While Bangladesh is widely recognized for its thriving textiles industry, a new industrial sector is on the rise. The nation has set ambitious goals for renewable energy, aiming to generate over 4,100 megawatts from clean sources by 2030.

This national drive is creating a significant opportunity, particularly for manufacturers who will supply the necessary technology. For investors, understanding the government’s comprehensive support structure is the first step toward capitalizing on this emerging market.

To attract and nurture investment in the solar photovoltaic (PV) manufacturing sector, the government of Bangladesh has implemented a strategic framework of incentives. This isn’t just a policy preference; it’s a calculated economic strategy designed to build domestic capacity, create skilled jobs, and ensure long-term energy security. This guide offers a clear overview of the key financial incentives available to entrepreneurs and corporations looking to establish solar module production facilities in the country.

Table of Contents

The Strategic Vision: Why Bangladesh Is Prioritizing Solar Manufacturing

To appreciate the value of these incentives, it helps to understand the government’s motivations. These policies are rooted in several national priorities:

-

Energy Independence: Reducing reliance on imported fossil fuels is a critical objective. A domestic solar manufacturing industry is fundamental to achieving this goal.

-

Economic Diversification: The government actively encourages growth in high-technology sectors to broaden its economic base beyond traditional industries.

-

Job Creation: Modern manufacturing facilities create high-skilled, stable employment opportunities, contributing to national development.

-

Climate Commitments: As a signatory to international climate agreements, Bangladesh is committed to increasing its share of renewable energy, and local manufacturing is key to meeting these targets at scale.

This strategic alignment means investors in the solar sector are more than just market participants—they are partners in a national project. This partnership is reflected in the tangible financial support on offer.

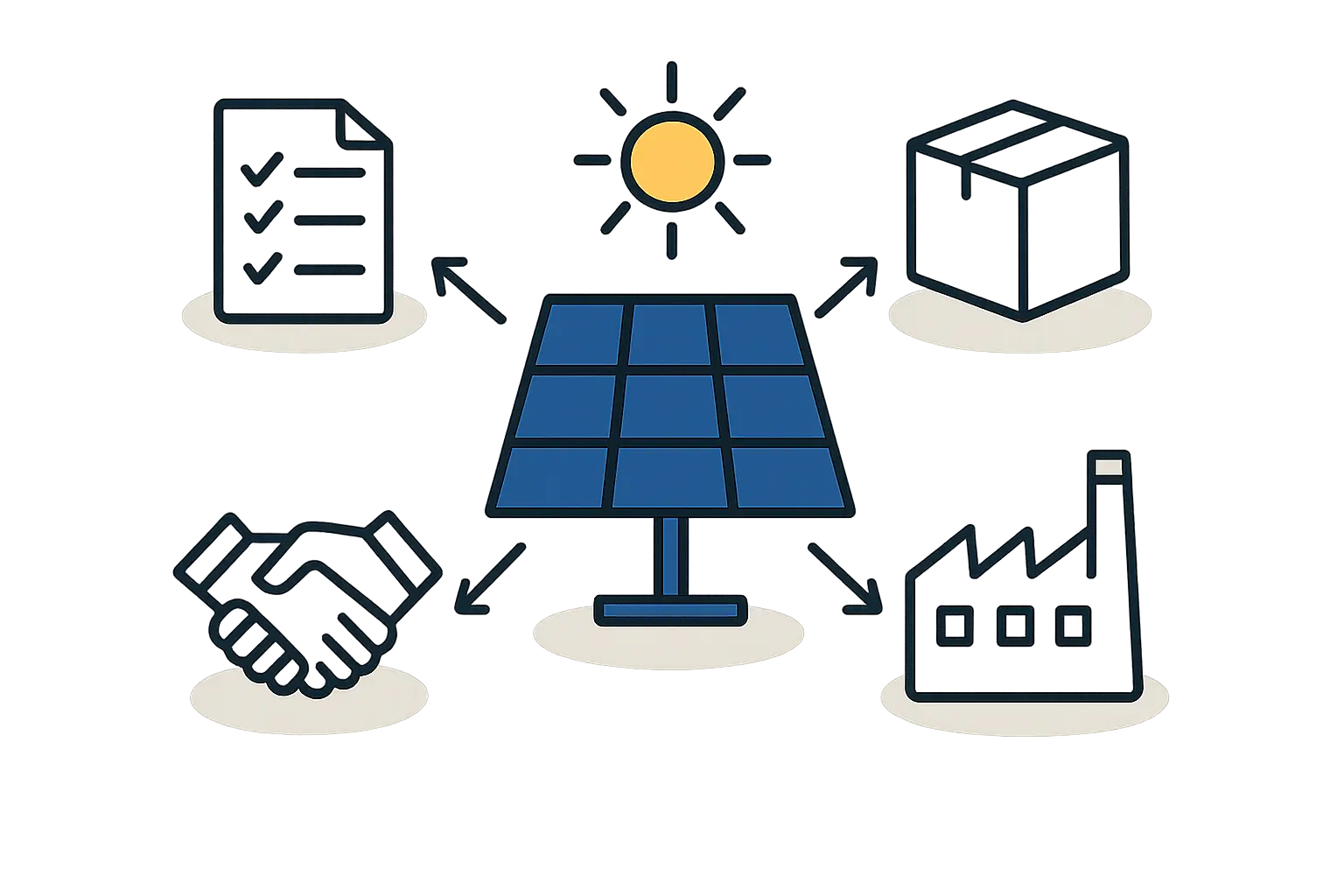

A Breakdown of Key Financial Incentives

The government, primarily through the Bangladesh Investment Development Authority (BIDA), offers a suite of incentives designed to reduce the initial financial burden and enhance the long-term profitability of new manufacturing ventures. Understanding these mechanisms is essential for building an accurate financial model.

1. Corporate Tax Holidays

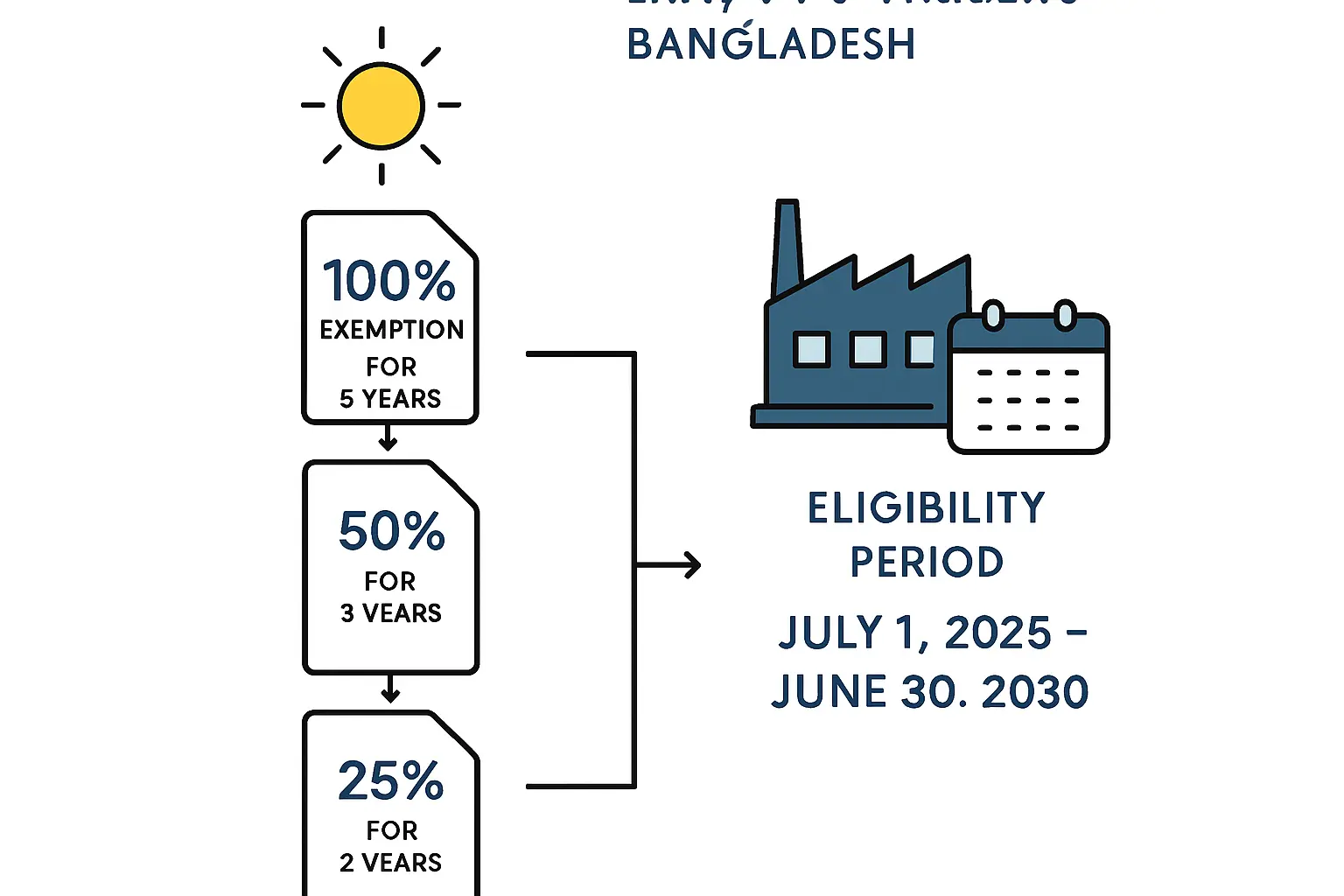

Perhaps the most significant incentive is a multi-year tax holiday. For qualifying projects in specific sectors, including renewable energy technology, the government offers a complete exemption from corporate income tax for a defined period.

How it Works: A new solar module factory could receive a tax exemption for five to ten years, depending on its location and the specific policy framework under which it is registered. This means 100% of profits during this time can be reinvested into the business for expansion, research, or debt servicing.

Business Impact: For a new enterprise, the first few years of operation are critical. A tax holiday dramatically improves cash flow and can shorten the payback period on the initial investment for a solar module production line by several years. Based on experience from J.v.G. turnkey projects in similar emerging markets, this single incentive can be the deciding factor in a project’s financial viability.

2. Import Duty Exemptions

High-precision machinery required for a solar module production line is typically imported, representing a substantial portion of the initial investment.

How it Works: Approved industrial projects can receive significant exemptions from customs duties and other import taxes on capital machinery, equipment, and spare parts. In many cases, a 100% exemption is granted. This exemption can also extend to a percentage of the raw materials required for production for a set number of years.

Business Impact: An exemption on import duties can reduce upfront capital expenditure by 15-25%. For a multi-million-dollar investment, this translates to a considerable saving, freeing up capital for operational runway or other critical areas.

3. Accelerated Depreciation Allowance

Beyond the tax holiday period, businesses can still benefit from favorable tax treatment through accelerated depreciation.

How it Works: This policy allows a company to deduct a larger portion of the cost of its capital assets (like machinery) from its taxable income in the early years of the asset’s life. Instead of straight-line depreciation over 10-15 years, a business might be able to depreciate 50-80% of the asset value in the first two to three years of operation.

Business Impact: This reduces the company’s taxable income in the years immediately following the tax holiday, easing the transition to a full tax liability and supporting continued financial stability.

Navigating the Process: The Role of BIDA

The Bangladesh Investment Development Authority (BIDA) serves as the central point of contact for investors. It’s designed as a one-stop shop to streamline the processes for registration, approval, and incentive applications.

The process for an investor typically follows these steps:

-

Project Registration: The first formal step is to register the proposed project with BIDA.

-

Incentive Application: Following registration, the investor submits a detailed application outlining the business plan, financial projections, and the specific incentives being sought.

-

Approval and Gazetting: Once BIDA approves the project and the incentive package, it’s formally recognized, often through an official government gazette notification.

Careful attention to documentation and procedural requirements is crucial, as this planning stage lays the foundation for success. This principle is a core focus of the structured e-course provided by pvknowhow.com, which helps new market entrants navigate the entire setup process.

Frequently Asked Questions (FAQ)

Q: Who is eligible for these incentives?

A: Generally, both local and foreign investors are eligible for the same set of incentives, provided their project is registered with BIDA and falls within a designated priority sector like renewable energy manufacturing.

Q: Are there geographical considerations for incentives?

A: Yes, Bangladesh often provides enhanced incentives, such as longer tax holiday periods, for projects located in less developed regions of the country to encourage balanced economic growth.

Q: What are the typical conditions attached?

A: Incentives are often conditional on meeting certain performance metrics, such as minimum investment levels, job creation targets, and commencing commercial operation within a specified timeframe.

Q: Can profits and dividends be repatriated?

A: Bangladesh law permits foreign investors to repatriate profits, dividends, and capital gains. The process is managed through the central bank and authorized dealer banks, ensuring a structured and transparent mechanism.

The Path Forward for Investors

The government of Bangladesh has created one of the most compelling policy environments in South Asia for investment in solar manufacturing. This combination of tax holidays, duty exemptions, and streamlined regulatory support significantly de-risks the investment and enhances potential returns.

For any entrepreneur or corporation considering this sector, the message is clear: the government is an active partner. The journey now shifts from policy to practice, requiring a deeper understanding of specific factory requirements—from choosing the right solar panel technology to designing an efficient production floor.

A thorough feasibility study and a detailed business plan are essential tools for translating this policy opportunity into an industrial reality.