Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

The United Arab Emirates is charting an ambitious energy future, with plans to invest AED 600 billion ($163 billion) in renewable energy by 2050. This national commitment will triple the country’s renewable capacity to 14 GW by 2030, creating significant and sustained demand for solar photovoltaic (PV) modules.

For established real estate and construction firms, this landscape presents more than just an opportunity—it raises a strategic question: should we continue to buy, or is it time to build?

For developers managing large-scale projects, relying on imported solar panels introduces significant variables. Project timelines can be disrupted by shipping delays, and budgets are exposed to fluctuating import tariffs and supply chain vulnerabilities.

Vertical integration through in-house solar module manufacturing offers a compelling solution, transforming a variable cost and logistical challenge into a controlled, strategic asset. This guide outlines a practical playbook for UAE-based developers considering this move.

The Strategic Imperative: Why Real Estate Firms Are Exploring Solar Manufacturing

The UAE construction market is projected to grow to USD 50.48 billion by 2029, and a growing percentage of this development will incorporate renewable energy. This trend places developers at a critical junction. Venturing into module production isn’t about becoming an entirely new type of company; it’s about securing a critical component of your existing business.

Mitigating Supply Chain Risks

Currently, the UAE imports the vast majority of its solar panels. This dependency creates exposure to international shipping bottlenecks, geopolitical trade dynamics, and customs delays—common challenges that can stall an entire project over the ‘last-mile’ availability of panels. Establishing a local solar module manufacturing plant insulates projects from these external risks, ensuring a predictable supply of modules tailored to project timelines.

Achieving Cost Control and Margin Security

By producing modules in-house, a developer transitions from a price-taker to a price-setter for one of a solar project’s most significant components, gaining direct control over costs and protecting profit margins from market volatility. With government initiatives encouraging local production, projects with higher local content often receive preferential treatment in government tenders, creating a distinct competitive advantage.

Aligning with National Policy

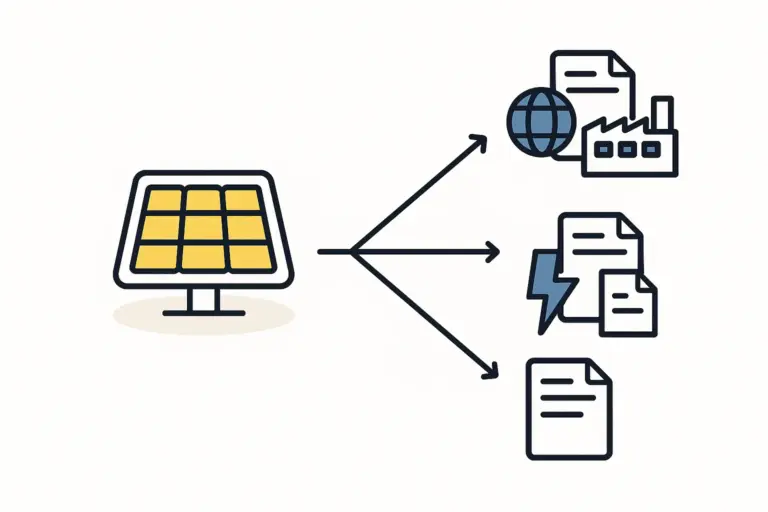

Initiatives like Dubai’s Shams program actively encourage property owners to install PV systems and connect to the grid. By manufacturing locally, developers not only contribute to the UAE’s renewable energy goals but also align their business model with a supportive and forward-looking regulatory framework.

A Phased Approach to In-House Production: A 50 MW Scenario

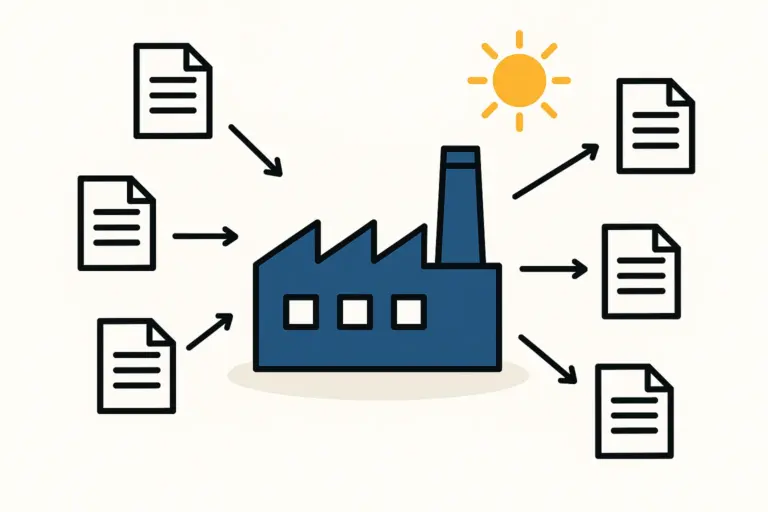

For a large construction or real estate firm, the risk of entering the manufacturing space can be managed by focusing first on captive demand—producing modules primarily for its own projects. This approach ensures a stable off-take for the factory’s initial output. A semi-automated 50 MW production line is a logical and financially sound starting point.

Step 1: Feasibility and Financial Modeling

The first phase is a rigorous assessment of the business case. The typical investment required for setting up a 50 MW semi-automated production line is between USD 5–7 million. Key considerations for a developer include:

- Captive Demand Analysis: Quantify the annual solar module demand from your own project pipeline. A 50 MW line can produce approximately 125,000 to 150,000 panels per year, depending on wattage; does your project portfolio support this volume?

- Return on Investment (ROI): With stable captive demand, the payback period for the initial investment can be as short as 3–5 years—a rapid return driven by savings on open-market modules and the elimination of associated logistical costs.

- Financial Planning: A detailed business plan is crucial. Based on experience gained from European PV manufacturers’ turnkey projects, this plan must account not only for machinery but also for working capital, raw material inventory, and operational ramp-up costs.

Step 2: Infrastructure and Sourcing

While a real estate firm has expertise in construction, a manufacturing facility has unique specifications. The factory building requirements for a 50 MW line typically demand 3,000 to 5,000 square meters of space with specific provisions for cleanroom environments, ceiling height for machinery, and robust utility connections.

Simultaneously, a new supply chain for raw materials—solar cells, glass, EVA encapsulant, backsheets, and aluminum frames—must be established. This requires a new operational discipline for a business focused on construction.

Step 3: Commissioning the Production Line

The heart of the factory is its machinery. A semi-automated solar panel production line offers an optimal balance between capital investment and labor, making it well-suited for the UAE market. This setup includes key machines like stringers for interconnecting solar cells, laminators for encapsulation, and testers for quality assurance.

Partnering with an experienced engineering firm that provides a turnkey line setup ensures the machinery is correctly specified, installed, and commissioned for peak performance.

Case in Point: From Captive Supply to Regional Player

The strategic logic outlined here is not merely theoretical. A premier EU provider client in the Middle East, a large construction conglomerate, embarked on this exact journey. They began with a 50 MW line dedicated to supplying their own extensive real estate developments.

The immediate benefits were clear: direct control over their supply chain and significantly improved project margins. This initial success validated their investment. Within three years, their confidence in the process and the market grew, leading them to expand the facility to 150 MW to serve the broader regional demand.

Their story demonstrates a successful, phased approach: secure the model with internal demand, then scale to capture external market opportunities.

Quality Control: Protecting Your Core Asset

For a developer, a building is a long-term asset. The solar panels installed on it are not just components; they are 30-year power-generating assets that impact the property’s value and operational costs. Relying on imported modules can mean accepting inconsistent quality.

An in-house manufacturing line provides ultimate control over quality assurance. From raw material inspection to final module testing, every step can be monitored to meet the stringent standards required by a premier real estate portfolio. This ensures the longevity and performance of the solar installations and directly protects the value of the core real estate asset.

Frequently Asked Questions (FAQ) for UAE Developers

-

How much capital is truly required to start a 50 MW line?

The core machinery and setup investment typically fall in the USD 5–7 million range. However, a comprehensive budget must also account for working capital for the first six months of raw material procurement and operational expenses. A detailed financial plan is essential. -

Do we need a team of solar technology experts to run a factory?

You do not need to be a solar expert to own the facility. The key is to hire a core team—including a plant manager and a few production engineers—with the right experience. A turnkey setup partner often provides initial training for local operators, ensuring a smooth transfer of knowledge. -

What are the biggest unforeseen challenges for a construction firm?

The most common learning curve for companies outside the manufacturing sector involves managing the raw material supply chain. Unlike project-based procurement in construction, a factory requires a continuous, well-managed flow of dozens of components. Establishing reliable supplier relationships is a critical early task. -

How long does it take to become operational?

From the final investment decision to producing the first certified solar module, a well-managed project can take between 12 and 18 months. This timeline includes factory preparation, machine manufacturing and shipping, installation, commissioning, and staff training.

Your Next Steps in Vertical Integration

For a UAE real estate developer, vertical integration into solar module manufacturing is a logical next step. It offers a strategic hedge against supply chain volatility, a mechanism for cost control, and direct alignment with the nation’s ambitious renewable energy vision.

The journey begins not with purchasing machines, but with building a robust business case. A thorough feasibility study, informed by real-world data and expert analysis, is the indispensable first step toward turning this opportunity into a profitable reality. The educational resources available at pvknowhow.com, including a structured e-course, can provide a solid foundation for this critical planning phase.

Download: UAE Real Estate Solar Integration Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.