An entrepreneur invests months in planning, securing capital, and selecting the finest European machinery for a new solar module factory. The state-of-the-art stringer and laminator are finally dispatched, but weeks later, the equipment sits immobile in a container at the Port of Casablanca, stalled by documentation issues and unexpected tax assessments.

This scenario, a common challenge for new entrants, reveals a critical truth: understanding customs procedures is as important as the technology itself. Navigating the import process in a new market can seem daunting. For business leaders entering Morocco’s solar manufacturing sector, mastering the logistics of customs clearance is essential to operational success. This guide provides a clear overview of the tariff structures, procedural steps, and strategic considerations for importing essential machinery into the country.

The Strategic Context: Why Morocco Prioritizes Solar Investments

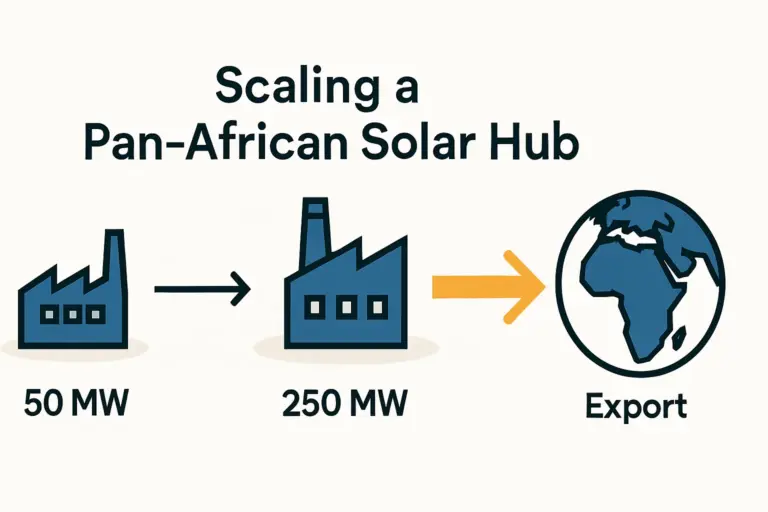

Morocco has established itself as a regional leader in renewable energy, with an ambitious goal to source over 52% of its electricity from renewables by 2030. This national strategy is supported by a legal and financial framework designed to attract foreign investment in the green energy sector.

The Moroccan government actively encourages the development of local manufacturing capabilities through its Investment Charter. This framework provides significant incentives, including potential exemptions from import duties and Value Added Tax (VAT) for capital goods. For an entrepreneur establishing a solar module factory, this means that the high-value solar module manufacturing equipment needed for production may qualify for preferential customs treatment, substantially reducing the initial capital outlay.

Understanding this context is crucial, as the customs process is not merely an administrative hurdle; it is a gateway shaped by national economic policy.

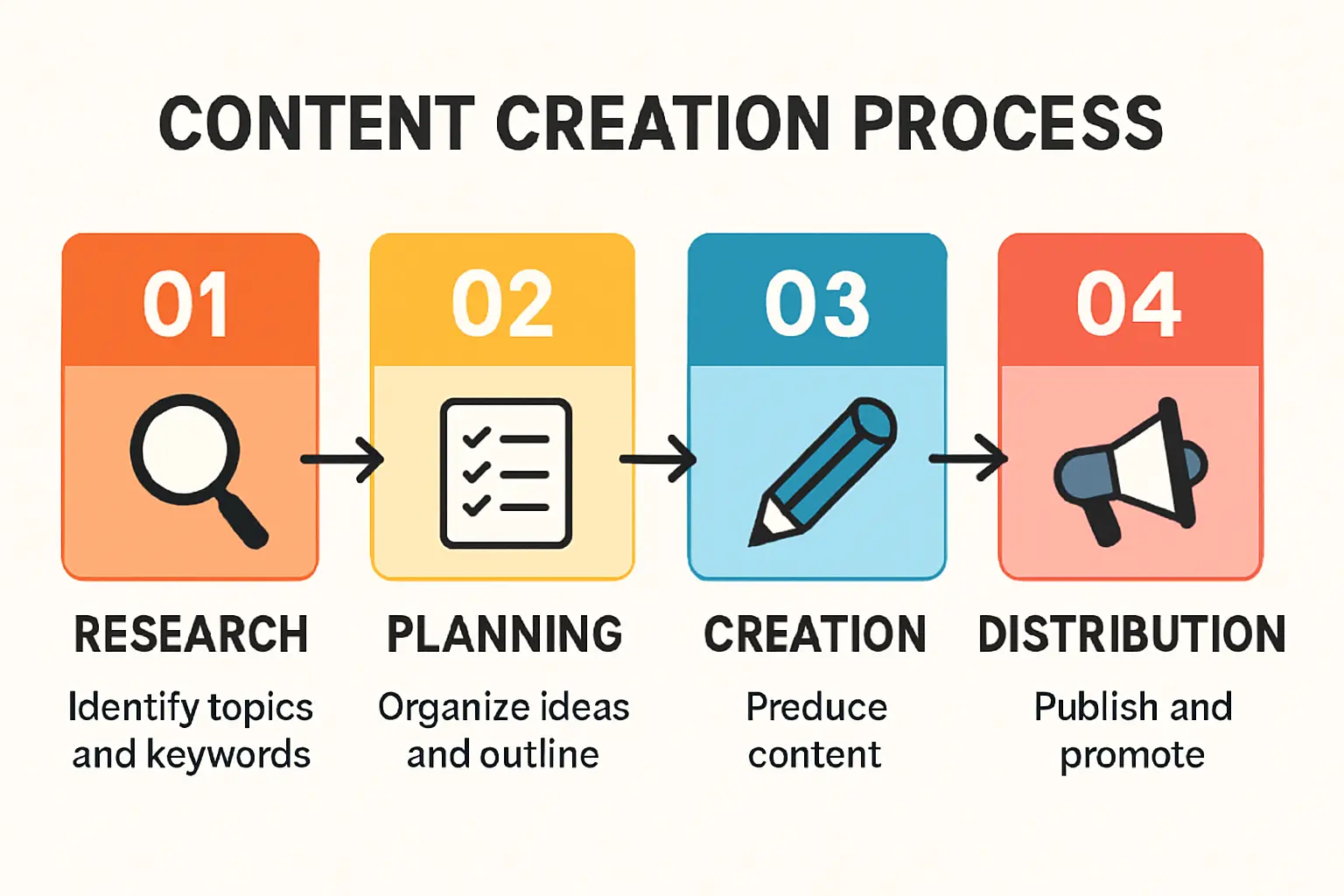

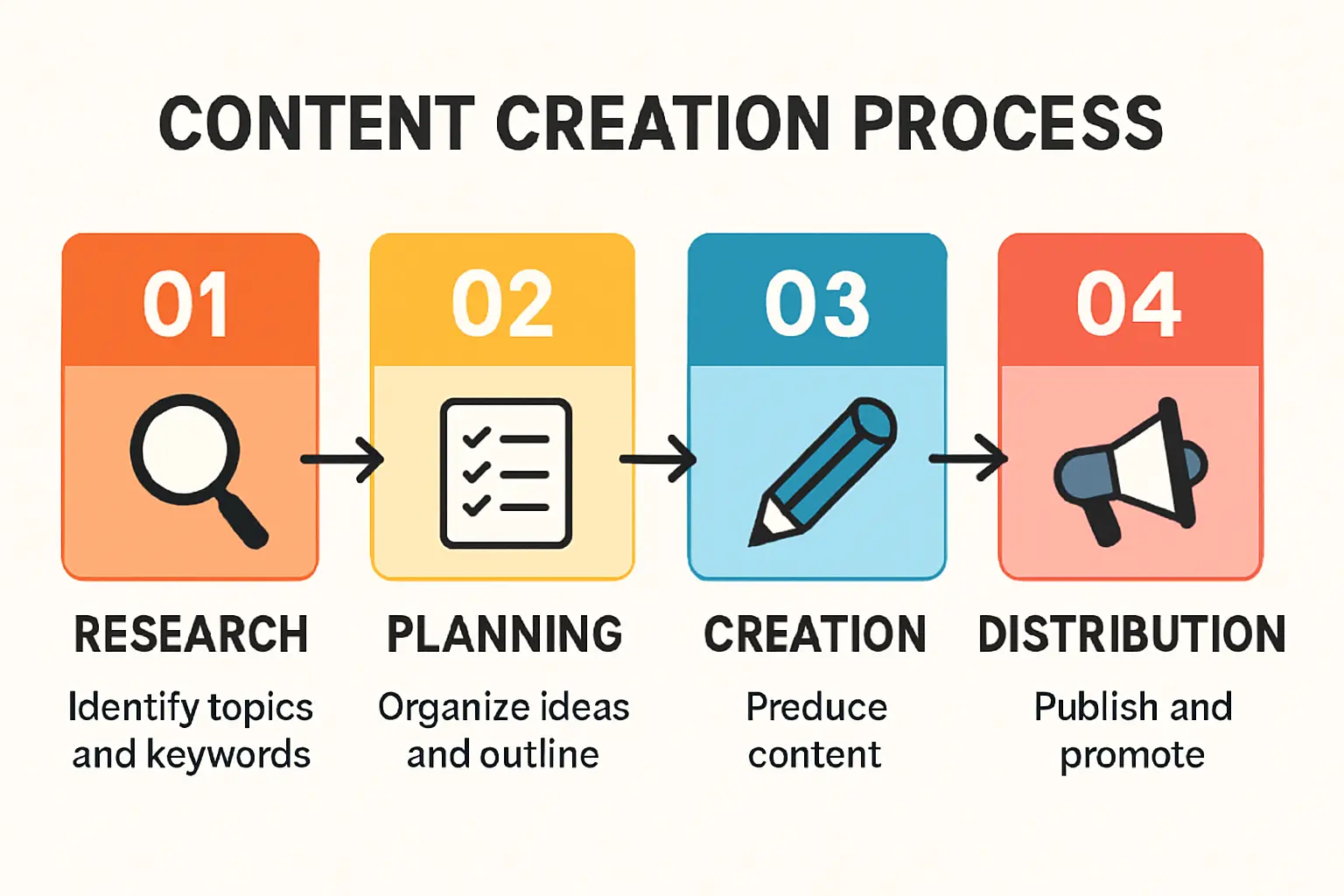

A Step-by-Step Guide to the Moroccan Import Process

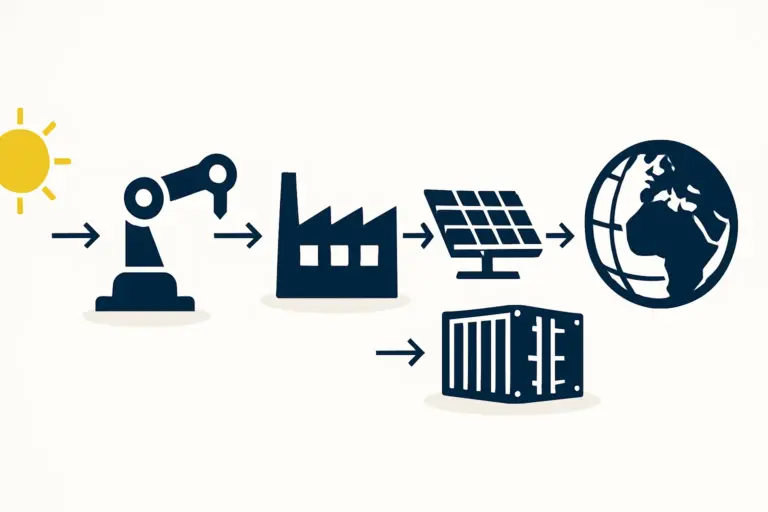

Successfully importing heavy machinery involves a sequence of precise steps. While a professional customs broker is indispensable, business owners must understand the process to manage it effectively. The typical journey, based on experience from J.v.G. turnkey projects, follows a clear, logical flow.

Step 1: Pre-Shipment Documentation

Accuracy is paramount. Before the equipment leaves the manufacturer, ensure all documentation is complete and correct. The core documents include:

- Commercial Invoice: Details the transaction between the buyer and seller, including the value of the goods.

- Packing List: An itemized list of the shipment’s contents, with weights and dimensions.

- Bill of Lading (B/L) or Air Waybill (AWB): The contract between the owner of the goods and the carrier.

- Certificate of Origin: Certifies the country where the goods were manufactured.

- Technical Specifications: Detailed documentation for the machinery, which helps customs officials with classification.

Step 2: Engaging a Licensed Customs Broker

In Morocco, it is mandatory to work with a licensed customs broker (transitaire) for commercial imports. This local expert is authorized to deal with the customs authority—Administration des Douanes et Impôts Indirects (ADII)—on your behalf. They handle the submission of declarations through the national online system, BADR, and navigate the local regulatory landscape.

Step 3: Goods Arrival and Customs Declaration

Upon arrival at a major port like Tanger Med or Casablanca, your broker will submit a detailed customs declaration. This declaration includes the Harmonized System (HS) code for each piece of equipment—a standardized numerical method for classifying traded products. For example, automatic solar cell stringers and laminators fall under specific subheadings within Chapter 84 of the HS nomenclature, which covers industrial machinery.

Step 4: Inspection and Valuation

Moroccan customs officials may conduct a physical inspection to verify that the shipment matches the declaration. They also assess the declared value of the goods to ensure it aligns with market rates. Any discrepancies can lead to delays and penalties.

Step 5: Assessment and Payment of Duties & Taxes

Once the declaration is accepted and the goods are valued, the ADII calculates the applicable import duties, VAT, and any other relevant taxes. If an exemption has been pre-approved under the Investment Charter, the corresponding duties will be waived.

Step 6: Release and Final Delivery

After all duties and taxes are paid (or the exemption is applied), customs will issue a release order. The equipment can then be cleared from the port and transported to your factory site, ready for installation.

Navigating Tariffs and Securing Exemptions

For entrepreneurs investing in a solar factory, managing import costs is a key financial consideration. Here is what to expect regarding tariffs and how to leverage available incentives.

Standard Duties and Taxes

Without any exemptions, imported industrial machinery is typically subject to:

- Import Duty: The standard rate for many types of capital goods is relatively low, often around 2.5%.

- Value Added Tax (VAT): The standard VAT rate in Morocco is 20%, calculated on the customs value plus the import duty.

A 20% VAT on a multi-million-dollar equipment purchase represents a significant upfront cost. The Investment Charter, however, offers a powerful solution.

The Investment Charter Exemption

New investment projects that meet certain criteria (such as job creation and value addition) can apply for an exemption from both import duties and VAT on capital goods.

Key Considerations:

- Proactive Application: The exemption must be applied for and granted before the equipment is shipped. This process involves submitting a detailed investment file to the relevant authorities.

- Critical Documentation: The application requires a comprehensive business plan, proof of financing, and a detailed list of the equipment to be imported.

- Time Allocation: Securing this approval can take several weeks. Investors often underestimate this timeline—a common pitfall that can lead to logistical complications.

By planning ahead and securing these exemptions, a business can eliminate a major upfront cost, freeing up capital for other critical areas like raw material procurement and workforce training.

Common Pitfalls and How to Avoid Them

- Incorrect HS Codes: Misclassifying machinery can result in incorrect duty calculations and potential fines. Always confirm the correct HS codes with both your equipment supplier and your customs broker.

- Documentation Discrepancies: A simple mismatch between the commercial invoice and the packing list can halt the entire clearance process. A thorough review of all documents is essential before dispatch.

- Underestimating Timelines: Standard customs clearance can take one to two weeks, but this assumes all paperwork is in order. Any complication can extend this period significantly. It’s prudent to build a buffer of at least four weeks into your project timeline for the customs process.

For those implementing a turnkey solar manufacturing line, the project partner often manages these complex logistics, absorbing the administrative burden and using their experience to ensure a smooth process.

Frequently Asked Questions (FAQ)

What is an HS Code and why is it important?

The Harmonized System (HS) code is an international standard for classifying goods. It is used by customs authorities worldwide to identify products and apply the correct duties and taxes. Using the precise HS code for your solar stringer or laminator is legally required and ensures you pay the correct tariff.

Is a local customs broker truly necessary?

Yes, for commercial shipments in Morocco, using a licensed customs broker is mandatory. Their expertise in local regulations, relationships with port authorities, and access to the BADR declaration system are essential for a smooth clearance process.

How does the customs process differ for used equipment?

Importing used or refurbished equipment can involve additional scrutiny and may require a pre-shipment inspection certificate from an approved agency to verify its condition and value. The rules are often stricter compared to those for new machinery.

Which Moroccan ports are best for importing heavy machinery?

The ports of Tanger Med and Casablanca are the largest and best-equipped to handle oversized and heavy industrial cargo. They have established infrastructure and efficient connections to major industrial zones across the country.

Planning for a Smooth Entry

Importing solar manufacturing equipment into Morocco is a structured process that, while complex, is entirely manageable with diligent preparation and expert guidance. The country’s pro-investment policies, particularly the potential for duty and VAT exemptions, offer a significant financial advantage to well-prepared entrepreneurs.

By understanding the key steps, anticipating documentation requirements, and allocating sufficient time, you can transform a potential logistical bottleneck into a smooth part of your factory setup. This foresight ensures that your high-value equipment arrives at your facility on time and on budget, ready to begin producing high-quality solar modules that meet international solar panel certification standards.