Blessed with abundant sunshine, Armenia is quickly emerging as a promising destination for solar energy development. Its average annual solar energy flow is around 1,720 kWh/m², significantly higher than the European average of 1,000 kWh/m², highlighting the immense potential for solar power generation.

The Armenian government has taken notice, actively fostering a supportive environment for renewable energy with a particular focus on encouraging local solar panel manufacturing. For entrepreneurs and companies looking to invest in this burgeoning sector, Armenia offers a compelling array of government incentives, tax benefits, and financial support mechanisms designed to catalyze growth and ensure long-term success.

This guide walks you through the financial landscape awaiting solar manufacturing investors in Armenia, helping you navigate the opportunities to establish a thriving production facility.

Table of Contents

Armenia’s Solar Energy Landscape: A Market Primed for Growth

Armenia has set ambitious renewable energy targets, aiming to significantly increase the share of solar power in its energy mix. This commitment is driven not just by environmental goals but also by a clear desire for energy independence, economic development, and sustainability.

The government’s vision extends beyond simply generating energy—it’s about fostering a domestic manufacturing base to supply the growing local and regional demand for solar technologies. This strategic focus creates fertile ground for investors in solar panel production, as a robust domestic market and supportive policies provide a solid foundation for any manufacturing venture.

Direct Financial Incentives for Solar Manufacturers

The Armenian government and its international partners offer several direct financial support mechanisms to help lower the risks and initial capital expenditure for new solar manufacturing projects.

Investment Grants and Subsidies

While large-scale grant programs dedicated solely to solar manufacturing are still evolving, several key initiatives support renewable energy projects, which in turn benefits the entire manufacturing ecosystem.

- Climate Investment Funds (CIF) & SREP: Armenia benefits from the Scaling Up Renewable Energy Program (SREP), administered through CIF. The country’s SREP investment plan is designed to reduce renewable energy technology costs and develop local markets. This type of funding stimulates demand and creates a highly supportive environment for local manufacturers.

- Eligibility & Application: Eligibility for these programs typically depends on investment size, job creation potential, technological innovation, and alignment with national strategic goals. Investors should connect directly with bodies like the Ministry of Economy or Investment Armenia for the latest information on grants or co-financing schemes relevant to manufacturing.

Concessional Loans and Financial Guarantees

For a capital-intensive business like manufacturing, access to favorable financing is crucial.

- International Financial Institutions (IFIs): Organizations like the European Bank for Reconstruction and Development (EBRD) and the Asian Development Bank (ADB) are active in Armenia’s renewable energy sector. The EBRD’s Green Economy Financing Facility (GEFF), for example, offers financial support that can include cash-back incentives for SMEs.

- SREP Funding: Part of the SREP funds has been allocated for concessional loans. These funds are intended to support renewable energy projects and may extend to parts of the manufacturing value chain.

- Government Guarantees: In some cases, government guarantees may be available for loans secured for strategic investment projects. This reduces risk for lenders and can significantly improve loan terms for the investor.

Support for Research & Development (R&D)

In the competitive solar industry, innovation is vital. Armenia is keen to encourage R&D in green technologies.

- FAST Foundation: The Foundation for Armenian Science and Technology (FAST) is a key resource, providing grants and support for R&D initiatives, including those in the energy transition space. Companies focusing on innovative solar manufacturing processes may find significant opportunities here.

Tax Benefits for Solar Manufacturing Operations

Armenia offers a range of tax incentives specifically designed to make investing in solar manufacturing more attractive and financially viable.

Corporate Income Tax (CIT) Relief

While general CIT rates apply, specific projects—particularly those involving significant investment or located in special economic zones—may qualify for preferential treatment or even tax holidays. A detailed consultation is recommended to explore the options for your specific project.

Value Added Tax (VAT) Exemptions and Reductions

VAT policies offer a significant, direct benefit to manufacturers. Provisions for VAT exemptions or deferrals on imported manufacturing equipment, machinery, and raw materials can substantially reduce the upfront costs of setting up a production line.

Customs Duty Exemptions

Customs duty exemptions provide another key advantage for solar businesses in Armenia. Notably, solar panels, solar batteries, electric vehicle chargers, and electric vehicles are exempt from import taxes.

This policy supports the adoption of solar energy and directly benefits manufacturers who need to import certain components or specialized raw materials. Under broader investment support laws, the exemption often extends to manufacturing equipment, which significantly reduces input costs.

Other Potential Tax Incentives

Other potential incentives are also available, particularly related to property tax for new industrial constructions or investments in designated development areas. Furthermore, the “tax-free” environment for small-scale solar generation underscores the government’s strong pro-solar stance, contributing to a positive operational climate for the entire industry.

Indirect Support & Market Creation Incentives

Direct financial aid and tax breaks are only one side of the coin. Policies that stimulate strong demand for solar panels are equally crucial for manufacturers.

Feed-in Tariffs (FiTs) and Power Purchase Agreements (PPAs)

Armenia has implemented a supportive FiT scheme to encourage investment in solar power plants. Energy produced from solar plants benefits from FiTs with long-term purchase guarantees, typically for 20 years.

For a manufacturer, these stable and attractive FiTs create a reliable and growing domestic market for solar panels. Large-scale projects like the Masrik-1 solar plant, often backed by international consortia and utilizing Public-Private Partnerships (PPPs), further anchor this demand.

Net Metering and Support for Self-Consumption

Regulations that favor the self-consumption of solar energy are another key driver for panel sales. Residential and commercial consumers operating under net metering schemes are often exempt from certain licensing requirements and fees. This simple, effective policy encourages the adoption of rooftop solar, directly expanding the market for manufactured panels.

Special Economic Zones (SEZs) and Strategic Projects

Armenia has established Special Economic Zones that offer a full suite of additional incentives, including tax exemptions and simplified customs procedures. While these zones may not be exclusively for solar manufacturing, locating your production facility within one could provide significant operational and financial benefits.

Additionally, large-scale or strategically important manufacturing projects may be eligible for bespoke incentive packages negotiated directly with the government.

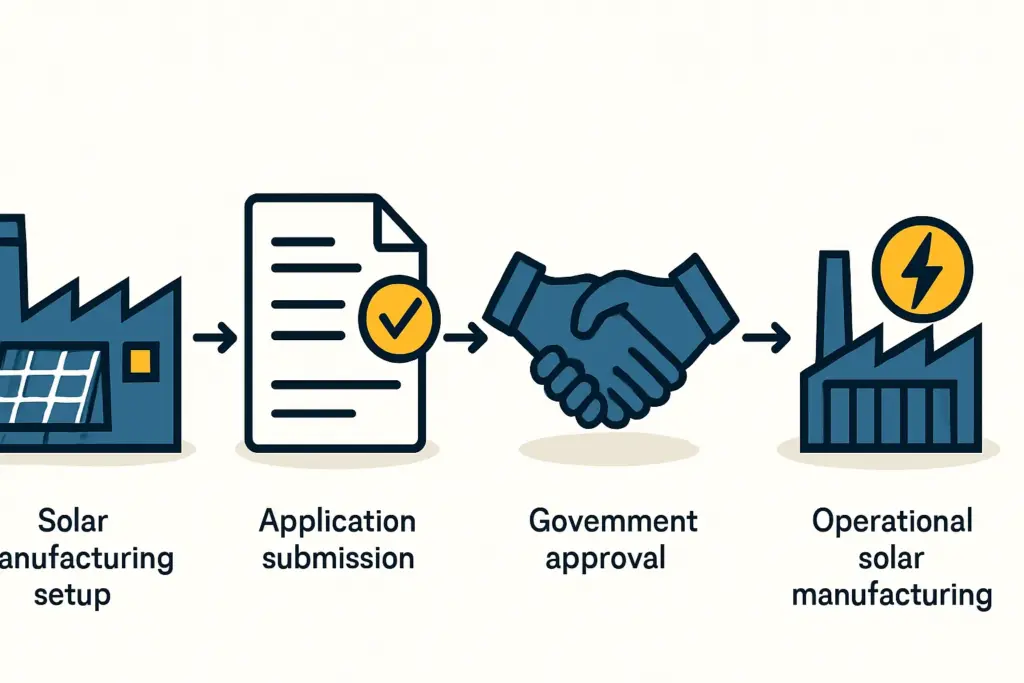

Navigating the Investment Process

Successfully accessing these incentives requires a solid understanding of the local regulatory landscape and engagement with the right authorities.

Key Government Agencies

- Ministry of Economy: Plays the central role in investment policy and industrial development.

- Investment Armenia (Enterprise Armenia): The national investment promotion agency, serving as your primary point of contact.

- Public Services Regulatory Commission (PSRC): Regulates the energy sector, including setting tariffs and handling licensing.

The application process generally involves submitting a detailed business plan that fulfills the eligibility criteria for each program. Working with local legal and business consultants familiar with Armenian procedures is crucial for a smooth and successful process.

Why Invest in Armenian Solar Manufacturing? The Competitive Edge

Armenia presents a compelling case for investment in solar panel manufacturing, underpinned by several competitive advantages:

- Strong Government Commitment: A proactive government with a clear vision for renewable energy growth.

- Generous Solar Resources: Extremely high levels of solar irradiation, ensuring strong technology performance.

- Attractive Financial Incentives: A powerful combination of potential grants, concessional loans, and R&D support.

- Significant Tax Advantages: Game-changing exemptions on import duties and VAT for manufacturing inputs.

- Growing Domestic Market: Demand actively driven by supportive FiTs, PPAs, and net metering policies.

- Strategic Location: Potential to serve regional markets in the Caucasus and beyond.

Conclusion: Powering Armenia’s Tomorrow, Today

Armenia’s strategic focus on renewable energy, combined with a rich package of financial incentives and tax benefits, creates an exceptionally favorable environment for investors in solar panel manufacturing. By leveraging these support mechanisms, companies can establish cost-effective and competitive production facilities, contributing to Armenia’s green energy transition while capitalizing on a rapidly growing market.

Navigating these opportunities is the crucial first step toward success. At PVknowhow.com, we have years of experience establishing solar module production lines worldwide and are well-positioned to guide you through every stage, from initial business planning and technology selection to factory commissioning.

Want to learn more or need expert help? Visit our free e-course or explore our services. Or, if you’re ready to dive deeper, our Premium Business Plan E-Course offers personalized guidance to get your venture off the ground. Let’s make your solar journey smooth and successful.

Frequently Asked Questions (FAQs)

Q1: What is the primary government agency for investment support in Armenia?

A1: Your first stop should be Investment Armenia (also known as Enterprise Armenia), the national investment promotion agency. The Ministry of Economy also plays a central role in shaping investment policies and supporting industrial development.

Q2: Are the incentives different for foreign versus domestic investors?

A2: No, and this is a key point: Armenia’s policy provides equal treatment to foreign and domestic investors. Most incentives and investment laws are designed to apply uniformly, encouraging both local entrepreneurship and foreign direct investment.

Q3: How stable are these government incentives and policies?

A3: Armenia has shown a consistent, long-term commitment to developing its renewable energy sector. Many support mechanisms, like Feed-in Tariffs, come with long-term guarantees (e.g., 20 years). While specific policies can evolve, the government’s overarching strategic direction toward green energy remains robust.

Q4: Are there specific incentives for establishing a solar manufacturing plant in a Special Economic Zone (SEZ)?

A4: Yes. Armenia’s SEZs offer powerful benefits, including exemptions from corporate income tax, VAT, and customs duties for businesses operating within their boundaries. You should evaluate if locating in an SEZ aligns with your operational needs.

Q5: What kind of support is available for importing manufacturing equipment?

A5: The benefits are significant. You can get exemptions or deferrals from both VAT and customs duties on the import of technological equipment, machinery, and raw materials intended for production. This can substantially reduce your initial capital investment.