What does Africa’s premier automotive manufacturing hub have in common with the future of renewable energy? The connection is far more direct than one might expect. While Morocco is celebrated for its capacity to produce over 700,000 vehicles annually, the industrial ecosystem that fuels this success is also uniquely positioned to support another high-growth sector: solar module manufacturing.

This analysis explores a strategic investment in a vertically integrated solar module assembly plant in Morocco. An entrepreneur can leverage the nation’s robust automotive supply chain—specifically its aluminum extrusion and glass manufacturing capabilities—to build a competitive and resilient solar enterprise. This approach optimizes local content, a critical factor for long-term success in the region.

The Untapped Synergy Between the Automotive and Solar Industries

The ‘aha moment’ for investors lies in the significant overlap in materials and industrial processes between modern vehicles and high-performance solar modules. Morocco’s automotive sector, which generated over $14 billion in exports in 2023, has cultivated a network of more than 250 specialized suppliers. This mature industrial base offers a ready-made advantage.

Instead of importing every component, a new solar venture can source two of the most critical structural elements locally: aluminum frames and protective glass. This strategy, drawn from J.v.G. turnkey project blueprints developed with Thoma family consulting, creates a powerful competitive edge by reducing logistical dependencies and increasing the ‘Made in Morocco’ value of the final product.

Core Components: Sourcing Key Materials from Local Suppliers

A standard solar module assembly process often relies on imported kits. A more vertically integrated model, however, substitutes key items with locally sourced alternatives, strengthening the business case.

Aluminum Frames: From Automotive Parts to Solar Module Structures

The lightweight, durable aluminum alloys used for automotive parts like roof rails, chassis components, and trim are fundamentally similar to the materials required for solar module frames. These frames are essential for protecting solar cells from mechanical stress and environmental factors for over 25 years.

Morocco’s automotive suppliers possess advanced capabilities in aluminum extrusion, precision cutting, and surface finishing. By qualifying and collaborating with these existing manufacturers, a solar assembly plant can achieve:

- Reduced Import Costs: Eliminating the need to ship bulky aluminum frames from Asia or Europe.

- Shorter Lead Times: Local sourcing provides greater agility and reduces inventory requirements.

- Customization: Direct collaboration with local suppliers allows for the development of frames tailored to specific module designs, such as robust DESERT+ solar modules engineered for arid climates.

Experience from J.v.G. turnkey projects shows that adapting an automotive supplier’s production for solar-grade frames involves a rigorous qualification process but can dramatically improve a project’s financial model.

High-Performance Glass: A Shared Requirement for Resilience

The glass for a solar module’s front sheet must be highly transparent, incredibly strong, and resistant to impacts like hail—the same qualities demanded of automotive glass. Morocco’s established glass manufacturers, serving giants like Stellantis and Renault, already operate at the scale and quality level required for the solar industry.

Engaging these suppliers provides access to:

- A Secure Supply Chain: Reducing vulnerability to global shipping disruptions.

- Proven Quality: Tapping into decades of experience in producing durable, high-specification glass.

- Economies of Scale: Benefiting from the high production volumes of the automotive sector.

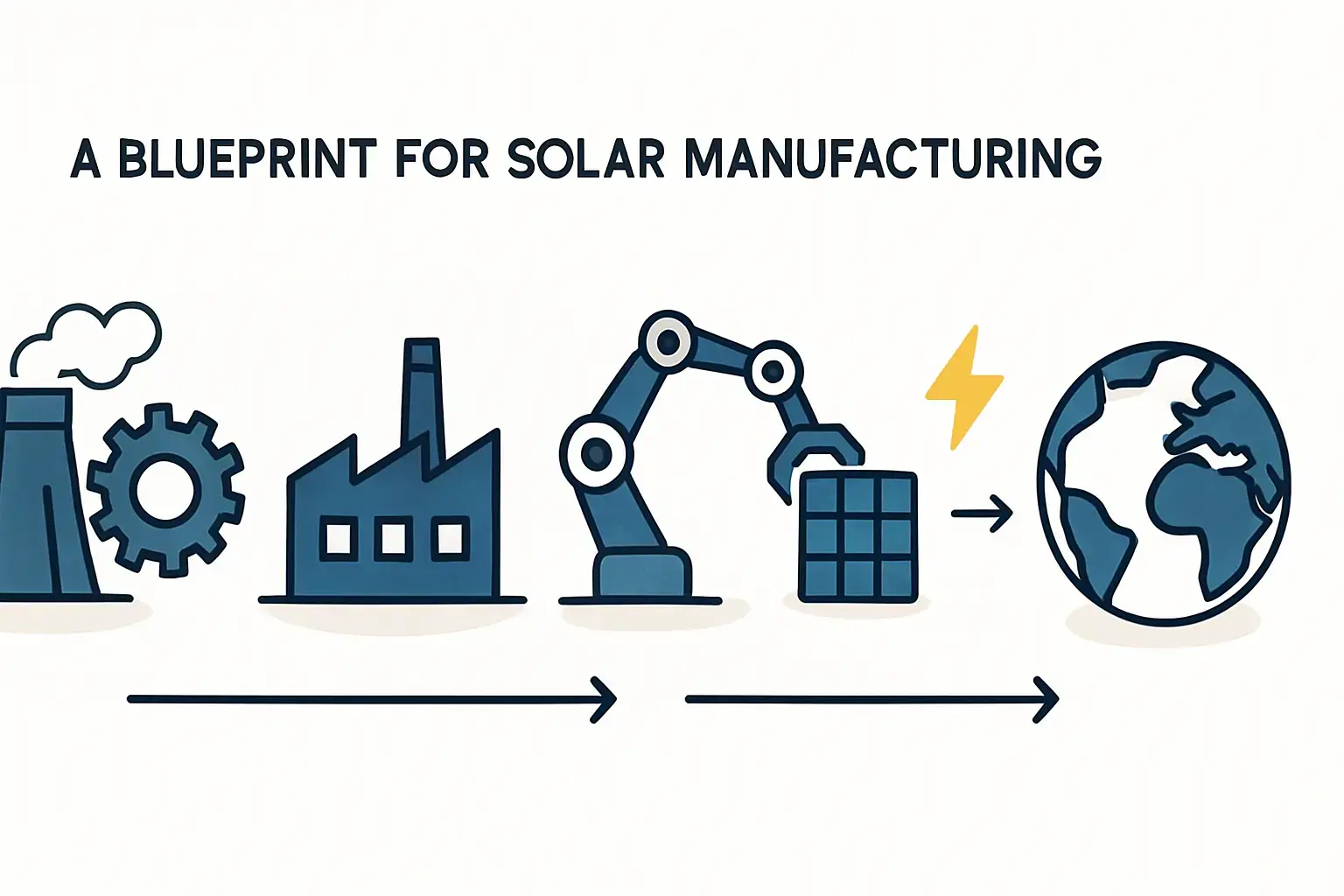

A Turnkey Project Blueprint: From Feasibility to Operation

Establishing such a facility requires a structured approach, moving from initial planning to full-scale production. This process ensures that reliance on local suppliers becomes a strength, not a liability.

Phase 1: Supplier Qualification and Integration

The first critical step is to identify and qualify automotive suppliers. While their technical capabilities are strong, their processes must be adapted to meet the specific tolerances and material standards of the photovoltaic industry. This involves:

- Technical Audits: Assessing a supplier’s machinery, quality control, and production capacity.

- Process Adaptation: Working with suppliers to fine-tune alloy compositions for frames or anti-reflective coatings for glass.

- Contractual Frameworks: Establishing clear quality agreements and delivery schedules.

This meticulous qualification ensures that locally sourced components meet or exceed international certification standards.

Phase 2: Logistics and Factory Setup

Morocco’s strategic location is a cornerstone of this business model. The Tanger Med Port, one of the largest in the Mediterranean, provides efficient access to global shipping lanes. This is vital for importing components that cannot be sourced locally, such as solar cells and junction boxes, and for exporting finished modules to European and American markets under favorable free trade agreements.

A typical turnkey solar module factory with a 50-100 MW annual capacity requires a facility of 5,000 to 7,000 square meters. The plant layout must be optimized for a seamless solar module manufacturing process, integrating the local supply of frames and glass directly into the assembly line.

Phase 3: Maximizing ‘Made in Morocco’ Certification Value

Achieving a high local integration rate—a metric where Morocco’s automotive industry already excels at 69%—is crucial. For a solar module manufacturer, this translates directly into significant advantages:

- Access to Government Incentives: Many national renewable energy programs favor products with high local content.

- Brand Differentiation: A ‘Made in Morocco’ label, backed by a substantive local supply chain, builds trust and market preference.

- Contribution to National Goals: The project aligns perfectly with Morocco’s ambitious plan to achieve a renewable energy mix of over 52% by 2030.

Frequently Asked Questions (FAQ)

What does ‘vertical integration’ mean in this context?

Here, vertical integration is the strategy of sourcing major components like aluminum frames and glass from local industries rather than importing a complete bill of materials. This approach gives the manufacturer greater control over its supply chain, costs, and quality.

Is the quality from automotive suppliers sufficient for solar modules?

The foundational manufacturing capabilities are excellent. However, a crucial part of the setup involves a specific qualification phase to ensure a supplier’s output meets the unique technical standards, material specifications, and long-term durability requirements of the photovoltaic industry.

How does this model differ from a standard solar assembly plant?

A standard plant typically functions as a final assembly point for imported kits. This integrated model is more complex to establish but offers greater long-term resilience and profitability by embedding the factory within a powerful local industrial ecosystem. Detailed figures are often explored in guides on investment requirements for solar manufacturing.

Why is this model particularly suited for Morocco?

This strategy is effective in Morocco because the country has deliberately built a world-class automotive supply chain. Few other nations in the region possess a comparable industrial base, creating a unique and difficult-to-replicate competitive advantage for an investor.

A Path Forward for Strategic Investment

The opportunity to leverage Morocco’s automotive ecosystem for solar manufacturing is a sophisticated, next-generation industrial strategy. It moves beyond simple assembly to create a deeply integrated enterprise that is more resilient, cost-effective, and strategically aligned with national economic goals. For entrepreneurs and investors looking to enter the solar industry, this model offers a clear blueprint for building a lasting and competitive business.

Understanding the detailed phases of planning, building, and operating such a factory is the logical next step. A structured approach is the key to translating this powerful concept into a successful operational reality.