Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

For many entrepreneurs, Egypt represents a compelling opportunity. The government’s ambitious renewable energy targets—aiming for 42% of electricity from renewables by 2030—create a powerful tailwind for new ventures in the solar sector.

Yet, the journey from a business plan to an operational solar module factory is paved with practical challenges. Many new investors underestimate the intricate process of securing their business’s physical foundations: the land, permits, and essential utility connections.

This guide offers a step-by-step overview of this critical phase, outlining the regulatory landscape, site selection criteria, and logistical hurdles investors face when establishing a greenfield solar manufacturing project in Egypt.

Understanding the Egyptian Regulatory Landscape

Before any physical work can begin, an investor must navigate Egypt’s administrative framework. The government has made significant strides in streamlining this process, driven by initiatives like the State Ownership Policy and the NWFE (Nexus of Water, Food, and Energy) program, which actively encourage private sector investment.

Key Governmental Bodies

Several key authorities oversee the investment process. Understanding their roles is the first step toward a smooth setup:

-

General Authority for Investment and Free Zones (GAFI): As the primary point of contact for investors, GAFI operates as a ‘one-stop-shop’ to simplify company registration, facilitate approvals, and provide information on available incentives.

-

New and Renewable Energy Authority (NREA): The NREA is responsible for implementing the national renewable energy strategy. While more focused on energy generation projects, its policies influence the entire solar value chain, including manufacturing.

-

Egyptian Electricity Holding Company (EEHC): This state-owned entity manages the country’s electricity generation, transmission, and distribution. Securing a reliable power connection for a factory requires close coordination with the EEHC and its regional subsidiaries.

-

Egyptian Electric Utility and Consumer Protection Regulatory Agency (ERA Egypt): As the industry regulator, ERA sets the standards and tariffs for electricity, ensuring fair practices for both producers and consumers.

The ‘Golden License’ Advantage

To further attract high-value projects, Egypt introduced the ‘Golden License.’ This single, comprehensive approval from the Cabinet grants a project all the necessary permits to build and operate, including land allocation. It serves as a significant fast-track mechanism for strategic investments that align with the nation’s development goals, such as solar module manufacturing.

Site Selection: Navigating Industrial Zones

Choosing the right location is a critical business decision with long-term implications for logistics, operational costs, and access to talent. Egypt has designated several industrial zones to attract manufacturing investment, offering pre-approved land and streamlined infrastructure access.

Strategic Locations to Consider

-

Suez Canal Economic Zone (SCZONE): Arguably Egypt’s most prominent industrial area, SCZONE offers world-class infrastructure, strategic proximity to global shipping lanes via the Suez Canal, and significant tax incentives. Its integrated ports, such as Ain Sokhna, provide a major advantage for importing raw materials and exporting finished modules.

-

New Administrative Capital: Located east of Cairo, this massive development includes dedicated industrial areas designed with modern infrastructure and connectivity to the country’s logistical backbone.

When evaluating sites, investors must look beyond the cost of land. A thorough analysis of factory building requirements is essential, covering key factors like soil quality, access for heavy machinery, and proximity to a skilled labor force.

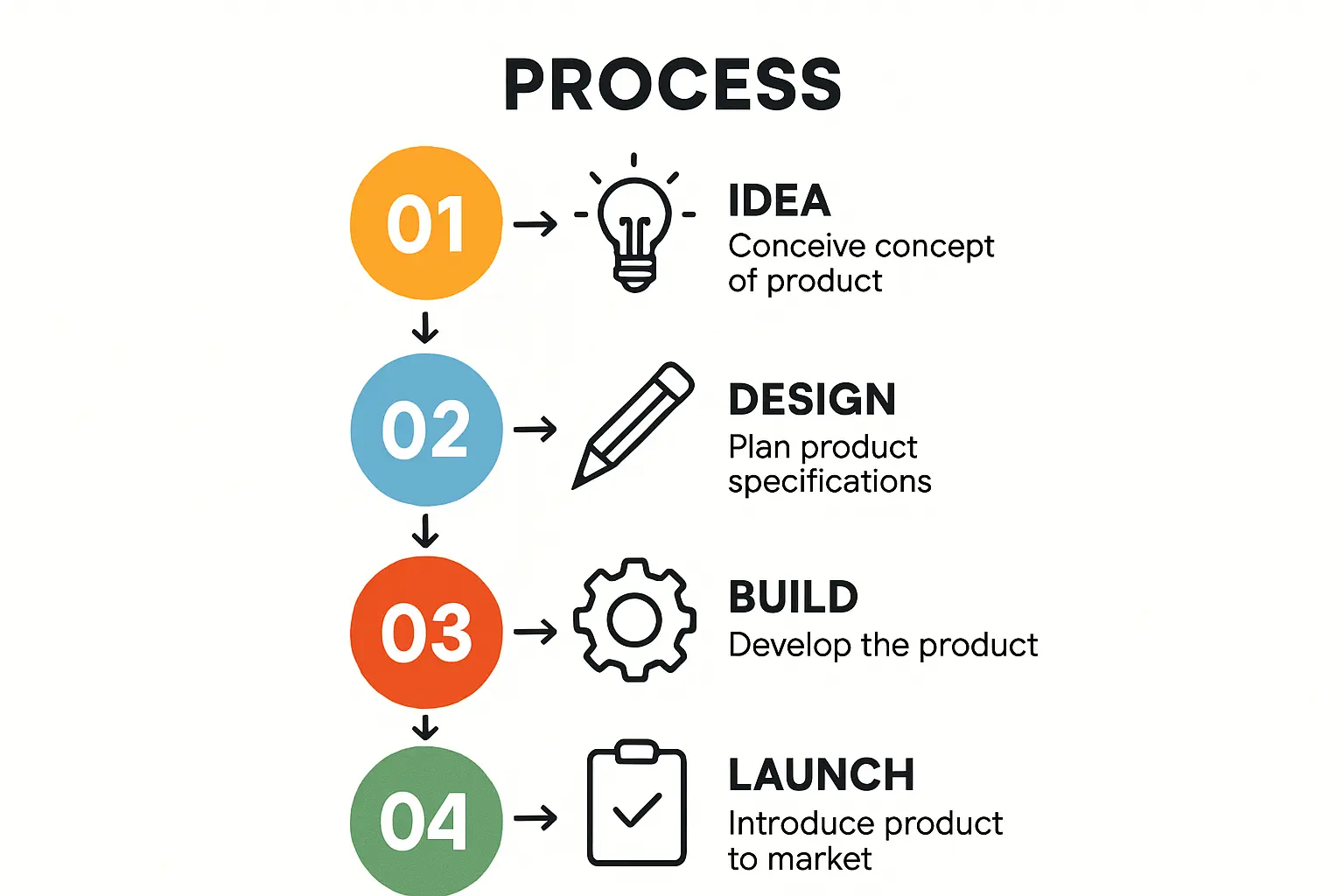

The Permitting Process: A Step-by-Step Breakdown

Based on experience gained from European PV manufacturers’ turnkey projects, investors should budget approximately 9 to 12 months to navigate the full permitting and land acquisition process. While GAFI’s one-stop-shop and the Golden License have reduced complexity, diligence and structured planning remain essential.

Typical Permitting Timeline

-

Company Registration (1-2 months): The first official step is legally establishing the company in Egypt through GAFI. This process involves submitting foundational documents and defining the scope of business activities.

-

Land Allocation (3-5 months): After registration, the investor can formally apply for an industrial plot within a designated zone. This involves submitting the project proposal, business plan, and proof of financial capability.

-

Environmental Impact Assessment (EIA) (2-3 months): The Ministry of Environment requires an EIA to ensure the factory’s operations will not negatively impact the surrounding area. This assessment is a prerequisite for most other permits.

-

Building and Construction Permits (2-3 months): Once the EIA is approved, the company can apply for permits to begin construction. This involves submitting detailed architectural and engineering plans.

-

Operational License (1-2 months): After construction is complete and the facility passes inspection, the final operational license is issued.

Connecting Utilities: The Practical Hurdles

Securing land and permits is a significant milestone, but a factory cannot operate without reliable power and water. This ‘last mile’ of an infrastructure connection can present unforeseen challenges.

Power Connection

A solar module factory is an energy-intensive operation. The process of connecting to the national grid involves:

- Submitting a load request to the local electricity distribution company, which falls under the EEHC.

- Conducting a grid capacity study to ensure the local substation can handle the factory’s demand without destabilizing the network.

- Negotiating a connection agreement and paying the associated fees, which can be substantial.

In regions with grid instability, planning for backup power generation is a prudent measure to protect sensitive manufacturing equipment.

Water Supply

Water scarcity is a reality in Egypt, making a secure water connection a critical planning component. Investors must verify that the chosen industrial zone provides sufficient water pressure and volume for both production processes (like glass washing) and general facility needs. In some cases, investing in on-site water treatment and recycling systems is a sound long-term strategy.

Frequently Asked Questions (FAQ)

What is the typical investment needed for a project of this nature?

While costs vary, understanding the financial scope is vital. A comprehensive overview of capital expenditures, from machinery to infrastructure, is available in guides detailing solar factory investment.

How much land is required for a small- to mid-sized solar factory?

A typical 50 MW per year solar module production line requires a facility of approximately 2,500 to 4,000 square meters. The total land plot should be larger to accommodate storage, logistics, and future expansion, often in the range of 10,000 to 15,000 square meters.

Can a foreign investor own 100% of a manufacturing company in Egypt?

Yes, Egypt’s Investment Law allows for 100% foreign ownership of companies in most sectors, including manufacturing. This has been a key policy in attracting international capital and expertise.

What is the most common unforeseen delay for new investors?

While bureaucratic processes can be slow, the most frequent unexpected delays arise from utility connections. Underestimating the time and technical coordination required to secure a high-capacity power line or a stable water supply can disrupt project timelines more than the paperwork itself.

From Blueprint to Production: Your Next Steps

Establishing a solar factory in Egypt is a journey that rewards meticulous planning and a clear understanding of the local operating environment. The country’s strategic vision for renewable energy creates a supportive climate for investment, but success depends on navigating the foundational steps of securing land, permits, and utilities with precision.

For entrepreneurs ready to take a deeper dive, the next logical step is to understand the core technology and operational planning. Exploring the components of a turnkey solar module production line provides the technical context needed to turn a strategic vision into an operational reality.

Download: Egypt Solar Factory Setup & Regulatory Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.