Many business leaders exploring an entry into solar manufacturing are initially drawn to Thailand by its competitive labor costs and strategic location. However, a modern solar module factory is a sophisticated operation that depends less on the sheer quantity of labor and more on its quality. The critical question is not ‘How much does labor cost?’ but rather, ‘Is there a sufficient pool of skilled engineers and technicians to ensure operational excellence and world-class product quality?’

This analysis offers a clear-eyed look at Thailand’s skilled labor landscape for the solar industry. It moves beyond a surface-level cost analysis to examine the availability of qualified technical personnel, the capabilities of local training institutions, and the practical steps for building a competent team for a new manufacturing facility.

Beyond General Labor: The Critical Need for Technical Expertise

A common misconception is that solar module assembly is a low-skill, labor-intensive process. While this may have been true decades ago, today’s automated production lines demand a high degree of technical proficiency. The success of a solar factory hinges on a core team of professionals who can manage complex machinery, optimize production processes, and uphold stringent quality standards.

Key roles that require specialized skills include:

- Process Engineers: Professionals responsible for calibrating machinery, monitoring production parameters, and continuously improving efficiency and yield.

- Maintenance Technicians: Technicians skilled in electronics, mechanics, and pneumatics who are essential for minimizing downtime and ensuring equipment longevity.

- Quality Assurance Specialists: Specialists trained in material inspection, performance testing (e.g., using a sun simulator), and international certification standards like those from IEC.

Without a strong team in these areas, even the most advanced production line will underperform, leading to lower output, higher defect rates, and a compromised return on investment.

An Analysis of Thailand’s Engineering and Technical Talent Pool

Thailand has a strong educational framework that produces a significant number of engineering and technical graduates annually. The country’s robust manufacturing base, particularly in the automotive and electronics sectors, has fostered a culture of technical education and created a large, experienced workforce.

Based on data from Thailand’s Ministry of Higher Education, Science, Research and Innovation, the country produces approximately 100,000 engineering graduates each year. Prominent institutions leading this output include:

- Chulalongkorn University

- King Mongkut’s Institute of Technology Ladkrabang (KMITL)

- King Mongkut’s University of Technology Thonburi (KMUTT)

- King Mongkut’s University of Technology North Bangkok (KMUTNB)

Graduates from these universities typically hold degrees in Electrical, Mechanical, and Industrial Engineering—disciplines directly applicable to the solar module manufacturing process. The result is a solid foundation of candidates with the necessary theoretical knowledge. The primary challenge for a new investor is the relative scarcity of professionals with direct, hands-on experience in photovoltaic (PV) technology.

The Role of Vocational Training and Skill Development

Supporting the university system is a well-established network of vocational colleges operating under the Office of the Vocational Education Commission (OVEC). These institutions are crucial for training the technicians who form the backbone of any manufacturing operation. They provide practical, hands-on training in fields essential for factory-floor roles.

These Technical and Vocational Education and Training (TVET) programs produce graduates with diplomas and certificates in areas such as:

- Industrial Electronics

- Electrical Power

- Production Technology

- Mechanical Maintenance

While these programs produce capable technicians, they generally do not offer specialized curricula focused on solar module manufacturing. Graduates possess strong foundational skills but will require specific, on-the-job training to master the unique demands of a PV factory. For investors considering a turnkey solar manufacturing line, factoring in a post-hiring training program is a critical part of planning.

Bridging the Skills Gap: In-House and Specialized Training

The most effective strategy for a new market entrant is to build upon Thailand’s strong foundational talent by implementing a structured, in-house training program. This approach recognizes that while new hires may lack PV-specific experience, they possess the core technical aptitude to learn quickly.

A successful training program typically involves several stages:

- Hiring for Aptitude: Recruiting engineers and technicians from adjacent high-tech industries like electronics or semiconductor manufacturing, who are already familiar with cleanroom protocols and automated machinery.

- Classroom Instruction: Providing foundational knowledge of PV technology, materials science, and the specific equipment used in the factory.

- ‘Train the Trainer’ Model: Key local engineers and supervisors are often sent abroad for intensive training at the equipment manufacturer’s facility. They then return to train the rest of the local team.

- On-Site Commissioning Support: Turnkey solution providers, such as J.v.G. Technology, typically include a period of on-site training where their experienced engineers work alongside the new local team during the factory’s ramp-up phase. This hands-on guidance is invaluable for transferring practical knowledge.

Regional Hubs and Strategic Location

The availability of skilled labor is not uniform across Thailand. The highest concentration of technical talent is found within the country’s primary industrial zones, most notably the Eastern Economic Corridor (EEC). This area, encompassing the provinces of Chonburi, Rayong, and Chachoengsao, is home to a vast number of manufacturing facilities and, consequently, a deep pool of experienced engineers and technicians.

Locating a factory within or near the EEC can significantly simplify recruitment efforts. Furthermore, the Thai government’s Board of Investment (BOI) often provides enhanced incentives for projects in these zones, including support for skill development and training initiatives.

Frequently Asked Questions (FAQ)

What are the typical salary expectations for engineers and technicians in Thailand’s solar sector?

Salary levels are competitive and depend on experience and location. A recent graduate engineer might expect a starting salary of THB 25,000–35,000 per month, while an experienced technician could earn THB 20,000–30,000. Senior engineers with management responsibilities command significantly higher compensation. These figures are general estimates and can vary based on the specific region and a candidate’s qualifications.

Is the English proficiency of Thai engineers sufficient for a multinational operation?

Engineers graduating from Thailand’s top universities generally have a good command of English, particularly in reading and writing technical documents. In manufacturing settings, communication is often supported by visual aids, standard operating procedures, and key bilingual staff who can act as liaisons. This is generally a manageable aspect of operations for foreign investors.

How long does it typically take to train a new team to operate a solar module production line?

A comprehensive training program for a new team typically lasts between three and six months. This period includes initial classroom theory, hands-on training with machinery during commissioning, and a supervised ramp-up phase to achieve target production levels and quality standards.

Are there government subsidies available for training employees in the renewable energy sector?

Yes, the Thailand Board of Investment (BOI) offers various investment promotion schemes, some of which include incentives for training and developing a skilled workforce, especially for businesses in targeted high-tech industries like renewable energy. Investors should consult directly with the BOI for the most current information on available programs.

Conclusion and Next Steps

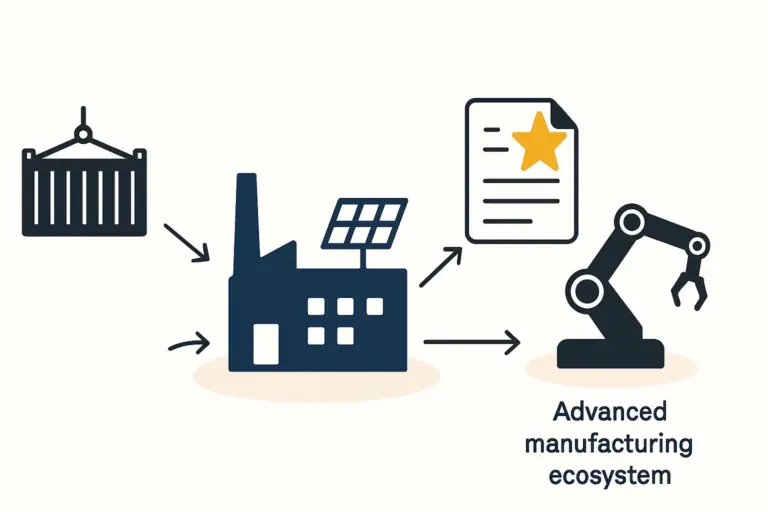

Thailand presents a compelling case for establishing a solar module manufacturing facility. The country possesses a large and well-educated pool of engineers and technicians with strong foundational skills rooted in its advanced manufacturing ecosystem.

While a skills gap in specific PV technology exists, it is a manageable challenge—one that can be addressed effectively through a well-structured, multi-stage training program. By leveraging local talent and partnering with experienced technology providers for knowledge transfer, investors can build a highly competent local team capable of operating a modern solar factory to international standards.

Understanding the labor landscape is a fundamental first step. The next phase of due diligence involves a detailed evaluation of facility requirements, logistical considerations, and the total investment needed for a successful market entry.