For any entrepreneur weighing a new industrial venture, the regulatory landscape is a critical factor. In some regions, it acts as a barrier; in others, it’s a powerful tailwind for growth. Bolivia, with its ambitious renewable energy goals and high solar irradiation, has positioned itself firmly in the latter category through its landmark legislation: Law No. 1205 for the Generation and Use of Renewable Energies.

This law is more than a policy statement; it is a clear invitation to investors, particularly those looking to establish local solar module production. It directly addresses the primary financial hurdles of setting up a new factory—capital expenditure on equipment and long-term revenue uncertainty—by offering a suite of targeted incentives.

This guide breaks down these provisions for business professionals evaluating the opportunity to manufacture solar panels in Bolivia.

Table of Contents

Understanding the Strategic Purpose of Law No. 1205

At its core, Law No. 1205 is designed to achieve several key objectives for Bolivia:

- Diversify the Energy Matrix: Reduce the country’s heavy reliance on fossil fuels for electricity generation.

- Enhance Energy Security: Develop domestic energy sources to ensure a stable and sovereign power supply.

- Promote Economic Development: Stimulate new industries, create skilled jobs, and attract foreign and domestic investment in the high-growth technology sector.

- Leverage Natural Resources: Capitalize on Bolivia’s exceptional solar resources, among the best in the world.

By creating a favorable environment for local manufacturing, the government aims to build a self-sustaining solar industry, from production to power generation. This creates a unique opportunity for early movers in the manufacturing space.

Core Financial Incentives for Solar Manufacturers

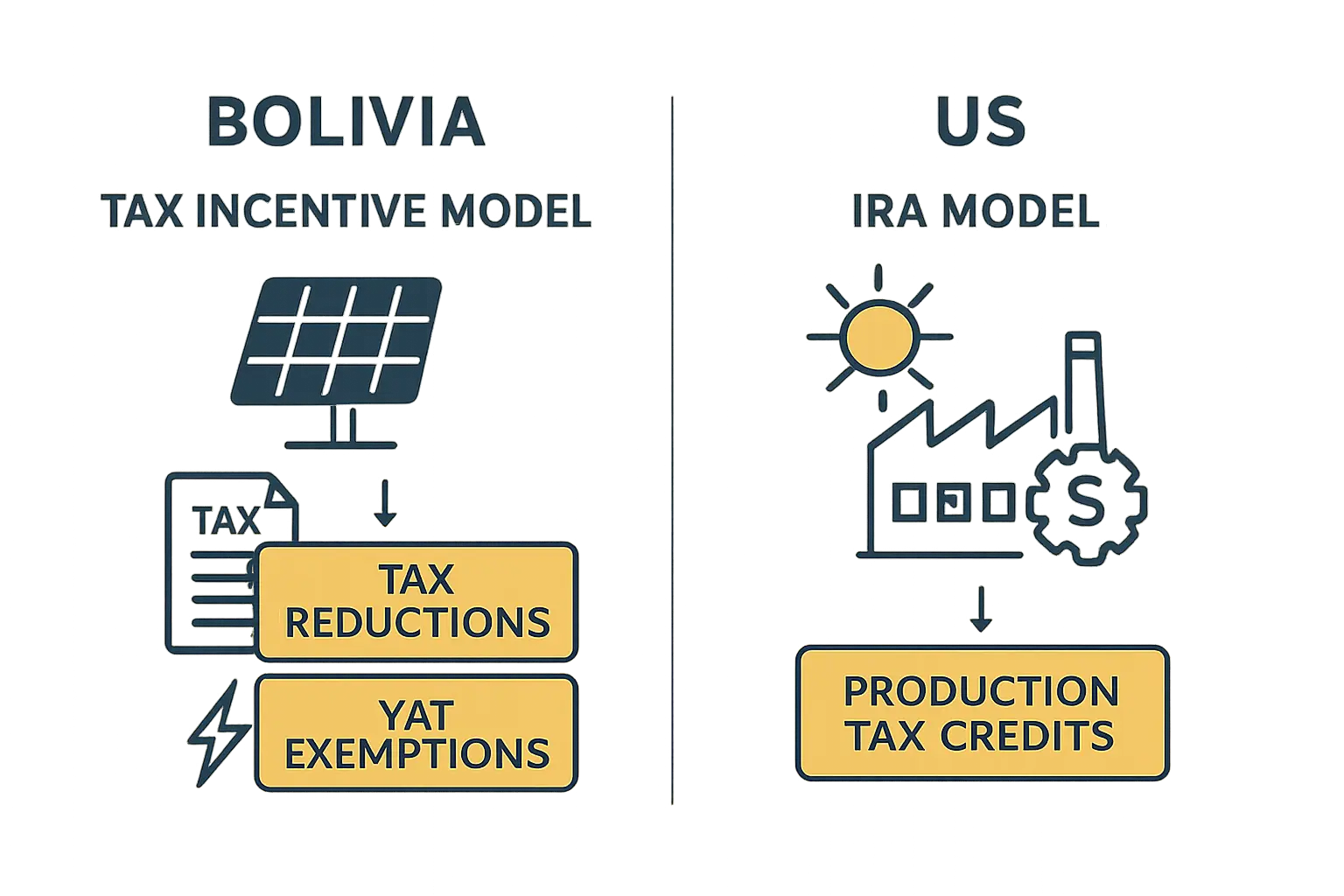

Law No. 1205 delivers financial support through two main pillars that directly benefit new solar module manufacturing operations: significant tax exemptions on imported goods and guaranteed revenue streams for generated electricity.

1. Exemption from Import Taxes and Duties

One of the largest initial costs in setting up a solar factory is the procurement and importation of necessary machinery and equipment—a burden that Article 7 of Law No. 1205 directly reduces.

The law grants a full exemption from two key taxes for the import of machinery, equipment, and raw materials essential for the solar module manufacturing process:

- Value Added Tax (IVA): A complete exemption from the standard IVA rate.

- Customs Duties (Gravamen Arancelario – GA): A complete exemption from import tariffs.

For an investor, this translates into a substantial reduction in initial capital expenditure (CAPEX). For example, on an equipment investment of several million dollars, these exemptions can result in direct savings of over 20%, significantly improving the project’s financial viability and shortening its payback period.

This provision covers the entire production chain, from stringers and laminators to testing equipment like sun simulators. Experience from turnkey projects in emerging markets confirms that managing the logistics and customs clearance for this equipment is a critical step where expert guidance proves invaluable.

2. Guaranteed Tariffs for Electricity Generation

Beyond reducing initial costs, the law enables a solar factory to generate an additional, stable revenue stream. Through a system of Feed-in Tariffs (FiTs) and Net Metering, a manufacturing facility can sell surplus electricity from its own rooftop or ground-mounted solar installations back to the national grid at a preferential rate.

This serves two purposes:

- Reduced Operational Costs: The factory can power a significant portion of its own operations, lowering electricity bills.

- New Revenue Generation: All excess power becomes a saleable asset with a government-guaranteed price.

The tariffs are structured to encourage investment across different scales. For solar photovoltaic (PV) systems, the law outlines specific rates, often guaranteed for several years, providing the long-term revenue certainty investors require. For instance, distributed generation systems up to a certain capacity (e.g., 500 kW) are assigned a specific, attractive tariff, making the installation of a PV system on the factory roof not just an operational decision but a sound financial one.

The Strategic Advantage of Manufacturing in Bolivia

The combination of these incentives creates a powerful business case. The tax exemptions lower the barrier to entry, while the feed-in tariffs improve the project’s long-term profitability.

This framework is particularly beneficial in regions with high solar irradiation but historically unstable grid infrastructure. A local factory can contribute to grid stability while profiting from it. Entrepreneurs who establish production facilities are not just building a business; they are becoming key players in the nation’s energy transformation, supported by a clear and favorable legal framework.

While entrepreneurs in other markets often face bureaucratic hurdles to secure such benefits, Law No. 1205 streamlines this process for qualifying projects by designating clear authority to the Ministry of Hydrocarbons and Energies (MHE) and the Electricity and Nuclear Technology Supervision Authority (AETN).

Frequently Asked Questions (FAQ)

Q: What specific equipment qualifies for the tax exemptions?

A: The law covers machinery, equipment, tools, and raw materials essential for the renewable energy generation and manufacturing chain. This typically includes items like cell stringers, laminators, framers, EL testers, and raw materials such as solar glass, EVA foil, and aluminum frames. A detailed list is usually confirmed during the project registration phase with the relevant authorities.

Q: How long are the Feed-in Tariffs guaranteed?

A: The duration and specific rates of the FiTs are defined by the implementing regulations of the law. Typically, such tariffs are guaranteed for a fixed period (e.g., 10-20 years) to provide investment security. Investors should consult the latest official decrees from the AETN for the current tariff structure.

Q: Are these incentives available to foreign investors?

A: Yes, Bolivian law generally encourages foreign investment. Law No. 1205 is designed to attract both domestic and international capital to build its renewable energy sector. Foreign-owned companies legally established in Bolivia can typically access these incentives on the same basis as local firms.

Q: What is the difference between Net Metering and a Feed-in Tariff?

A: A Feed-in Tariff (FiT) is a fixed price paid for every kilowatt-hour (kWh) of renewable electricity fed into the grid. Net Metering, on the other hand, allows a producer to “bank” surplus energy with the grid. If you produce more than you consume, your meter runs backward. The FiT system in Bolivia provides a more direct and often more financially attractive mechanism for new industrial producers.

Q: What is the first step to apply for these benefits?

A: Typically, the first step is to develop a comprehensive project proposal and business plan. This plan would then be presented to the Ministry of Hydrocarbons and Energies (MHE) for evaluation and registration as a qualifying project under Law No. 1205. Engaging with a consultancy that understands both the technical requirements of a turnkey solar factory solution and the local regulatory environment is highly recommended.

Conclusion: A Clear Path Forward for Investors

Bolivia’s Law No. 1205 is a clear signal to the global business community. It demonstrates a sophisticated understanding of what it takes to attract investment in high-tech manufacturing. By directly addressing the key financial risks—high upfront capital costs and uncertain future revenues—the policy creates a stable and predictable environment for establishing a solar module factory.

For the discerning entrepreneur, this legal framework transforms a potential opportunity into a tangible and financially sound investment case, paving the way for a profitable enterprise at the forefront of Bolivia’s energy future.