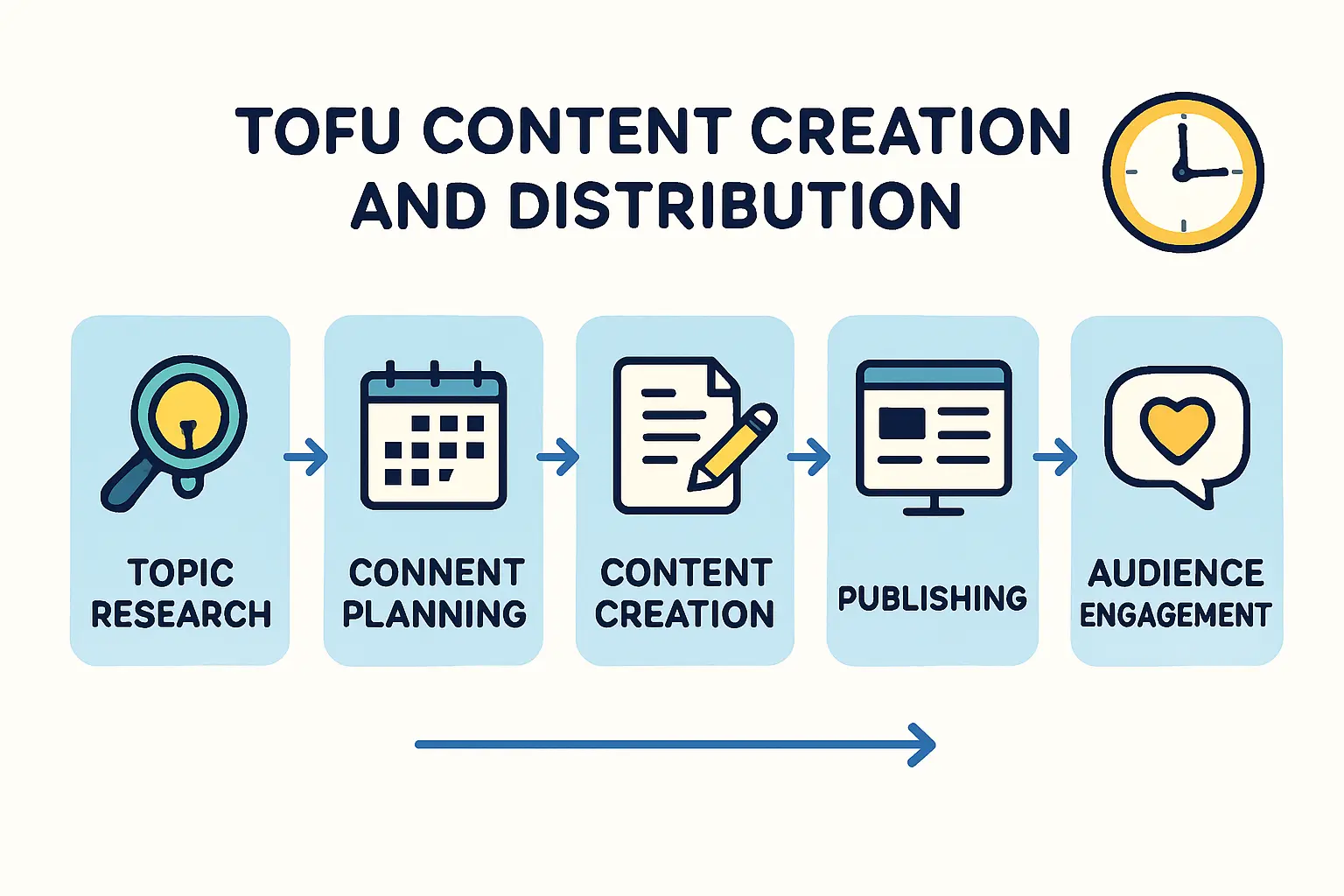

An entrepreneur is finalizing the business plan for a new solar module assembly plant. The numbers look promising: machinery costs are clear, a building is secured, and the labor model is sound.

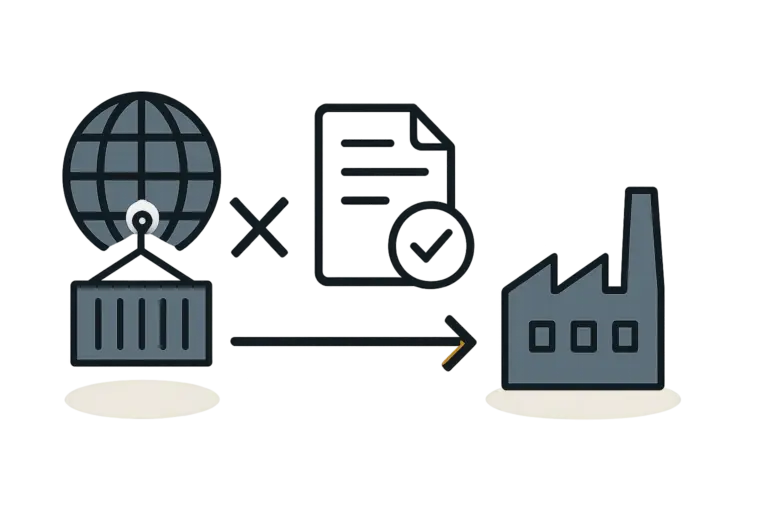

However, a significant variable remains—the unpredictable cost of duties and tariffs on imported solar cells and other key components. This single factor can erode profit margins and challenge the financial viability of the entire enterprise before the first module is ever produced.

This scenario highlights a critical challenge for any investor in the US solar manufacturing market. Navigating the complex landscape of international trade policy is just as crucial as understanding the technical side of production. For certain business models, a powerful but often overlooked solution exists: operating within a US Foreign-Trade Zone (FTZ). Here, we’ll explore the strategic financial and logistical advantages an FTZ can offer a solar module manufacturer, along with the key considerations.

The Core Challenge: Tariffs on Solar Component Imports

The United States has several trade mechanisms that directly impact the cost of solar manufacturing. These include Section 201 and Section 301 tariffs, as well as anti-dumping and countervailing duties (AD/CVD), which primarily target solar cells and modules from specific regions.

For a manufacturer, this means the single most expensive component—the solar cell—is often subject to significant import duties, which immediately inflate production costs. A typical solar module manufacturing process relies on a global supply chain. Components such as cells, backsheets, and junction boxes are sourced internationally. Without a strategic approach, the cumulative duties on these parts can place a new US-based assembly plant at a competitive disadvantage.

What is a US Foreign-Trade Zone (FTZ)?

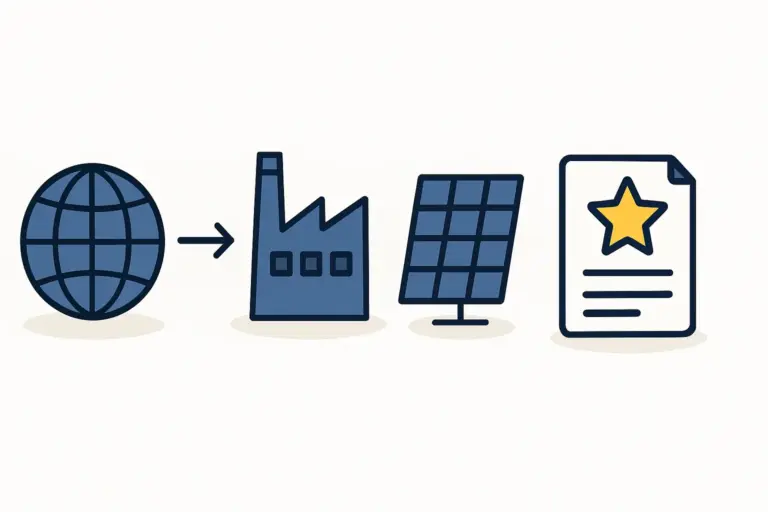

A Foreign-Trade Zone is a secured area within the United States that is legally considered outside of US customs territory for duty and tariff purposes. It is the US version of what are known internationally as free-trade zones.

Within an FTZ, a company can import foreign goods, manufacture, assemble, store, and process them without being subject to US customs duties. These duties are only paid if and when the finished products enter the US domestic market. This framework was designed to encourage domestic manufacturing and investment by leveling the playing field against foreign competitors. For a solar module manufacturer, this special designation can fundamentally alter the financial structure of the operation.

Key Financial Benefits of Operating a Solar Factory in an FTZ

Operating within an FTZ offers several distinct financial advantages that directly address the tariff challenges of solar manufacturing.

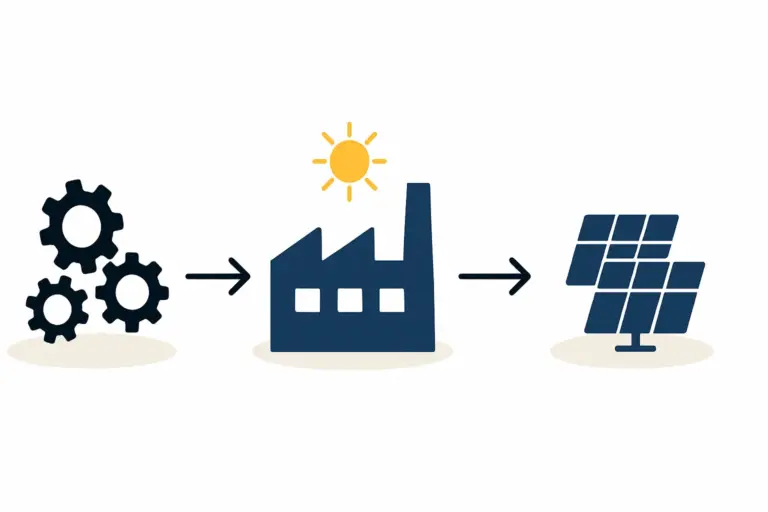

1. Duty Reduction through the ‘Inverted Tariff’ Principle

This is the most significant benefit for a solar manufacturer. An ‘inverted tariff’ situation occurs when the duty rate on a finished product is lower than the duty rate on its imported foreign components.

In solar manufacturing, high-tariff components (like solar cells at a 25% tariff rate) are assembled into a finished solar module, which may be subject to a lower tariff rate. Within an FTZ, the manufacturer can choose which duty rate to pay when the product enters US commerce. They can elect to pay the duty rate applicable to the finished solar module rather than the higher rates on its individual imported components.

Example Scenario:

Standard Process: A manufacturer imports $1 million worth of solar cells with a 25% tariff. The immediate duty payment is $250,000.

FTZ Process: The same $1 million in cells are brought into an FTZ duty-free. They are assembled into modules. When these finished modules leave the zone for the US market, the manufacturer pays the duty rate applicable to the modules (e.g., 14.25%). This results in a substantial cost saving and directly improves the project’s profitability.

The inverted tariff benefit allows manufacturers to pay the duty rate on the finished module instead of the often higher rates on individual components, directly impacting the final cost per watt.

2. Duty Deferral for Improved Cash Flow

In any business, cash flow is critical. Without an FTZ, customs duties are due upon importation of the components. This requires a significant upfront cash outlay before any revenue is generated.

Within an FTZ, duties are deferred until the finished modules are shipped out of the zone and into the US market. This delay can span weeks or months, allowing the manufacturer to use that capital for other operational needs, such as payroll or raw material procurement. This deferral improves the financial efficiency of the entire operation.

Components like solar cells often carry the highest tariffs, making FTZ strategies particularly relevant for managing production costs.

3. Duty Elimination on Exports

For manufacturers who plan to export to markets outside the United States (e.g., Canada or Latin America), the FTZ offers a clear advantage. When finished solar modules are exported directly from the FTZ, no US customs duties are ever paid on the imported components used to produce them. This makes US-assembled products more competitive on the global market.

4. Managing Costs on Scrap, Waste, and Damaged Goods

Any solar panel production line cost must account for a certain percentage of material loss during manufacturing. In a standard operation, duties are paid on all imported materials—including those that are ultimately scrapped, damaged, or become waste. Within an FTZ, however, no duties are paid on imported components that are scrapped, destroyed, or consumed during the production process. This eliminates the ‘duty on defect’ and provides a direct, albeit smaller, cost saving.

Practical Considerations and Challenges

While the benefits are compelling, establishing and operating within an FTZ is a strategic decision that requires careful planning—it’s not a simple administrative step.

The Application and Approval Process

Gaining approval to operate as a manufacturer within an FTZ requires a formal application to the US Foreign-Trade Zones Board. This process is detailed and requires a strong business case. The application must demonstrate that the proposed activity is in the public interest of the United States, typically by showing it will create or retain domestic jobs and promote economic activity that might otherwise move offshore.

Operational and Compliance Costs

Operating an FTZ comes with its own costs. These include application fees, costs for implementing required security measures, and the administrative burden of inventory control and reporting systems that must meet US Customs and Border Protection (CBP) standards. A thorough cost-benefit analysis is essential.

Demonstrating Public Interest

For a solar manufacturing project, the public interest case is often strong. Such projects create skilled manufacturing jobs, contribute to the domestic renewable energy supply chain, and support national energy security goals. This aspect is central to a successful application. Experience from turnkey projects managed by firms like J.v.G. Technology shows that comprehensive logistical and regulatory planning is just as critical as the technical factory setup.

Is an FTZ Strategy Relevant for Your Project?

Deciding whether to pursue an FTZ designation depends on several factors specific to a business plan. An investor should consider the following questions:

- Source of Components: What percentage of your key components, particularly solar cells, will be imported and subject to high US tariffs?

- Target Market: Is your primary market the US, or do you plan for significant exports?

- Production Scale: Is your production volume large enough to justify the administrative and compliance costs of an FTZ?

- Financial Model: How significantly would duty deferral and reduction impact your project’s internal rate of return (IRR) and overall how to start a solar panel factory investment case?

For projects heavily reliant on imported cells and focused on the US domestic market, the FTZ strategy can be a decisive competitive advantage.

Frequently Asked Questions (FAQ)

What kind of company can apply for FTZ status?

Any firm, public or private, can apply to establish an FTZ. For manufacturing, this is typically done on a ‘subzone’ basis, which is an area designated for the specific use of one company’s operations.

How long does the FTZ approval process typically take?

The process can be lengthy, often taking between 10 to 12 months from application submission to final approval. This timeline must be factored into the overall project plan.

Are FTZs only located near ports or borders?

No. While many FTZs are located near ports of entry for logistical convenience, a subzone can be established at nearly any manufacturing facility in the United States.

Does this strategy apply to components other than solar cells?

Yes. The benefits apply to all imported components brought into the zone, including backsheets, encapsulants, junction boxes, and aluminum frames. The financial impact is simply greatest for the highest-cost, highest-tariff components.

A Strategic Tool for Sophisticated Planning

Establishing a solar factory in a US Foreign-Trade Zone is not a universal solution, but rather a sophisticated strategic tool. For the right business model, it can directly address the primary financial obstacle of component tariffs, enhance cash flow, and improve global competitiveness.

This approach transforms a regulatory challenge into a competitive advantage. It demonstrates that long-term success in solar manufacturing requires more than just technical expertise; it demands a comprehensive understanding of global trade, logistics, and financial strategy. Entrepreneurs who explore such options position their ventures for greater resilience and profitability in a dynamic market.