Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

For generations, family offices in Jordan and the wider Middle East have demonstrated a mastery of long-term value creation, traditionally anchored in real estate and established equity markets.

As national economic strategies evolve, however, a new class of tangible assets is emerging. These assets align with both fiscal prudence and national development goals. This framework outlines a compelling case for one such opportunity: a turnkey solar module manufacturing facility.

This is not a proposal for entering a complex, high-tech industry from a standing start. It is an investment thesis for acquiring a fully managed, de-risked industrial asset that capitalizes on Jordan’s strategic push towards energy independence. It represents a shift from passive investments to productive, nation-building ventures that offer stable, inflation-hedged returns comparable to prime infrastructure projects.

The Macroeconomic Imperative: Jordan’s Path to Energy Security

Jordan’s economic landscape presents a clear and urgent opportunity. The Kingdom currently imports over 90% of its energy, creating significant economic vulnerability to global price fluctuations. In response, the government has established an ambitious National Energy Strategy, which aims for renewable sources to generate 31% of its electricity by 2030.

This government-mandated transition creates predictable, long-term domestic demand for high-quality solar modules. Investors are not speculating on future market trends; they are aligning with a clearly defined national priority.

Furthermore, Jordan benefits from one of the world’s most favorable solar irradiation levels, receiving an average of 2,000 to 2,500 kilowatt-hours per square meter annually. This natural advantage, combined with government incentives like tax exemptions and simplified permitting, establishes a uniquely stable foundation for a local manufacturing enterprise.

Investing in local solar manufacturing directly supports this national agenda. It helps reduce reliance on imports, foster technical skill development, and strengthen the country’s economic sovereignty.

Aligning Investment Philosophy: Solar Manufacturing as a Tangible, Long-Term Asset

For any investment portfolio manager or family principal, the primary question is how a new asset class fits within an established philosophy. A solar manufacturing plant, when structured as a turnkey project, shares many characteristics with traditional investments like commercial real estate or infrastructure.

Key Parallels for the Prudent Investor:

-

Tangible Asset: Like a building or a bridge, a factory is a physical asset with intrinsic value. It produces a tangible product essential for modern infrastructure.

-

Long-Term Horizon: Unlike a short-term trade, a solar factory is a 20-plus-year asset designed to generate consistent cash flow by supplying a foundational component for the energy sector.

-

Inflation Hedge: Revenue is tied to energy and infrastructure development, sectors that typically perform well during inflationary periods.

-

Legacy and ESG Impact: Beyond financial returns, such an investment contributes directly to national goals for sustainability and energy independence, building a lasting legacy that aligns with modern Environmental, Social, and Governance (ESG) principles.

This venture transforms capital from a passive store of value into a productive engine for national growth—a proposition that resonates deeply with the custodians of multi-generational wealth.

De-risking the Venture: A Turnkey Approach for the Non-Technical Investor

The most significant barrier for new entrants into any industrial sector is operational complexity. The turnkey model is essential for overcoming this hurdle. It is designed specifically to mitigate technical and operational risks for investors whose expertise lies in finance and strategy, not photovoltaic engineering.

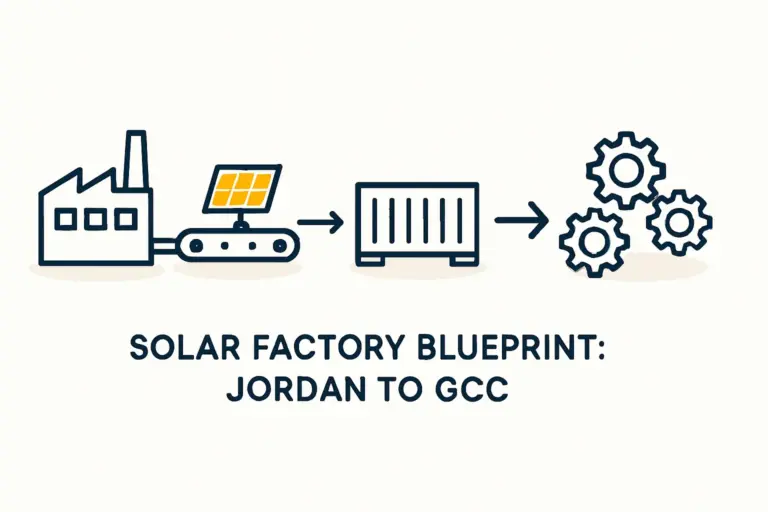

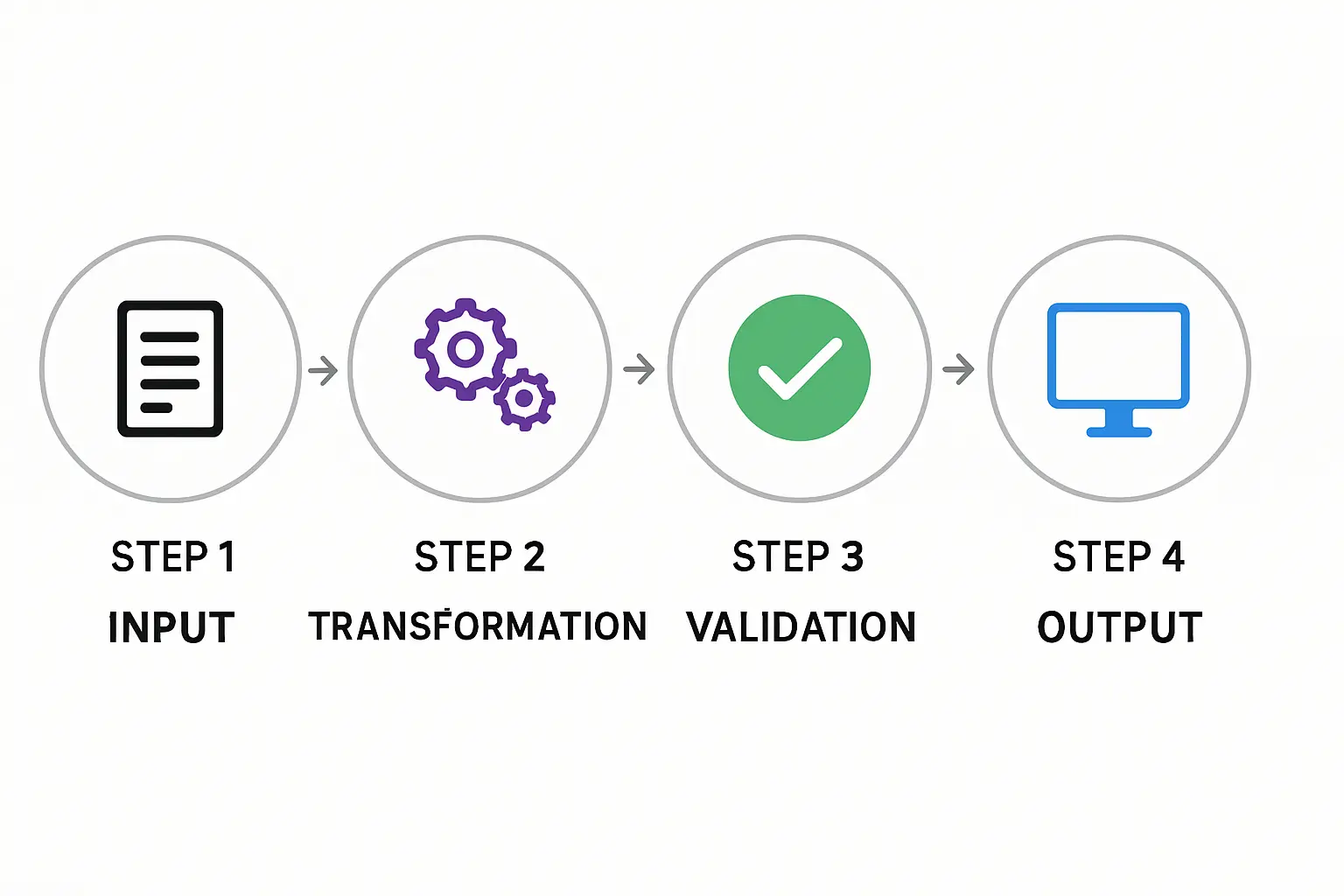

A turnkey solar factory solution encompasses the entire project lifecycle, managed by a single, experienced partner like an EU-Based Photovoltaic Manufacturing Solutions Partner. The process includes:

-

Feasibility and Business Planning: In-depth analysis of the local market, supply chains, and financial viability.

-

Factory Layout and Design: Engineering the optimal production flow for efficiency and quality.

-

Machinery Procurement and Integration: Sourcing, shipping, and installing a complete, state-of-the-art production line.

-

Commissioning and Staff Training: Ensuring the facility is fully operational and local teams are trained to international standards.

-

Certification and Quality Assurance: Guiding the facility through necessary IEC and ISO certifications to guarantee product bankability.

For an entry-level investment in a market like Jordan, a highly automated 25 MW production line is an ideal starting point. This capacity is substantial enough to be profitable yet manageable in scale, minimizing initial capital outlay and operational overhead. Automation in critical stages, such as cell stringing and lamination, ensures consistent product quality and reduces dependency on specialized manual labor.

This approach effectively transforms a complex industrial project into a structured, de-risked investment vehicle.

A Financial Framework for a 25 MW Solar Module Production Line

A comprehensive financial analysis is the cornerstone of any serious investment consideration. While a detailed business plan provides precise figures, this high-level framework can illustrate the potential for a 25 MW production line.

Investors should model both capital expenditures (CAPEX) and operational expenditures (OPEX).

Typical Capital Expenditures (CAPEX)

The initial investment covers the physical assets of the factory. The largest component is the production machinery, followed by facility adaptation, logistics, and initial raw material stocks. A thorough analysis of these costs is a critical first step in financial modeling.

Typical Operational Expenditures (OPEX)

Ongoing costs include raw materials (glass, cells, backsheets, aluminum frames), labor, energy, facility maintenance, and administrative overhead. A highly automated line helps control labor costs and improve material efficiency.

Revenue is generated from the sale of finished solar modules to local project developers, EPC (Engineering, Procurement, and Construction) companies, and potentially for export to neighboring markets. The government’s renewable energy targets provide a clear demand pipeline that stabilizes revenue projections.

Based on experience gained from European PV manufacturers’ turnkey projects in emerging markets, a well-managed 25 MW facility can achieve profitability and deliver a strong return on investment within a five- to seven-year period, while continuing to generate value for decades.

Operational Management and Long-Term Support

The commitment of a true turnkey partner extends beyond the factory’s commissioning. To ensure the investment performs as a hands-off, professionally managed asset, ongoing support is crucial. This support can include:

-

Remote Process Monitoring: Digital systems that allow German-based engineers to monitor production parameters and advise on optimization.

-

Ongoing Staff Development: Advanced training programs to build a world-class local team.

-

Supply Chain Consulting: Guidance on sourcing high-quality, cost-effective raw materials.

-

Optional Management Contracts: In some cases, an experienced partner can provide interim operational management to ensure a smooth transition until the local team is fully independent.

This long-term partnership ensures the asset continues to operate at peak efficiency, protecting the investment and maximizing returns for the family office.

Frequently Asked Questions for First-Time Solar Manufacturing Investors

What is the typical timeline from investment decision to production?

For a 25 MW turnkey line, the process from final contract to the first certified module typically takes 10 to 12 months. This includes machinery manufacturing, shipping, installation, and commissioning.

How many employees are required for an automated 25 MW line?

A modern, semi-automated line of this capacity generally requires a team of approximately 25 to 30 people operating on a two-shift basis, including production operators, technicians, quality control, and administrative staff.

Is prior experience in manufacturing necessary for the investor?

No. The turnkey model is structured specifically for entrepreneurs and investors from diverse backgrounds. The partner provides the technical and operational expertise, allowing the investor to focus on strategic oversight and financial management.

What are the main business risks to consider?

The primary risks stem from global raw material price fluctuations and the challenge of securing a stable, high-quality supply chain. A thorough feasibility study, a key part of the premier EU provider process, identifies and proposes mitigation strategies for these risks.

Next Steps in Evaluating a Solar Manufacturing Investment

A turnkey solar module factory offers Jordanian family offices a unique opportunity to diversify into a tangible, long-term asset fully aligned with national strategic interests. It is an investment in infrastructure, energy security, and sustainable economic growth.

The logical next step is to deepen your understanding of the process and financial requirements. We invite you to explore our complete guide to solar panel manufacturing for entrepreneurs, which provides a comprehensive overview of this entire journey.

For a formal evaluation, the process begins with a detailed, customized feasibility study and business plan. This foundational document, prepared by our experts, serves as the blueprint for a successful and profitable venture into the future of energy.

Download: The Case for Turnkey Solar Manufacturing in Jordan (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.