Entrepreneurs in the solar manufacturing sector often set their sights on large, established markets like Europe or North America. This perspective, however, can obscure significant regional opportunities where strategic positioning creates a powerful competitive advantage.

One such opportunity lies in the heart of Central America, built upon a key trade agreement that provides duty-free access to a growing, energy-hungry market. For those in the industry, understanding international trade agreements is as critical as the technology itself. This article explores the business case for establishing a solar panel manufacturing facility in Nicaragua to serve the markets within the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR).

What is CAFTA-DR and Why Does It Matter for Solar?

The Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) is an economic pact between the United States and six countries in the region: Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and the Dominican Republic. Implemented in 2006, its primary goal was to eliminate tariffs and reduce trade barriers, fostering a more integrated economic zone.

For a solar panel manufacturer, the agreement’s most significant provision is duty-free market access among member nations. A solar module produced in Nicaragua can be exported to Guatemala, Costa Rica, or the Dominican Republic without the import tariffs that would apply to a panel from China, Europe, or other non-member regions.

This creates a substantial pricing advantage and simplifies regional logistics, allowing a Nicaraguan-based manufacturer to serve neighboring countries more efficiently and cost-effectively than outside competitors.

Nicaragua as a Strategic Manufacturing Hub

While several countries are part of the agreement, Nicaragua offers a unique combination of factors that makes it an especially attractive base for manufacturing.

Geographic and Logistical Advantages

Centrally located within the CAFTA-DR bloc, Nicaragua offers a key geographical benefit: coastlines on both the Pacific Ocean and the Caribbean Sea. This dual-ocean access provides flexibility for importing raw materials (like solar cells, glass, and aluminum frames) from Asia and exporting finished modules to regional and international markets. Its proximity to neighboring countries via land routes further reduces transport times and costs for serving the immediate Central American market.

Economic and Labor Advantages

Compared to more developed economies, Nicaragua offers competitive labor costs and has one of the youngest populations in Latin America, which provides a readily available and trainable workforce. For an entrepreneur, these factors translate into lower operational expenditures—a critical consideration when establishing a new manufacturing facility. In such an environment, the foundational steps of learning how to start a solar panel factory become more financially viable.

The ‘Rules of Origin’ Consideration

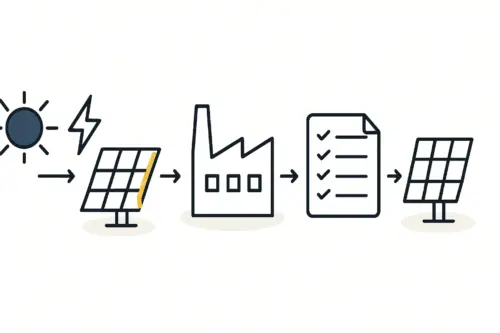

Leveraging CAFTA-DR effectively requires a firm grasp of its ‘Rules of Origin.’ To qualify for duty-free treatment, a product must be ‘originating,’ meaning it has been sufficiently produced or transformed within a member country.

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

Simply importing finished panels and re-exporting them does not qualify. However, a factory that imports components—such as solar cells, glass, and encapsulants—and performs substantial transformations like stringing, lamination, framing, and testing in Nicaragua will typically produce an ‘originating’ good.

In effect, the process transforms a collection of global components into a Nicaraguan product, making it eligible for duty-free export to other CAFTA-DR nations. This is a crucial point where technical and legal planning intersect. Experience from J.v.G. turnkey projects shows that defining the production process to meet these rules is a fundamental part of the initial factory setup.

Key Considerations for Establishing a Nicaraguan Facility

Venturing into a new market requires careful planning across several key operational areas.

Feasibility and Business Planning

Success begins with a robust and realistic solar panel manufacturing business plan. A thorough plan must account for local regulations, labor laws, logistics, and the specific requirements of the CAFTA-DR agreement. It should outline capital expenditures, operational costs, and revenue projections based on regional market dynamics.

Equipment and Technology

The core of the factory is its production line. Selecting the right solar manufacturing machines is essential for ensuring product quality, reliability, and efficiency. The technology chosen must be robust enough to handle local conditions and produce modules that meet international certification standards—a critical step for building trust with regional buyers.

Factory Setup and Investment

A typical entry point for a new regional manufacturer is a facility with an annual capacity of 20–50 MW. Proper factory layout and design is critical for optimizing workflow and ensuring a safe, efficient production environment. While the overall investment requirements will depend on the chosen capacity, level of automation, and building costs, this scale often provides a strong balance between initial capital outlay and market potential.

Frequently Asked Questions (FAQ)

Do all solar panel components need to come from CAFTA-DR countries to qualify for duty-free status?

No. The ‘Rules of Origin’ focus on ‘substantial transformation.’ As long as the key manufacturing processes (e.g., cell stringing, lamination, assembly) occur within Nicaragua, the final product is generally considered ‘originating,’ even if raw components like solar cells are imported from outside the region.

What is a typical factory size for a new entrant in this market?

From J.v.G. Technology’s experience with turnkey projects in emerging markets, a production line with an annual capacity of 20 MW to 50 MW is a common and viable starting point. This scale is large enough to be cost-effective yet manageable for a new venture.

How does political and economic stability in Nicaragua affect such an investment?

As with any investment in an emerging market, thorough due diligence is essential. Prospective investors should consult with local investment promotion agencies, legal experts, and business consultants to understand the current landscape. While challenges exist, the country has a history of attracting foreign investment in manufacturing.

What is a realistic timeline for setting up a solar factory in Nicaragua?

With a well-structured plan and an experienced technical partner, a 20–50 MW solar module production line can be operational in under one year from the start of the project.

A Strategic Path Forward

The combination of the CAFTA-DR trade agreement, Nicaragua’s strategic advantages, and growing regional energy demand creates a compelling business case for solar manufacturing. This synergy offers a clear path to serving a market of over 45 million people with a locally produced, competitively priced product.

While the opportunity is significant, success depends on meticulous planning and technical expertise. Understanding the interplay of international trade law, manufacturing technology, and local business conditions is the key to transforming this strategic vision into a profitable reality.