An investor’s initial focus is often on the capital expenditure (CAPEX) required to establish a solar module assembly line. However, the long-term profitability and sustainability of the venture ultimately hinges on its operational expenditure (OPEX).

For an entrepreneur considering Saint Lucia—a market with unique advantages and specific challenges—a clear grasp of ongoing costs isn’t just an academic exercise; it’s the foundation of a viable business plan. This guide provides a framework for estimating the key operational costs for a solar assembly plant in Saint Lucia. Moving beyond initial investment figures allows a prospective owner to build a financial model that accurately reflects the economic realities of operating in this strategic Caribbean location.

Understanding the Core Components of Operational Expenditure (OPEX)

Operational expenditure refers to the recurring costs of running the business. While the initial cost of a solar factory covers machinery and setup, OPEX encompasses everything required to keep that machinery producing. For a solar assembly plant, these costs fall into several key categories, each with local factors that must be considered.

A comprehensive financial model must account for each of these areas to accurately project cash flow and determine the break-even point.

Analyzing Labor Costs in the Saint Lucian Context

Labor is a significant component of OPEX. Saint Lucia offers a competitive advantage with its skilled and available workforce. However, a financial model needs to differentiate between the various roles within the factory.

Skilled vs. Semi-Skilled Labor

-

Assembly Line Workers: This group forms the largest portion of the workforce. Based on Saint Lucia’s labor market data, wages for semi-skilled manufacturing workers typically range from XCD 8 to XCD 12 per hour (approximately USD 3.00 to USD 4.45).

-

Technical Staff: The operation will require skilled technicians for machine maintenance and quality control, as well as engineers for process oversight. Salaries for these roles are considerably higher and should be benchmarked against local industry standards for technical professionals.

-

Administrative and Management Staff: This includes roles in management, logistics, accounting, and sales.

Based on experience from J.v.G. turnkey projects, a 20-50 MW per year assembly line often requires fewer than 30 well-trained employees per shift. Initial training is critical to achieving efficiency and quality standards, and this cost should be factored into the early-stage operational budget.

Managing Utility Expenses: The Electricity Challenge

Utility costs are a major consideration for any manufacturing facility, and in Saint Lucia, they require special attention.

The national grid is primarily powered by diesel generators, resulting in high electricity costs, often ranging from USD 0.35 to USD 0.45 per kWh. For an energy-intensive operation like a solar assembly plant, this can become one of the largest single operational expenses, directly impacting the final cost per module.

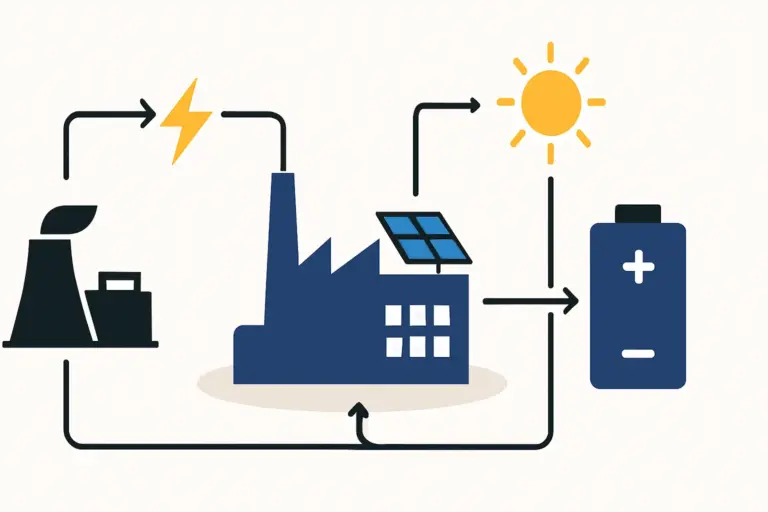

The Self-Consumption Solution

A powerful strategy to mitigate this high cost is for the factory to use its own product. By installing a solar PV system on the factory roof, the business can generate its own electricity at a fraction of the cost of grid power. This not only dramatically reduces OPEX but also serves as a compelling, real-world showcase of the product’s performance in local conditions.

Other essential utilities, such as water and high-speed internet, are readily available in Saint Lucia’s industrial zones but also need to be budgeted for.

Logistics and Supply Chain: An Island Nation’s Reality

As an island nation, Saint Lucia is entirely dependent on sea and air freight for its supply chain. A robust financial model must factor in the logistics of both inbound raw materials and outbound finished products.

-

Inbound Logistics: The solar panel manufacturing process relies on imported components such as solar cells, EVA film, glass, backsheets, and aluminum frames. The cost of shipping these materials to Saint Lucia, including customs clearance and port fees, must be calculated precisely.

-

Outbound Logistics: The finished solar modules are destined for local, regional (CARICOM), or international markets. Shipping costs from Saint Lucia to these target markets will be a key factor in the final landed price of the product.

Saint Lucia’s strategic location, with major ports in Castries and Vieux Fort and an international airport, provides excellent connectivity to North America, Latin America, and Europe. This logistical infrastructure is a significant advantage for an export-oriented business.

Factoring in Facility and Compliance Costs

Beyond core production costs, a sound financial model should also incorporate building, maintenance, and regulatory expenses.

-

Facility Costs: This typically involves leasing a suitable industrial building that meets specific factory building requirements, including sufficient floor space, ceiling height, and electrical capacity. The budget should also cover insurance, security, and property maintenance.

-

Equipment Maintenance: While new machinery comes with warranties, a budget for routine maintenance, spare parts, and consumables is essential for minimizing downtime and ensuring consistent output.

-

Compliance and Taxes: The standard corporate income tax rate in Saint Lucia is 30%. However, it is vital to engage with Invest Saint Lucia, the national investment promotion agency. They can provide guidance on available fiscal incentives, which may include tax holidays or waivers on import duties for manufacturing equipment and raw materials, significantly reducing the operational cost burden.

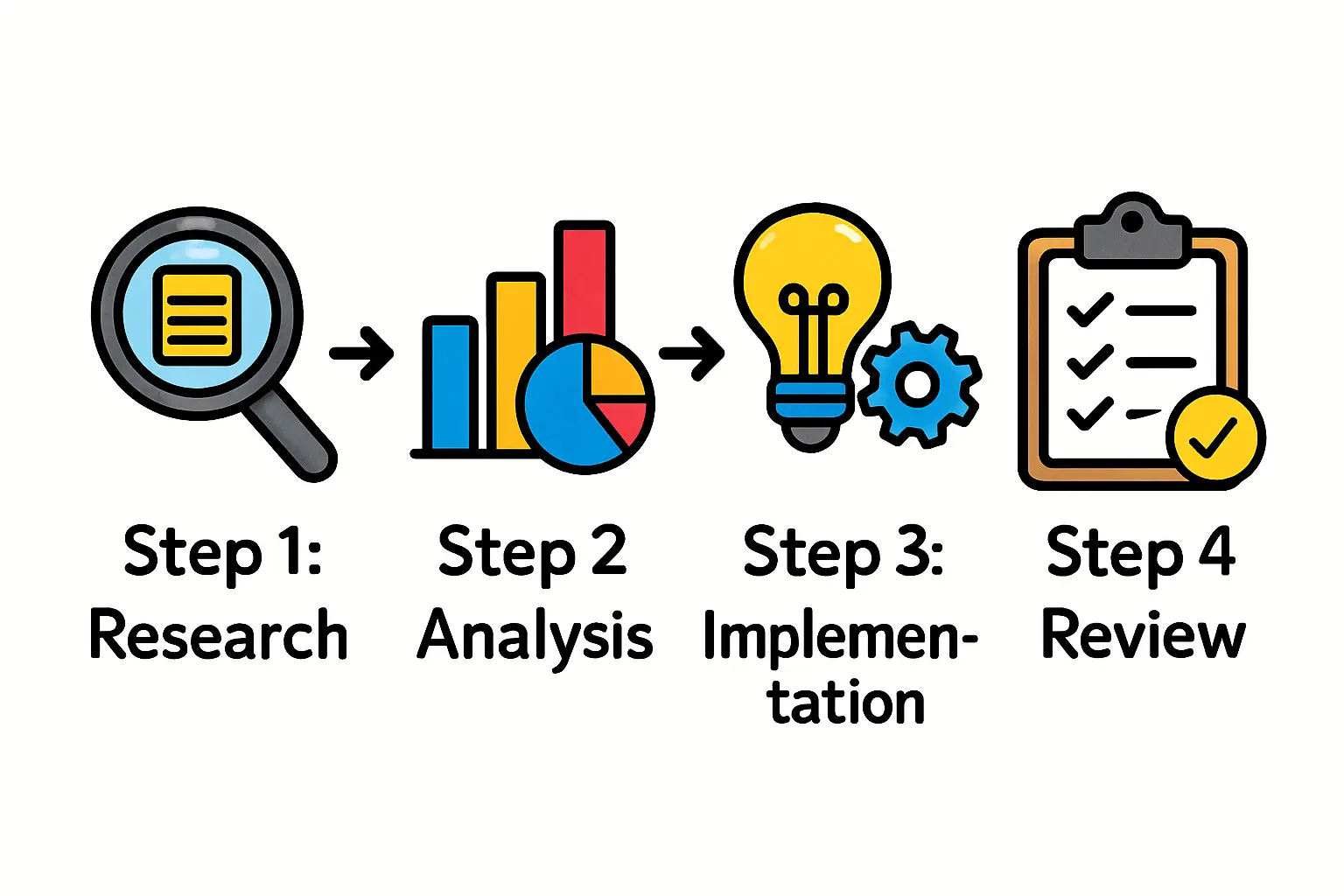

Building a Realistic Financial Projection

Building a credible financial projection involves methodically combining these cost categories. It’s prudent to use conservative estimates, especially for variable costs like shipping and utilities, and to include a contingency fund (typically 10-15%) to account for unforeseen expenses.

The local currency, the Eastern Caribbean Dollar (XCD), is pegged to the US Dollar at a fixed rate of XCD 2.70 to USD 1.00, providing crucial currency stability for international business planning.

Frequently Asked Questions (FAQ)

What are the biggest ‘hidden’ operational costs to be aware of in Saint Lucia?

The most significant variable costs that can be overlooked are the volatility of global shipping rates and the high price of grid electricity. A robust model will include sensitivity analysis for these two factors. Additionally, budgeting for ongoing staff training and development is crucial for maintaining quality and efficiency.

How can a new solar assembly plant in Saint Lucia remain competitive?

Competitiveness hinges on several key strategies:

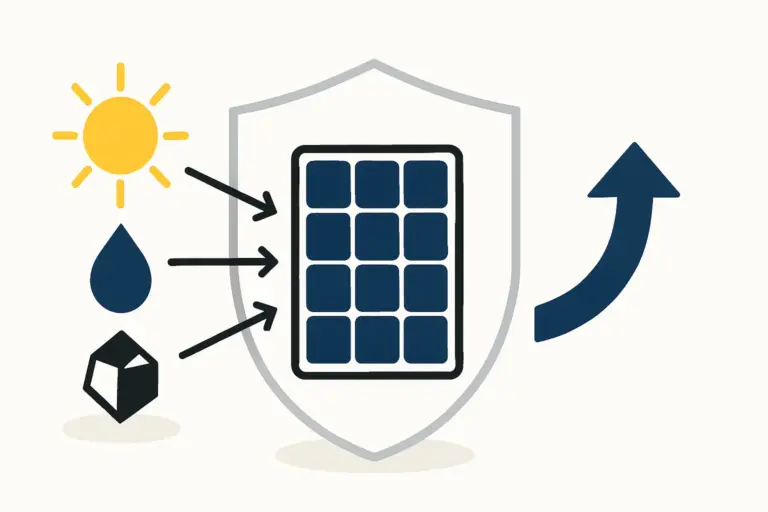

- High Efficiency: Using modern, automated machinery to maximize throughput and minimize waste.

- Quality Focus: Obtaining international certifications (e.g., IEC) to build a reputation for reliability.

- Regional Advantage: Leveraging CARICOM trade agreements to serve the Caribbean market with shorter lead times and lower shipping costs than competitors from Asia or Europe.

- Energy Independence: Implementing a solar self-consumption system to drastically reduce electricity costs.

Are there government incentives that can directly reduce OPEX?

Yes. Through Invest Saint Lucia, a business may qualify for incentives under acts such as the Special Development Areas Act or the Free Zone Act. These can include a complete or partial waiver of corporate income tax for a set period and exemptions from import duties on raw materials, both of which directly lower operational costs.

What is a typical number of employees for a small to medium-sized plant?

A semi-automated assembly line with a capacity of 20-50 MW per year typically runs effectively with a team of 25 to 35 employees per shift, including production line staff, technicians, and supervisors.

Conclusion: From Estimation to Execution

Estimating operational costs is a critical step that bridges the gap between an investment idea and a functional business. For entrepreneurs looking at Saint Lucia, a detailed OPEX model reveals the financial reality of the venture. A careful analysis of labor, utilities, logistics, and compliance allows an investor to create a realistic projection that stands up to scrutiny.

This detailed financial groundwork is the key to securing financing, planning for long-term profitability, and successfully launching a solar module assembly operation that can thrive in the Caribbean and beyond.