For many international entrepreneurs, the decision to enter the solar module manufacturing market is driven by opportunity, but the question of where to establish production hinges on the complexities of logistics, tariffs, and market access. While traditional manufacturing hubs in Asia have long dominated the supply chain, a strategic shift is underway. Business leaders are increasingly looking for locations that offer supply chain resilience and preferential access to growing markets. The Republic of Panama offers a compelling, and often overlooked, strategic advantage.

This analysis examines the business case for establishing a solar module production facility within Panama’s Special Economic Zones (SEZs) and explores the specific fiscal, logistical, and regulatory frameworks that make this Central American nation a powerful base for serving the rapidly expanding solar markets of North and South America.

Why Consider Panama for Solar Manufacturing?

The global supply chain disruptions of recent years have highlighted the risks of concentrating production in a single region. In response, businesses are adopting ‘nearshoring’ strategies—locating manufacturing operations closer to their end markets. For entrepreneurs targeting the Americas, Panama offers a unique combination of geographical centrality and business-friendly policies.

Positioned as the land bridge between North and South America, Panama provides unparalleled access to both continents. Its strategic location is not merely geographical; it is the cornerstone of a logistics infrastructure built around one of the world’s most critical maritime trade routes—the Panama Canal.

This unique position allows a manufacturer to source raw materials globally and distribute finished solar modules efficiently throughout the Western Hemisphere, significantly reducing shipping times and costs compared with an Asian production base.

Understanding Panama’s Special Economic Zones (SEZs)

A Special Economic Zone is a geographically designated area that operates under different economic regulations than the rest of the country. These zones are specifically designed to attract foreign investment by offering a suite of incentives, simplified administrative procedures, and world-class infrastructure.

The core purpose of an SEZ is to create a highly competitive environment for export-oriented businesses. For a prospective solar module manufacturer, this translates into a framework designed to minimize operational hurdles and maximize financial efficiency. The process of setting up a turnkey solar module manufacturing line becomes more streamlined within a structured environment that removes many bureaucratic hurdles. Key benefits typically include:

- Fiscal Incentives: Substantial reductions or exemptions on corporate taxes, import duties, and export taxes.

- Logistical Advantages: Access to premier ports, airports, and logistics networks with simplified customs procedures.

- Regulatory Stability: Clear and stable legal frameworks governing investment, labor, and operations, often with dedicated administrative bodies to assist investors.

A Closer Look at Key Panamanian SEZs

Panama is home to several SEZs, each with a distinct focus. Two of the most relevant for solar module manufacturing are the Colón Free Zone and Panamá Pacífico.

The Colón Free Zone (CFZ): A Global Logistics Powerhouse

Established in 1948, the Colón Free Zone is the largest free zone in the Americas and the second largest in the world. Situated at the Atlantic entrance to the Panama Canal, its primary strength lies in logistics and trade. The CFZ is a hub for importing goods in bulk, storing them, and then re-exporting them to markets throughout Latin America and the Caribbean.

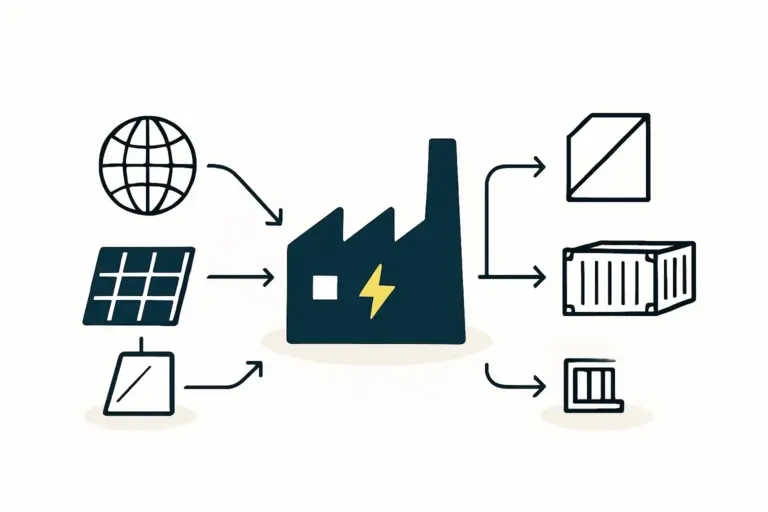

For a solar panel factory, the CFZ offers a powerful model:

- Duty-Free Imports: Raw materials, such as solar cells, EVA film, glass, and aluminum frames, can be imported into the zone without incurring import tariffs.

- Re-Export Efficiency: Finished solar modules can be exported to regional markets without being subject to Panamanian export taxes, making the final product highly cost-competitive.

- Established Infrastructure: The zone provides access to a vast network of warehouses, logistics providers, and shipping lines accustomed to handling high volumes of international cargo.

Panamá Pacífico: A Modern Hub for High-Tech Manufacturing

Located on the site of the former Howard U.S. Air Force Base near the Pacific entrance of the Canal, Panamá Pacífico is a more modern development focused on high-tech manufacturing, logistics, and corporate services. It is designed as a master-planned community, integrating business parks with residential areas, schools, and recreational facilities.

This environment is particularly well-suited for the technical and operational demands of a modern solar factory:

- High-Quality Infrastructure: Offers reliable power, high-speed telecommunications, and modern industrial buildings ready for custom fitting.

- Focus on Value-Added Activities: The legal and operational framework is tailored for assembly and manufacturing, not just transshipment.

- Specialized Incentives: Provides a distinct set of fiscal, migratory, and labor benefits designed to attract skilled talent and technology-focused companies.

The Tangible Business Advantages for Solar Producers

Choosing an SEZ in Panama offers concrete benefits that directly impact financial viability and operational success.

Fiscal and Tax Incentives

The tax regime within Panama’s SEZs is a primary driver for investment. While specific benefits vary by zone, they generally include exemptions from all import and export duties on machinery, raw materials, and finished products. Companies operating within these zones often benefit from significantly reduced corporate income tax rates. This favorable structure can substantially lower the initial investment requirements for a solar factory and improve long-term profitability.

Logistical and Supply Chain Efficiency

A factory in Panama can serve both the North American and South American markets with transit times measured in days, not weeks. This proximity reduces inventory holding costs and helps manufacturers respond more quickly to market demand. Whether shipping containers north to the United States or south to Brazil, access to major shipping lanes on both the Atlantic and Pacific oceans provides unparalleled flexibility.

Regulatory and Operational Framework

Panama’s dollarized economy eliminates currency exchange risk for businesses transacting in USD. The SEZs operate with ‘one-stop-shop’ administrative offices that consolidate the processes for permits, licenses, and registrations, saving valuable time and resources during the setup phase. With the administrative side of the business simplified, management can focus on core production and quality control—a critical advantage when navigating the complexities of the solar module production process.

Initial Considerations for Establishing a Facility

While the advantages are clear, establishing a manufacturing facility requires careful planning. Key considerations include selecting the appropriate zone based on the business model (logistics-heavy vs. manufacturing-focused), ensuring building specifications meet the technical requirements for a clean production environment, and developing a plan for recruiting and training a local workforce.

Experience with J.v.G. Technology turnkey projects shows that the structured environment of an SEZ simplifies many of these steps. However, specialized guidance remains essential to navigate the specific regulations of each zone and optimize the factory layout for local conditions.

Frequently Asked Questions (FAQ)

What is the typical minimum investment for a small-scale solar factory in Panama?

While this depends on the level of automation and production capacity, a semi-automated 20-50 MW line is a common starting point. The SEZ incentives significantly reduce the duties on imported machinery, which makes up a major part of the initial capital expenditure.

Is a local Panamanian partner required to set up a business in an SEZ?

No, foreign companies can generally establish a 100% foreign-owned entity within Panama’s Special Economic Zones, giving them full control over their operations.

How long does it typically take to become operational?

With a clear plan and experienced partners, a solar module line can be operational in under a year, from company registration to the first module produced. The streamlined administrative processes in the SEZs help shorten this timeline.

What are the primary target markets for modules produced in Panama?

The primary target markets are North, Central, and South America, as well as the Caribbean. Production in Panama can offer significant advantages for projects in these regions due to lower shipping costs and potentially favorable trade agreements.

The Strategic Imperative of Location

For the international entrepreneur looking to enter the solar industry, the choice of location is a foundational decision that influences cost structure, market access, and long-term competitiveness. Panama’s Special Economic Zones offer a powerful strategic proposition: a stable, dollarized, and business-friendly hub positioned between major North and South American markets.

By leveraging its unique logistical infrastructure and attractive fiscal incentives, a solar module manufacturer in Panama can build a resilient and competitive operation positioned for growth in the dynamic solar markets of the Americas.