A business plan for a solar module factory can appear robust on paper, with its global equipment prices and standard efficiency assumptions. Yet its real-world viability is often determined not by the technology itself, but by local operational costs that are frequently underestimated.

An investor might project a healthy profit margin, only to see it eroded by an unexpectedly high electricity bill or the complexities of inland logistics.

For entrepreneurs entering Pakistan’s growing solar market, success requires moving beyond generic templates. A precise financial model must be grounded in the realities of the local business environment. This requires a granular analysis of three critical operational expenditures: industrial energy tariffs, labor wages, and supply chain logistics. Understanding these variables is the first step toward creating a truly sustainable and profitable enterprise.

Why Generic Financial Models Fall Short in Pakistan

Standard financial models often rely on international benchmarks for operational costs, a practice that can be dangerously misleading. The cost of electricity, labor, and transport can vary by over 50% depending on the country and even the specific city.

A successful solar panel manufacturing business plan must be a living document, tailored to the unique economic landscape of Pakistan.

Neglecting to accurately forecast these local costs can lead to several challenges:

- Inaccurate Profitability Projections: Overly optimistic cost assumptions can make an unviable project appear profitable.

- Cash Flow Shortages: Underbudgeting for monthly expenses like energy and salaries can strain working capital.

- Poor Strategic Decisions: An inaccurate model might lead to suboptimal choices in factory location, automation level, or product pricing.

A model grounded in local data provides the clarity needed to navigate the early stages of operation and secure a competitive advantage.

Deconstructing Key Operational Costs in Pakistan

Building a reliable financial forecast starts with analyzing the primary cost drivers unique to the Pakistani context. Based on data from recent projects and public records, three areas demand particular attention.

1. Industrial Electricity Tariffs

Energy is a significant and recurring operational expense for any manufacturing facility. The machinery in a solar module production line—such as laminators and cell stringers—is a major consumer of electricity.

In Pakistan, industrial electricity tariffs are regulated by the National Electric Power Regulatory Authority (NEPRA). As of late 2023, the B2 industrial tariff is approximately PKR 37.75 per kilowatt-hour (kWh). For a 50 MW production line operating a single eight-hour shift, this single line item can become a major monthly expenditure.

Using this precise figure, rather than a global average, is crucial for projecting utility costs accurately. This, in turn, allows for better management of working capital and informs a more realistic pricing strategy for the finished solar modules.

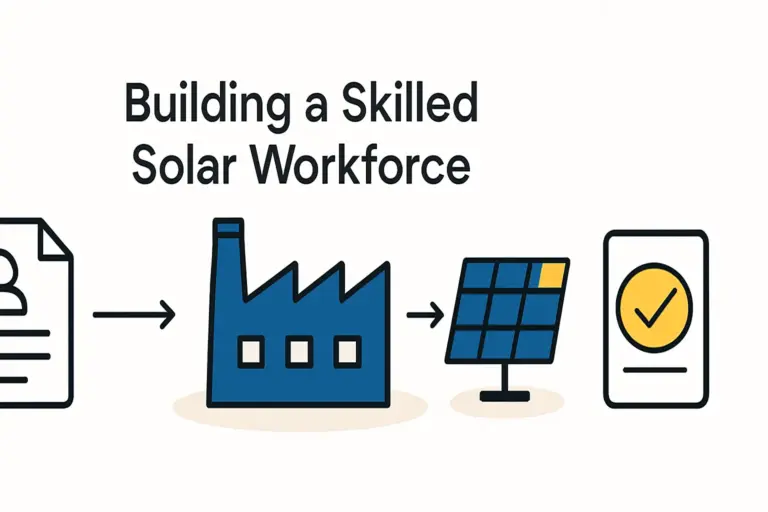

2. Labor and Workforce Costs

While automation is increasing, a skilled and semi-skilled workforce remains essential for operating and maintaining a solar panel factory. Labor costs in Pakistan are competitive, but they must be calculated based on current regulations and market rates for different skill levels.

- Unskilled Labor: The government-mandated minimum wage for unskilled workers is PKR 32,000 per month. This applies to roles such as material handlers or general assistants.

- Skilled Operators: For more technical roles, such as machine operators or quality control technicians, market rates are higher. An investor should budget between PKR 60,000 and PKR 80,000 per month for these positions to attract and retain qualified personnel.

A typical semi-automated production line may require 25 to 35 employees per shift, and the blend of skilled and unskilled labor directly impacts the total monthly payroll. These recurring costs then influence the overall investment requirements for a solar module factory, as a higher degree of automation may reduce long-term labor expenses but increase initial capital outlay.

3. Inland Logistics and Transportation

Pakistan’s primary seaport for containerized cargo is in Karachi. The location of a manufacturing plant relative to this port profoundly impacts logistics costs and timelines. Raw materials, such as solar cells, glass, and aluminum frames, are typically imported and must be transported inland.

The cost difference is significant:

- Factory in Karachi: Transporting a 40-foot container from the port to a local industrial zone typically costs between USD 500 and USD 800.

- Factory in Lahore: The same container transported inland to Lahore, a major industrial hub, will cost approximately USD 3,000 to USD 4,000.

This cost differential must be factored into the business model. While Lahore offers proximity to major markets in Punjab, its higher logistics costs for imported raw materials must be weighed against these benefits. Informed by accurate cost data, this strategic decision is fundamental to an operation’s long-term competitiveness.

And while setting up a turnkey solar panel production line often includes a plan where the provider manages the initial machinery delivery for a clear, one-time cost, the ongoing logistics for raw materials remain a critical, recurring variable.

Building a Resilient and Realistic Business Plan

By replacing generic assumptions with verified local data, an investor can transform a standard business plan into a strategic tool. The interplay between energy tariffs, labor wages, and logistics costs influences critical decisions, from selecting a factory location to determining the right level of automation.

For instance, in a region with high energy costs, investing in more energy-efficient machinery may offer a better long-term return. Similarly, a location far from the primary seaport might justify a larger warehouse for raw materials to reduce the frequency of costly shipments.

This level of detail and foresight is what separates speculative ventures from successful industrial enterprises.

Frequently Asked Questions (FAQ)

What is the typical electricity consumption for a 50 MW solar module factory?

A semi-automated 50 MW factory operating one shift typically consumes between 80,000 and 120,000 kWh per month. However, this can vary based on the specific machinery, operational efficiency, and number of shifts.

How many employees are needed for a small-scale production line?

A 20–50 MW semi-automated line generally requires 25 to 35 employees per shift, including operators, quality control staff, maintenance technicians, and general labor. The exact number depends on the level of automation.

Are there other logistics costs to consider besides inland transport?

Yes. The financial model should also account for sea freight to Karachi, port handling charges, customs duties and clearing fees, and potential demurrage charges if cargo is not cleared in a timely manner. These costs are incurred before inland transportation begins.

How do operational costs in Pakistan compare to other emerging markets?

Pakistan offers a competitive labor market. However, industrial electricity tariffs can be higher than in some other regional countries. This makes energy efficiency a particularly important consideration for manufacturers. The key is not whether costs are high or low in absolute terms, but whether the business model accurately reflects them.