Imagine a state-of-the-art solar module factory standing ready for production near Khartoum. The machinery is calibrated, the staff is trained, and the market is eager for locally produced renewable energy. Yet, the production line remains silent. The reason? A critical shipment of solar cells is delayed in customs at Port Sudan, halting the entire operation.

This scenario underscores a fundamental truth for any entrepreneur entering the solar manufacturing sector in Sudan: your factory is only as productive as its supply chain.

While the technology inside the facility is crucial, the strategic management of raw materials ultimately determines success. This article outlines the core challenges and strategies for structuring a resilient Bill of Materials supply chain for a solar factory in Sudan.

Understanding the Core Components: The Anatomy of a Solar Module

The first step in establishing a supply chain is understanding what, exactly, needs to be supplied. The complete list of raw materials required to produce a single solar module is known as the Bill of Materials (BOM). While it contains dozens of items, production hinges on a few key components.

The primary materials in a standard solar module include:

- Solar Glass: A highly transparent, low-iron, tempered glass that protects the module from the elements while maximizing light absorption.

- Encapsulant (EVA): Ethylene Vinyl Acetate is a polymer sheet used to laminate the components, providing adhesion and electrical insulation.

- Solar Cells: The active components that convert sunlight into electricity. These are the most technologically sensitive and highest-value part of the BOM.

- Backsheet: A durable, multi-layered polymer sheet that protects the rear of the module from moisture and UV radiation.

- Aluminum Frame: Provides structural rigidity and a means for mounting the module.

- Junction Box: An enclosure on the back of the panel that houses the bypass diodes and wiring.

For a new manufacturing venture in Sudan, securing a reliable and cost-effective supply of these six items is the primary logistical hurdle.

The Global Sourcing Puzzle: Where to Find Your Materials

While the goal is local manufacturing, the global solar industry relies on a handful of highly specialized international suppliers for most core components. A successful sourcing strategy requires a pragmatic mix of global procurement and, where possible, local sourcing.

Sourcing High-Technology Components

Materials like solar cells, EVA encapsulant, and backsheets are products of a complex, high-volume chemical and electronics industry. Currently, this industry is heavily concentrated in Asia, with China being the dominant global supplier.

For a Sudanese factory, sourcing these items is inevitably an international exercise. Key considerations include:

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

- Supplier Vetting: Establishing relationships with reputable, Tier-1 manufacturers is critical. Product quality and consistency directly impact the final module’s performance and bankability.

- Quality Control: Implementing a robust incoming quality control (IQC) process is non-negotiable. This may involve pre-shipment inspections at the supplier’s factory.

- Volume and Pricing: Material costs are highly dependent on order volume. New entrants must accurately forecast production to negotiate favorable terms.

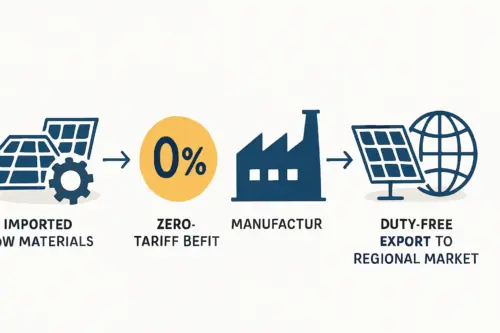

The Glass and Frame Dilemma: Local vs. International

Heavier, less technologically complex components like glass and aluminum frames present a different strategic question.

- International Sourcing: Importing these materials guarantees access to specialized solar-grade quality but incurs high shipping costs, which can significantly impact the final module cost.

- Local Sourcing: The ideal long-term solution is to source these materials locally. However, this depends on whether Sudanese or regional suppliers can meet the strict technical specifications for solar glass (low-iron content) and aluminum alloys (specific tensile strength and anodization quality).

Based on experience from J.v.G. turnkey projects in emerging markets, most new factories begin by importing all major components. Over time, as production stabilizes, they can invest in developing local suppliers for frames and, eventually, glass.

Navigating the Path to Sudan: Logistics and Import Strategy

Sourcing the materials is only half the battle; getting them to your factory floor on time and on budget is the other half. The logistics chain for a Sudanese solar factory is a multi-stage process that requires meticulous planning.

The typical journey for imported materials involves:

- Sea Freight: The most common and cost-effective method for shipping bulky materials. Standard 40-foot containers will travel from ports in Asia or Europe to Port Sudan. Transit times can range from 30 to 60 days.

- Customs Clearance: This is a critical bottleneck. Incomplete documentation, unexpected tariffs, or procedural delays at Port Sudan can halt the entire supply chain. Working with an experienced local customs broker is essential.

- Inland Transportation: Once cleared, materials must be transported by road from Port Sudan to the factory. The quality of infrastructure and security along this route must be factored into planning.

A common oversight for new investors is underestimating these ‘soft’ costs. Logistics, import duties, and local transport can add a substantial percentage to the landed cost of materials, impacting the project’s financial viability.

Balancing Supply and Demand: Inventory in a Volatile Market

Given the long lead times and potential for logistical disruptions, a factory in Sudan cannot rely on a ‘Just-in-Time’ (JIT) delivery model. Effective inventory management is crucial for ensuring continuous production.

This creates a delicate trade-off:

- Risk of Stock-Out: Insufficient inventory of a single critical component (like junction boxes) can bring the entire production line to a standstill, leading to lost revenue and idle labor costs.

- Cost of Capital: Holding large volumes of raw materials (safety stock) ties up significant working capital. For instance, holding a three-month supply of solar cells for a 50 MW factory could represent an investment of over a million US dollars.

For a market like Sudan, a conservative approach is recommended. New factories should plan to hold at least two to three months of safety stock for all critical imported components to buffer against supply chain volatility.

Financial Considerations for a Sudanese Supply Chain

The international nature of the BOM supply chain introduces financial complexities. Most material suppliers require payment in a stable foreign currency, such as US Dollars or Euros. This presents the business with two key financial challenges:

- Currency Fluctuation: The cost of materials in Sudanese Pounds will vary with the exchange rate. This risk must be hedged or factored into the final module pricing.

- Payment Instruments: International suppliers often require Letters of Credit (L/C) from a reputable bank to guarantee payment, adding an administrative and financial layer to the procurement process.

Frequently Asked Questions (FAQ)

Can I source all materials for a solar panel locally in Sudan?

Initially, this is highly unlikely. Critical components like solar cells and specialized polymers (EVA, backsheet) will need to be imported. Over time, it may become feasible to localize the supply of aluminum frames, glass, and packaging materials as local industrial capabilities develop.

What is the biggest supply chain risk for a new factory?

The most significant risks are logistical delays (at sea or in customs) and supplier quality issues. A delay in a single, inexpensive component can halt production of a high-value module. A batch of poor-quality cells can ruin an entire week’s output.

How much working capital is needed for raw materials?

This depends entirely on the factory’s production capacity. As a general rule, a business plan should allocate sufficient working capital to cover the purchase and shipping of at least three months’ worth of the complete Bill of Materials.

How does currency fluctuation affect the BOM cost?

It has a direct and significant impact. Since the majority of the BOM is priced in foreign currency, any depreciation of the local currency will increase the cost of production. This is a critical financial variable that must be continuously monitored.

Building a Resilient Foundation

Establishing a solar module factory in Sudan offers immense potential to meet the country’s growing energy needs. However, the success of such a venture is built not just on advanced machinery, but on a robust, well-planned, and resilient supply chain.

Entrepreneurs must look beyond the factory walls and develop a comprehensive strategy for sourcing, logistics, inventory, and financial management. This detailed planning is a core component of a professional turnkey factory setup, ensuring that when the factory doors open, the production lines run smoothly, turning global components into local sources of clean energy.