A Guide to Securing Finance for Solar Manufacturing in Saudi Arabia Through the SIDF

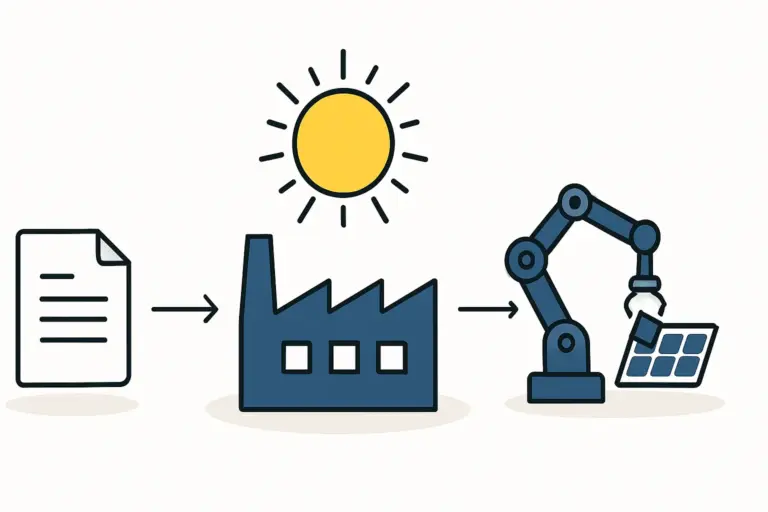

For many entrepreneurs looking to enter Saudi Arabia’s solar manufacturing sector, the ambition is clear, but the financial pathway is less so. The capital required to establish a modern photovoltaic (PV) module production facility is substantial.

While commercial banks do offer financing, their terms are often designed for established industries, featuring shorter repayment periods and higher interest rates that can strain the profitability of a new industrial venture.

This is where the Saudi Industrial Development Fund (SIDF) becomes a critical partner. Established to champion industrial growth within the Kingdom, the SIDF operates not as a mere lender but as a strategic enabler, offering financial solutions tailored to the long-term nature of industrial projects. For aspiring solar manufacturers in the region, navigating its processes is key to success.

Understanding the Saudi Industrial Development Fund (SIDF)

The Saudi Industrial Development Fund is a government financial institution dedicated to supporting the Kingdom’s private industrial sector. With a capital of SAR 105 billion, its mandate is to help drive economic diversification in line with Saudi Vision 2030.

For the renewable energy sector, this means actively promoting local manufacturing capabilities to build a self-sufficient and export-oriented solar industry. Unlike commercial lenders, which focus on short-term risk and return, the SIDF’s objective is long-term industrial development. Its financial products provide patient capital, allowing new factories the time they need to ramp up production, achieve operational efficiency, and establish a market presence before significant debt repayment pressures begin.

Why SIDF is the Preferred Partner for PV Manufacturing Projects

Choosing a financing partner is one of the most consequential decisions an industrial investor will make. For PV manufacturing projects in Saudi Arabia, the SIDF offers distinct advantages over traditional financing routes. Its primary benefits are rooted in the structure of its loans, which are specifically designed to align with the lifecycle of an industrial startup.

Key advantages often include:

- Extended Loan Tenors: The SIDF may offer repayment periods of up to 20 years, a stark contrast to the 5–7 year terms common in commercial lending. This extended timeframe significantly reduces the monthly repayment burden on a new enterprise.

- Generous Grace Periods: New factories need time to commission equipment and ramp up production. The SIDF typically provides a grace period of up to 36 months, during which no principal or interest payments are due. This allows the business to stabilize operations and generate revenue before servicing its debt.

- High Financing Percentage: The fund can finance up to 75% of a project’s total eligible costs, covering expenses like land, buildings, machinery, and pre-operating costs. This reduces the initial equity burden on the investor.

- Strategic Alignment: An SIDF loan is more than just capital; it is an endorsement signaling the project’s alignment with national strategic goals. This can open doors to further government support and facilitate smoother interactions with other regulatory bodies.

Key Eligibility Criteria for SIDF Financing

Accessing SIDF financing requires meeting rigorous criteria. The fund conducts thorough due diligence to ensure the projects it supports are viable, well-planned, and contribute to the Kingdom’s industrial objectives.

Industrial License Requirement

The most fundamental requirement is a valid industrial license issued by the Ministry of Industry and Mineral Resources (MIM). This license officially recognizes the project as an industrial activity and is a prerequisite for the SIDF application.

Saudi Ownership and Legal Structure

The project must be legally established within Saudi Arabia. While foreign investment is encouraged, SIDF guidelines typically require a significant level of Saudi ownership. Applicants must present a clear legal and ownership structure that complies with these regulations.

Project Feasibility and Business Plan

A credible and detailed feasibility study is the cornerstone of a successful application. This document must demonstrate the project’s technical, market, and financial viability. It should include market analysis, production technology choices, and comprehensive financial projections. A comprehensive business plan for a solar factory (placeholder_link) is non-negotiable and must be prepared to the highest professional standard.

Local Content (In-Country Value – ICV)

Alignment with the Kingdom’s In-Country Value (ICV) objectives is increasingly important. The application should demonstrate how the project will contribute to the local economy by creating jobs for Saudi nationals, procuring local raw materials, and engaging local service providers.

Financial Viability and Equity Contribution

Applicants must demonstrate the financial soundness of their project and their capacity to contribute the required equity portion (typically 25% or more of the project cost). The SIDF assesses the project’s projected profitability, cash flow, and ability to service debt over the long term.

The SIDF Application Process: A Step-by-Step Overview

The application process is structured and methodical. While it can seem complex, it is designed to thoroughly vet every aspect of a proposed project.

-

Initial Inquiry and Pre-screening: The process begins with an initial application through the SIDF portal. The fund’s team reviews the project’s basic concept to determine if it aligns with its mandate and eligibility criteria.

-

Formal Application Submission: If the project passes this initial screening, the applicant is invited to submit a complete application package. This includes the detailed feasibility study, industrial license, legal documents, and details about the project’s key sponsors. Understanding the full scope of investment requirements for a solar module factory (placeholder_link) is crucial at this stage.

-

Due Diligence and Appraisal: A dedicated SIDF team then conducts a comprehensive appraisal. This involves a deep dive into the market analysis, technical specifications, financial models, and management team. They may conduct site visits and request additional information to validate the business plan’s assumptions.

-

Loan Approval and Agreement: Once due diligence is successfully completed, the project is presented to the SIDF’s loan committee for final approval. If approved, a formal loan agreement is drafted, outlining all terms, conditions, and covenants.

-

Disbursement and Project Monitoring: Funds are typically disbursed in tranches tied to project milestones, such as the completion of civil works or the arrival of machinery. The SIDF continues to monitor the project’s progress through construction and into its operational phase to ensure it is implemented as planned.

Preparing a Compelling Application Package

Success with the SIDF hinges on the quality and professionalism of the application package. Based on experience from J.v.G. turnkey projects, the feasibility study is the single most important document. It must be data-driven, realistic, and defensible.

This requires a deep understanding of the solar panel manufacturing process (placeholder_link), from sourcing raw materials to final module certification. The technical sections must be robust, specifying the chosen technology, machinery suppliers, factory layout, and production capacity. The financial models must be built on credible assumptions for revenue, operating costs, and working capital.

Engaging with experienced consultants who understand both the technical aspects of PV manufacturing and the financial requirements of institutions like the SIDF can significantly improve the application’s quality and likelihood of approval.

Frequently Asked Questions (FAQ) about SIDF Loans

What is the typical size of an SIDF loan for a manufacturing project?

Loan amounts vary based on the project’s scale and costs, but they are substantial enough to cover a major portion of a new factory, often running into tens of millions of Saudi Riyals.

What kind of collateral is required?

The SIDF typically secures its loans with a mortgage on the project’s fixed assets, including land, buildings, and machinery. Personal or corporate guarantees from the project sponsors may also be required.

How long does the approval process typically take?

The timeline can vary depending on the complexity of the project and the completeness of the application. A well-prepared application can move through the process in 6–9 months, but it is wise to plan for a longer timeframe.

Can foreign investors access SIDF funding?

Foreign investors can benefit from SIDF financing, but typically as part of a joint venture with a Saudi partner. The exact ownership requirements should be confirmed directly with the fund.

Does the SIDF finance used equipment?

The SIDF strongly prefers to finance new, state-of-the-art equipment to ensure projects are technologically competitive and efficient. Financing for used equipment is rarely provided and only under very specific circumstances.

Conclusion: Strategic Partnership for Industrial Growth

Securing financing from the Saudi Industrial Development Fund is a milestone that transforms a business concept into a tangible industrial project. The process is demanding, requiring meticulous preparation, but the benefits—favorable loan terms, a long-term financial partner, and alignment with national strategy—are immense.

For entrepreneurs serious about establishing a presence in the Kingdom’s growing solar sector, the SIDF is not just another financing option; it is the primary strategic enabler. A successful application rests on a solid foundation of technical knowledge, market insight, and financial diligence. For those embarking on this journey, the path begins with a complete understanding of how to start a solar panel factory (placeholder_link) from the ground up.