While the global solar industry often focuses on mass-produced, standardized modules, a significant opportunity exists for entrepreneurs who think differently. In a market as unique as Qatar—with its ambitious National Vision 2030, extreme climate, and focus on architectural innovation—a standard approach to solar manufacturing falls short.

The real value lies in specialization: producing high-performance modules precisely engineered for the region’s specific challenges and goals. This framework outlines a business plan for a niche 50 MW solar module factory in Qatar, focused on two high-demand sectors: Agrivoltaics and Building-Integrated Photovoltaics (BIPV). It is a roadmap for moving beyond commodity products to establish a technologically advanced, locally focused manufacturing operation.

The Unique Opportunity in Qatar: Beyond Standard Solar

Qatar’s strategic objectives create an ideal environment for a specialized solar enterprise. The government’s push for 70% food self-sufficiency and its reputation as a hub for groundbreaking architecture present dual challenges that specialized solar technology is uniquely positioned to solve.

At the same time, the country’s climate—with ambient temperatures exceeding 45°C, high humidity, and frequent dust storms—imposes severe stress on conventional solar modules, causing rapid performance degradation. This convergence of factors creates a clear market gap. While commodity modules are widely available, they aren’t designed for the specific environmental and application demands of Qatar. A local manufacturer capable of producing durable, purpose-built modules can command a premium and capture a market that values long-term performance and reliability over initial cost.

Niche 1: Agrivoltaics for Food Security

Agrivoltaics combines solar power generation with agriculture. Specially designed, semi-transparent solar modules are mounted high above crops. This setup provides shade, reduces water evaporation by up to 30%, and protects plants from excessive heat—all while generating electricity. For Qatar’s food security goals, this technology is not just beneficial; it is transformative.

Niche 2: BIPV for Architectural Excellence

Building-Integrated Photovoltaics (BIPV) transform a building’s entire facade or roof into an active, energy-producing asset. These are not standard panels mounted on a roof; they are functional building materials—like colored glass, tiles, or facade elements—that generate electricity. In a country known for its iconic skyscrapers and futuristic urban design, BIPV allows architects to merge sustainability with aesthetic vision, a critical consideration for projects tied to National Vision 2030 and beyond.

Designing the Product: The DESERT+ Module Concept

A specialized plant in Qatar would succeed by producing a module engineered specifically for local conditions. Drawing on experience from J.v.G. turnkey projects in similarly demanding climates, a ‘DESERT+’ module design is recommended. This design prioritizes durability and sustained performance, ensuring reliability over decades of operation.

The key components of this module include:

-

Glass-Glass Construction: Instead of a plastic backsheet, which degrades under intense UV radiation and heat, this design uses a second layer of glass. This provides superior protection against humidity, sand abrasion, and mechanical stress.

-

High-Efficiency PERC Cells: Passivated Emitter and Rear Contact (PERC) cells offer excellent performance, especially in high-temperature conditions, ensuring maximum energy yield even during the hottest parts of the day.

-

Specialized Encapsulants and Edge Seals: Using advanced materials that resist moisture ingress and temperature-induced degradation is critical. This prevents delamination and internal corrosion, common failure points for standard modules in coastal desert environments.

This base design is then customized for the two target markets:

-

For Agrivoltaics: The cell layout is adjusted to create semi-transparent modules that allow a specified percentage of sunlight (e.g., 50-70%) to reach the crops below.

-

For BIPV: The front glass can be colored to match architectural specifications, and modules can be produced in custom shapes and sizes to integrate seamlessly into building facades.

Market Entry Strategy: Focusing on High-Value Applications

A specialized manufacturer cannot compete on price with global gigafactories. Instead, the strategy must be to compete on value, performance, and customization. The target customers are not residential homeowners seeking the cheapest panels, but large-scale project developers, government agencies, and architectural firms that prioritize long-term ROI and technical excellence.

Target Markets & Sales Channels:

-

Agrivoltaic Projects: The primary customers are government ministries focused on agriculture and food security, as well as large private agricultural enterprises. The sales cycle is long and relationship-based, requiring direct engagement and technical consultation.

-

BIPV Projects: The key stakeholders are architectural firms, real estate developers, and construction companies working on landmark commercial, governmental, or hospitality projects. The sales process involves collaborating early in the design phase to provide custom-engineered solutions.

By focusing on these niches, the factory positions itself as a high-tech solution provider, not a commodity supplier.

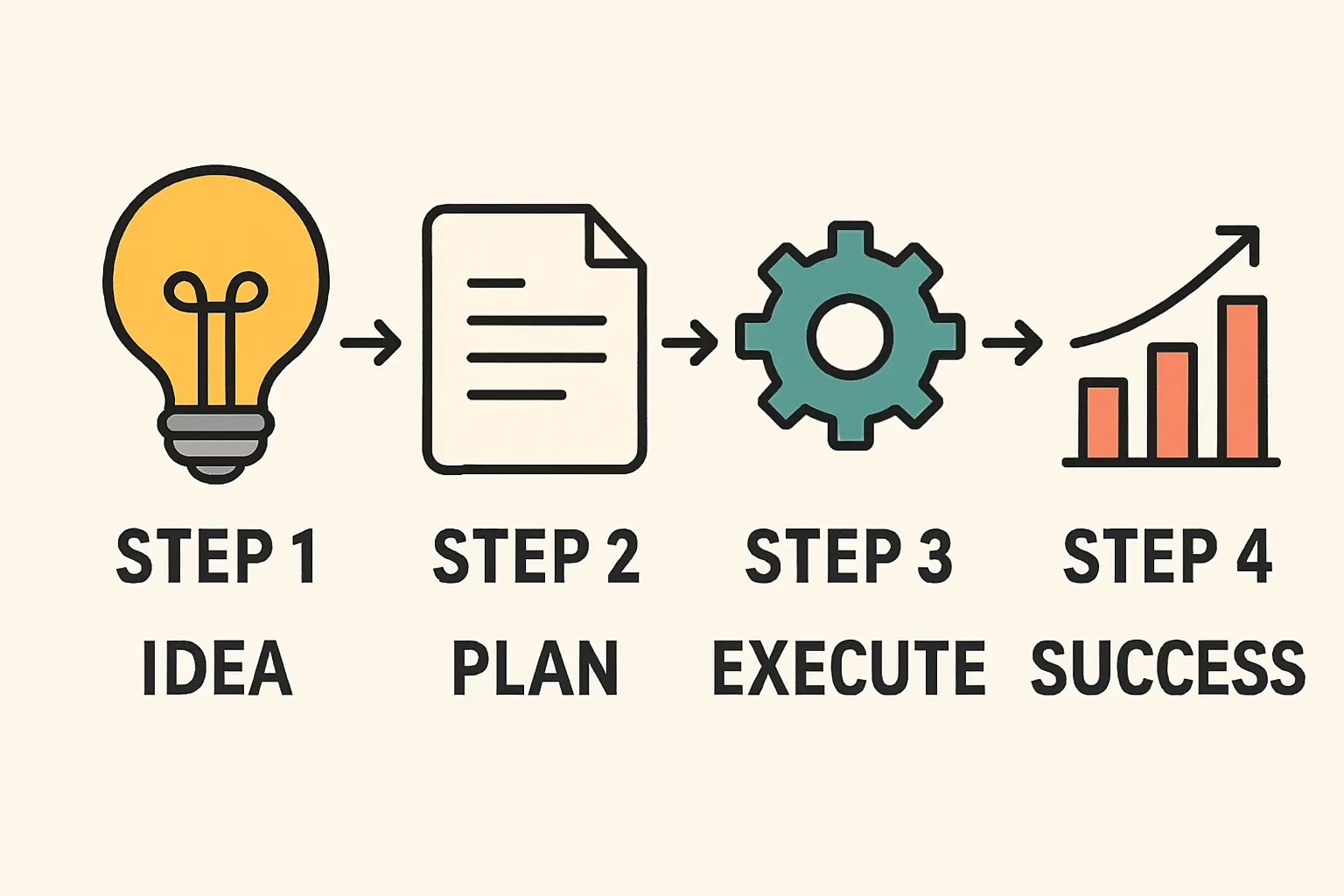

A Financial Blueprint for a 50 MW Specialized Plant

Establishing a solar module factory demands a clear understanding of the financial commitments and operational realities. The following model is based on data from J.v.G. Technology GmbH’s turnkey factory solutions, providing a realistic baseline for a 50 MW facility in Qatar.

Key Investment Parameters

-

Initial Capacity: 50 MW per year. This scale is large enough for efficiency but small enough to maintain focus on specialized, high-margin products.

-

Core Technology: A complete turnkey production line, including all machinery for stringing, lamination, framing, and testing.

-

Estimated Investment: Approximately €6–7 million for the machinery, installation, technology transfer, and initial staff training. More details can be found in a guide on investment requirements for a solar module factory.

Operational Projections

-

Required Workforce: A lean, skilled team of 30–40 personnel is sufficient for a semi-automated 50 MW line. This typically includes engineers, machine operators, quality control technicians, and administrative staff. An overview of staffing can be found in an article about how many employees are needed for a solar module factory.

-

Factory Footprint: A facility of approximately 3,000–4,000 square meters is required to house the production line, a warehouse for raw materials, and finished goods storage.

-

Project Timeline: From the final investment decision to the production of the first certified module, a realistic solar module factory project timeline is 9–12 months.

Revenue and Profitability

The primary financial advantage of this model is the higher average selling price (ASP) for specialized modules compared to standard panels. Although production costs are marginally higher due to premium materials, the increased revenue per watt leads to stronger profit margins. Financial models from similar J.v.G. projects show that a well-managed plant focused on these niches can achieve a payback period of 3–5 years.

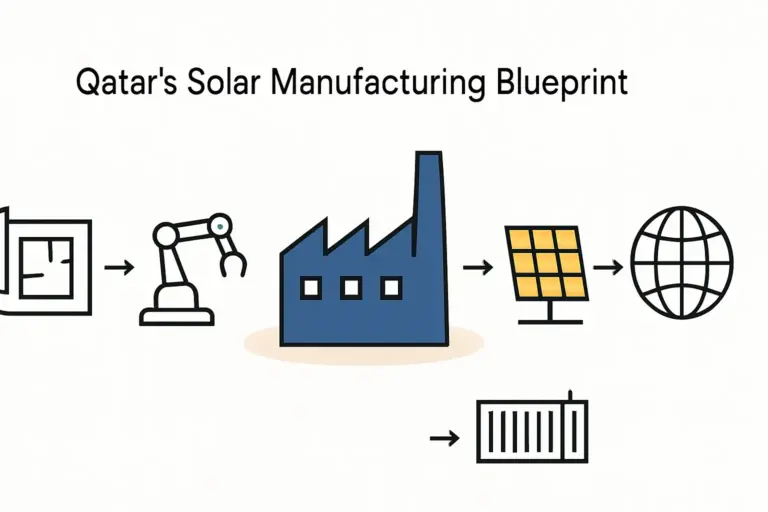

The Strategic Advantage of Local Production

Establishing a ‘Made in Qatar’ solar module brand offers significant competitive advantages beyond the technical specifications of the product itself.

-

Supply Chain Resilience: Local production insulates projects from global shipping delays and logistical uncertainties.

-

Customization and Speed: A local factory can offer bespoke solutions for architects and developers with much shorter lead times than international competitors.

-

National Contribution: The enterprise directly supports Qatar’s National Vision 2030 by fostering industrial diversification, creating skilled jobs, and enhancing technological sovereignty.

Frequently Asked Questions (FAQ)

Why not just import specialized modules from abroad?

Importing carries risks of supply chain disruption, lacks the flexibility for rapid customization required by architects, and may not comply with potential future requirements for local content in government-backed projects. A local factory offers control, speed, and strategic alignment with national interests.

What is the biggest technical challenge in producing DESERT+ modules?

The lamination process for glass-glass modules requires precise control over temperature and pressure to ensure a perfect, bubble-free bond that will last for over 30 years. Additionally, maintaining a dust-free environment during cell stringing and layup is critical to prevent contamination and ensure high quality.

Is a 50 MW plant considered large or small in the global context?

On a global scale, 50 MW is a small, boutique-sized facility. Gigafactories in China often exceed 10,000 MW (10 GW). However, the strategy here is not to compete on scale but on specialization. A 50 MW plant is the ideal size to serve the high-value niche markets in Qatar and the surrounding GCC region without being burdened by the high overheads of a commodity-focused gigafactory.

What kind of expertise is needed to run such a factory?

While a core team with engineering and manufacturing experience is necessary, the owner does not need to be a photovoltaic expert from day one. Turnkey solutions from providers like J.v.G. include comprehensive training for local staff on machine operation, quality control, and maintenance. Educational platforms like pvknowhow.com provide structured courses to build the foundational knowledge needed for strategic planning and management.

For entrepreneurs and investors in Qatar, the opportunity is not to replicate what others are doing, but to innovate. By focusing on the specific needs of the local market—from food security to architectural ambition—a specialized solar module plant can become a highly profitable and strategically important asset for the country’s future.