The Bahamas, with an average of 350 sunny days per year, offers a prime opportunity for solar energy.

For entrepreneurs and investors, however, harnessing this power means facing a significant logistical challenge: importing the necessary components. The journey from a manufacturer’s warehouse to a project site in Nassau or one of the Family Islands is filled with complexities, from customs procedures to supply chain reliability.

Table of Contents

Understanding The Bahamas’ Push for Solar

The push for solar energy in The Bahamas is both economic and strategic. The nation spends over $400 million each year on imported fossil fuels, a dependence that drives up energy costs and creates economic vulnerability. In response, the government has set an ambitious target to generate 30% of its energy from renewable sources by 2030. This national goal, supported by projects like the planned 132 MW solar plant, signals a long-term commitment to clean energy and creates a favorable environment for new solar ventures.

Navigating Customs and Duties

Successfully importing solar equipment requires a clear understanding of the customs process. While it can seem complex, a structured approach—and a clear grasp of the import duties in The Bahamas—makes it manageable. The Bahamas Customs Department has specific regulations and concessions for renewable energy goods that importers need to be aware of.

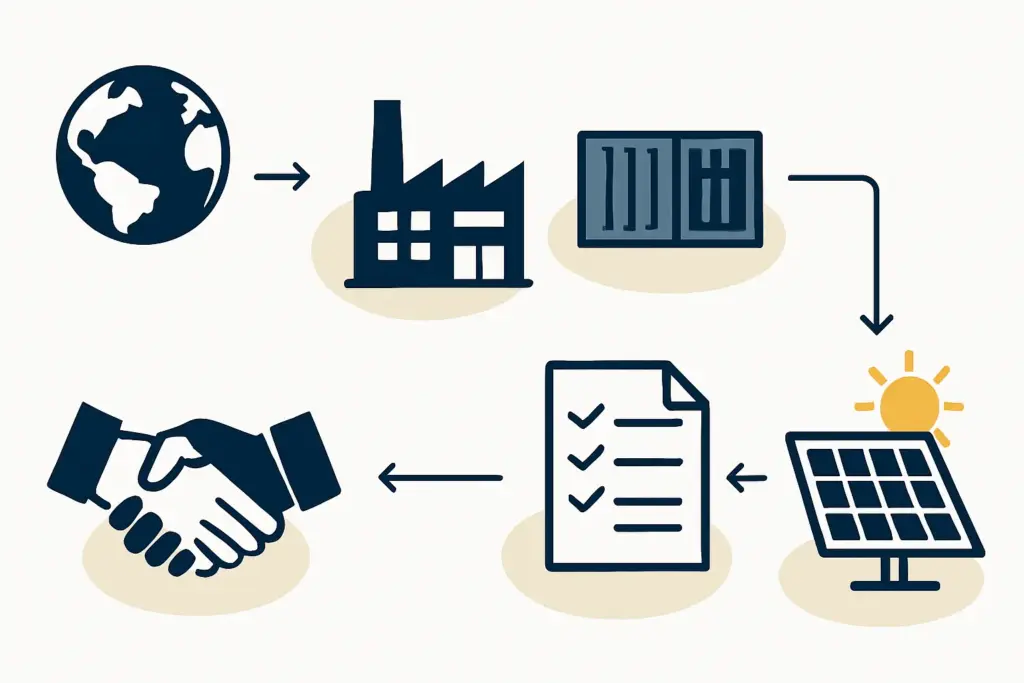

The Customs Clearance Process

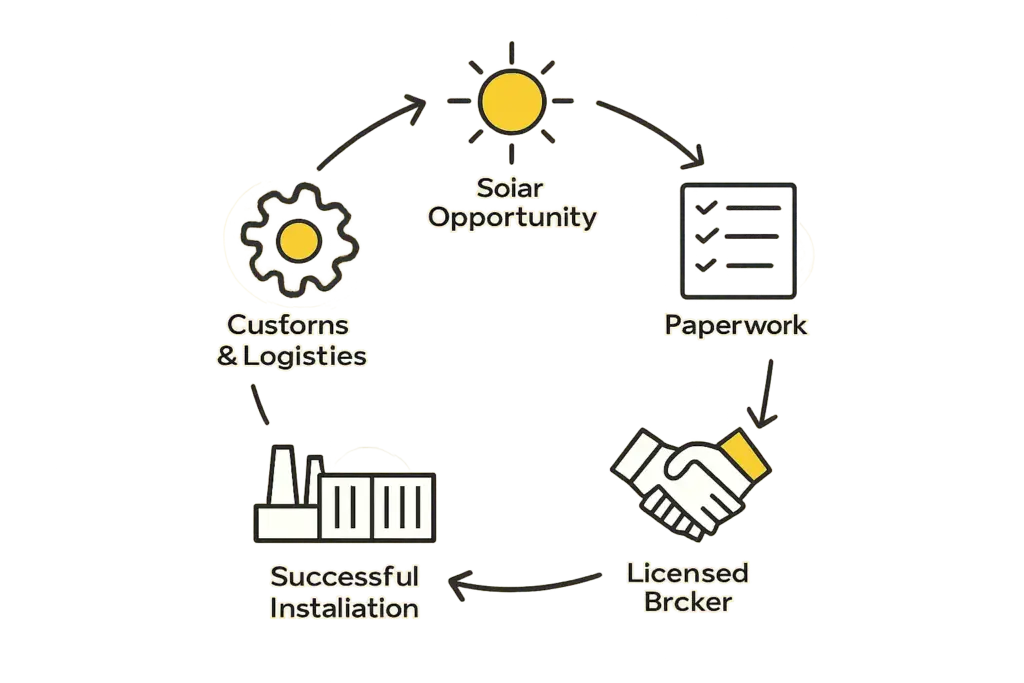

Importing commercial goods into The Bahamas requires a registered customs broker. The process generally follows these steps:

- Engage a Licensed Customs Broker: This step is mandatory for commercial imports. A broker will handle the required documentation and communication with the Customs Department.

- Submit Required Documents: Your broker will need the commercial invoice, a bill of lading (for sea freight) or airway bill (for air freight), and a detailed packing list.

- Declare Goods and Apply for Concessions: The broker files a declaration listing all items and applies for any available duty exemptions for your solar components.

- Pay Duties and Taxes: Once the declaration is processed and verified, the assessed duties and Value Added Tax (VAT) must be paid before the goods can be released.

- Release of Goods: After payment, customs authorities will release the shipment from the port or airport.

Duty and Tax Exemptions for Solar

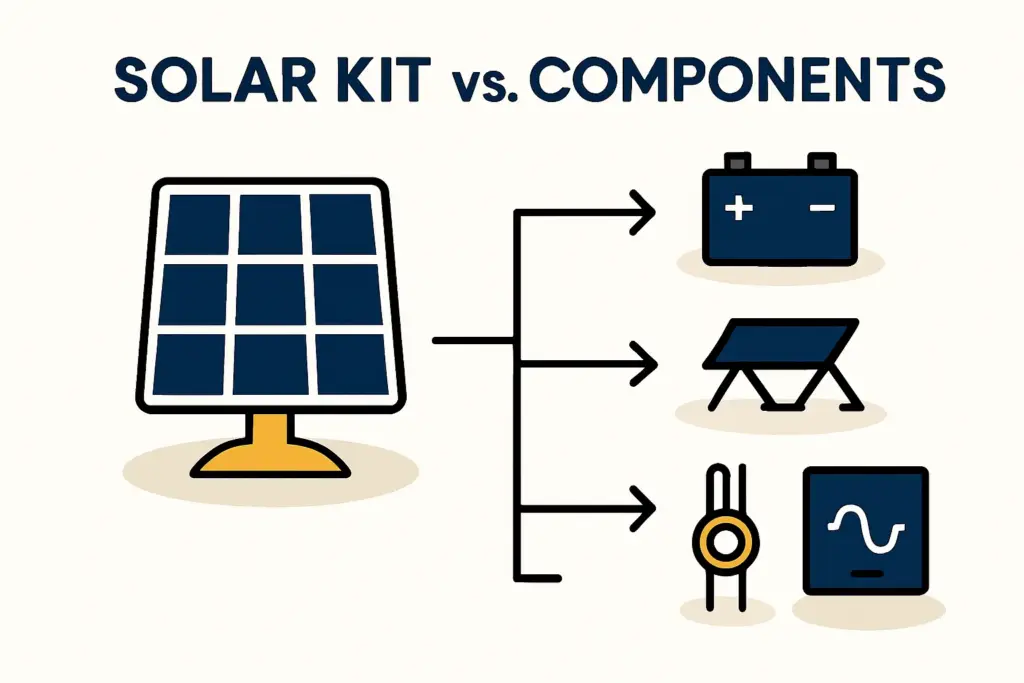

The Bahamian government offers specific financial incentives to encourage solar adoption. Key components like solar panels and inverters are exempt from both customs duty and VAT. However, other essential components—such as batteries, mounting racks, and wiring—may still be subject to standard rates.

For example, lithium-ion batteries often carry a duty rate. To accurately forecast your total import costs, a clear, itemized quote from your supplier and customs broker is critical.

Managing Supply Chain and Logistics

Getting your solar components to The Bahamas is just the first hurdle. The true logistical test lies in managing the supply chain and Bahamas logistics within the archipelago.

Shipping to The Bahamas

There are two primary options for international shipping:

- Sea Freight: The most cost-effective method for large, heavy shipments like solar panels and batteries. Sea freight is slower but significantly cheaper than air freight. Most shipments arrive at the Port of Nassau, the country’s primary commercial port.

- Air Freight: A faster, more expensive option suited for smaller, time-sensitive, or high-value components. While useful for replacing a critical part quickly, it is not practical for an entire solar system.

Port Logistics and Inter-Island Transport

Once your shipment arrives in Nassau, you need to plan its onward journey, especially if your project is on one of the Family Islands. This leg of the journey is often the most challenging part of the supply chain.

- Port Congestion: The Port of Nassau can experience delays. Plan for extra time in your project schedule for customs clearance and container handling.

- Inter-Island Shipping: Moving goods from Nassau to other islands requires local mail boats or charter services. These services have varying schedules and capacities, so coordinating this leg of the journey in advance is essential.

- Last-Mile Delivery: On any island, the final transport from the local port to the project site requires careful planning. Roads may be narrow or unpaved, requiring specialized vehicles for the safe delivery of fragile solar panels.

Handling and Storage

Solar panels are fragile and require careful handling at every stage. Ensure your logistics partners have experience with such equipment. If your components arrive before the site is ready, you’ll need to arrange for secure, dry warehousing. Factor the cost of temporary storage into your project budget, whether in Nassau or on the destination island.

Mitigating Risk in Your Supply Chain

Managing risk proactively is essential for a successful import operation. The primary risks in The Bahamas are shipping delays, component damage, and unexpected costs.

- Plan for Delays: Build buffer time into your project timeline. Customs clearance and inter-island transport often take longer than expected.

- Secure Comprehensive Insurance: Insist on “all-risk” cargo insurance that covers your goods from the supplier’s warehouse to the final project site. This protects you against financial loss from damage or theft.

- Choose Reliable Partners: Your project’s success is tied to the quality of your partners. Thoroughly vet your customs broker, freight forwarder, and local transport providers. Ask for references from others who have completed similar projects in The Bahamas.

Navigating these logistics can be complex, but you don’t have to do it alone. For a step-by-step walkthrough, visit our free e-course or explore our services. If you’re ready to build a bankable project, our Premium Business Plan E-Course offers expert guidance to get your venture off the ground. Let’s power your success in the Bahamian solar market.

Frequently Asked Questions (FAQs)

Q: What documents are needed to import solar panels into The Bahamas?

A: You will need a commercial invoice from your supplier, a bill of lading or airway bill, and a detailed packing list. A licensed customs broker is also required to file the formal customs declaration (C-41 form).

Q: Are all solar components duty-free?

A: No. While solar panels and inverters are typically exempt from duty and VAT, other system components, such as batteries, mounting hardware, and charge controllers, are often subject to standard import duties and taxes.

Q: How do I find a reliable customs broker in The Bahamas?

A: You can find a list of licensed brokers through the Bahamas Customs Department. Seeking recommendations from local business associations or other importers with experience in renewable energy projects is also highly recommended.

Q: What is the best way to ship solar components to the Family Islands?

A: The most common method is to ship the container to Nassau, clear customs there, and then use a local mail boat or charter vessel for inter-island transport. Direct shipping to some of the larger Family Islands may be possible but is less common and can be more complex to arrange.