Choosing a location for a new manufacturing facility is a critical decision for any entrepreneur. While factors like capital and technology are vital, the physical location ultimately shapes a project’s operational costs, logistical efficiency, and long-term viability—especially in geographically distinct markets.

This article uses New Zealand as a case study to provide a framework for analyzing a key strategic choice: whether to establish a solar module factory in the populous North Island or the resource-rich South Island. While the analysis focuses on New Zealand, the principles for evaluating labor, logistics, energy, and incentives apply to any investor weighing potential solar factory locations.

Foundational Criteria for Site Selection

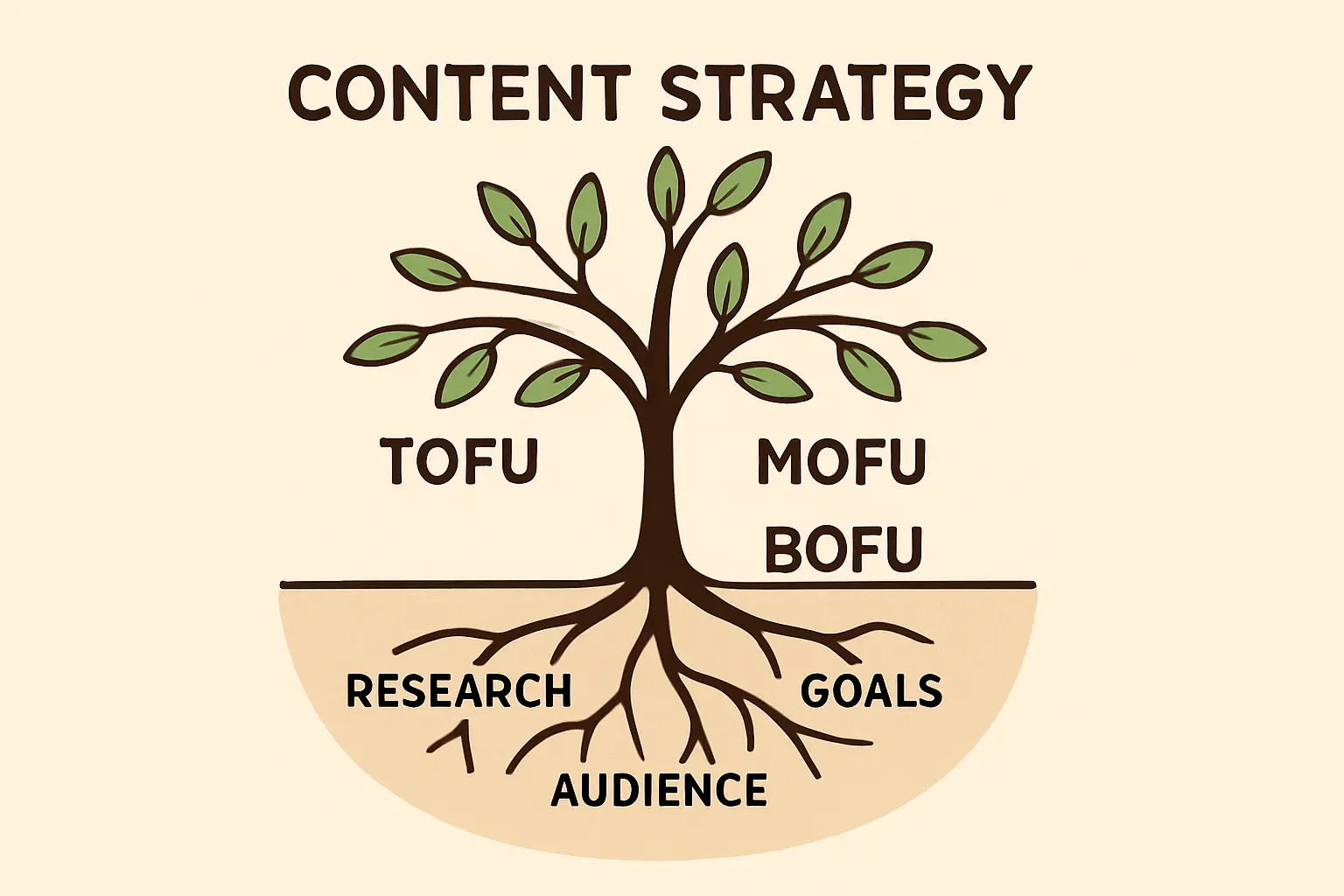

A robust site selection process for a solar manufacturing operation evaluates four key pillars:

-

Labor and Skills: Access to a qualified workforce, from technicians and engineers to management and administrative staff.

-

Logistics and Supply Chain: Proximity to ports for importing raw materials and exporting finished modules, as well as the efficiency of inland transport networks.

-

Energy Costs and Availability: Solar module manufacturing is an energy-intensive process, making stable and cost-effective electricity a significant competitive advantage.

-

Regulatory Environment and Incentives: Support from local and regional governments, including grants, tax benefits, and streamlined permitting processes.

Comparative Analysis: The North Island vs. The South Island

An investor looking at New Zealand will find two very different value propositions. The North Island is the nation’s commercial and demographic heart, while the South Island offers an industrial legacy and an abundance of renewable energy.

The North Island: Commercial Hub and Population Center

The North Island is home to over 75% of New Zealand’s population, including its largest city, Auckland, and the capital, Wellington. This concentration drives its primary advantages.

-

Labor and Skills: The talent pool is significantly larger and more diverse. According to a 2023 NZ Skills Outlook report, the Auckland and Waikato regions host the highest concentration of engineering and high-tech manufacturing professionals. This provides access to experienced staff but also creates more competition for talent, potentially leading to higher wage expectations.

-

Logistics and Port Access: The Ports of Auckland and Tauranga are the country’s two largest container ports, handling the majority of international freight. They offer excellent shipping line connectivity to key markets in Asia and North America. This high traffic, however, can lead to more port congestion and higher associated logistical costs compared to southern ports.

-

Market Proximity: Locating a factory in the North Island places it closer to the largest domestic market for solar panels, reducing final-stage distribution costs and lead times for local projects.

The South Island: Industrial Heritage and Energy Powerhouse

The South Island, particularly the Canterbury region around Christchurch, has a strong history of manufacturing and engineering. Its key advantage, however, lies in its energy infrastructure.

-

Energy Costs: The South Island generates the vast majority of its electricity from a network of large hydroelectric power stations. This grid provides some of the lowest and most stable industrial electricity prices in the OECD. A recent MBIE Energy Price Report noted that large industrial users in the lower South Island could secure long-term contracts for as low as NZD 0.12/kWh, compared to a North Island average closer to NZD 0.18/kWh. For an energy-intensive operation, this 33% cost reduction is a powerful financial incentive.

-

Labor and Skills: While the overall talent pool is smaller, regions like Canterbury have a skilled workforce with deep experience in industrial processes. Experience from J.v.G. Technology GmbH in setting up turnkey lines globally shows that a dedicated, well-trained local team is often more valuable than a larger, more transient workforce. The necessary workforce training can be adapted to the specific skills available in the region.

-

Regional Incentives: Development agencies in the South Island are often highly motivated to attract new industries to diversify their economies. This motivation often translates into more attractive incentives, such as capital investment grants, support with land acquisition, and dedicated project management assistance from local authorities.

Synthesizing the Data: A Strategic Decision Framework

The choice is not about which island is ‘better’, but which one is better aligned with a specific business model and its priorities.

| Factor | North Island Advantage | South Island Advantage | Strategic Implication |

|---|---|---|---|

| Operational Costs | Lower final distribution costs. | Significantly lower energy costs. | If minimizing production cost per module is the goal, the South Island’s energy advantage is key. |

| Logistics | Superior international port connectivity. | Lower port congestion. | If exporting to Asia, the North Island offers more direct routes. For Australia, the South is efficient. |

| Labor | Larger, more diverse talent pool. | Stable, skilled industrial workforce. | A highly automated line may thrive in the South, while R&D may favor the North. |

| Market Access | Proximity to 75% of the domestic market. | Stronger access to the growing Australian market. | The decision depends on the target customer: domestic installation vs. international export. |

Based on experience from past J.v.G. turnkey projects, a client whose model relied on high-volume, automated production for export to Australia found that the energy savings in a location like the South Island provided a decisive competitive edge. Conversely, a client focused on bespoke, high-value modules for a concentrated domestic urban market benefited from being near the main commercial hub.

Beyond the Primary Factors: Second-Order Considerations

Beyond these primary factors, a comprehensive analysis should also weigh other critical considerations.

-

Land Availability and Cost: Industrial land is generally more available and affordable in the South Island, reducing the initial capital outlay. A typical 50 MW turnkey solar module manufacturing line requires approximately 3,000 to 4,000 square meters, and securing a suitable site is a critical first step.

-

Supply Chain Resilience: While most raw materials will be imported, having local suppliers for maintenance, packaging, and other operational needs can reduce downtime.

-

Scalability: The potential for future expansion is a crucial long-term consideration. A site with ample adjacent land and scalable utility connections offers significant strategic value.

Frequently Asked Questions (FAQ)

What are the typical investment requirements for a small-scale solar factory?

The investment requirements for a 20-50 MW semi-automated line typically range from USD 3 to 6 million for machinery and initial setup, excluding the building and land. The site selection can influence this through land costs and the need for utility upgrades.

How critical are government incentives in the final decision?

While financial incentives are attractive, they should not be the primary driver. A location with strong fundamentals, like low energy costs and good logistics, provides sustainable benefits long after a short-term grant is spent. Incentives should be seen as a bonus, not the foundation of the business case.

Does proximity to raw material suppliers matter in a place like New Zealand?

Since most core components like solar cells and specialized glass are imported, direct port access is more critical than proximity to raw material sources. The focus then shifts to the efficiency and cost of moving containers from the port to the factory.

How long does it typically take to establish a production line?

With a structured approach and a clear plan, a new solar module production line can become operational in under 12 months, from initial planning to the first certified module coming off the line.

Conclusion and Next Steps

The case of New Zealand’s North vs. South Island illustrates a core principle of manufacturing investment: there is no single ‘best’ location. The optimal choice is always a function of a company’s specific business strategy.

An export-focused, cost-driven model will prioritize the energy and operational advantages of a region like the South Island. A domestic-focused, service-oriented model may find the market proximity and talent pool of the North Island more compelling.

This kind of detailed, data-driven comparison is the foundation of a sound investment decision. By systematically evaluating each critical factor, entrepreneurs can move beyond assumptions and build a business case grounded in the economic and logistical realities of their chosen market.

Understanding these variables is the first step in a complex but manageable journey. For those looking to build a deeper understanding of the entire process, pvknowhow.com provides structured educational resources to guide new market entrants.