An investor might identify a compelling opportunity in solar module manufacturing, secure initial funding, and develop a robust business concept. Yet, one fundamental question can stall momentum: Where, precisely, should the factory be built?

This decision extends far beyond real estate; it’s a strategic choice that shapes a company’s logistical efficiency, operational costs, access to talent, and long-term competitive advantage.

For entrepreneurs and established companies looking to enter the European solar market, Portugal has emerged as a location of significant interest. Choosing the right industrial zone within the country, however, requires a detailed understanding of the unique strengths and trade-offs of each region. This guide provides a structured comparison of Portugal’s key industrial areas to help investors make an informed, strategic decision.

Why Portugal Presents a Strategic Opportunity for Solar Manufacturing

Portugal’s appeal for industrial investment stems from several key pillars that directly benefit a solar module manufacturing operation.

Gateway to European and Global Markets

As a member of the European Union, Portugal offers frictionless access to the vast EU single market. Its strategic location on the Atlantic coast, particularly the Port of Sines, serves as a vital logistical hub. Sines is one of the few deep-water ports in Europe capable of accommodating the world’s largest container ships, providing a non-congested entry point for raw materials from Asia.

Robust Infrastructure and Political Stability

The country has a modern network of highways connecting it to Spain and the rest of Europe. This infrastructure, combined with a stable political and economic environment, creates a reliable and predictable setting for long-term industrial investment.

Commitment to Renewable Energy

The Portuguese government has shown a strong commitment to the green transition, supported by EU initiatives like the Recovery and Resilience Plan (PRR). This creates a favourable regulatory environment and unlocks potential incentives for projects aligned with national energy goals.

Access to a Skilled Workforce

Portugal has a growing pool of engineering and technical talent, supported by a network of reputable universities. This is crucial for an industry that requires both skilled production line operators and qualified management staff.

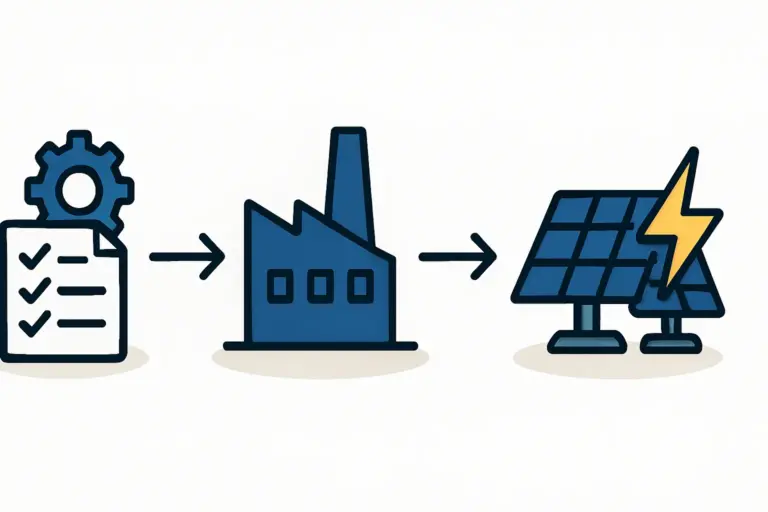

Core Factors in Factory Site Selection: A Framework for Decision-Making

Before comparing specific regions, it’s essential to establish a clear set of evaluation criteria. A systematic approach ensures the final decision aligns with the plant’s specific business model. The entire process forms a crucial part of planning a solar module factory.

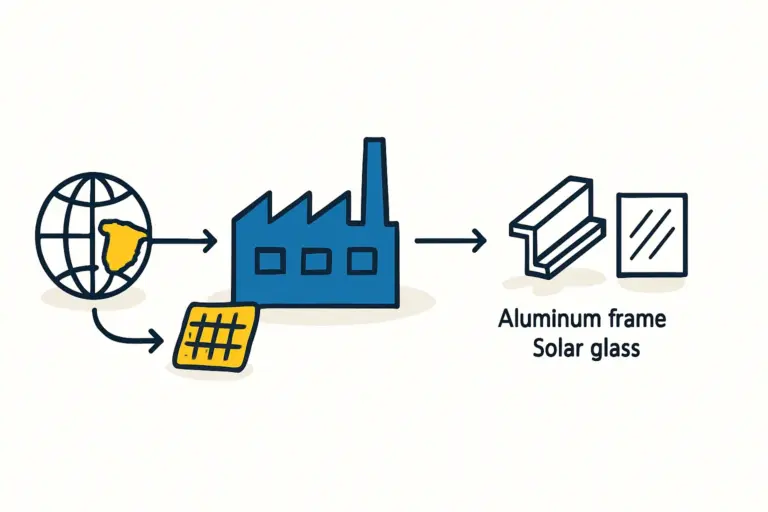

Proximity to Logistics Infrastructure

The efficiency of importing raw materials (like solar cells, glass, and aluminium frames) and exporting finished modules is paramount. Proximity to a major port and easy access to the national highway network can significantly reduce transport costs and lead times.

Land and Utility Costs

The cost of acquiring or leasing industrial land varies considerably between regions. Equally important are the availability and cost of essential utilities, particularly electricity, which is a major operational expense for any manufacturing facility.

Access to a Skilled Labor Pool

A factory requires a diverse team, from production line workers to engineers and quality control specialists. The availability of this talent within a reasonable commuting distance is a critical factor for operational success and scalability.

Local and Regional Incentives

Beyond national programs, specific municipalities or industrial zones may offer their own incentives, such as tax abatements or streamlined permitting processes, to attract investment.

A Comparative Analysis of Portugal’s Key Industrial Zones

Applying this framework, we can analyze the distinct profiles of Portugal’s most promising regions for solar manufacturing.

The Alentejo Region: The Strategic Port of Sines

Primary Focus: Logistics, large-scale production, and export-oriented operations.

The Alentejo region, particularly the area around the Port of Sines, is defined by its logistical prowess. The Sines Industrial and Logistics Zone (ZILS) is a massive, well-planned area designed for heavy industry and logistics.

Strengths:

- Unmatched Port Access: Direct proximity to the deep-water Port of Sines minimizes inland transportation costs for raw materials.

- Large Land Plots: ZILS offers large, infrastructure-ready plots of land suitable for extensive manufacturing facilities.

- Green Energy Ecosystem: Sines is being developed as a major hub for green hydrogen and other renewable energy projects, creating potential synergies and a supportive industrial environment.

Considerations:

The local labor pool in the immediate vicinity is less dense than in major metropolitan areas. A comprehensive strategy for attracting and retaining talent from the wider region may be necessary.

The Setúbal Peninsula: The Established Industrial Powerhouse

Primary Focus: Access to a mature industrial ecosystem and a large, diverse talent pool.

Located just south of Lisbon, the Setúbal Peninsula is one of Portugal’s traditional industrial heartlands. It is home to major manufacturing operations, including the Volkswagen Autoeuropa plant, which has cultivated a deep-rooted industrial culture.

Strengths:

- Proximity to Lisbon: Close to the capital’s international airport and a major container port, offering excellent connectivity.

- Dense and Skilled Labor Pool: The region offers access to a large and diverse workforce with experience in manufacturing and industrial processes. Based on experience from J.v.G. turnkey projects, regions with established automotive or electronics manufacturing often have transferable skills beneficial for solar module assembly.

- Developed Supply Chains: The presence of other major industries means a more developed network of local suppliers and service providers.

Considerations:

Land and labor costs are generally higher compared to other regions due to proximity to the capital.

Competition for both land and skilled talent can be more intense.

The Aveiro Region: The Northern Engineering Hub

Primary Focus: Technical expertise, R&D collaboration, and a strong engineering talent pipeline.

Located between Porto and Coimbra, the Aveiro region is a well-established center for innovation and engineering. It has a strong industrial tradition in sectors like ceramics, metallurgy, and technology, supported by the prestigious University of Aveiro.

Strengths:

- Engineering Talent: Direct access to a steady stream of engineering graduates and technical specialists from the University of Aveiro.

- Lower Operational Costs: Land and labor costs can be more competitive than in the greater Lisbon area.

- Strong Manufacturing Culture: The region has deep experience in complex industrial processes, providing a solid foundation for high-tech manufacturing.

Considerations:

Aveiro is further from the key deep-water Port of Sines, which could slightly increase logistics costs for sea freight. However, it has good access to the Port of Leixões (near Porto).

Making the Final Decision: Aligning Location with Business Strategy

There is no single ‘best’ location for every solar manufacturing project. The optimal choice depends entirely on the specific priorities of the business. The investment needed for a solar panel factory is significant, and site selection directly impacts the return on that investment.

- An investor planning a large-scale, export-focused operation heavily dependent on imported raw materials would likely find the logistical advantages of Sines decisive.

- A company seeking to build a large, diverse workforce quickly and leverage existing industrial supply chains might gravitate towards the Setúbal Peninsula.

- A venture focused on advanced module technology or requiring a high concentration of R&D and engineering talent may find the ecosystem in Aveiro most suitable.

Frequently Asked Questions (FAQ) for Investors

What are the typical land costs in these Portuguese industrial zones?

Costs vary significantly based on exact location and infrastructure readiness. As a general guide, industrial land in zones further from major metropolitan areas, like Alentejo, may be more competitive than plots on the highly developed Setúbal Peninsula. A detailed survey is always required.

How does Portugal’s infrastructure compare to other EU countries?

Portugal’s infrastructure is considered modern and highly competitive. Its highway network is excellent, and the Port of Sines offers a unique advantage in its deep-water, non-congested capacity—a significant edge over many other busy European ports.

Are there specific free-trade zones or tax incentives to consider?

The Sines Industrial and Logistics Zone (ZILS) operates with certain logistical and customs advantages. Additionally, investments in manufacturing, particularly in the renewable energy sector, may be eligible for various national and EU-level incentives under programs like the PRR. Professional consultation is recommended to explore these opportunities.

How long does the process of acquiring land and permits typically take?

The timeline can vary depending on a project’s complexity and the specific municipality. However, a period of 6 to 12 months for land acquisition, licensing, and obtaining building permits is a realistic initial estimate.

What level of technical expertise is required to manage a solar manufacturing plant?

While a strong in-house technical team is essential for long-term operations, an investor doesn’t need to be a photovoltaic expert during the initial setup phase. The necessary technical expertise for managing a solar manufacturing plant can be supplemented by experienced consultants who guide the process from factory layout to machine commissioning and staff training.

Conclusion and Next Steps

Selecting a factory site in Portugal is a critical strategic decision that balances the competing priorities of logistics, cost, and talent. Each of the primary industrial regions—Alentejo (Sines), Setúbal, and Aveiro—offers a distinct value proposition that can be aligned with different business models.

This comparative overview serves as a foundational step. A thorough feasibility study, including detailed logistical analysis and financial modeling, is an essential next stage to validate any potential location. Platforms like pvknowhow.com provide structured guidance, including sample business plans and e-learning courses, to help investors navigate these complex early-stage decisions with confidence.