Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

An investor from North America, successful in traditional manufacturing, recently explored expanding into solar energy production. He considered several countries but was intrigued by reports of Vietnam’s rapid industrial growth.

But he was also concerned about the complexity: ‘How does one navigate a foreign legal system to build a factory, especially in a high-tech field like solar?’ It’s a question common among entrepreneurs looking to enter new, dynamic markets.

Vietnam has strategically positioned itself as a prime destination for high-tech manufacturing, moving beyond simple assembly to attract sophisticated investments. For any business professional considering this move, understanding the regulatory landscape is the first critical step.

This guide walks through the legal and administrative pathway for establishing a solar factory in Vietnam, focusing on licensing, environmental compliance, and the significant incentives available for high-tech projects.

Why Vietnam is Attracting High-Tech Investment

Vietnam’s appeal is no accident; it is the result of deliberate policy and inherent strengths. The country offers a compelling combination of political stability, a young and increasingly skilled workforce, and a strategic location in the heart of Asia.

Its participation in numerous free trade agreements (FTAs), including the CPTPP and EVFTA, grants preferential access to major global markets. The government’s commitment is formalized in its national strategy, which prioritizes attracting foreign direct investment (FDI) into high-value sectors. This creates a supportive, forward-looking environment that fosters technological growth.

Understanding the Legal Cornerstones

The foundation for foreign investment in Vietnam is the Law on Investment 2020. This legislation clarifies the process, outlines protections for investors, and specifies which sectors are eligible for incentives. Navigating this framework involves interacting with several key government bodies:

-

The Ministry of Planning and Investment (MPI): The central government agency overseeing all investment activities, including foreign ones.

-

The Ministry of Science and Technology (MOST): The body responsible for evaluating and certifying projects as ‘high-tech’ to qualify them for special incentives.

-

Local Departments of Planning and Investment (DPI): Provincial-level offices that handle the day-to-day application and approval processes for most investment projects.

For a new investor, understanding this hierarchy is crucial. While national laws provide the framework, the practical application and approvals happen at the provincial level.

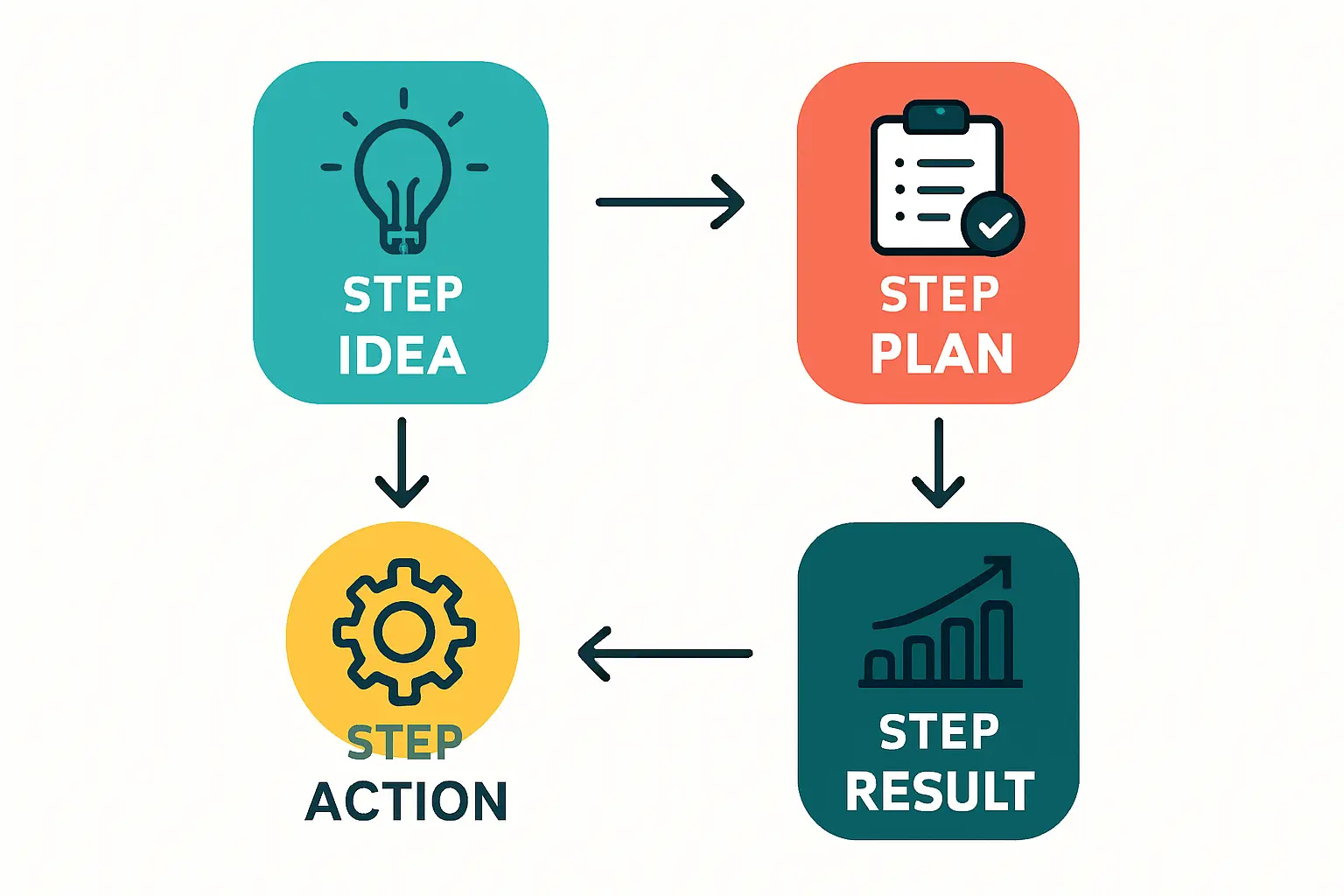

The Core Licensing Process: A Step-by-Step Guide

Establishing a manufacturing entity in Vietnam follows a structured, two-certificate process. While it can seem bureaucratic, thinking of it as two distinct phases—project approval and company formation—makes it easier to navigate.

Step 1: Obtain the Investment Registration Certificate (IRC)

The IRC is the government’s formal approval of your investment project, confirming that your proposed factory aligns with national and local development plans. To obtain it, you must submit a detailed proposal to the provincial DPI, outlining:

- Project objectives and scale.

- Total solar panel manufacturing plant cost and capital contribution schedule.

- Proposed location and land use requirements.

- Technology and environmental protection measures to be used.

Authorities will review the proposal for its financial viability, technological soundness, and environmental impact.

Step 2: Secure the Enterprise Registration Certificate (ERC)

Once the IRC is granted, you can formally establish your Vietnamese company. The ERC is the legal birth certificate of your business entity. This application, also submitted to the provincial DPI, requires information about the company’s name, address, charter capital, and legal representative.

The combination of the IRC (approving the project) and the ERC (forming the company) grants you the full legal right to operate your solar factory in Vietnam.

Step 3: Complete the Environmental Impact Assessment (EIA)

An EIA is mandatory for any industrial project. This is a separate but parallel process that must be completed before operations can begin. The assessment details the factory’s potential environmental effects and the mitigation measures you will implement.

The complexity of the EIA depends on the scale and nature of your operations. Experience gained from European PV manufacturers’ turnkey projects shows that a thorough description of the solar panel manufacturing process is essential for smooth EIA approval.

Unlocking High-Tech Incentives: The Real Advantage

This is where Vietnam’s strategy to attract quality investment becomes tangible. Projects officially certified as ‘high-tech’ gain access to a suite of government-backed incentives that significantly improve financial performance.

The most valuable of these is the preferential Corporate Income Tax (CIT) rate. A standard business in Vietnam pays a 20% CIT. A certified high-tech project, however, benefits from a ‘4-9-10’ structure:

- 4 years of tax exemption: 0% CIT.

- 9 subsequent years of a 50% reduction: 5% CIT.

- A reduced rate of 10% for the remaining years, completing a total of 15 years of preferential treatment.

Beyond tax holidays, other key incentives include:

- Land Rent Exemption: Exemption from or reduction of land rent for the entire project duration.

- Import Duty Exemption: No import duties on raw materials, supplies, and components that cannot be produced domestically—a crucial advantage for solar manufacturing, which relies on a global supply chain.

These incentives are designed to lower initial financial barriers and reward investors who bring advanced technology and knowledge into the country.

How to Qualify for High-Tech Status

Obtaining high-tech certification from the Ministry of Science and Technology (MOST) is a distinct process from the initial investment licensing. To qualify, an enterprise must meet specific, measurable criteria. Key requirements typically include:

- Revenue from High-Tech Products: A significant percentage of the company’s total annual revenue must come from the sale of certified high-tech products.

- R&D Expenditure: The company must allocate a defined percentage of its annual revenue to research and development activities conducted within Vietnam.

- Qualified Labor: A certain percentage of the workforce must consist of employees with university degrees or higher who are directly involved in R&D.

Meeting these criteria requires a long-term commitment to innovation and localization, not just manufacturing.

Navigating Common Challenges

While the opportunity in Vietnam is substantial, new investors should be aware of potential challenges:

- Administrative Bureaucracy: The application process involves detailed paperwork and coordination between multiple government agencies. Delays can occur if documentation is incomplete or improperly prepared.

- Intellectual Property (IP) Protection: While Vietnam has strengthened its IP laws, enforcement can still be a concern. A robust legal strategy for protecting patents and trademarks is essential.

- Local Partnerships: Finding a reliable local partner can be beneficial but also adds complexity. Thorough due diligence is non-negotiable.

A structured approach—such as engaging experienced consultants or opting for a turnkey solar panel production line where the provider assists with compliance—can help mitigate these risks.

Frequently Asked Questions (FAQ)

-

What is the typical timeline for obtaining the IRC and ERC?

While the statutory timeframe is around 15 working days for the IRC and 3 for the ERC, it’s prudent to budget two to three months for the entire process. This accounts for document preparation and any potential requests for clarification. -

Is it mandatory to have a local Vietnamese partner?

No, a 100% foreign-owned enterprise is permitted for most manufacturing sectors, including solar. The decision to include a local partner is a strategic one, often based on a need for local market knowledge or relationships. -

What are the key considerations for the Environmental Impact Assessment (EIA)?

The EIA must detail your factory’s planned water usage, waste treatment systems, chemical handling procedures, and emissions control. It is a technical document that requires expert input to ensure it meets the standards of the Ministry of Natural Resources and Environment. -

Can an existing factory apply for high-tech status?

Yes, an existing manufacturing operation can apply for high-tech certification if it can demonstrate that it meets the necessary criteria regarding R&D spending, revenue from high-tech products, and qualified labor.

Your Next Steps in Exploring the Opportunity

Entering Vietnam’s high-tech manufacturing sector successfully requires careful planning and a clear understanding of the regulatory environment. The government has created a highly attractive framework, but navigating it effectively is the key to unlocking its full potential.

By breaking down the process into manageable stages—from initial licensing to high-tech certification—investors can chart a more confident course. For those ready to move forward, the next step is to understand the universal business principles of starting a solar panel manufacturing business, which provides the foundation for success in any location.

Download: Vietnam Solar Manufacturing Investment Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.