An investor reads the news about Australia’s Solar Sunshot program, a multi-billion dollar initiative to stimulate domestic solar manufacturing. The opportunity seems immense—a chance to build a sovereign industrial capability in a high-growth sector. Yet, after the initial excitement, a fundamental business question emerges: If you were to build a solar panel factory in Australia today, where would the components come from? This question isn’t merely logistical; it’s the strategic core on which the entire venture’s viability rests.

Building a solar module is essentially an act of assembly. The final product’s quality, cost, and supply reliability depend entirely on the strategic sourcing of its components. For an aspiring manufacturer in Australia, this means navigating a complex landscape of local potential and global market realities. This article examines the critical decisions involved in developing a resilient supply chain, breaking down the options for sourcing raw materials and components for a new Australian solar factory.

The Australian Solar Manufacturing Landscape: A Tale of Import Reliance

Australia has one of the highest rates of rooftop solar adoption in the world, yet over 90% of the panels installed are imported. This disconnect highlights a significant industrial gap and a substantial opportunity. Government initiatives aim to reverse this trend, fostering an environment where domestic production can flourish.

However, a new factory cannot be willed into existence. It requires a robust supply chain. The central challenge for any new entrant is creating this network from a relatively low industrial base. Success will depend on a clear-eyed assessment of which components can be sourced locally and which must, at least initially, be sourced from established international markets.

Deconstructing the Solar Module: A Bill of Materials (BOM) Overview

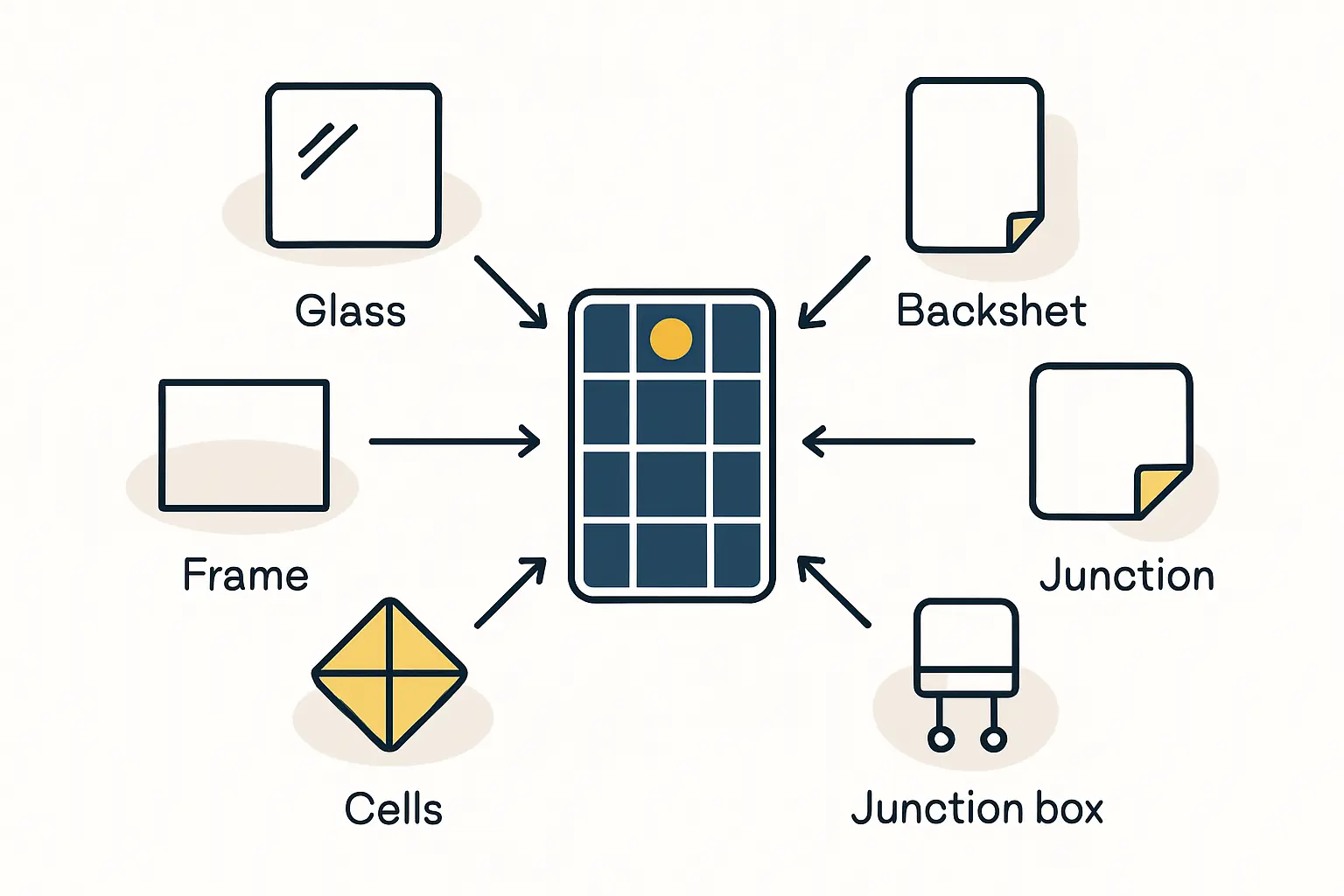

Before analysing sourcing options, it’s essential to understand the key components that make up a modern solar panel. The primary elements in the Bill of Materials (BOM) include:

- Solar Glass: The front layer, protecting the internal components while allowing maximum light transmission.

- Solar Cells: The active component that converts sunlight into electricity. This is the most technologically complex and highest-value part of the module.

- Aluminium Frame: Provides structural rigidity and a means for mounting the panel.

- Encapsulant (EVA): A polymer sheet used to laminate the components together, protecting cells from moisture and impact.

- Backsheet: The rearmost layer, providing mechanical protection and electrical insulation.

- Junction Box: An enclosure on the back of the panel where the cell strings are connected and which allows the panel to be connected to the system.

Exploded view of a solar panel’s components, including glass, EVA, solar cells, backsheet, and aluminum frame.

Each of these components presents a unique sourcing challenge and opportunity within the Australian context.

The Sourcing Dilemma: Local Champions vs. Global Giants

The decision to source locally or internationally is a trade-off between supply chain security, cost, logistics, and quality. A hybrid approach is often the most pragmatic starting point.

Solar Glass: Australia’s Clear Advantage

One of the most promising areas for local sourcing is solar glass. Australia possesses vast reserves of high-purity silica sand, the primary raw material for glass production.

- Existing Capability: A local supply chain already exists. Tindo Solar, Australia’s current sole panel manufacturer, sources its glass from Oceania Glass, a domestic producer. This demonstrates a viable, established pathway.

- Strategic Benefits: Sourcing glass locally dramatically reduces logistical complexity and cost. Shipping large, fragile sheets of glass across oceans is expensive and carries a high risk of breakage. Local sourcing offers shorter lead times, greater control over specifications, and improves the solar panel quality assurance process.

Aluminium Frames: Tapping into Natural Resources

Australia is a world leader in the production of bauxite and its refined product, alumina—the precursors to aluminium. This presents a strong case for local frame manufacturing.

- Potential: While the country has a robust aluminium smelting industry, the capacity for extruding and fabricating frames to the precise specifications of solar modules would need to be scaled.

- Analysis: The business case involves comparing the cost of importing finished frames from mass-producers in Asia versus the investment in local extrusion and anodizing capabilities. For a new entrant, partnering with existing Australian aluminium extruders is a logical first step.

Solar Cells: The Critical Missing Link

The most significant hurdle for Australian solar manufacturing is the lack of commercial-scale solar cell production.

- Current Reality: All solar cells would need to be imported. The global market is dominated by manufacturers in China and Southeast Asia. This is the single largest point of import dependency for a new Australian factory.

- Future Outlook: While Australian research institutions like UNSW are world-renowned for photovoltaic R&D, and companies like SunDrive are developing promising technologies, commercial-scale production is not yet a reality. A new manufacturing operation must plan to import cells for the foreseeable future. This dependency is a key factor influencing supply chain risk.

Encapsulants (EVA) & Backsheets: An Emerging Opportunity

The polymers used for encapsulation (Ethylene Vinyl Acetate or EVA) and backsheets are specialized products. Currently, there is limited local production capacity at the scale required for a major solar manufacturing industry.

- Initial Strategy: Like solar cells, these components will likely need to be sourced from established international suppliers.

- Future Potential: As the domestic manufacturing industry grows, it could create sufficient demand to justify investment in local polymer film production, creating an opportunity for Australia’s chemical industry.

Junction Boxes & Connectors: The Economies of Scale Challenge

Junction boxes, diodes, and connectors are highly commoditized electronic components. They are produced in extremely high volumes, primarily in Asia, at very low costs.

- Economic Reality: For a new factory, establishing local production for these items would be economically unfeasible. The scale required to compete on price with global leaders is immense. This means they will remain imported components.

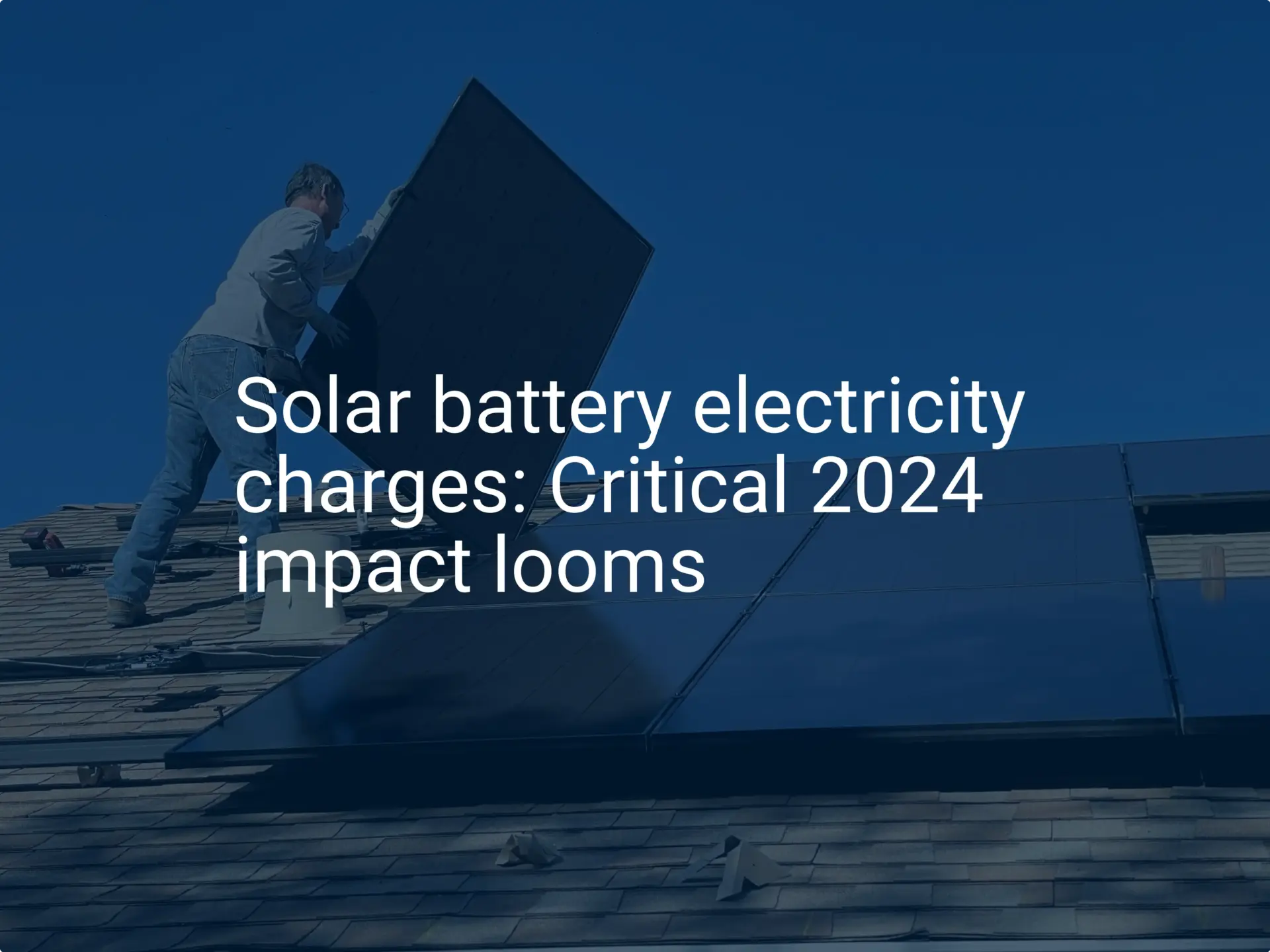

Navigating International Logistics and Import Complexities

For components that must be imported, a thorough understanding of logistics is critical. This extends beyond simple shipping arrangements to a core business function.

- Costs & Lead Times: Ocean freight costs, insurance, and import tariffs can add a substantial percentage to the component’s landed cost. Lead times of 6–12 weeks from order to delivery are standard and must be managed to ensure continuous production.

- Supplier Vetting: Establishing relationships with reliable international suppliers is paramount. This involves rigorous vetting of product quality, production capacity, and financial stability. Experience from turnkey projects shows that a failure in a single component supplier can halt an entire production line.

- Regulatory Compliance: Navigating Australian customs and ensuring all imported goods meet local standards is a complex task requiring specialist brokers.

Map showing shipping lanes from major manufacturing hubs in Asia to key Australian ports like Sydney, Melbourne, and Fremantle.

A Phased Approach to Building a Resilient Supply Chain

For a new entrant, attempting to localize the entire supply chain from day one is unrealistic. A more strategic, phased approach is recommended.

- Phase 1: Hybrid Model (Year 1-2): Focus on immediate local strengths. Establish partnerships with Australian suppliers for glass and aluminium frames, while importing critical, high-tech components like solar cells, EVA, backsheets, and junction boxes from vetted international partners.

- Phase 2: Deepening Localisation (Year 3-5): As production volume increases and the local ecosystem matures, explore opportunities to attract or develop local suppliers for encapsulants and backsheets. This move would further insulate the operation from global shipping volatility.

- Phase 3: The Sovereign Goal (Long-Term): The ultimate objective for the Australian industry is to establish domestic cell manufacturing. While likely outside the scope of a single module assembler, a thriving module industry would create the necessary demand to make large-scale cell production commercially viable.

This phased strategy balances the practical realities of global markets with the long-term strategic goal of building a robust, sovereign manufacturing capability.

Frequently Asked Questions (FAQ)

What is the single most difficult component to source locally in Australia?

Solar cells are currently the most significant challenge. There is no commercial-scale cell manufacturing in Australia, making importation a necessity for any new module assembly factory.

Can a new factory rely 100% on local sourcing from its first day?

No, this is not currently feasible. Due to the lack of cell manufacturing and limited production of other specialized components like EVA and junction boxes, a hybrid model that combines local and international sourcing is the only practical approach.

How do import tariffs affect the cost of components?

Import tariffs and duties can significantly impact the final cost of goods and must be carefully calculated in the Bill of Materials. These costs vary by component type and country of origin. Engaging a customs broker is essential to accurately forecast these expenses, which are a key part of the overall investment requirements for a solar factory.

Is it better to source from multiple international suppliers or a single one?

Diversifying suppliers for a single component (e.g., using two different cell suppliers) can mitigate risk if one supplier faces disruption. However, consolidating volume with a single supplier can lead to better pricing. A common strategy is to have a primary supplier for 70-80% of the volume and a secondary, fully qualified supplier for the remainder.

Conclusion: From Sourcing Strategy to Strategic Advantage

The development of a solar manufacturing industry in Australia is a marathon, not a sprint. The foundation of any successful venture will be a sophisticated and resilient supply chain strategy. The question is not local versus global, but how to achieve a calculated integration of both.

By leveraging Australia’s natural advantages in materials like glass and aluminium while building robust partnerships for essential imported components like cells, a new manufacturer can create a competitive and sustainable operation. The journey begins not with machinery on a factory floor, but with a clear-eyed analysis of the supply chain and the strategic decisions that will define the business’s success.