While an investor’s vision for a new solar module factory rightly focuses on sourcing the best machinery and securing financing, the final journey of that equipment—from port of arrival to the factory floor—is a critical phase that can shape the project’s timeline and budget.

The logistical complexities of customs clearance and inland transportation, particularly for heavy industrial machinery, are frequently underestimated. This guide offers a step-by-step overview of customs and logistics procedures at Syrian ports. Understanding this process is essential for any entrepreneur planning to establish a solar manufacturing presence in the region, helping to ensure that valuable equipment arrives safely, on time, and within budget.

The Strategic Advantage: Syrian Customs Exemptions

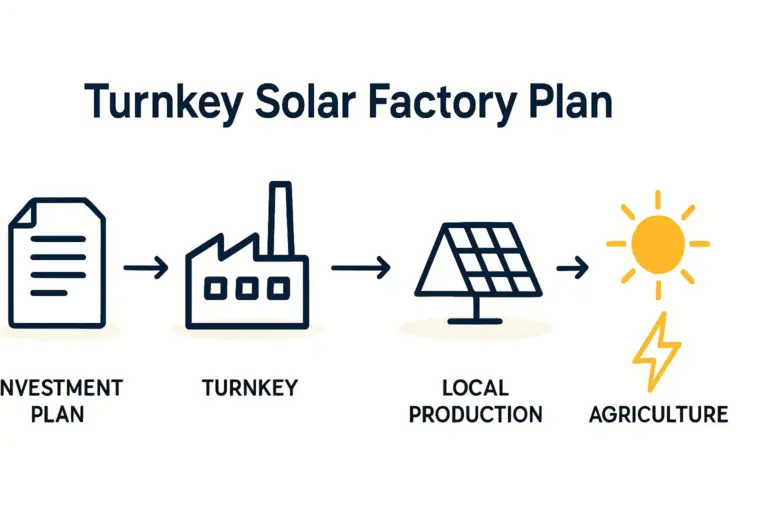

Before delving into the procedural details, it’s worth noting a significant advantage offered in the Syrian renewable energy sector. Under Syrian Law No. 2 of 2021, equipment, machinery, and production lines required for renewable energy projects are granted an exemption from customs duties.

This policy is designed to encourage investment and accelerate the development of local energy production. For an entrepreneur setting up a solar module factory, this exemption can substantially reduce the initial capital outlay, making the overall investment in solar manufacturing more financially viable. Crucially, while customs duties are waived, other fees such as port handling, agent fees, and Value-Added Tax (VAT) still apply.

The journey of solar manufacturing equipment begins with international shipping and careful port handling.

The Customs Clearance Process: A Step-by-Step Breakdown

Navigating Syrian customs successfully requires a systematic approach. The process, managed by the Syrian Customs Directorate at major ports like Latakia and Tartous, unfolds in four main phases. Based on experience from J.v.G. turnkey projects, a typical clearance timeline is 7-14 business days, provided all documentation is in order.

Phase 1: Pre-Arrival and Documentation Submission

The foundation for a smooth clearance process is laid well before the vessel docks.

-

Pre-Clearance Filing: Your appointed customs clearance agent can submit the necessary import declarations and supporting documents to customs authorities electronically before the shipment arrives. This allows for an initial review and helps identify potential issues early on.

-

Document Verification: Customs officials conduct a preliminary check of the submitted paperwork for accuracy and completeness. Any discrepancies here can lead to significant delays down the line.

Phase 2: Vessel Arrival and Physical Inspection

Once the shipment arrives at the port, the physical verification process begins.

-

Container Unloading: The containers carrying the machinery for your solar panel manufacturing line are offloaded and moved to a designated customs inspection area.

-

Physical Examination: Customs officers physically inspect the goods, primarily to verify that the contents match the declaration in the commercial invoice and packing list. They will check serial numbers, country of origin markings, and the general condition of the equipment.

Phase 3: Duty Assessment and Final Payments

Even with the customs duty exemption, this phase is critical for calculating other applicable charges.

-

Valuation and Assessment: Officials confirm the value of the machinery to calculate any applicable taxes (like VAT) and fees.

-

Payment of Dues: Your agent settles all port handling charges, agent fees, and other government levies. A final release order is issued only once these payments are confirmed.

Phase 4: Final Release and Gate Pass

With all inspections passed and payments made, the final step is to move the cargo out of the port.

-

Issuance of Release Order: The customs authority issues a formal release order.

-

Port Authority Gate Pass: This release order is presented to the port authority, which then issues a gate pass authorizing the equipment to be loaded onto trucks for inland transportation.

Essential Documentation for a Seamless Clearance

Meticulous and accurate documentation is the single most important factor in preventing delays, as incomplete or incorrect paperwork is the most common reason shipments are held at customs. The following documents are mandatory:

-

Commercial Invoice: Details the transaction between the seller and buyer, including a description of the goods and their value.

-

Packing List: An itemized list of the contents of each container, including weights and dimensions. This is crucial for customs to verify the shipment’s contents against the invoice.

-

Certificate of Origin: A document certified by a chamber of commerce in the country of origin, confirming where the machinery was manufactured.

-

Bill of Lading (B/L): A legal document from the carrier that details the type, quantity, and destination of the goods. It serves as a shipment receipt.

-

Import License: If required for the specific type of machinery.

-

Proof of Exemption: Documentation referencing Law No. 2 of 2021 to claim the customs duty waiver.

Working with an experienced customs clearance agent who understands the specific requirements for industrial machinery and renewable energy projects is highly recommended.

Inland Transportation: The Final Stage

Once cleared, the machinery for turnkey solar production lines must be transported from the port to the factory site—a stage that presents its own logistical challenges.

-

Specialized Transport: Solar manufacturing equipment is often heavy and oversized, requiring specialized flatbed trucks, cranes for loading and unloading, and experienced drivers.

-

Infrastructure and Security: The condition of roads and security along the route must be assessed in advance. Planning the route with a local logistics partner is essential to avoid delays and ensure the safety of the valuable cargo.

-

Coordination: This final step requires precise coordination between the customs agent, the transport company, and the team at the factory site to ensure a smooth offloading and installation process.

Frequently Asked Questions (FAQ)

Q1: What is the most common cause of customs delays in Syria for industrial equipment?

The most common issue is incorrect or incomplete documentation. Any discrepancy between the commercial invoice, packing list, and the physical goods can halt the process. Working closely with the equipment supplier and a professional agent to ensure all paperwork is perfectly aligned is critical.

Q2: Can an investor handle the customs clearance process directly without an agent?

While technically possible, it is strongly discouraged. The customs process involves complex regulations, and an experienced local agent has established relationships with port and customs officials. Such an agent can navigate the system efficiently, troubleshoot issues, and save significant time and money.

Q3: Does the customs exemption under Law No. 2 of 2021 cover all import-related costs?

No. The exemption applies specifically to customs duties. Investors must still budget for other costs, including port handling fees, customs agent fees, VAT, and the cost of inland transportation and insurance.

Q4: What happens if the machinery is damaged during shipping or handling at the port?

Having comprehensive cargo insurance that covers the journey from the supplier’s factory to your own is essential. If damage is discovered during customs inspection, it must be documented immediately in a formal report to support an insurance claim.

Conclusion: Planning for a Successful Import

Importing solar production machinery into Syria is a manageable process, but one that requires thorough preparation and professional support. By understanding the customs exemption framework, preparing meticulous documentation, and partnering with experienced local logistics and clearance agents, investors can mitigate the risks of delays and unexpected costs. This careful planning ensures that the foundational equipment for a new solar factory arrives securely, keeping the project on schedule for its operational launch.