An entrepreneur planning to establish a solar module factory in the Gulf region faces a foundational question that will define the entire operation: Where will the raw materials come from?

This decision—whether to source components like glass and aluminum frames from a local supplier in Riyadh or import high-efficiency solar cells from Asia—is not just a logistical choice. It is a strategic one that profoundly impacts project costs, production timelines, and the ability to compete for large-scale government projects.

This article breaks down the critical factors in structuring a supply chain for a new solar module facility in the Gulf. It compares the benefits and challenges of local sourcing against an international import model, providing a framework for a resilient and cost-effective strategy.

The Strategic Importance of Your Supply Chain

For a solar module manufacturer, the supply chain is more than a series of transactions; it is the business’s operational backbone. A well-optimized supply chain minimizes costs and reduces risk. A poorly planned one, however, can lead to production stoppages, budget overruns, and lost opportunities.

A key driver shaping this strategy in the Gulf is the growing importance of Local Content Requirements (LCRs). Governments are increasingly mandating that a certain percentage of components for renewable energy projects be sourced locally to stimulate domestic industry. For instance, Saudi Arabia’s Vision 2030 aims for 40% local content in the renewables sector. Meeting these targets is often a prerequisite for bidding on lucrative state-backed projects, making local sourcing a powerful competitive advantage. This decision is a cornerstone of any comprehensive solar module manufacturing business plan.

Analyzing the Bill of Materials (BOM) for a Solar Module

Building an effective supply chain begins with understanding the core components of a solar panel. While dozens of materials are involved, the primary components by cost and volume are:

- Solar Glass: The tempered front glass that protects the solar cells while allowing maximum light transmission.

- Aluminum Frame: Provides structural rigidity and a means for mounting the module.

- Encapsulant (EVA/POE): Polymer sheets that laminate the components together, protecting the cells from moisture and impact.

- Solar Cells: The semiconductor devices that convert sunlight into electricity. This is the most technologically advanced and highest-value component.

- Backsheet: A durable polymer layer at the rear of the module that provides electrical insulation and environmental protection.

- Junction Box: An enclosure on the back of the module where the electrical connections are made.

The sourcing strategy for each of these items can—and often should—be different.

The Case for Local Sourcing in the Gulf Region

The Gulf Cooperation Council (GCC) region has developed a world-class industrial base, making it an increasingly viable source for key solar materials. This presents a significant opportunity for new manufacturers to build a more efficient and responsive supply chain.

Key Materials Available Locally

Based on the region’s industrial strengths, several components are prime candidates for local procurement:

- Glass: The Gulf is home to major glass producers, such as Obeikan Glass in Saudi Arabia and Emirates Float Glass in the UAE. Sourcing this heavy, fragile material locally drastically reduces shipping costs and the risk of breakage.

- Aluminum Frames: With world-leading aluminum smelters like Emirates Global Aluminium (EGA) in the UAE and Ma’aden in Saudi Arabia, the region offers a highly competitive source for the high-quality aluminum extrusions needed for frames.

- Encapsulants & Polymers: The region’s dominance in the petrochemical sector, led by giants like SABIC and Borouge, provides a distinct advantage. These companies produce the raw materials for EVA and POE encapsulants as well as backsheets.

The Business Advantages of Sourcing Locally

Opting for regional suppliers for these materials offers clear benefits that directly impact the bottom line and operational efficiency. These early decisions can significantly influence the overall cost to start a solar panel factory.

- Reduced Lead Times: Local delivery can take as little as one to two weeks, compared to the eight to twelve weeks common for sea freight from Asia. This allows for more agile production planning.

- Lower Working Capital Requirements: Shorter lead times mean less cash is tied up in inventory that is in transit or sitting in a warehouse.

- Simplified Logistics and Lower Costs: Eliminating international freight, customs clearance, and import duties for bulky materials like glass and aluminum yields substantial savings.

- Compliance with LCR Mandates: A strong local sourcing strategy is essential for qualifying for government tenders and incentives.

The Necessity of an International Import Strategy

Despite the clear advantages of local sourcing, a purely regional supply chain is not currently feasible. Certain high-technology components are almost exclusively manufactured elsewhere, making a well-managed import strategy essential.

The most critical component in this category is the solar cell. The global market for high-efficiency solar cells is dominated by producers in Asia, particularly China. For the foreseeable future, any manufacturer in the Gulf will need reliable import channels for this core technology, as well as for specialized items like certain junction boxes and connectors.

Navigating the Challenges of Importing

While necessary, importing comes with its own set of risks and complexities that must be carefully managed:

- Long Lead Times & Volatility: The 8- to 12-week shipping time from Asia demands meticulous forecasting. Global shipping lanes are also subject to disruptions—as seen with recent challenges in the Red Sea—which can cause unpredictable delays and cost increases.

- Quality Assurance: Vetting international suppliers is critical. It is essential to partner with established manufacturers whose products are certified to meet international standards (e.g., IEC 61215 and IEC 61730).

- Financial and Currency Risks: International transactions often require different payment instruments, such as Letters of Credit (L/C), and expose the business to currency exchange rate fluctuations.

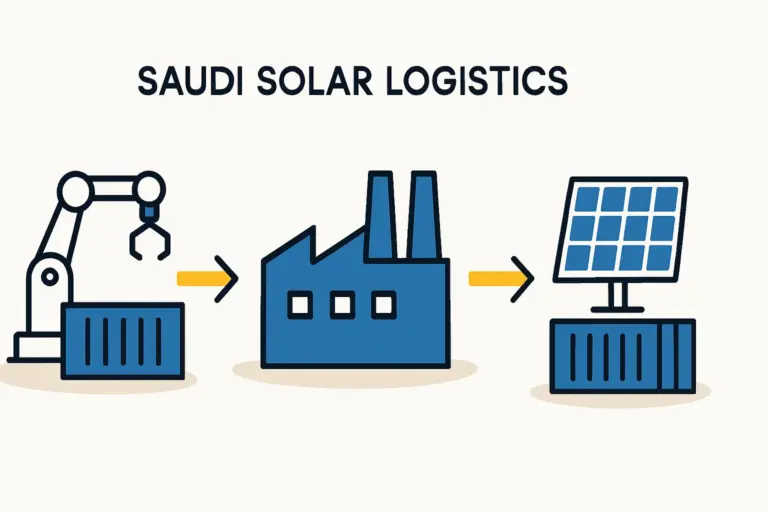

Developing a Hybrid Supply Chain Model: The Recommended Approach

For a new solar manufacturer in the Gulf, the most resilient and economically sound approach is a hybrid supply chain model. This strategy leverages the strengths of both local and international sourcing to create a balanced and de-risked operation.

The logic behind this approach is straightforward:

- Source Locally: Procure bulky, heavy, and regionally abundant materials like glass, aluminum frames, and certain polymers from suppliers within the GCC.

- Import Internationally: Secure high-value, technologically advanced components that are not produced locally—primarily solar cells—from reputable global suppliers.

This hybrid model balances cost, efficiency, and resilience. It reduces transportation costs and working capital needs while ensuring access to the best available solar cell technology on the global market. Expert support can be invaluable here; companies offering a turnkey solar panel production line often help establish these foundational supplier relationships, using their global experience to identify reliable partners.

Frequently Asked Questions (FAQ)

Q: How can a new business find and vet local suppliers in the Gulf region?

A: Initial research can be done through regional industry associations, chambers of commerce, and local industrial trade fairs. For technical validation, it’s best to work with a consultant or engineering partner who can audit a potential supplier’s quality control processes and ensure their products meet the necessary specifications for solar module manufacturing.

Q: What are the typical payment terms for international solar cell suppliers?

A: Terms can vary, but common arrangements include a down payment (e.g., 30%) via Telegraphic Transfer (T/T) upon placing the order, with the remaining balance (70%) paid against shipping documents or via a Letter of Credit (L/C) for larger orders to provide security for both buyer and seller.

Q: Does sourcing some parts locally automatically guarantee LCR compliance?

A: Not necessarily. LCR is typically calculated based on the monetary value of the locally sourced content as a percentage of the total product cost. Because imported solar cells represent a large portion of a module’s cost, manufacturers must strategically maximize the value of locally sourced glass, frames, and labor to meet aggressive LCR targets.

Q: How does an import-heavy model affect initial working capital?

A: An import-heavy model significantly increases working capital requirements. With lead times of two to three months, a factory must hold a much larger inventory of raw materials to ensure continuous production. This ‘buffer stock’ represents cash that is not generating returns, making a compelling case for local sourcing wherever possible.

Conclusion and Next Steps

Structuring the supply chain is one of the most critical tasks an entrepreneur undertakes when establishing a solar module factory. For those operating in the Gulf, the optimal path is not a choice between local or international sourcing but a carefully balanced hybrid of the two.

By leveraging the region’s growing industrial capacity for materials like glass and aluminum while maintaining robust import channels for critical technologies like solar cells, a new manufacturer can build a competitive, resilient, and profitable enterprise. This strategic foresight, implemented from day one, lays the groundwork for long-term success in a rapidly expanding market.