Anyone evaluating Brazil’s solar market will quickly notice a compelling contrast. The country boasts one of the world’s highest solar irradiation levels, a vast domestic market, and growing energy demand. Yet, Brazil is also known for its notoriously complex business environment.

For many potential solar manufacturers, the country’s intricate tax codes can mean the difference between a highly profitable venture and an unworkable one. This guide breaks down the key federal and state-level tax incentives available to solar module manufacturers in Brazil. Understanding these mechanisms—specifically IPI, PIS/COFINS, and the critical ICMS—is essential for any entrepreneur planning to establish a production facility in the region.

Table of Contents

The Core Challenge: Understanding Brazil’s Layered Tax System

Brazil’s tax structure is multi-layered, with distinct taxes levied at the federal, state, and municipal levels. For industrial producers, this creates a complex compliance landscape.

Woven into this complexity, however, are powerful government programs designed to stimulate specific industries, including renewable energy. The primary challenge for an investor is not just manufacturing a quality product, but structuring the business to legally and efficiently leverage these fiscal benefits. Failure to do so can put a new factory at an immediate and significant cost disadvantage against established local players.

Key Federal Tax Incentives for Solar Manufacturers

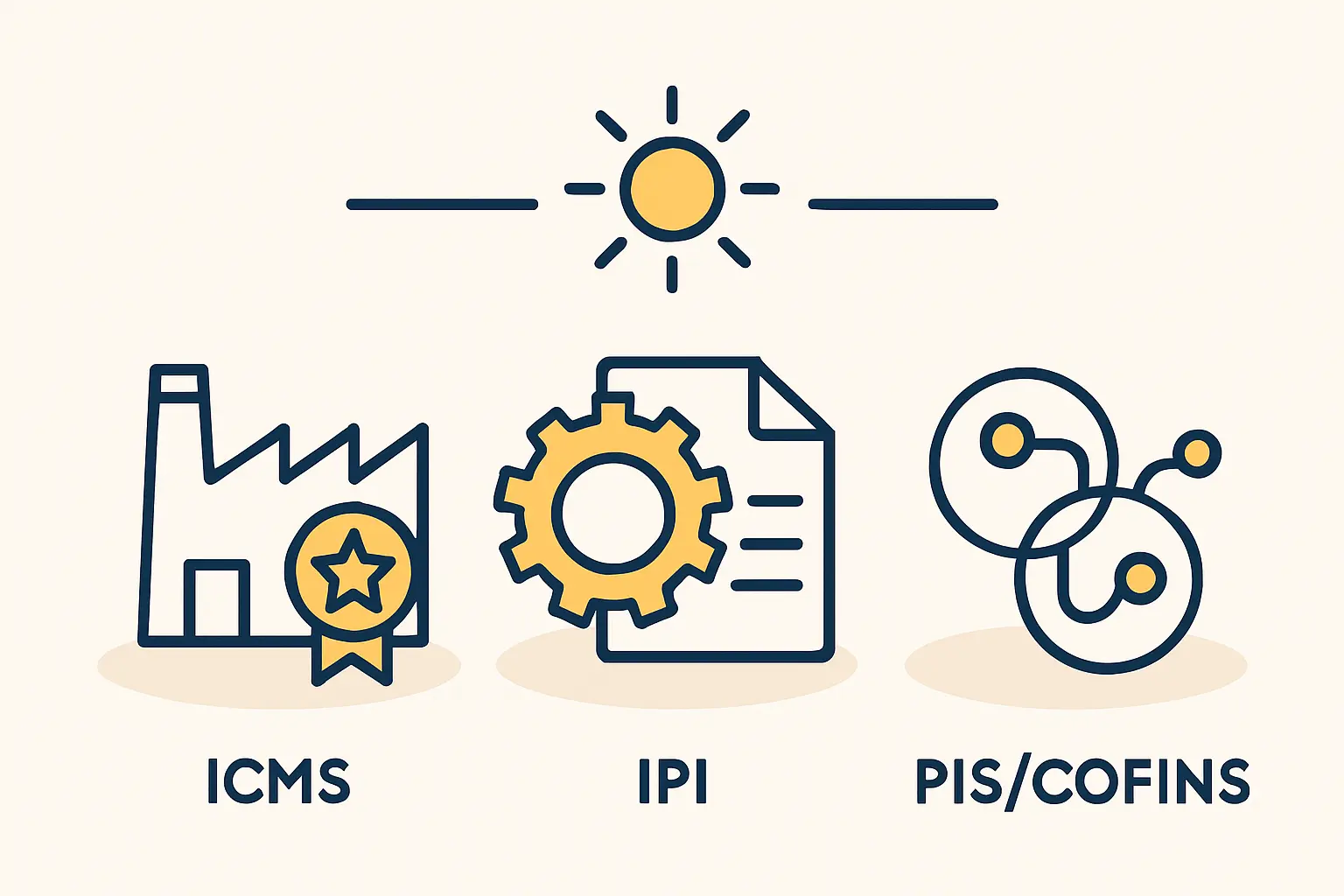

At the federal level, significant benefits for solar manufacturers come from a program known as PADIS (Program for the Technological Development of the Semiconductor and Display Industry). While its name suggests a different focus, the program has been extended to cover the solar photovoltaic sector. Companies that qualify for PADIS receive exemptions from three major federal taxes.

IPI (Imposto sobre Produtos Industrializados)

IPI is a federal value-added tax levied on manufactured goods, both domestic and imported. For a solar module factory, this tax applies to finished modules sold on the market and to imported production machinery.

Under the PADIS program, qualified companies receive a full exemption from IPI on their products and the capital goods required to produce them. This substantially reduces both the initial investment and ongoing operational costs.

PIS/COFINS (Programa de Integração Social / Contribuição para o Financiamento da Seguridade Social)

PIS and COFINS are federal social contributions calculated on a company’s revenue. Combined, they represent a significant tax burden. The PADIS program grants a full exemption from PIS/COFINS on the sale of qualified solar equipment. This incentive directly boosts the profitability of every module sold within Brazil, strengthening the manufacturer’s bottom line.

The Decisive Factor: State-Level ICMS Incentives

While federal incentives are crucial, the most pivotal tax consideration for a solar manufacturer in Brazil often lies at the state level. The ICMS (Imposto sobre Circulação de Mercadorias e Serviços) is a state-governed tax on the circulation of goods and services, functioning similarly to a VAT. Rates vary significantly by state, typically ranging from 12% to 18%.

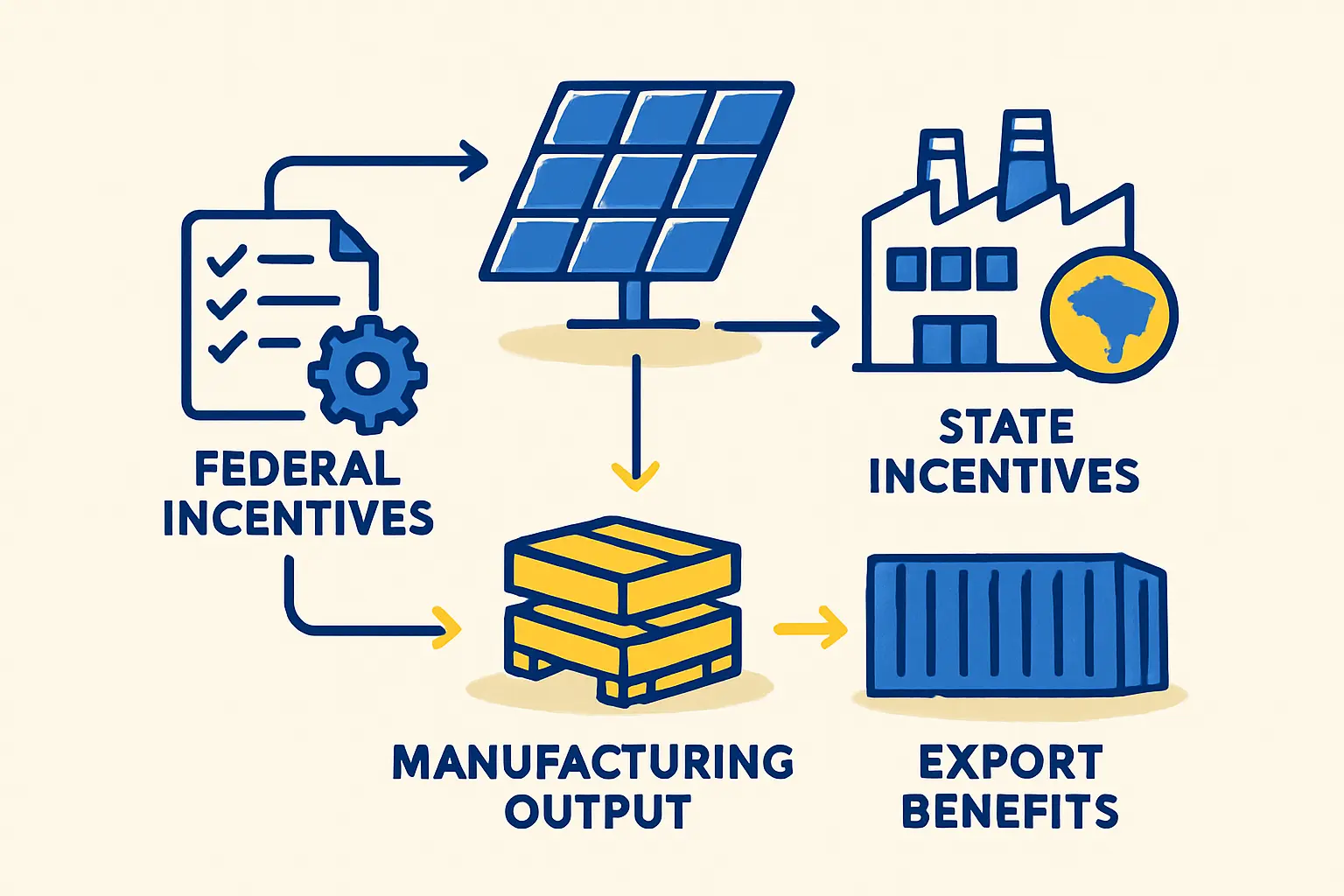

A national agreement, known as Convênio ICMS 101/97, authorizes Brazilian states to grant ICMS exemptions on equipment related to solar and wind energy generation. However, each of the 26 states and the Federal District can choose whether to adhere to this agreement.

This creates a critical strategic decision for any new investor. Establishing a factory in a state that has adopted the ICMS exemption provides a formidable competitive advantage. The final price of a solar module can be 12% to 18% lower simply based on the factory’s location—a factor that directly impacts market share and profitability.

The Strategic Importance of PADIS

Access to the powerful federal tax exemptions for IPI and PIS/COFINS depends on a company’s successful application to the PADIS program. Eligibility requires a commitment to the local economy, primarily through investing a percentage of annual revenue in local Research and Development (R&D) activities.

This requirement is designed to foster a domestic technology ecosystem. The application process is meticulous and demands a detailed investment plan, making expert guidance essential for navigating the bureaucratic procedures.

Key Considerations for Foreign Investors

When planning a new solar panel manufacturing plant in Brazil, tax planning cannot be an afterthought; it must be a foundational component of the business strategy. The choice of state, the structure of the legal entity, and the plan for PADIS qualification will have a more significant impact on long-term financial success than minor variations in equipment or labor costs.

Experience from J.v.G. turnkey projects in the region shows that a successful market entry depends on a thorough analysis of how these incentives integrate with logistics, supply chain, and workforce availability. For example, a state with excellent tax benefits might have less developed port infrastructure, requiring a careful trade-off analysis.

Solar Manufacturing Facility”/>

Solar Manufacturing Facility”/>Frequently Asked Questions (FAQ)

Q: What is the single most important tax for a new solar factory in Brazil?

A: While all taxes are important, the state-level ICMS is often the most critical variable. A full exemption granted by a state government can provide a double-digit cost advantage over competitors in states that don’t offer the incentive.

Q: Are these tax benefits permanent?

A: No. Tax legislation in Brazil can and does change. The incentives under PADIS and the Convênio ICMS are subject to legislative review. Continuous monitoring of fiscal updates, such as any Brazil ICMS news, and expert consultation are essential for ensuring long-term compliance and optimizing benefits.

Q: Do these incentives apply to imported machinery for the factory?

A: Yes, for companies qualified under the PADIS program, the exemption from IPI and PIS/COFINS typically applies to the importation of new machinery and equipment needed to set up the production line. This significantly lowers the initial capital expenditure.

Q: How long does it take to secure these tax benefits?

A: The process, particularly for PADIS qualification, is comprehensive and can take several months. It requires submitting a detailed technical and investment project to the federal government. Starting this process early in the business planning phase is crucial.

Conclusion and Next Steps

Brazil offers immense opportunities for solar module manufacturing, driven by its natural resources and economic scale. The pathway to profitability, however, hinges on careful fiscal planning. The federal IPI and PIS/COFINS exemptions, unlocked through the PADIS program, combined with a strategic choice of location to leverage state-level ICMS benefits, are not merely advantages—they are prerequisites for competitive success.

A detailed financial model that accurately accounts for these tax variables is a cornerstone of any viable business plan. For investors, structuring a turnkey solar module production line with these incentives in mind from day one is the key to securing a strong and sustainable position in the Brazilian market.