Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

The global shift towards renewable energy has created an unprecedented demand for solar photovoltaic (PV) modules. For European nations, meeting this demand is not just a goal but a strategic imperative. The REPowerEU plan sets ambitious targets to install 320 GW of solar capacity by 2025 and nearly 600 GW by 2030. Yet, a critical vulnerability remains: while the continent aims to manufacture 30 GW of solar panels annually by 2025, its current capacity is only around 8 GW.

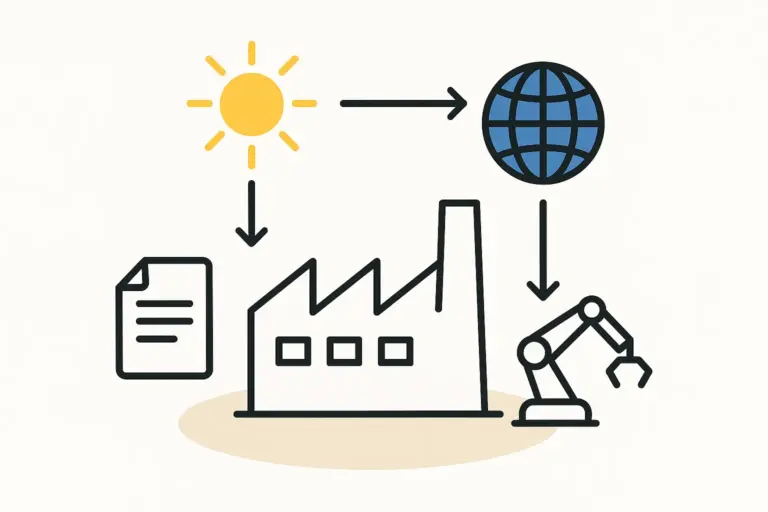

This supply-demand gap presents a significant opportunity for investors with the foresight to look beyond traditional manufacturing hubs. For entrepreneurs in North Africa, it poses a compelling question: what if the solution to Europe’s supply chain challenge lies not in Asia, but just across the Mediterranean? This analysis explores the business case for establishing a large-scale, 500 MW+ solar module factory in Algeria, designed specifically to serve the lucrative European and growing North African markets.

The Strategic Imperative: Europe’s Search for Secure Solar Supply Chains

Europe’s heavy reliance on imported solar modules has become a source of economic and geopolitical concern. The concentration of manufacturing in a single region creates risks of shipping disruptions, trade policy fluctuations, and logistical bottlenecks.

To mitigate these risks, European policymakers and industries are actively seeking to diversify their supply chains, prioritizing manufacturers in nearby, economically integrated regions. This creates a unique window of opportunity. A manufacturing facility in Algeria is more than an alternative; it is a strategic solution offering resilience, speed, and cost-competitiveness right at the EU’s southern border.

Why Algeria? A Confluence of Geographical and Economic Advantages

Algeria is uniquely positioned to become a solar manufacturing powerhouse. This potential rests on a combination of logistical superiority, favorable trade agreements, and strong domestic fundamentals.

Geographical Proximity and Logistics

The most apparent advantage is geography. While a container from Asia to a European port like Rotterdam can take four to six weeks, a shipment from Algiers to Marseille can be completed in just a few days. This proximity drastically reduces lead times, lowers shipping costs, and minimizes the carbon footprint of transportation—a factor of growing importance to environmentally conscious European buyers.

The Trans-Mediterranean Transport Network (TEN-T) further strengthens these logistical links, integrating Algerian ports like Algiers, Skikda, and Oran directly into Europe’s core transport corridors.

Favorable Trade Agreements

Strategic trade agreements provide a significant competitive edge. The EU-Algeria Association Agreement, in effect since 2005, establishes a free trade area that eliminates tariffs on industrial goods. This means solar modules manufactured in Algeria can enter the vast EU market duty-free—a crucial advantage over competitors who may face import tariffs.

Furthermore, Algeria’s accession talks for the Agadir Agreement signal the potential for tariff-free access to other key North African markets, including Tunisia, Egypt, and Morocco, creating a dual export focus.

Abundant Raw Materials and Low Energy Costs

Access to affordable raw materials and energy is fundamental to successful manufacturing. Algeria possesses vast reserves of high-purity silica sand, the primary raw material for producing solar glass and cells. This local resource reduces import dependency and material costs.

Perhaps more importantly, Algeria offers some of the world’s lowest industrial electricity prices, at around €0.03 per kilowatt-hour. Since energy is a major operational expense in module manufacturing, this provides a sustainable cost advantage difficult for European-based manufacturers to match.

Government Support and Domestic Market Foundation

The Algerian government is clearly committed to developing its renewable energy sector. Initiatives like the ‘Solar 1,000 MW’ project and the state utility Sonelgaz’s plan to build a 2 GW/year manufacturing facility indicate strong institutional support. For a new 500 MW+ factory, this creates a stable domestic market that can absorb a portion of the output, de-risking the initial investment while export channels are established.

Designing a 500 MW+ Export-Oriented Production Facility

To successfully penetrate the competitive European market, a new factory cannot simply replicate existing models. It must be built around advanced technology, high automation, and rigorous quality control.

Competing on a Global Stage: Technology and Automation

An export-focused facility must produce modules that meet or exceed international standards for efficiency and reliability. This requires investing in a production line capable of handling next-generation cell technologies such as TOPCon or HJT. These technologies deliver higher power output and better performance, commanding a premium in sophisticated markets.

High levels of automation are equally critical. A fully integrated Manufacturing Execution System (MES) ensures process consistency, minimizes human error, and provides complete traceability for every module produced—a key requirement for European buyers and financiers. Automation reduces labor costs and, more importantly, guarantees the quality necessary to compete with established global players.

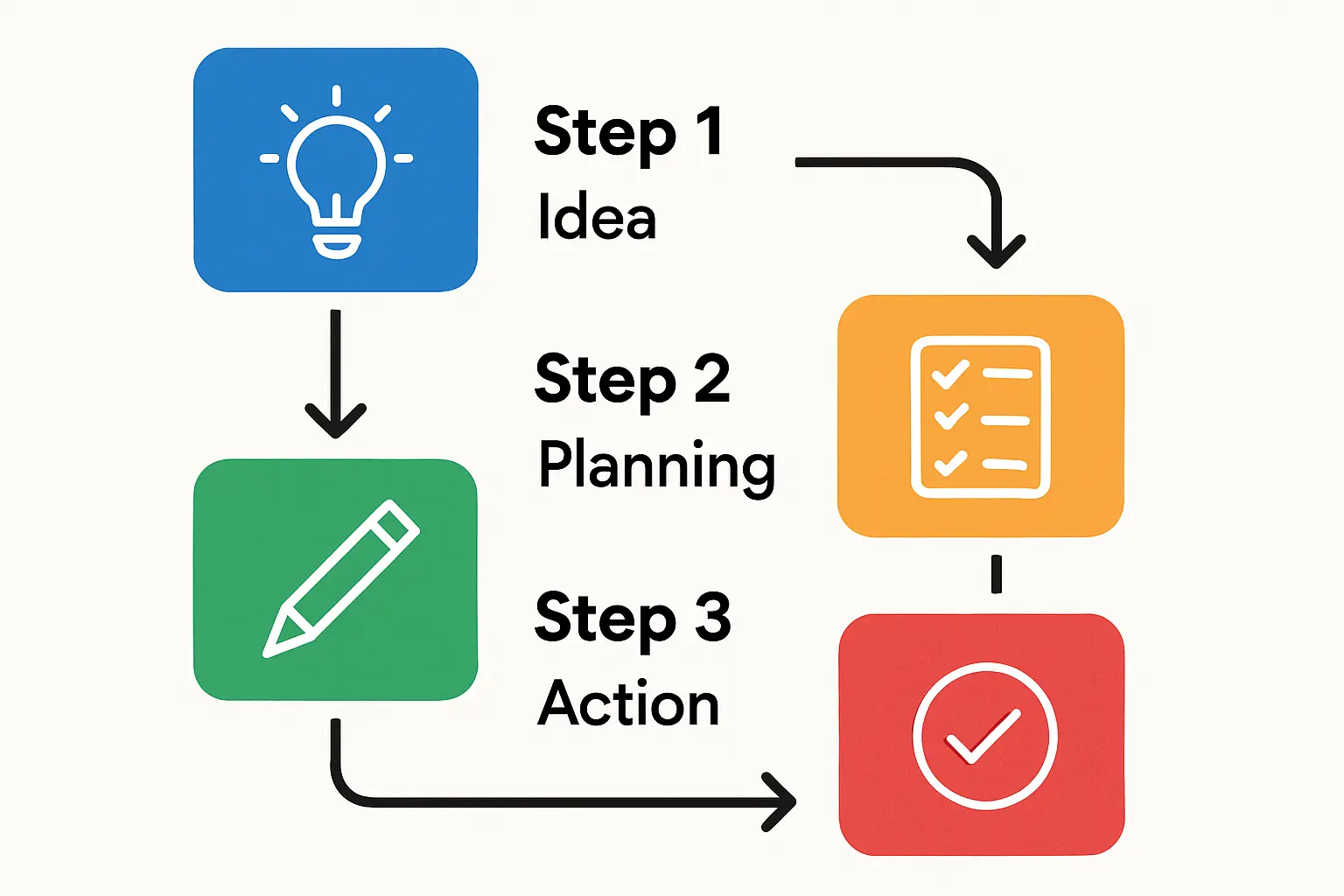

The Turnkey Approach: From Blueprint to Production

For entrepreneurs entering the solar industry, navigating the complexities of factory design, equipment procurement, and process integration can be daunting. A turnkey solution provides a structured, end-to-end approach. This model, often managed by expert-led European solar project architecture and modeling firm, covers everything from the initial feasibility study and factory layout to equipment commissioning and staff training. It streamlines the path to production, ensuring the facility is built to international standards from day one.

Investment and Infrastructure Considerations

Based on experience from numerous turnkey projects, the initial investment for a modern, highly automated 500 MW solar module production line typically ranges from €25 million to €35 million. This includes all machinery, installation, and commissioning. Beyond the production line, investors must also factor in the specific building requirements for a solar factory, which include specifications for cleanrooms, storage areas, and logistical infrastructure.

A Comparative Business Case: Algeria vs. Traditional Asian Hubs

When viewed through a strategic lens, the business case for manufacturing in Algeria becomes clear. It shifts the competitive paradigm from a pure cost-per-watt calculation to a more holistic evaluation of value, risk, and speed.

Here is a direct comparison:

| Factor | Manufacturing in Asia | Manufacturing in Algeria |

|---|---|---|

| Shipping Time to EU | 4–6 weeks | 2–5 days |

| Logistics Costs | High and volatile | Low and stable |

| Carbon Footprint | High | Low |

| EU Market Access | Subject to potential tariffs | Tariff-free (EU-Algeria Agreement) |

| Supply Chain Resilience | Concentrated and vulnerable | Diversified and resilient |

This comparison highlights how an Algerian manufacturing base offers a powerful blend of cost-efficiency and strategic advantages, directly addressing the primary concerns of the European market.

Frequently Asked Questions (FAQ)

What are the main challenges for such a project in Algeria?

While the advantages are significant, potential challenges include navigating local bureaucracy, developing logistics infrastructure outside of main ports, and training a skilled technical workforce. These hurdles are manageable but require careful planning and the guidance of experienced partners who understand both the technical requirements and the local business environment.

Is a 500 MW factory considered large?

Yes, a 500 MW annual capacity represents a significant industrial scale designed for the export market. It establishes the operator as a major regional player capable of fulfilling large-volume orders for utility-scale projects and distribution networks in Europe and North Africa.

What kind of quality certifications are needed for the European market?

To sell in Europe, modules must meet core international standards, primarily IEC 61215 (performance) and IEC 61730 (safety). Increasingly, customers and regulations are also demanding low-carbon footprint certifications, which would be a natural advantage for a factory using Algeria’s low-carbon electricity grid.

How does the lamination process ensure module durability for different climates?

The lamination stage is critical for long-term reliability. A high-quality solar module laminator uses precise heat and pressure to encapsulate the solar cells between layers of glass and protective backing. This process seals the cells from moisture, humidity, and physical stress, ensuring the module can perform reliably for 25+ years in diverse climates, from the high temperatures of North Africa to the wet and varied conditions across Europe.

Conclusion: Seizing a Strategic Manufacturing Opportunity

The convergence of Europe’s urgent need for a secure solar supply chain and Algeria’s unique combination of geographical, economic, and resource advantages has created a historic investment opportunity. An entrepreneur who establishes a 500 MW+ export-oriented solar module factory in Algeria is not just building a plant; they are building a strategic bridge between African manufacturing potential and European energy demand.

The path to realizing this opportunity requires a clear vision, a solid financial foundation, and technical excellence. Projects of this scale benefit from structured guidance from industry experts to navigate the complexities from initial planning to full-scale production. For the right investor, this is a chance to become a key player in the global energy transition.

Download the 500 MW+ Algeria Solar Export Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.