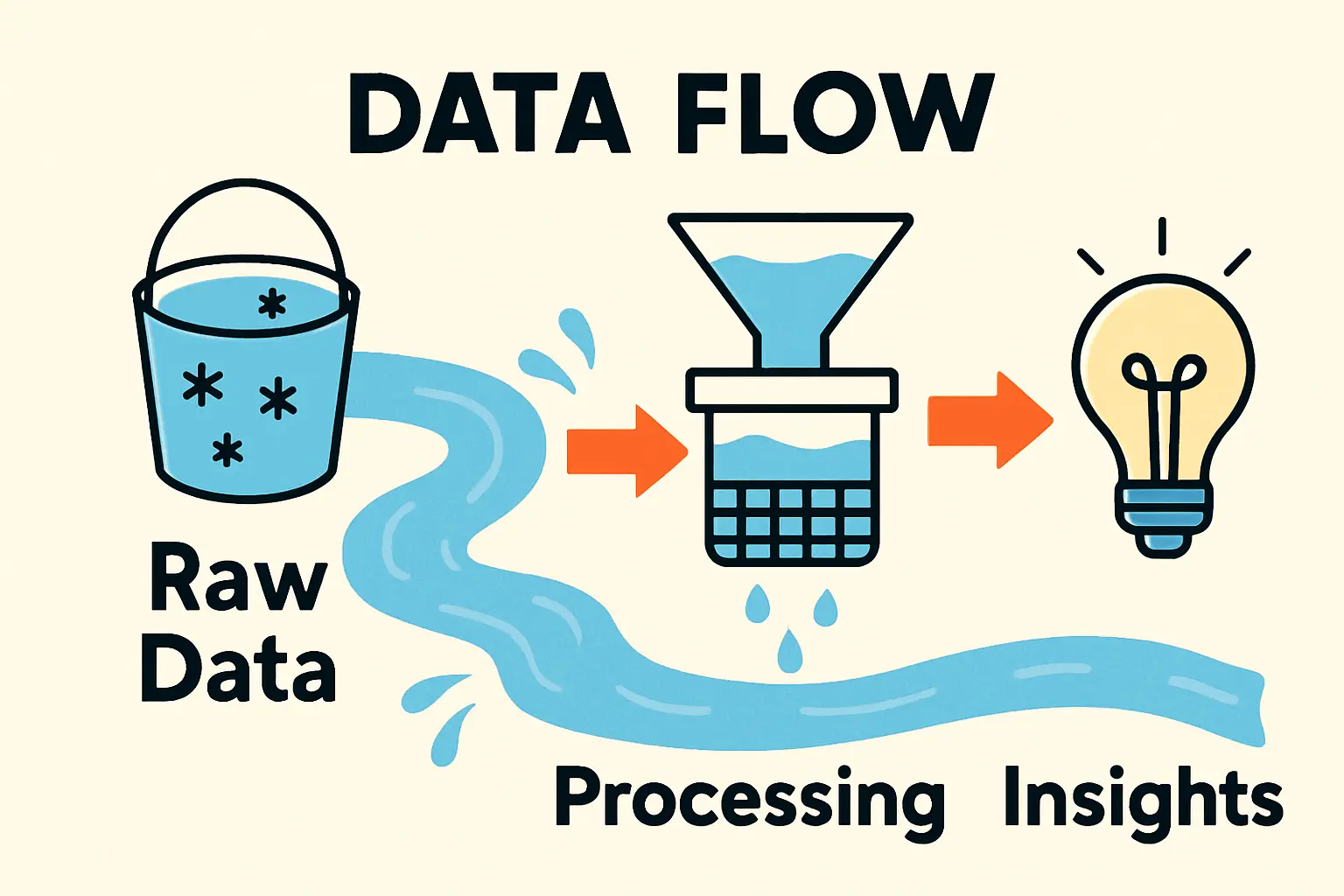

Since dedicated solar module manufacturing is a nascent industry in Malta, expecting a large pool of candidates with direct experience is unrealistic. A structured training program is therefore not just an advantage—it is a necessity. The operation’s success hinges on bridging this knowledge gap effectively.

Leveraging Transferable Skills

The core strategy is to hire for foundational competence and train for specific applications. A candidate’s aptitude for technical work and their experience in a regulated manufacturing environment are more important than prior solar knowledge.

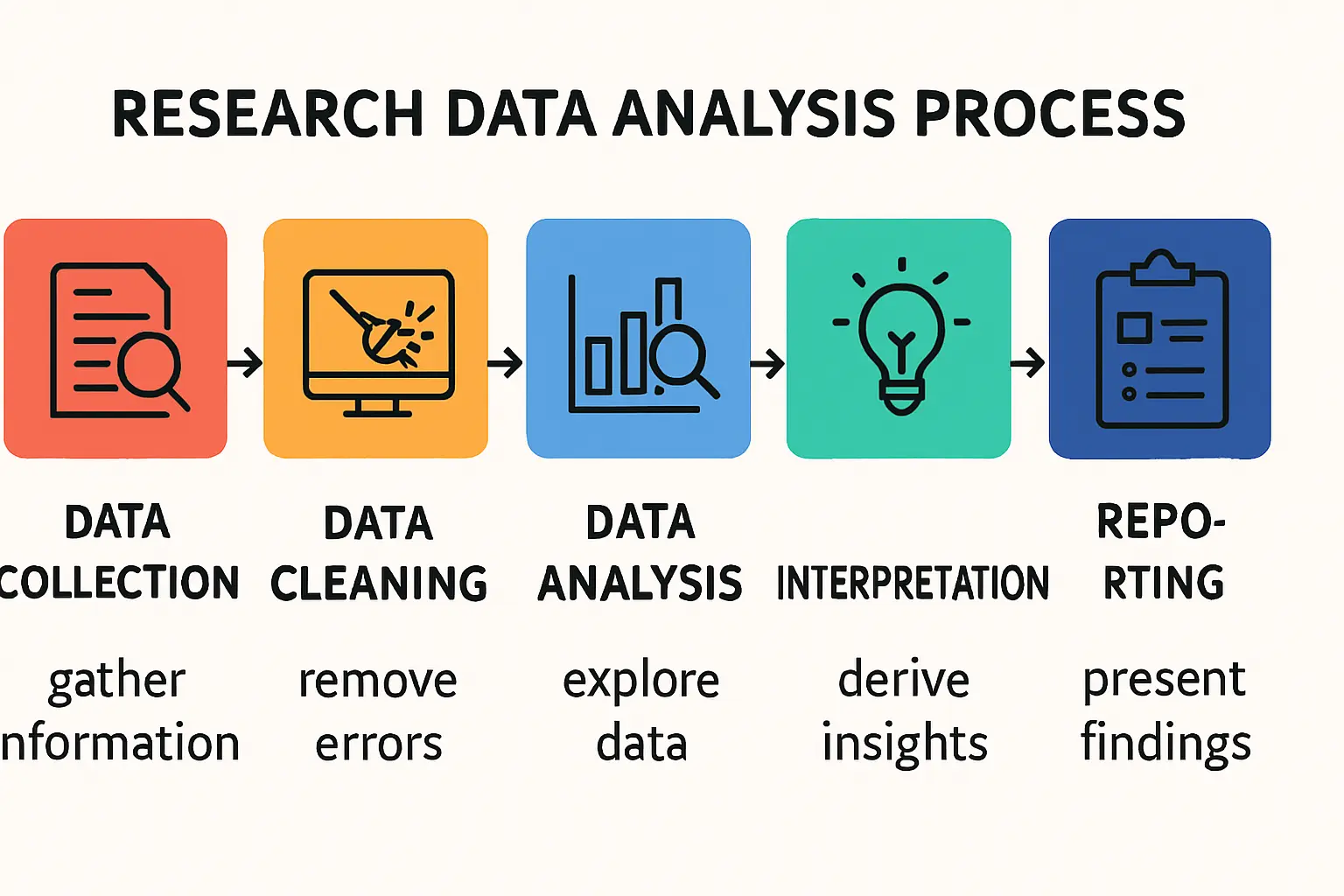

A comprehensive training plan, often developed as part of a turnkey solar panel production line, should cover:

-

PV Technology Fundamentals: The science behind solar cells and module construction.

-

Machine-Specific Operations: Hands-on training for each piece of equipment, from the stringer to the sun simulator.

-

Process Control: Understanding the critical parameters of processes like lamination and curing.

-

Quality Standards: Training on IEC standards and in-house quality control procedures.

Government Support for Upskilling

The Maltese government actively encourages workforce development. Organizations like Jobsplus, the national employment agency, offer various schemes and incentives to support companies in training and upskilling their employees. These programs can help offset the costs associated with developing a specialized team, making the investment in local talent more financially viable. Engaging with these agencies early in the planning process can be a significant advantage.

Practical Considerations for an Investor

Building a team in Malta requires a realistic and informed approach. Based on experience from J.v.G. turnkey projects in new markets, investors should consider the following:

-

Realistic Wage Expectations: The competitive labor market and inflation have led to rising wage expectations. A thorough analysis of prevailing salaries for technical roles is a crucial part of the initial solar factory business plan.

-

Employee Retention: Attracting talent is only half the battle. Creating a professional work culture with clear paths for career advancement is essential for long-term retention, particularly as the ‘brain drain’ of skilled workers to other EU countries is a known challenge.

-

Phased Recruitment: It is advisable to begin by hiring a core management and engineering team. This group can then be deeply involved in the factory setup and equipment commissioning, gaining product and process knowledge before they help recruit and train the wider operational staff.

Frequently Asked Questions (FAQ)

Do I need to hire staff with prior solar manufacturing experience?

Not necessarily. While advantageous, it’s more critical to hire individuals with strong foundational skills in engineering, manufacturing processes, and quality control from adjacent industries. A structured, in-depth training program can bridge the specific PV knowledge gap.

What are the most critical roles to fill first?

The first hires should be a Plant Manager and a Lead Process or Production Engineer. These individuals will be instrumental in overseeing the project’s implementation phase, from factory layout to equipment installation and commissioning.

How much does language impact recruitment in Malta?

English is an official language in Malta and is widely spoken in business, technical, and educational contexts. This significantly simplifies the recruitment and management of a diverse, multinational team.

What is a typical timeframe for recruiting and training a core team?

For a small-to-medium-scale factory (20-50 MW), an investor should budget approximately 3-6 months for the recruitment and initial training of the core technical and operational team. This timeline runs parallel to the procurement and shipping of the production equipment.

A Strategic Approach to Building Your Maltese Team

The Maltese labor pool presents a landscape of opportunity tempered by competition. The nation’s strategic pivot to high-value manufacturing and its investment in technical education have created a solid foundation of skilled and adaptable workers. For an investor, success depends not on finding a ready-made solar workforce, but on the ability to identify potential, leverage transferable skills, and implement a robust training program.

By understanding the local industrial context and planning for comprehensive workforce development, an investor can build a competent, dedicated team capable of producing high-quality solar modules in the heart of the Mediterranean.