Modern Syria presents a paradox: the country enjoys some of the highest solar irradiation levels in the world, averaging over 5 kWh per square meter daily, yet it faces significant energy deficits. For an entrepreneur considering solar module manufacturing, this energy gap represents a substantial opportunity.

Success, however, hinges not on machinery alone, but on establishing a robust and resilient supply chain for the Bill of Materials (BOM). This guide outlines a strategic framework for sourcing essential components for a solar factory in Syria, addressing the region’s unique geopolitical and logistical challenges and focusing on practical strategies to build a supply chain that can withstand volatility and support long-term growth.

The Strategic Importance of a Resilient Supply Chain

Before a single solar module can be assembled, a factory requires a consistent flow of high-quality raw materials. The complete list of these components is known as the Bill of Materials (BOM). For a standard solar panel, this includes solar cells, encapsulant film (EVA), backsheets, glass, aluminum frames, and junction boxes.

In stable markets, sourcing the BOM is typically a matter of negotiating cost and quality. In Syria, however, resilience becomes paramount. A resilient supply chain is designed not just for efficiency, but for durability against disruptions such as shipping delays, sudden tariff changes, currency fluctuations, and the complex web of international sanctions. For a new manufacturing venture, a single extended disruption in the supply of a critical component can halt production entirely.

Navigating Syria’s Unique Sourcing Landscape

Establishing a supply chain for a Syrian solar factory requires a clear-eyed view of the obstacles and strategic workarounds.

Key Challenges:

- International Sanctions: Navigating financial transaction limitations and shipping restrictions requires specialized logistical and financial partners.

- Logistical Bottlenecks: Port congestion and overland transport complexities can lead to delays and increased costs.

- Currency Instability: Fluctuations in the local currency against the US Dollar or Euro can dramatically impact the cost of imported goods.

- Limited Local Manufacturing: Currently, there is no domestic production base for key components like solar cells or EVA, making imports a necessity.

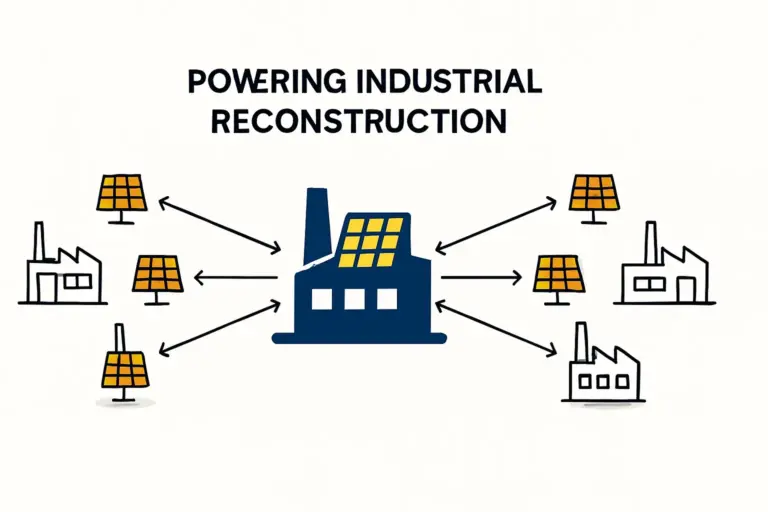

Despite these hurdles, a growing focus on reconstruction and renewable energy within Syria creates momentum. The strategic imperative is to shift from a single-source, lowest-cost model to a diversified, region-focused approach.

A Component-by-Component Sourcing Strategy

A resilient BOM strategy involves analyzing each component individually to identify both primary and secondary suppliers, with a strong preference for geographical proximity.

Solar Cells: The Heart of the Module

Solar cells are the most critical and technologically sensitive component. While China remains the global leader in cell production, relying on it exclusively introduces significant logistical risk.

- Primary Option (Regional): Egypt is emerging as a regional hub for cell manufacturing. Sourcing from Egypt can reduce shipping times and complexity compared to East Asia.

- Secondary Option (Global): Top-tier Chinese suppliers remain a necessary option for accessing the latest high-efficiency technologies like PERC and TOPCon. Success depends on working with experienced freight forwarders who understand the routes into Syria through neighboring ports.

EVA and Backsheets: Protecting the Investment

The encapsulant (EVA) and backsheet are vital to a solar module’s 25-year lifespan. Compromising on their quality can lead to premature failure.

- Primary Hub: The United Arab Emirates (UAE) has become a major distribution and conversion hub for these materials. Sourcing from the UAE offers a good balance of quality from reputable global brands and more manageable logistics.

- Secondary Hub: Turkish suppliers also offer quality backsheets and are increasingly active in the solar materials market. Their proximity is a significant advantage.

When sourcing these protective layers, adhering to strict quality control standards and verifying supplier certifications (e.g., TUV, ISO) is essential.

Aluminum Frames and Glass: The Structural Components

These bulky components are expensive to ship over long distances, making regional sourcing the most practical option.

- Aluminum Frames: Turkey is the undisputed regional leader in aluminum extrusion. Numerous Turkish companies specialize in solar panel frames, offering high quality, competitive pricing, and straightforward logistics.

- Solar-Grade Glass: High-transmission, low-iron tempered glass is another specialty product. Suppliers in both Turkey and Egypt are the most viable sources. Establishing a strong relationship with a glass manufacturer is a critical early step.

Junction Boxes and Connectors

These components, while small, are crucial for safety and performance. The UAE is an excellent regional source, where many distributors stock high-quality junction boxes from specialized European and Asian manufacturers.

Logistics: The Gateway Through Neighboring Countries

Because direct shipping to Syrian ports can be unreliable, the ports of Beirut (Lebanon) and Aqaba (Jordan) often serve as primary entry points, from which goods are transported overland. Building strong relationships with logistics companies based in these countries is as important as securing the component suppliers themselves. These partners are experts in handling customs clearance and ensuring the final leg of the journey proceeds smoothly.

Experience from J.v.G. turnkey projects in emerging markets shows that establishing a buffer stock for critical components (e.g., a two- to three-month supply of solar cells and EVA) is a crucial risk mitigation strategy. This provides a cushion against unforeseen delays.

Frequently Asked Questions (FAQ)

-

How do international sanctions directly affect sourcing solar components?

Sanctions primarily impact financial transactions and shipping. It is often necessary to work through intermediary financial institutions in neutral countries and with logistics firms that have established, compliant pathways into Syria. While this adds complexity and cost, the process is manageable with experienced partners. -

What is a realistic timeframe for establishing an initial supply chain?

A business should budget six to nine months from initial supplier identification and qualification to receiving the first shipments. This includes time for sample testing, contract negotiation, and navigating initial logistical hurdles. -

Is it feasible to manufacture any components locally in Syria in the near future?

While manufacturing solar cells or EVA film requires massive capital investment and technical expertise, local assembly of junction boxes or the fabrication of aluminum frames from imported extrusions could be a feasible long-term goal. Initially, however, the focus must be on importing all BOM components. -

How critical are supplier certifications like ISO or TUV?

They are absolutely critical. For a new manufacturer, relying on internationally recognized certifications is the primary way to ensure material quality without an extensive in-house testing lab. These certifications guarantee that a supplier meets global standards for performance, safety, and durability, which is essential for producing a bankable solar module.

A Foundation for Sustainable Growth

Building a resilient supply chain is the foundation for any solar module manufacturing venture. For entrepreneurs in Syria, the path is more complex than in other regions. By adopting a diversified, region-focused sourcing strategy, however, these challenges can become a competitive advantage. A stable supply chain not only ensures consistent production but also builds a resilient business capable of capturing the immense potential of Syria’s solar energy market. The process requires careful planning, where a consultant providing a turnkey production line can prove instrumental in qualifying and establishing these critical supplier relationships.