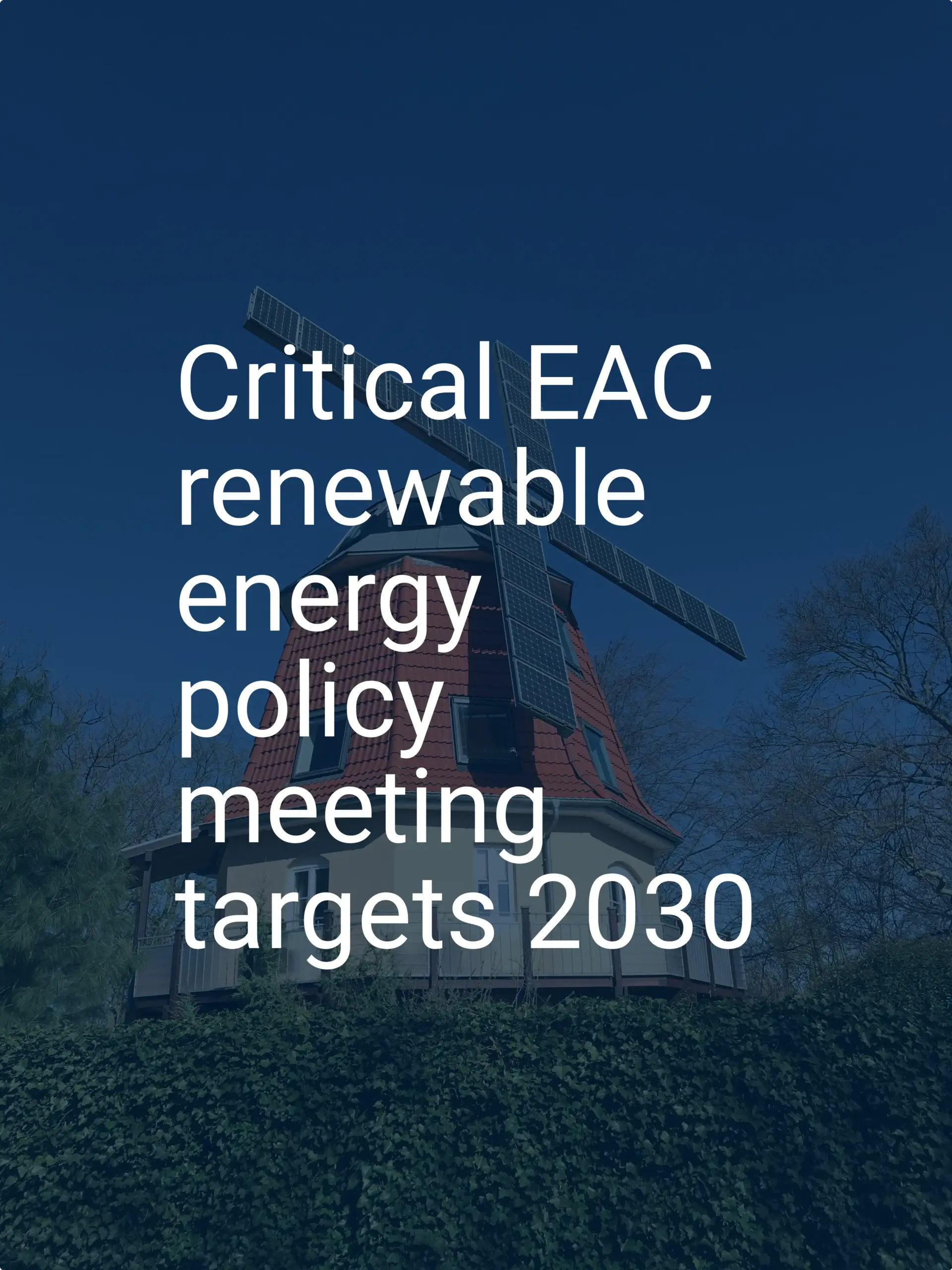

An entrepreneur looking at a map of Africa sees more than just geography—they see opportunity. In Uganda, the ‘Pearl of Africa,’ that opportunity is exceptionally bright. With an average of 5-6 kilowatt-hours of solar energy per square meter daily, the country holds immense potential for solar power generation.

For a business professional considering solar module manufacturing, however, the initial capital outlay for machinery and facilities can appear daunting. This is a common and valid concern.

Yet many potential investors may not realize that Uganda has established a robust legal framework specifically designed to mitigate these initial financial hurdles. The Investment Code Act of 2019 is not just legislation; it is a clear invitation for investment in strategic sectors like solar energy manufacturing. This article breaks down the key incentives available under the Act and how they directly support the establishment of a solar manufacturing enterprise in Uganda.

Understanding the Investment Code Act of 2019

The primary objective of the Investment Code Act is to attract, promote, and protect private investment in Uganda. It streamlines processes and fosters a predictable, transparent environment for local and foreign investors alike.

For those entering the capital-intensive field of solar panel production, the Act offers a suite of powerful incentives aimed at de-risking the initial investment and accelerating the path to profitability. The Uganda Investment Authority (UIA) is the government agency responsible for administering the Act. It serves as a one-stop shop for investors, facilitating licensing, providing information, and helping them navigate the regulatory landscape.

Key Financial Incentives for Solar Manufacturing Investors

The Act provides several tiers of benefits, but investors in strategic sectors like solar manufacturing qualify for the most significant advantages. These incentives directly address the largest cost centers in setting up a factory: taxes and equipment importation.

1. Ten-Year Corporation Tax Holiday

One of the most compelling incentives is a complete exemption from corporation tax for ten years. To qualify, an investor must meet specific criteria, such as investing in industrial parks or engaging in priority sectors, which includes manufacturing solar equipment.

Business Impact: This exemption profoundly affects a project’s financial projections. For a new factory, the first decade is a critical period for repaying loans and reinvesting profits into expansion. By eliminating corporation tax, the government allows a business to retain significantly more of its earnings, improving cash flow and strengthening its financial foundation for long-term growth. It’s a crucial variable when developing a comprehensive solar module manufacturing business plan.

2. Duty and Tax Exemptions on Imported Equipment

Setting up a solar module factory involves importing specialized machinery, equipment, and construction materials. Under the Act, qualifying investors are exempt from import duties and other taxes on all plant, machinery, and equipment necessary for the project.

Business Impact: This provision directly reduces the initial capital expenditure. The cost of a turnkey solar module production line represents a substantial portion of the startup budget. Eliminating import duties on these core assets significantly lowers the barrier to entry, making the investment more accessible and improving the project’s return on investment (ROI) from day one.

3. VAT Deferral on Plant and Machinery

In addition to exemptions, the Act allows for the deferment of Value Added Tax (VAT) on specific plant and machinery. This means the VAT payment is postponed rather than paid upfront, providing a significant cash flow advantage during the critical construction and commissioning phases of the factory.

Investment Thresholds and Protections

To access these benefits, investors must meet certain minimum investment thresholds. For a foreign investor, the required minimum capital investment is typically USD 250,000. This figure ensures the incentives are directed toward serious, substantial projects that contribute to the country’s industrial development. The total investment for a solar module factory will, of course, be higher, but this threshold is the key to unlocking the government’s support package.

The Investment Code Act also provides robust protections for investors, including:

-

Protection against expropriation: The Act guarantees that the government cannot compulsorily acquire an investor’s property without prompt and fair compensation.

-

Repatriation of funds: Foreign investors are guaranteed the right to repatriate profits, dividends, and principal payments on foreign loans.

These protections create a secure and predictable environment—a critical consideration for any long-term industrial investment. Based on J.v.G.’s experience guiding international investors, understanding these legal protections is a foundational step before committing capital.

Frequently Asked Questions (FAQ)

Is the 10-year tax holiday guaranteed for any solar project?

The 10-year tax holiday is available to investors who meet specific criteria outlined in the Investment Code Act. This typically includes operating within an industrial park or free zone and meeting the minimum capital investment requirements. Engaging with the Uganda Investment Authority (UIA) is essential to confirm eligibility for your specific project.

What is the process for applying for these incentives?

The first step is to register the business in Uganda. An investor must then apply for an investment license from the UIA. The application should detail the nature of the business, the investment plan, and the specific incentives being sought. The UIA guides applicants through this process.

Do these incentives apply to both local and foreign investors?

Yes, the Investment Code Act provides incentives for both Ugandan and foreign investors. However, the minimum investment thresholds required to qualify may differ. The Act is designed to encourage both domestic industrial growth and foreign direct investment.

What happens after the 10-year tax holiday expires?

After the 10-year exemption period ends, the business will be subject to the standard corporate income tax rate applicable in Uganda at that time. The initial decade is designed to allow the business to establish a strong financial footing before it begins contributing through corporation tax.

Conclusion: A Strategic Framework for Growth

Uganda’s Investment Code Act of 2019 is a powerful statement of the country’s commitment to industrialization, particularly in high-potential sectors like solar energy. For international business professionals, it transforms the country from a location with high solar irradiation into a structured, supportive, and financially attractive destination for manufacturing investment.

The combination of a decade-long tax holiday, duty exemptions on essential machinery, and robust legal protections addresses the primary concerns of any new industrial investor. While navigating the application process requires careful planning and due diligence, the framework itself provides a solid foundation for building a successful and sustainable solar module manufacturing business in the heart of East Africa.