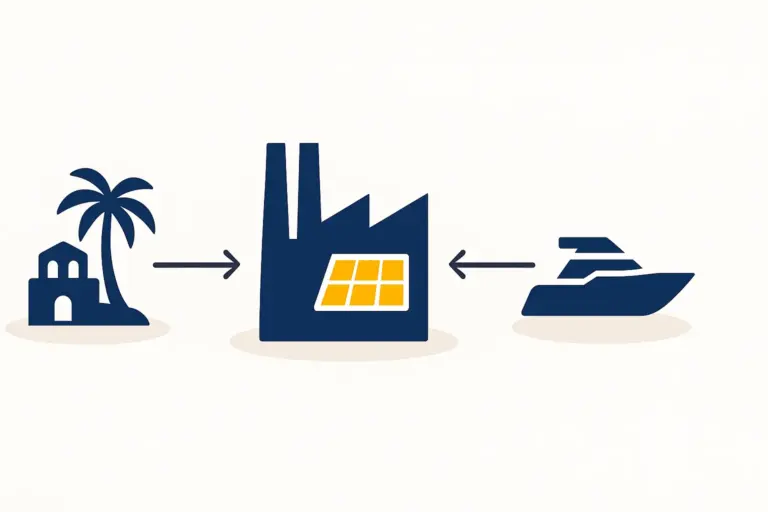

Entrepreneurs exploring new markets often face a critical question: how to justify the high initial investment for a new manufacturing facility, especially in an emerging industry? For those considering solar module production in the Caribbean, St. Vincent and the Grenadines (SVG) offers a compelling answer through its fiscal incentives program—specifically, the designation of ‘Pioneer Status.’

This status is more than a title; it’s a powerful financial tool designed to attract investment in industries considered vital to the nation’s economic development. For a solar panel manufacturer looking to invest, understanding this program is the first step toward building a viable business case. This guide explains the benefits of Pioneer Status and outlines the practical steps for a successful application through Invest SVG.

Understanding Pioneer Status: What It Means for Your Solar Venture

Pioneer Status is a legal designation granted under SVG’s Fiscal Incentives Act to new enterprises in sectors the government seeks to promote. With its potential for job creation, technology transfer, and greater energy independence, solar module manufacturing is a prime candidate for this classification.

When the government grants a company Pioneer Status, it’s formally recognizing it as a trailblazer in a new or underdeveloped field. This recognition comes with substantial financial benefits designed to reduce initial capital expenditure and improve profitability during the crucial early years. Ultimately, the goal is to de-risk the investment and create a favorable environment for growth.

Key Financial Incentives for Pioneer Solar Manufacturers

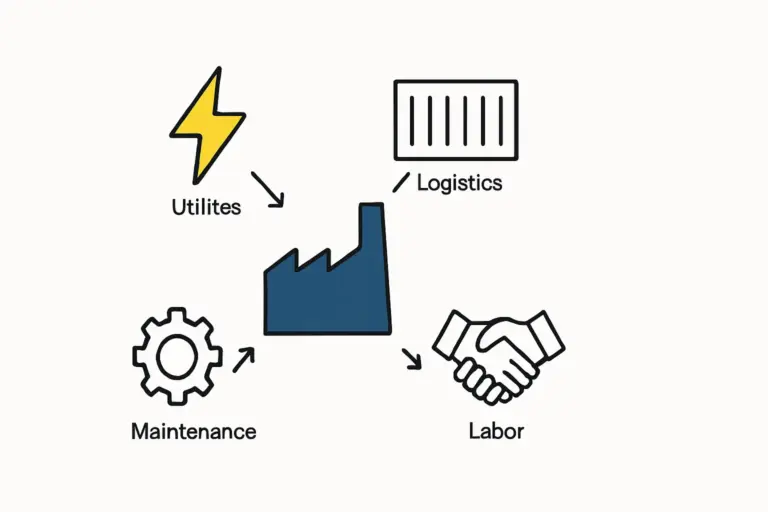

Securing Pioneer Status unlocks several significant advantages that directly impact a project’s bottom line, making SVG a competitive location for establishing a modern solar module production line.

Corporate Tax Holiday

The most significant benefit is a complete exemption from corporate income tax for up to 15 years. For a new manufacturing business, this means profits from this initial phase can be fully reinvested into expansion, equipment upgrades, or market development.

Duty-Free Concessions

Building a solar factory requires importing significant amounts of machinery, equipment, and raw materials. Pioneer Status grants concessions on customs duties for all these items. This dramatically lowers the initial solar factory investment and reduces ongoing operational costs, since production materials can be imported duty-free.

Repatriation of Profits

The ability to repatriate profits and capital is a critical consideration for international investors. The government of SVG guarantees that funds from legitimate earnings and capital can be moved out of the country, offering crucial confidence and security to foreign investors.

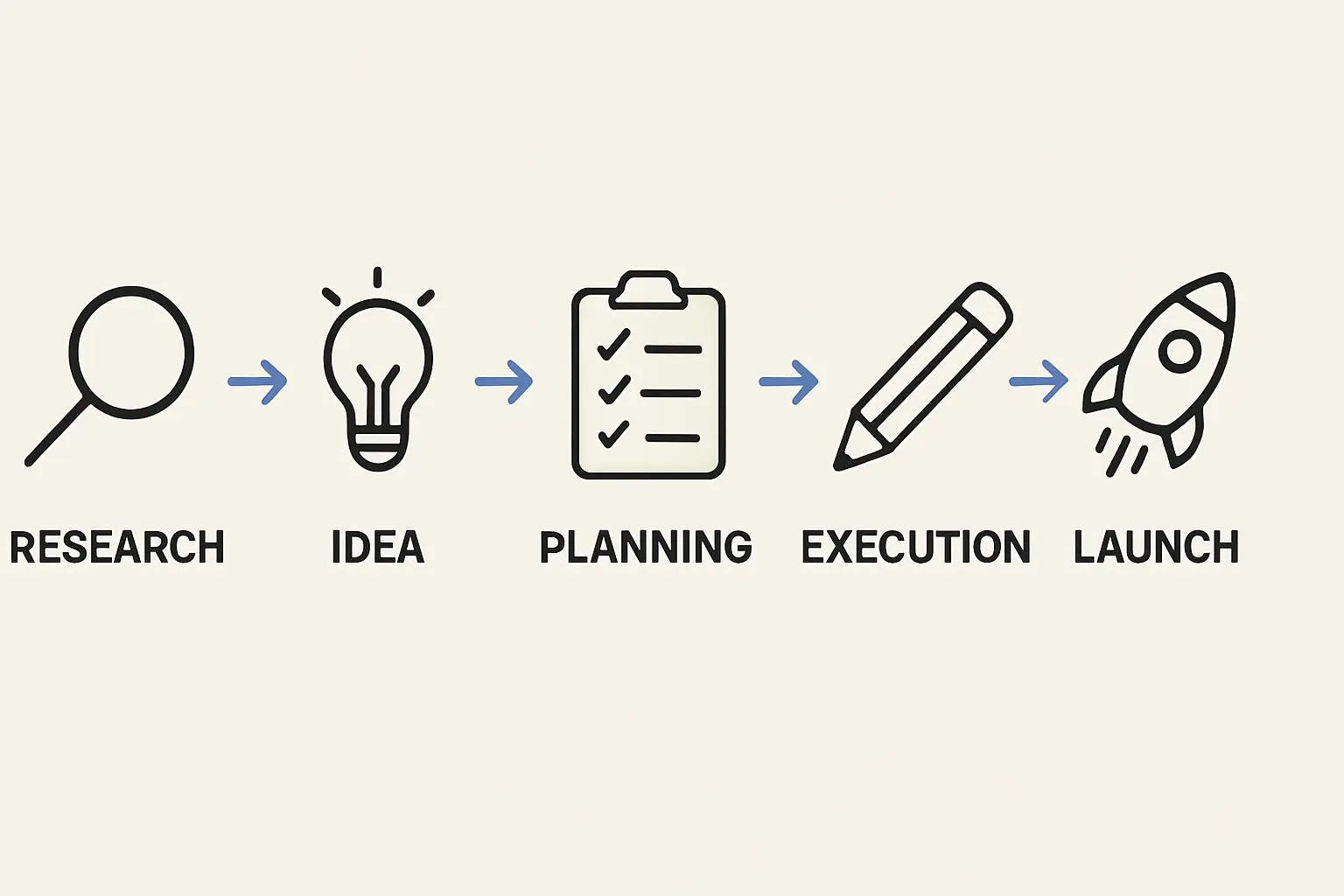

The Application Process: A Step-by-Step Walkthrough with Invest SVG

The application for fiscal incentives is managed by Invest SVG, the nation’s investment promotion agency. The process is structured and requires meticulous preparation.

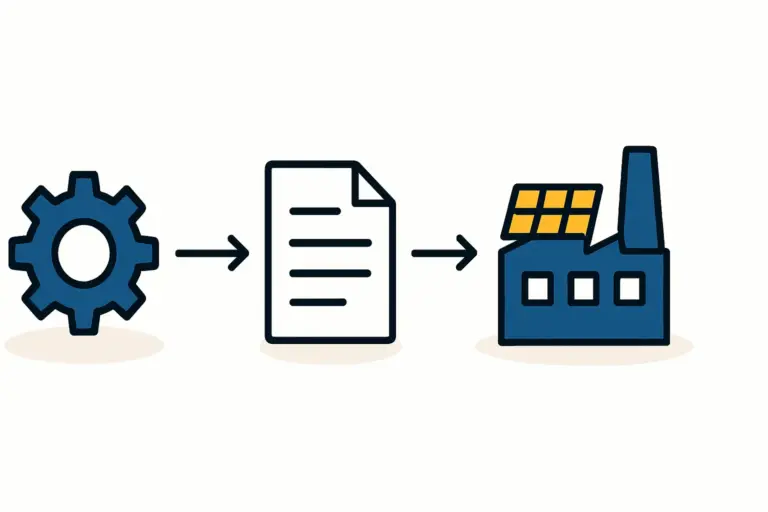

Step 1: Initial Consultation and Business Plan Submission

The first formal step is to engage with Invest SVG, where you will present a comprehensive business plan and a completed ‘Application for Fiscal Incentives’ form. The business plan is the most critical document in this process; it must clearly demonstrate the project’s vision, technical feasibility, market analysis, and financial viability.

Based on experience with turnkey projects, a successful solar factory business plan should include:

- Project Description: A detailed overview of the proposed manufacturing facility, including production capacity, technology to be used, and types of solar modules to be produced.

- Market Analysis: An assessment of the target markets (local, regional, and international).

- Financial Projections: Detailed cash flow forecasts, profit and loss statements, and a balance sheet for the first five to ten years of operation.

- Employment Plan: The number of local jobs the project will create, along with plans for training and skill development.

Step 2: Assembling the Required Documentation

A complete application package is essential to avoid delays. The following documents are typically required alongside the business plan:

- Certificate of Incorporation or Business Registration in SVG.

- A detailed list of the machinery, equipment, and raw materials to be imported.

- Proof of financing for the project (e.g., bank statements, letters of credit, or loan agreements).

- Biographical data and identification for the company’s directors.

- Certificates of compliance from the National Insurance Scheme (NIS) and Inland Revenue Department, if the company is already operating in SVG.

Step 3: Cabinet Review and Approval

Once Invest SVG confirms the application is complete, the agency submits it with a recommendation to the Cabinet of St. Vincent and the Grenadines. The Cabinet, as the executive branch of government, makes the final decision on granting Pioneer Status and its associated incentives. This review can take several months, as it depends on the project’s perceived contribution to national development goals.

Step 4: Gazetting the Order

Following Cabinet approval, a formal Order is published in the Official Gazette. This publication is the final legal step that officially grants the company Pioneer Status and makes the fiscal incentives legally binding.

Common Challenges and How to Prepare

While the process is straightforward, applicants can still face challenges that may cause delays or rejection.

- Incomplete Documentation: An incomplete application is the most common cause of delays. Use a checklist to ensure every required document is correctly prepared and submitted.

- Unrealistic Projections: Invest SVG and the Cabinet will carefully scrutinize financial projections. Overly optimistic or poorly researched figures can undermine the credibility of the entire proposal.

- Lack of Clarity on Local Impact: The government prioritizes projects that deliver tangible benefits to the local economy. Your business plan must clearly detail job creation, potential export earnings, and partnerships with local suppliers.

Frequently Asked Questions (FAQ)

What is the minimum investment required to qualify for Pioneer Status?

While the Fiscal Incentives Act does not specify a minimum investment amount, the project must be of a scale that is considered significant and impactful for the national economy. A commercial-scale solar module manufacturing facility would typically meet this criterion.

Does Pioneer Status apply to the expansion of an existing business?

Yes, the incentives can be granted for the establishment of a new enterprise or for the expansion or modernization of an existing one, provided the expansion meets the government’s strategic objectives.

How long does the application process typically take?

From the submission of a complete application to the final gazetting, the process can take between three to six months, depending on the complexity of the project and the schedule of Cabinet meetings.

Are there any local employment requirements?

There is no strict quota, but the government strongly favors projects that commit to hiring and training Vincentian nationals. The number of jobs created is a key factor in the evaluation of an application.

Securing Pioneer Status is a structured process that can transform the financial outlook for a new solar manufacturing enterprise in St. Vincent and the Grenadines. The generous tax and duty concessions offer a significant competitive advantage. Success, however, hinges on diligent preparation, a professional business plan, and a clear demonstration of the project’s value to the nation’s economic future. For any serious investor, mastering this process is an essential step toward launching a successful venture in the Caribbean.