An entrepreneur in Kuwait, already successful in construction or logistics, sees the government’s frequent announcements of large-scale solar energy projects. He recognizes the immense potential but assumes the contracts will inevitably go to major international manufacturers.

What he may not realize is how the government has structured its policies to give a significant, often decisive, advantage to entrepreneurs just like him—provided they manufacture the solar modules locally.

This isn’t a minor preference; it’s a core component of Kuwait’s national strategy. For the discerning investor, understanding these incentives transforms the prospect of solar manufacturing from a high-risk venture into a calculated, strategic investment with a protected local market.

This article breaks down the financial incentives and tendering frameworks designed to foster a domestic solar production industry under the ‘New Kuwait 2035’ vision.

The Strategic Foundation: ‘New Kuwait 2035’ and Renewable Energy

The primary driver for the solar opportunity in Kuwait is the nation’s ambitious ‘New Kuwait 2035’ vision. A central pillar of this strategy is economic diversification away from oil dependency and the development of sustainable infrastructure.

To achieve this, the government has set a target to generate 15% of its total energy demand from renewable sources by 2030. This target means a multi-gigawatt pipeline of solar projects over the coming decade. Flagship developments like the Al-Shagaya Renewable Energy Park are not isolated initiatives but the first of many large-scale projects that will require a steady supply of millions of solar modules.

This government-led demand creates a predictable and substantial market, reducing the uncertainty often associated with new industrial ventures. The state’s goal is not merely to install solar panels but to use this transition to build local industrial capacity, create skilled jobs, and foster technology transfer.

The Core Incentive: The Power of ‘Local Content’ Preference

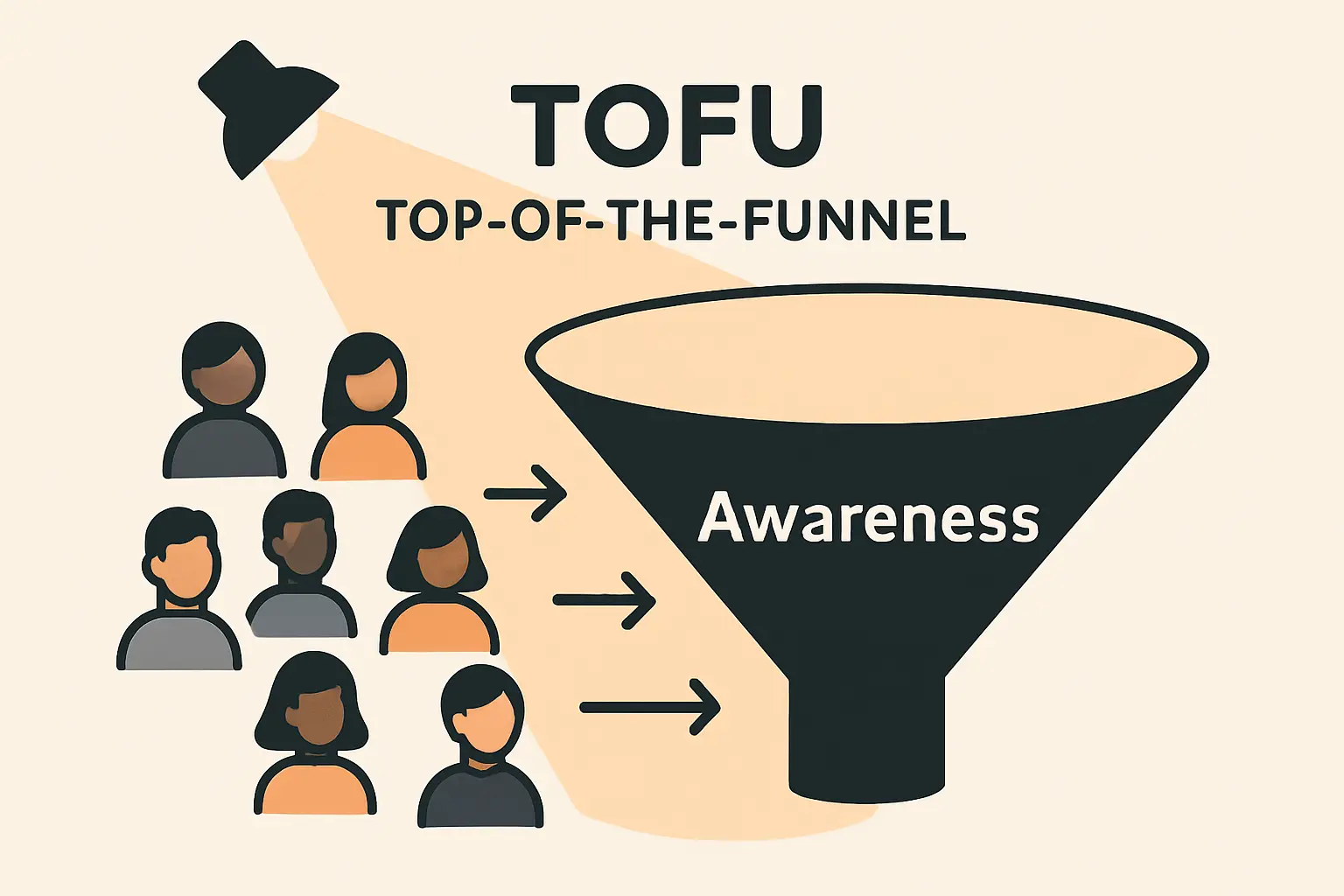

The most powerful, yet often misunderstood, advantage for a local producer lies in the government’s emphasis on ‘local content’. For public tenders in major energy and infrastructure projects, ‘local content’ refers to the use of goods and services that are produced or supplied from within Kuwait.

When entities like the Kuwait National Petroleum Company (KNPC) or the Ministry of Electricity & Water (MEW) issue tenders for solar power plants, the evaluation criteria extend beyond the lowest price. Bids that commit to using locally manufactured solar modules receive preferential treatment. This preference can be a significant factor in the final selection, effectively creating a protected market for domestic manufacturers.

An international company bidding for a project might offer a slightly lower price by importing modules from a mass-production facility abroad. However, a competing bid that incorporates modules from a Kuwaiti factory, even at a slightly higher cost, may be deemed more valuable to the state’s long-term economic goals and therefore win the contract. This policy directly mitigates price competition from established global players.

Unlocking Financial Benefits: Key Government Support Mechanisms

To support new local industries, the Kuwaiti government offers several powerful financial incentives through key state authorities.

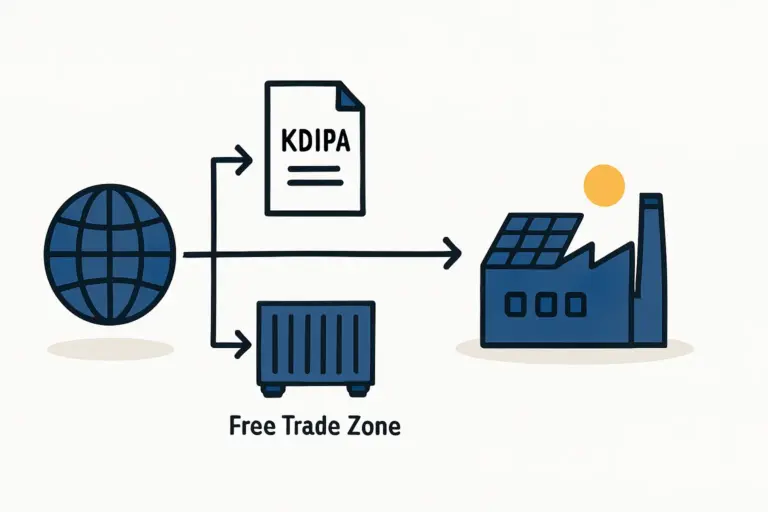

The Kuwait Direct Investment Promotion Authority (KDIPA)

For foreign investors or joint ventures, KDIPA is the primary gateway to establishing a business in Kuwait. Created to attract value-added investment, it offers a compelling package of benefits to qualifying companies, including those in the renewable energy manufacturing sector.

Key incentives offered by KDIPA include:

- Tax Exemption: A potential corporate income tax holiday of up to ten years.

- Customs Duty Relief: Full or partial exemption from customs duties on the importation of necessary raw materials and, crucially, the machinery required for a turnkey solar production line.

- Full Foreign Ownership: Permission for up to 100% foreign ownership of a Kuwaiti company, providing full control over the investment.

These incentives directly address the two largest financial hurdles for a new factory: initial capital expenditure on equipment and early-stage profitability.

Public-Private Partnerships (PPP) Framework

The Kuwait Authority for Partnership Projects (KAPP) facilitates long-term partnerships between the public and private sectors to develop major infrastructure projects. Many of the country’s upcoming large-scale solar farms will likely be structured as PPPs.

For a local module manufacturer, this framework provides a clear and stable source of demand. The private consortium that wins a 25-year contract to build and operate a solar park becomes a long-term, high-volume customer. Being a pre-qualified local supplier for such projects is a significant commercial advantage.

Understanding the Tendering Process: How to Qualify as a Preferred Supplier

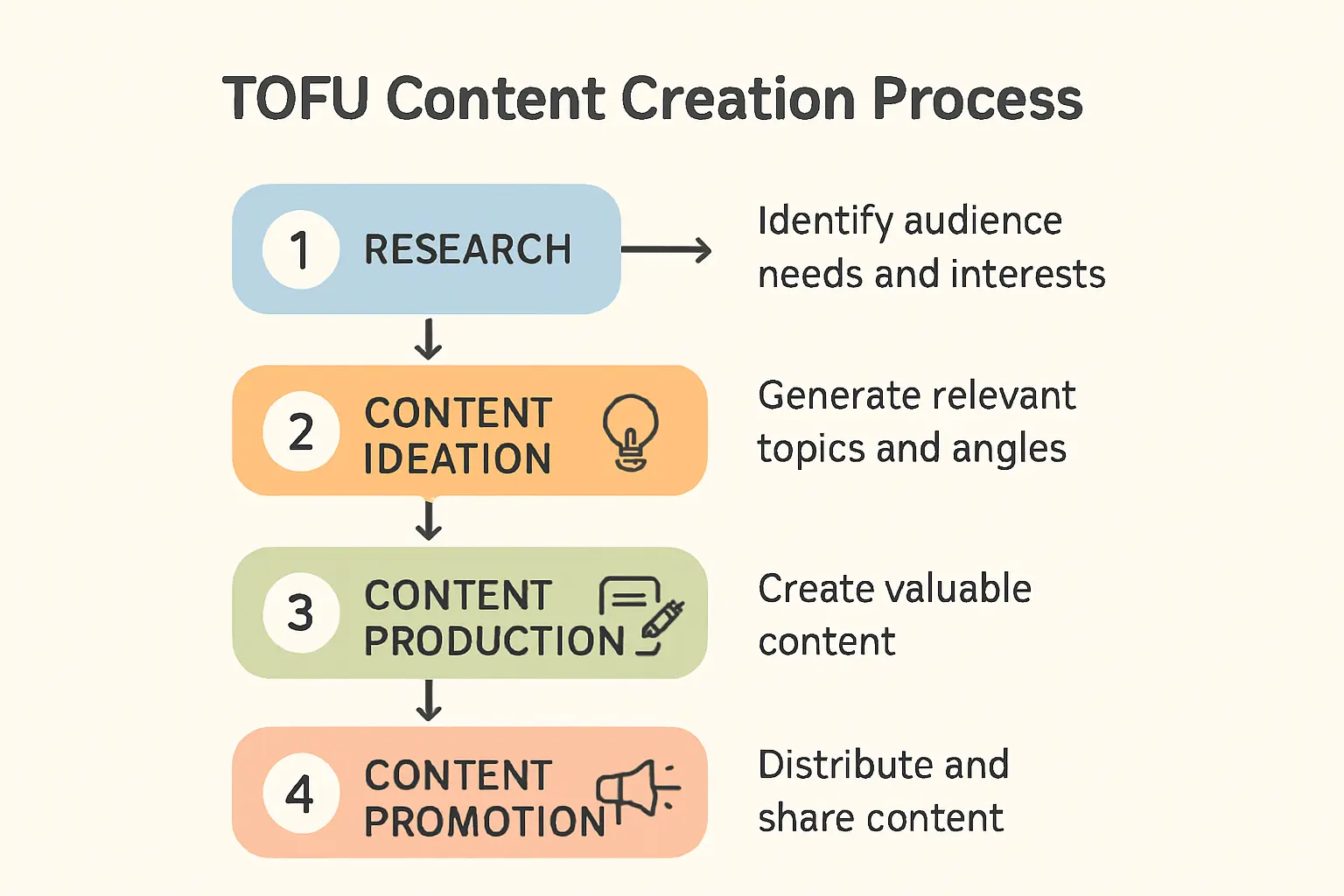

Navigating the public procurement system is critical. Tenders are typically managed by the Central Agency for Public Tenders (CAPT) or directly by state-owned entities. While each tender has specific requirements, the process generally follows a structured path where local content is evaluated.

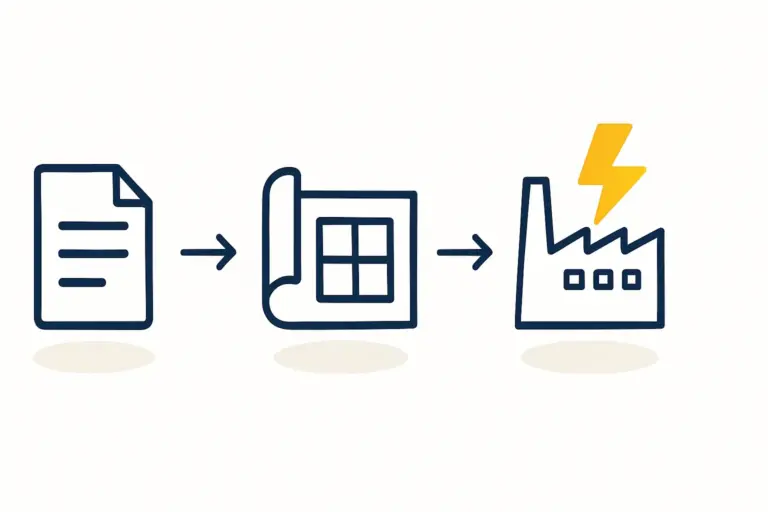

A simplified view of the process looks like this:

-

Pre-Qualification: Companies must register and prove their technical and financial capacity. Having an operational or near-operational manufacturing facility in Kuwait is a fundamental pre-qualification step.

-

Bid Submission: Submitting a detailed technical proposal (outlining the quality and specifications of the modules) and a commercial proposal (pricing).

-

Evaluation: Bids are assessed against multiple criteria. The evaluation committee will score the bids based on technical compliance, financial viability, and strategic value to Kuwait—this is where the local content preference is applied.

An investor who understands this process can strategically position their company to maximize the local content score, turning a regulatory requirement into a competitive moat.

The Practical Implications for an Aspiring Solar Manufacturer

These policies converge to create a uniquely favorable environment for early movers in Kuwait’s solar manufacturing sector. The key takeaway is that the business case is not based on competing with global giants on price, but on becoming a strategic partner in the nation’s economic development.

An investor considering how to start a solar factory in Kuwait can therefore plan with a degree of market security that is rare in other regions. The challenge shifts from ‘Can I compete?’ to ‘Can I meet the quality and volume standards required by national projects?’

This requires a deep understanding of the solar panel manufacturing process and a commitment to operational excellence. Experience from J.v.G. Technology turnkey projects shows that establishing a production line that meets these international quality standards follows a structured process and can be achieved within a predictable timeframe, provided the planning is sound.

Frequently Asked Questions (FAQ)

What exactly qualifies as ‘local content’ for solar modules?

While specific definitions can vary by tender, it generally requires that significant value-adding stages of the manufacturing process—such as cell stringing, layup, lamination, and framing—are performed inside Kuwait. Simple final assembly of pre-fabricated kits may not be sufficient.

Do these incentives apply only to Kuwaiti citizens?

No. The framework established by KDIPA is specifically designed to attract foreign capital and expertise. It allows for up to 100% foreign ownership of a Kuwaiti entity, which can then fully benefit from the available incentives and local content preferences.

How complex is the tendering process for a newcomer?

The process is formal and rigorous, demanding meticulous preparation of technical documents, financial statements, and quality certifications, but it is standardized. For a well-prepared company with a solid production foundation, the complexity is manageable, and the built-in preference for local producers provides a distinct advantage.

What is the typical scale of a government-led solar project in Kuwait?

Projects can range from tens to hundreds of megawatts. A single 100 MW project, for example, would require approximately 250,000 to 300,000 solar modules, representing a substantial order for a local factory.

The path to becoming a key supplier for Kuwait’s energy future is paved with clear government strategy and powerful financial incentives. For the investor willing to invest in local production capacity, the opportunity extends beyond a single project to becoming an integral part of the nation’s sustainable development vision.